RVNL 1 Week Time Frame 📍 Current Status (as of latest market data):

RVNL trading around ₹356–₹360 on NSE/BSE.

📈 Key Levels for this Week (Intraday / Swing)

🔹 Resistance Levels

1. ₹369‑₹373 — Immediate resistance zone where short‑term counter may face selling pressure.

2. ₹377‑₹380 — Higher resistance; a breakout above this could signal short‑term bullish continuation.

🔻 Support Levels

1. ₹362‑₹357 — First support; holds short‑term pullbacks intraday.

2. ₹354‑₹350 — Deeper support — breach of this could see more downside.

3. ₹345‑₹340 — Strong support zone seen from recent chart structures (near 50DMA and consolidation).

📊 What This Means for the Next Week

✅ Bullish scenario

If RVNL closes above ₹373‑₹377 on daily closes, momentum could push towards ₹385‑₹395 in the coming sessions (momentum breakout).

Sustained buying and above‑average volumes would strengthen upside bias.

❌ Bearish scenario

A breakdown below ₹350‑₹345 could lead to a slide to ₹330‑₹325, where longer‑term support zones lie.

Daily closes below ₹350 increases the chances of deeper correction.

⚡ Neutral / Consolidation

If price stays between ₹350–₹373, expect sideways range‑bound trade before a clearer breakout direction.

🧠 Traders’ Focus This Week

✔ Watch daily closing levels above resistance / supports.

✔ Breakouts with higher volumes matter more than intraday spikes.

✔ Stop losses below the strong support zones (e.g., ~₹345) if positioning long.

Rail Vikas Nigam Ltd.

No trades

What traders are saying

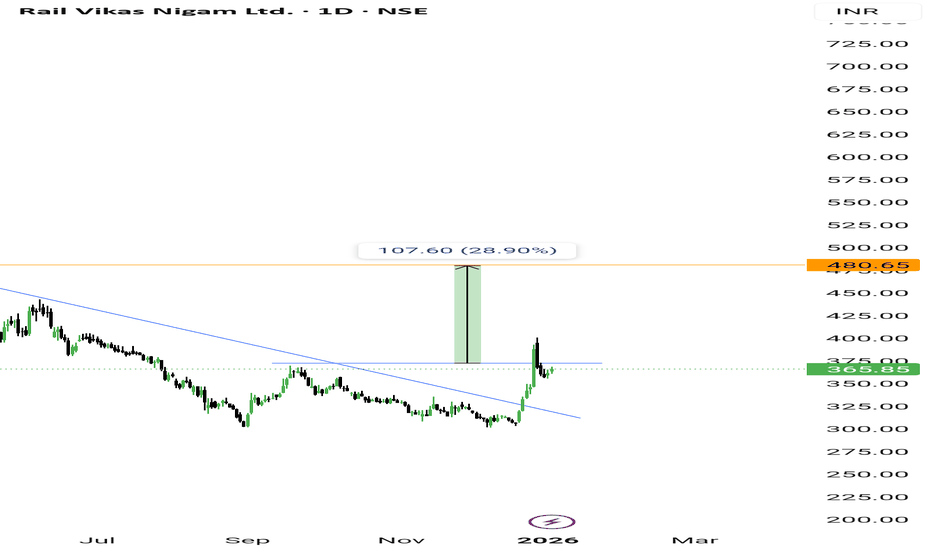

RVNL Can Give 20–30% Upside Move🚀 One Stock That Can Give 20–30% Upside Move

Stock: RVNL Limited 🚆 - NSE:RVNL

🔥 Why This Stock Is On The Radar

• Railways capex cycle remains strong with execution visibility

• Order inflow momentum continues to support earnings outlook

• PSU rail stocks remain leadership names in the current market

This Is Not A Fresh Breakout.

This Is A Re-accumulation Setup At Higher Levels.

📊 What The Chart Is Showing

• Strong rally already played out earlier

• Price has shifted into time correction, not price correction

• No major breakdown despite volatility

That Is The Key Observation.

📈 Current Price Behaviour

• Price consolidating around the 355–370 zone

• Candles overlapping tightly

• Volatility compression visible

• Higher lows still intact

Price Is Holding Strength.

It Is Not Distributing.

⏳ Why A 20–30% Move Is Possible

• Rail stocks typically move in momentum legs

• Supply has been absorbed during consolidation

• Breakout from a tight range can be swift

🎯 Trade Idea Framework

• Entry: Sustained hold above 372

• Stop-Loss: Below 345

• Targets:

– Target 1: 430

– Target 2: 480

👀 Confirmation Rule

• After breakout, price should not fall back below 365

• Volume should expand on the breakout

Back Below The Range = No Trade.

Hold Above The Range = Momentum Active.

🧠 Final Line

Strong Moves Often Resume After Quiet Consolidation.

