MAXHEALTH trade ideas

MAX HEALTHCARE - Bearish after breaking down from Double Top

DOUBLE TOP PATTERN -

market has broken down from perfect double top pattern indicating potential downward fall for the stock

VOLUME SURGE -

market has shown sudden volume surge recently indicating downward fall is coupled with strong volume

NEARING 100D SMA -

market is hovering above 100D sma. In past, it had touched the 100D sma whenever it has come close to it indicating market may soon fall to touch this moving average

TARGET -

price may fall till the target of 1008

HOW-TO: Use Demand and Supply Zones Pro [Afnan] As Screener In this video, I walks you through an exciting update to the Demand and Supply Zones Pro Indicator—integration with TradingView’s Pine Screener. This powerful tool allows traders to scan stocks based on demand and supply zones, helping to streamline your trading process and increase your efficiency.

Key Highlights:

Learn how to set up the Pine Screener for scanning stocks from your watchlist based on demand and supply zones.

A step-by-step guide to creating and using a Nifty 200 Watchlist.

Setting up Demand and Supply Zones Pro with custom timeframe and alert configurations.

How the screener analyzes stocks, focusing on demand and supply zone proximity and key price levels.

Understanding the columns in the Pine Screener and how to interpret them for your trades.

This screener is available exclusively to Premium and higher TradingView plans, so ensure your account is upgraded to take advantage of this feature.

Max Health Institute Ltd view for Intraday 22th Dec #MAXHEALTH

Max Health Institute Ltd view for Intraday 22th Dec #MAXHEALTH

Resistance 1220 Watching above 1222 for upside movement...

Support area 1200 Below 1200 ignoring upside momentum for intraday

Support 1200 Watching below 1198 or downside movement...

Resistance area 1220

Above 1220 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

Max Health Institute Ltd view for Intraday 18th Dec #MAXHEALTH

Max Health Institute Ltd view for Intraday 18th Dec #MAXHEALTH

Resistance 1220 Watching above 1222 for upside movement...

Support area 1200 Below 1200 ignoring upside momentum for intraday

Support 1200 Watching below 1198 or downside movement...

Resistance area 1220

Above 1220 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

MAXHEALTH - Breakout on 3rd Attempt?For the last two times, it broke above the wedge and fell down.

looks like it is sustaining at the third attempt.. wait for the breakout above the recent swing high..

I am not a SEBI registered Analyst. Views are personal and for educational purpose only. Please consult your Financial Advisor for any investment decisions.

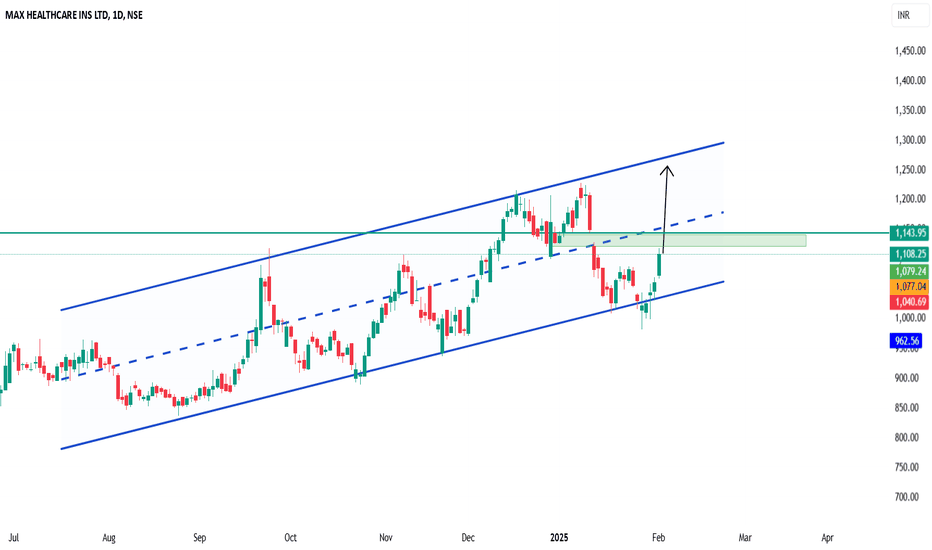

MAX HEALTHCARE INS LTDThe stock is currently in a strong uptrend, moving within a well-defined ascending channel and respecting both the upper and lower trendlines, indicating sustained bullish momentum. The lower trendline, around INR 950–1,000, serves as a critical support zone and presents an ideal buy level, offering a favorable risk-reward ratio. Immediate support lies around INR 1,050–1,080, which can also be considered for short-term entries. The RSI, currently above 70, suggests overbought conditions, signaling a possible correction or consolidation before the next upward move. A pullback to the lower channel, especially if accompanied by increased volume and RSI levels near 40–50, would strengthen the case for a buy. To minimize risk, a stop-loss can be placed slightly below the channel boundary. Waiting for a retracement or consolidation phase near these levels, coupled with confirmations from other indicators like moving averages or candlestick patterns, can enhance the quality of the entry point.

Max Healthcare Institute Ltd - Breakout Setup, Move is ON...#MAXHEALTH trading above Resistance of 991

Next Resistance is at 1392

Support is at 721

Here is previous chart:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

MAXHEALTH - Price Observation & OverviewOverview & Observation:

1. Trendline trap.

2. Good volume breakout.

3. Strength in buying.

4. Broke recent ATH.

Trade Plan:

1. Best entry was around 850. One more aggressive entry can be planned but the risk will be higher in that case.

- Stay tuned for further insights, updates and trade safely!

- If you liked the analysis, don't forget to leave a comment and boost the post. Happy trading!

Disclaimer: This is NOT a buy/sell recommendation. This post is meant for learning purposes only. Please, do your due diligence before investing.

Thanks & Regards,

Anubrata Ray