Bullish Manapuram*The stock had already done its 50% retracement.

*If it sustains this level it can touch its previous highs i.e.229

*Fundamentals are strong.

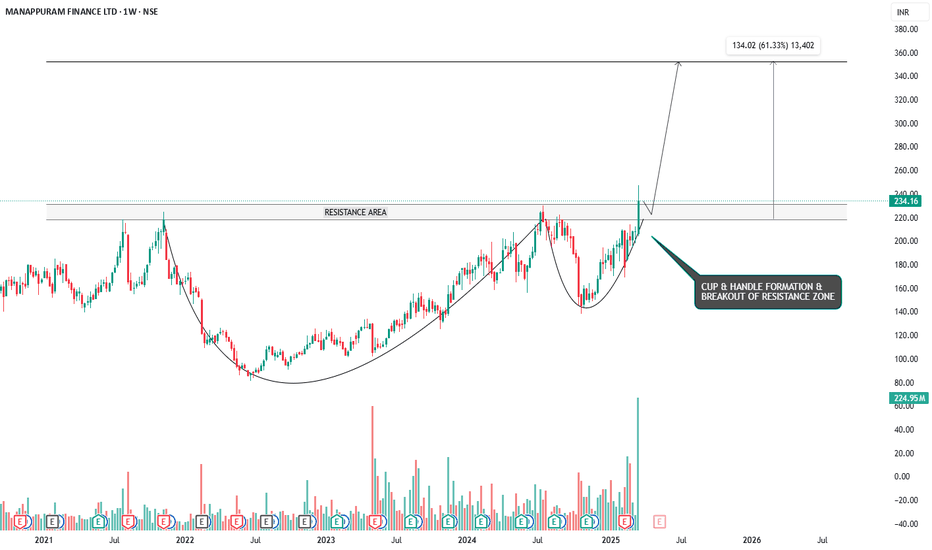

*Cup and handle formation may also confirmed.

*THIS ANALYSIS IS JUST FOR EDUCATIONAL PURPOSE. AND IT IS NOT ANY TYPE OF BUY OR SELL

RECOMMENDATION.

MANAPPURAM trade ideas

Malappuram The stock has confirmed a bullish breakout from a symmetrical triangle, supported by strong volume and favorable indicators. With price trading above the 21 EMA and 50 EMA, RSI showing healthy strength, and MACD momentum building, the setup favors continued upside. A long entry around ₹275 is attractive, with a stop loss near ₹260 to manage risk, while upside potential remains open as momentum carries the trend higher.

Manappuram Finance LtdThe stock is currently moving within an ascending broadening wedge, a pattern that usually indicates a bearish reversal. However, it is forming higher highs and higher lows. The support line has been well respected, with multiple touches and no breakdowns.

Consider buying above 285, aiming for targets of 315 and 350.

Manappuram Finance LimitedManappuram Finance Limited is a leading non-banking financial company (NBFC) in India, primarily known for its gold loan business, which constitutes about 50% of its portfolio. Founded in 1949 and headquartered in Thrissur, Kerala, it has grown into the second-largest gold loan financier in the country, serving over 6.59 million customers through 5,357 branches and employing 50,795 people as of FY25. The company has diversified into microfinance, vehicle finance, housing finance, and SME lending, positioning itself as a comprehensive financial services provider.

Recent Performance and News (as of June 17, 2025):

Stock Performance: Manappuram Finance shares have seen significant gains, hitting an all-time high of ₹278.25 on June 13, 2025, driven by soaring gold prices (MCX gold futures crossed ₹1,00,000 per 10 grams) and favorable RBI regulations. The stock rose 17% in a week and 49% over the past year, outperforming the Sensex. Despite a broader market downturn, it gained 1.23% on June 16, 2025

Financials: In Q4 FY25, Manappuram reported a consolidated net loss of ₹191.17 crore, compared to a ₹561.53 crore profit in Q4 FY24, though total income remained stable at ₹2,363.25 crore. Earnings per share (EPS) dropped 2.9% annually over the past three years, despite a 223% stock gain in the same period.

Corporate Developments:

Leadership: Deepak Reddy was appointed CEO, effective August 1, 2025, bringing over 30 years of financial services experience.

Investment: Bain Capital invested ₹4,385 crore for an 18% stake (potentially up to 41.7% with warrants) at ₹236/share in March 2025

In every Flag Pattern pole is the next target. here is I found two pole as per breakout with targets of ₹269–323.

MANAPPURAM: Soaring High with a 15% Growth Potential

Strong Resistance Breakout

Trading above all EMAs

Gap Filled

RSI Above 60

Next Resistance Level and Breakout Indicated on the Chart

Disclaimer: This analysis is provided solely for informational and educational purposes and should not be interpreted as financial advice. It is essential to conduct your own research and consult with a qualified financial advisor before making any investment decisions.