RVNL Is Currently In That Phase.

That Is The Edge.

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Breakout in IRCON

BUY TODAY SELL TOMORROW for 5%

RVNL 1 Week Time Frame 📊 Recent Price Context

RVNL has been rallying sharply this week, up ~20–25% over the last 5–7 sessions amid sector optimism (rail fares hike & pre‑budget buying).

Current prices have now moved well off recent lows and are trading near short‑term resistance zones.

📈 Key Levels to Watch (1‑Week Swing)

Resistance (Upside)

1. ~₹380–385 — Near‑term swing resistance

Price has reacted here during recent rallies and this zone aligns with Fibonacci retracement resistance from the recent downtrend.

2. ~₹395–405 — Next barrier zone

Psychological and technical resistance from broader hourly/daily pivots. Breaching this would be bullish short‑term.

3. ~₹415+ — Larger breakout resistance

Stronger supply zone in short‑term technical studies; a clear break above here opens momentum for higher swings.

Bullish bias short‑term only if price holds above resistance breakouts.

Support (Downside)

1. ~₹360–365 — First support zone

Often an important short‑term floor if profit‑taking occurs after strong gains.

2. ~₹345–350 — Key pivot support

Near recent pivot and shorter moving averages — breaching this may weaken the short‑term bullish case.

3. ~₹330–335 — Stronger base

Below this could signal retest of broader consolidation area seen earlier in December.

📌 What to Watch This Week

📌 If price sustains above ₹380–385 with good volume → potential push toward ₹395–405.

📌 If it fails at resistance and drops below ~₹360 → risk of support test at ₹345–350, then ₹330.

📌 Broader market breadth (Nifty/BSE market conditions) & sector cues (budget news) will heavily influence intraday/week momentum.

RVNL – Technical Setup Analysis RVNL has been in a sustained downtrend over the past few weeks, marked by consistent lower highs and lower lows. Recently, the selling pressure has started to fade near the ₹300 zone, leading to price stabilization and consolidation.

On the daily chart, ₹300 has emerged as a very strong support level, as the stock has repeatedly taken support from this zone in the past. This level also coincides with earlier demand areas, making it a high-probability support region.

The stock has now broken above the falling trendline, indicating a potential trend reversal or pullback rally after a significant correction. The breakout is accompanied by improving price structure and better momentum, suggesting renewed buying interest.

RVNL is also trading above its short-term moving averages, reflecting strength returning to the bulls. As long as the stock sustains above the breakout zone and the ₹300 support holds, the technical setup remains positive.

Risk Management:

Stop Loss: ₹300 (strict daily/weekly closing)

A decisive close below ₹300 would invalidate the bullish setup; strict stop-loss discipline is advised.

Trade with proper risk management.

RVNL cmp 319.15 by Daily Chart viewRVNL cmp 319.15 by Daily Chart view

- Support Zone 294 to 306 Price Band

- Resistance Zone 332 to 345 Price Band

- Support Zone tested retested over past few days

- Support Zone since January 2025 seems been sustained

- Volumes below avg traded quantity, need to increase for fresh upside

- Breakout from Descending Triangle pattern might be in the making process

Buy set up Using RSI When we want to enter any Trade we Go to lower time frame of 1 Hour

We take the note of RSI which has made low below 25 and then reverse

then we will wait for price to close 3 Candle high prior to it , Then we enter

we will ride until the Momentum starts dropping when RSI hints of divergence

This is education content

Good luck

RVNL - Bullish Flag & Pole Breakout (Daily T/F)Trade Setup

📌 Stock: RAIL VIKAS NIGAM LTD ( NSE:RVNL )

📌 Trend: Strong Bullish Momentum

📌 Risk-Reward Ratio: 1:3 (Favorable)

🎯 Entry Zone: ₹430.45 (Breakout Confirmation)

🛑 Stop Loss: ₹388.70(Daily Closing Basis) (~10% Risk)

🎯 Target Levels:

₹448.35

₹467.00

₹486.45

₹506.65

₹527.75

₹549.70 (Final Target)

Technical Rationale

✅ Bullish Flag & Pole Breakout - Classic bullish pattern confirming uptrend continuation

✅ Strong Momentum - Daily RSI >65 , Weekly RSI >57

✅ Volume Confirmation - Breakout volume 41.14M vs previous day's 6.07M (Nearly 2x surge)

✅ Multi-Timeframe Alignment - Daily and weekly charts showing strength

Key Observations

• The breakout comes with significantly higher volume, validating strength

• Well-defined pattern with clear price & volume breakout

• Conservative stop loss at recent swing low

Trade Management Strategy

• Consider partial profit booking at each target level

• Move stop loss to breakeven after Target 1 is achieved

• Trail stop loss to protect profits as price progresses

Disclaimer ⚠️

This analysis is strictly for educational purposes and should not be construed as financial advice. Trading in equities involves substantial risk of capital loss. Past performance is not indicative of future results. Always conduct your own research, consider your risk appetite, and consult a financial advisor before making any investment decisions. The author assumes no responsibility for any trading outcomes based on this information.