MANAPPURAM FIN – 18 May 25 | Intraday Plan 5 MIN ENTRY📌 MANAPPURAM FIN – 18 May 25 | Intraday Plan (15-min chart, entries on 5-min close)

Bias: Neutral-to-Bullish above 230.00

CMP: 229.44

Market Structure

• Sideways box 229.00–230.00 after sharp sell-off; compressing into lower-volatility equilibrium.

• Short-term momentum flirting with resistance—decision imminent.

Levels

│ R1 231.96 │ R2 233.71

│ S1 229.00 │ S2 227.73

Trade Plan

🟢 Breakout Long → Entry on 15-min candle close > 230.00.

Targets 231.96 / 233.71 │ SL 229.80

🔴 Breakdown Short → Entry on 15-min close < 228.90.

Targets 227.73 / 226.29 │ SL 229.40

Notes

• Steer clear of 229.00–230.00 chop—range fools both bulls & bears.

• Look for volume spike on trigger to validate move.

Set TradingView alerts at 230.00 & 228.90; risk ≤ 1 % per trade.

#PriceAction #MANAPPURAM #15min

Cup and Handle - ManappuramManappuram

Manappuram Finance is a Non-Banking Finance Company (NBFC), which provides a wide range of fund based and fee based services including gold loans, money exchange facilities, etc. The Company is a Systemically Important Non-Deposit taking NBFC(NBFC-ND).

Recent Important NEWS

Bain Capital will acquire an 18.6% stake in Manappuram Finance, a leading Indian gold loan company, through a primary infusion and secondary sale. The investment includes a mandatory open offer, potentially increasing Bain's stake to 41.7%. The deal, subject to regulatory approvals, aims to propel the company's growth.

Cup & Handle Pattern

Stock Weekly chart formed Cup and Handle pattern , retest confirmation also done 220 level. Expected target 350 and sustain above 500+++ possibility high. Duration 1 to 2 year. Stop loss continue 2 week closing based below 220.

RIDING THE WAVE - CUP & HANDLE BREAKOUT IN MANAPPURAM FINANCESymbol - MANAPPURAM

CMP - 234.16

Manappuram Finance is a Non-Banking Finance Company (NBFC), which provides a wide range of fund based and fee based services including gold loans, money exchange facilities, etc. The Company is a Systemically Important Non-Deposit taking NBFC.

Manappuram Finance Ltd. has recently demonstrated a significant bullish breakout, having formed a classic cup and handle pattern on a larger time frame and breaking out with strong volume. The cup and handle pattern is a well-regarded bullish breakout formation, and when it occurs on weekly or larger time frames, it tends to be highly reliable, indicating a robust upward momentum.

Currently, the stock price may retest the breakout zone, which coincides with the previous resistance area; now turned support - around the 230 to 217 range. This retest is a natural price action behavior and offers an attractive entry point for long positions before the stock continues its upward trajectory.

The target for this breakout, based on technical projections, is around 350, representing a 60% upside from the current market price. Given the strength of the breakout and the established pattern, this target appears achievable over the medium term.

For risk management, a stop loss can be placed around the 197 level, providing a reasonable cushion in case of a price reversal.

From a broader perspective, the formation of a cup and handle pattern coupled with a successful breakout on higher time frames adds a significant bullish bias to the stock. Investors looking for a favorable risk-to-reward setup may find this an opportune time to initiate or add to their positions in Manappuram Finance.

Disclaimer: The information provided here should not be construed as a buy or sell recommendation. It reflects my personal analysis and my trading position. Please consider this trading idea for educational purposes only. Thank you!

Manappuram Finance Ltd – Potential Breakout Trade! Manappuram Finance Ltd is showing a promising setup with an entry at ₹208. To minimize risk, maintain a stop-loss at ₹190, while the upside target is ₹241. Monitor price action for confirmation before entering.

Disclaimer: This is for educational purposes only and not financial advice. Please do your own research and consult a financial advisor before making any investment decisions. Trading involves risk, and past performance is not indicative of future results.

Amazing breakout on WEEKLY Timeframe - MANAPPURAMCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

exit the counterManappuram- CMP 234

Trend- the stock has been in a broad sideways move. Hence lacks any strength.

RSI - the RSI is back to it bear zone at the trendline resistance.

Volume - watch the tower on the volume, its again a sign that the retail has entered in huge numbers, thinking it as a breakout.

Extreme indicator- the detrend indicator has reached its previous all time high, asking one to be careful.

Conclusion - exit the counter.

#MANAPPURAM - Weekly Time Frame VCP Break Out with Volume📊 Script: MANAPPURAM

Key highlights: 💡⚡

📈 VCP formation in Weekly chart.

📈 Volume Spike seen

📈 Can Enter Breakout on if price sustains

📈 MACD Bullish

📈 RS is Bullish

📈 One can go for Swing Trade.

BUY ONLY ABOVE 240 WCB

⏱️ C.M.P 📑💰- 235

🟢 Target 🎯🏆 – 35%

⚠️ Stoploss ☠️🚫 – 17%

️⚠️ Important: Market conditions are getting better, Position size 50% per Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

Manappuram Finance - Trade Setup📊 Trade Plan:

Entry: Above ₹215 if broken out with volume.

Stop Loss: ₹192.95 (Closing basis).

Target: Watch price action near ₹231 (ATH); safe traders wait for a daily close above it.

Position Sizing: Buy in small quantities and accumulate gradually.

📈 Why This Stock?

Technical Setup:

Trading above key DMAs (Daily Moving Averages).

Stock was in an uptrend (June-Aug 2022) but fell out of the channel and gapped down significantly (Oct 24, 2022).

Now recovering and trading near ATH (₹231), forming another channel.

Entry possible above ₹215 if broken with volume.

Watch for ₹231 breakout with volume (4-year trading range).

Finance index has broken out of base and is trading above key DMAs.

⚠️ Market Conditions & Risks:

We are trading against the trend (LL-LH structure).

The overall market is below the 50 & 200 DMA, indicating potential further dips.

Trades are more prone to failure unless the market structure changes.

Safe traders should wait for confirmation before entering.

📊 Fundamentals (Key Data)

Market Cap: ₹18,107 Cr

Current Price: ₹214

52-Week High/Low: ₹230 / ₹138

Stock P/E: 9.21

ROCE: 13.8%

ROE: 20.6%

🚨 Disclaimer:

⚠️ This is not financial advice. We are trading against the broader trend, meaning the risk of failure is high. Do your own analysis before taking any trade. Always manage risk and trade cautiously! 🚀

#MANAPPURAM - Potential BO / Keep in Radar/ March25📊 Script: MANAPPURAM

Key highlights: 💡⚡

📈 VCP formation in Daily chart.

📈 Price gave a good up move and went into consolidation.

📈 Wait for Volume spike on Breakout.

📈 Wait for BO with Volume

📈 One can go for Swing Trade.

BUY ONLY ABOVE 215 DCB

⏱️ C.M.P 📑💰- 206

🟢 Target 🎯🏆 – NA%

⚠️ Stoploss ☠️🚫 – NA%

️⚠️ Important: Market conditions are not great, Paper Trade Only. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

mannapuram finance breakout soonManappuram Finance Ltd. is a prominent Indian non-banking financial company (NBFC) specializing in gold loans, microfinance, and other financial services. Here's a comprehensive analysis of the company's current situation:

**Fundamental Analysis:**

- **Financial Performance:**

- **Revenue Growth:** In the fiscal year ending March 31, 2024, Manappuram Finance reported a 32.15% year-over-year increase in revenue, surpassing its three-year compound annual growth rate (CAGR) of 11.73%. citeturn0search1

- **Profitability:** The company maintains a net profit margin of 6.77%, indicating consistent profitability. citeturn0search1

- **Asset Quality:** The gross non-performing assets (GNPA) ratio stood at 1.8% as of December 2024, reflecting a stable asset quality.

- **Operational Segments:**

- **Gold Loans:** This segment remains the primary revenue driver, contributing significantly to the company's income.

- **Microfinance:** The microfinance division has shown robust growth, with an 18% increase in income reported in the first quarter of fiscal year 2025. citeturn0news9

- **Regulatory Developments:**

- **RBI Restrictions:** In October 2024, the Reserve Bank of India (RBI) imposed lending restrictions on Manappuram's subsidiary, Asirvad Micro Finance, due to concerns over "usurious" pricing and excessive markup over funding costs. This decision impacted approximately 27% of the company's consolidated assets. citeturn0news10

**Technical Analysis:**

- **Stock Performance:**

- **Current Price:** As of February 24, 2025, the stock is trading at ₹204.03. citeturn0search5

- **52-Week Range:** The stock has fluctuated between ₹147.00 and ₹384.80 over the past year, indicating significant volatility.

- **Support and Resistance Levels:**

- **Support Level:** The immediate support is around ₹190.00.

- **Resistance Level:** The immediate resistance is near ₹220.00.

**Analyst Ratings:**

- **Consensus Rating:** The average target price for Manappuram Finance is ₹207.40, suggesting a potential upside of approximately 1.65% from the current price. citeturn0search4

- **Brokerage Views:** Morgan Stanley maintains an "Equal-Weight" rating with a target price of ₹170, indicating a potential downside from the current market price. citeturn0search3

**Recent Developments:**

- **Q1 FY2025 Performance:** In the first quarter of fiscal year 2025, Manappuram Finance reported a 12% increase in profits, driven by strong growth in gold-backed loans. citeturn0news9

**Conclusion:**

Manappuram Finance has demonstrated robust growth in its core segments, particularly gold loans and microfinance. However, recent regulatory challenges, including the RBI's restrictions on its microfinance subsidiary, have introduced uncertainties. The stock's volatility and mixed analyst opinions suggest a cautious approach for investors. Monitoring the company's regulatory compliance and financial health will be crucial for assessing its future prospects.

navlistRecent Developments in Manappuram Financeturn0news9,turn0news10