What do you think? Are you watching NSE:RVNL for this breakout opportunity? Share your views in the comments!

Breakout in RVNLRVNL is engaged in the business of implementing various types of Rail infrastructure projects assigned by MoR including doubling, gauge conversion, new lines, railway electrification, major bridges, workshops, Production Units and sharing of freight revenue with Railways as per the concession agreement entered into with Ministry of Railway

✅ Flag & Pole formation- Bullish Breakout

📈 RSI near 60 & rising – strength building, but not yet overbought.

🧭 Trading above EMA50 – solid support confirms bullish trend.

🔥 Volume picking up – smart money possibly entering!

Disc: for study not a recommendation

A notable recovery is observed in RVNL stock performanceAs per the current analysis, after a healthy correction from ₹647 to ₹305, the stock appears to be showing signs of a potential reversal on the upside. In my view, an ideal buying range lies between ₹410 and ₹420, with a suggested stop-loss at ₹350. The short-term target is estimated around ₹500, while the positional target is projected to be approximately ₹650.

Disc: I AM NOT A SEBI REGISTERED. PLEASE CONSULT WITH YOUR FINANCIAL ADVISOR BEFORE INVEST ANY AMOUNT ON THE BASIS OF MY RESEARCH.

Rail Vikas Nigam Ltd (RVNL)Impact on Railway-Related Stocks (2025–2031)

The railway sector’s growth, driven by these contracts and government initiatives like ‘Make in India’ and ‘Amrit Bharat Station Scheme,’ is likely to benefit companies involved in infrastructure, rolling stock, and technology. Here’s an outlook for railway-related stocks over the next six years:

Key Players:

Rail Vikas Nigam Limited (RVNL): As a major player in railway infrastructure, RVNL benefits from contracts like the Siemens Mobility deal and traction substation projects. Its order book and government-backed projects ensure steady revenue growth. Analysts project a 15–20%

CAGR in earnings, supported by India’s ₹2.5 lakh crore railway budget (FY 2024–25).

Metro and High-Speed Rail:

Siemens Mobility-RVNL consortium won contracts for electrification technologies for Ahmedabad Metro Phase 2 (24 km, 23 stations) and Surat Metro Phase 1 (40 km, 38 stations) in 2023.

The Mumbai-Ahmedabad High-Speed Rail (bullet train) project, with 300 km of viaduct completed, is gearing up for a 2028 launch in Gujarat and full operation by 2030. The Integral Coach Factory (ICF) is developing a bullet train exceeding 250 kmph.

Other Major Contracts:

RVNL secured a ₹191.53 crore contract from South Eastern Railway for a 132 KV traction substation project to support a 3,000 MT loading target, to be completed in 18 months.

GR Infraprojects won a ₹903.5 crore contract from Maharashtra Metro Rail Corporation for a 17.6 km elevated metro viaduct in Nagpur, to be completed in 30 months.

Growth Drivers:

Infrastructure Investment: India’s railway budget has increased five-fold since 2014, with ₹2.5 lakh crore allocated in FY 2024–25. Plans for 508 station redevelopments and green energy initiatives (e.g., LED lights, zero-emission stations by 2030) will drive contracts.

High-Speed Rail and Vande Bharat: The Mumbai-Ahmedabad bullet train and Vande Bharat expansion (including Amrit Bharat 2.2 with AC/non-AC coaches) will boost demand for rolling stock and infrastructure.

Freight Corridors: The Eastern Dedicated Freight Corridor (EDFC) and Western DFC, with contracts worth $2.72 billion, will enhance freight capacity, benefiting companies like RVNL and Jupiter Wagons.

Export Potential: Indian railway companies are eyeing exports to Southeast Asia and Africa, leveraging cost-effective manufacturing.

Locomotive Manufacturing :

Siemens Mobility, in a consortium with Rail Vikas Nigam Limited (RVNL), secured a $6.5 billion contract in 2023 to supply 1,200 electric freight locomotives with 35 years of maintenance. A new 9,000 HP electric locomotive (EF-9K) with regenerative braking was unveiled, to be rolled out from a new plant in Dahod, Gujarat.

GE won a $2.6 billion order to supply 1,000 locomotives to Indian Railways.

Wabtec will deliver 300 high-power diesel locomotives by FY 2028.

Risks:

High Valuations: Some railway stocks (e.g., RVNL, Titagarh) trade at elevated P/E ratios, reflecting high growth expectations. A correction could occur if projects face delays.

Project Delays: Land acquisition issues, as seen in the Mumbai-Ahmedabad bullet train, and bureaucratic hurdles could delay contract execution.

Geopolitical and Economic Risks: Global supply chain disruptions or reduced government spending could impact order flows.

Competition: Increased private sector participation may pressure margins for smaller firms.

Conservative Scenario: If project delays or economic slowdowns occur, growth may moderate to 10–15% CAGR. Smaller firms may face volatility due to reliance on fewer contracts.

Investment Recommendations

Focus Areas: Invest in companies with strong order books (e.g., RVNL, RITES), exposure to high-speed rail (Titagarh, Siemens), and diversified portfolios (GR Infraprojects).

Diversification: Spread investments across infrastructure, rolling stock, and technology to mitigate risks from project-specific delays.

Conclusion

Recent sanctions and contracts, such as those for Vande Bharat trains, station redevelopment, and freight locomotives, signal robust growth for India’s railway sector through 2031. Stocks like RVNL, Siemens India, RITES, and Titagarh Rail Systems are well-positioned to benefit, with potential 15–25% CAGR in an optimistic scenario. However, investors should monitor project execution, valuations, and geopolitical risks. For real-time updates on new contracts, check Indian Railways’ e-Procurement System (IREPS) or news portals like The Economic Times.

Disclaimer: Investments in securities are subject to market risks. Past performance does not guarantee future results. Conduct your own research and consult a financial advisor before investing.

Monitor Developments: Track railway budget announcements, new contract awards, and progress on high-speed rail and freight corridors via sources like Indian Railways’ IREPS portal.

Long-Term Perspective: Railway projects have long gestation periods, making these stocks suitable for patient investors.

RAIL VIKAS NIGAM LTDAs of May 29, 2025, Rail Vikas Nigam Ltd. (NSE: RVNL) is trading at approximately ₹416.15, reflecting a 0.85% increase over the previous close.

📊 30-Minute Support & Resistance Levels

Based on recent technical analysis and pivot point calculations, the following support and resistance levels are identified for RVNL:

Support Levels:

S1: ₹411.93

S2: ₹407.72

S3: ₹401.43

Resistance Levels:

R1: ₹422.43

R2: ₹428.72

R3: ₹432.93

These levels are derived from the price range of the previous trading day.

🔍 Technical Indicators Overview

Relative Strength Index (RSI): The RSI is currently hovering around 70, indicating that the stock is approaching overbought territory.

Moving Averages: RVNL is trading above its 5-day, 10-day, 20-day, 50-day, 100-day, and 200-day simple and exponential moving averages, indicating a strong bullish trend.

📈 Market Sentiment

The technical indicators collectively suggest a strong bullish sentiment for Rail Vikas Nigam Ltd. However, the RSI indicates that the stock is approaching overbought territory, which may lead to a short-term correction. Investors should monitor the support and resistance levels closely for potential breakout or pullback scenarios.

Please note that stock market investments are subject to market risks, and it's essential to conduct thorough research or consult with a financial advisor before making investment decisions.

BUY TODAY SELL TOMORROW for 5%ON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Inverted Head & Shoulder Breakout in RVNL

BUY TODAY SELL TOMORROW for 5%

RAIL VIKAS NIGAM LTDAs of May 16, 2025, Rail Vikas Nigam Ltd. (NSE: RVNL) exhibits a bullish trend on the 30-minute timeframe, supported by several technical indicators:

📈 30-Minute Technical Analysis Summary

Current Price: ₹412.45

Relative Strength Index (RSI): 70.92

Indicates overbought conditions, suggesting strong upward momentum.

Moving Average Convergence Divergence (MACD): 2.89

Positive value supports the bullish trend.

Average Directional Index (ADX): 62.56

Reflects a strong trend strength.

Stochastic Oscillator: 78.09

Near overbought territory, indicating strong buying pressure.

Rate of Change (ROC): 0.972

Positive value aligns with upward price movement.

Supertrend: ₹372.14

Below current price, reinforcing the bullish outlook.

Parabolic SAR (PSAR): ₹371.61

Below current price, indicating an uptrend.

Chaikin Money Flow (CMF): 0.216

Positive value suggests buying pressure.

📊 TradingView Technical Summary (30-Minute Timeframe)

On TradingView, the 30-minute technical indicators for RVNL present a Neutral outlook, suggesting a balance between bullish and bearish signals.

⚠️ Trading Considerations

Overbought Indicators:

RSI and Stochastic values suggest the stock is in overbought territory; traders should watch for potential pullbacks.

Support Levels:

Supertrend and PSAR levels around ₹372 may act as support in case of a price correction.

Volume Analysis:

Monitoring volume trends alongside price movements can provide additional insights into the strength of the current trend.