UBL (United Breweries) – Weekly Swing Trading PlanUBL (United Breweries) – Weekly Swing Trading Plan (Educational)

Structure overview

Price has completed a multi‑month corrective leg into a confluence support cluster: Wave‑4 completion zone 1712–1756 overlaps with the projected Wave‑C (intermediate) completion band 1701–1337 and the extended retr

United Breweries Limited

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

13.85 INR

4.42 B INR

89.15 B INR

68.77 M

About United Breweries Limited

Sector

Industry

CEO

Vivek Gupta

Website

Headquarters

Bangalore

Founded

1915

Identifiers

2

ISININE686F01025

United Breweries Ltd. is a holding company, which engages in the manufacture and trade of beer and Non-alcoholic beverages. It operates through the Beer and Non-Alcoholic Beverages segments. The Beer segment includes the production and sale of beer, as well as the licensing of brands. The Non-Alcoholic Beverages segment involves in the purchase and sale of non-alcoholic drinks. The firm's brands include Kingfisher Premium, Kingfisher Strong, Kingfisher Ultra, Kingfisher Ultra Max, Kingfisher Storm, and Kingfisher Buzz. The company was founded on March 15, 1915 and is headquartered in Bangalore, India.

Related stocks

United Breweries – Confluence of Supports Testing Bulls’ NerveThe stock has completed a clear 5-wave impulse into the 2182.45 high. Since then, price action has unfolded into a complex W–X–Y corrective structure.

Now, price is testing a confluence of supports — the strong demand area, channel bottom, and the rising 200-week MA. This cluster raises the probabi

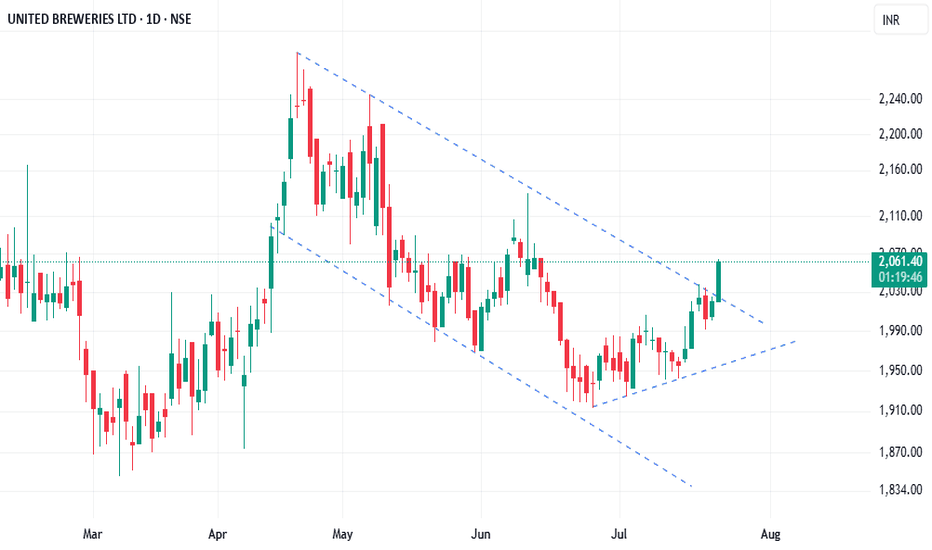

United Breweries Ltd (UBL) – NSEThe chart shows a descending channel pattern that began forming in early May 2025. This is characterized by:

Lower highs and lower lows within parallel trend lines.

🔍 Key Technical Indicators Based on Visual Chart Only:

Breakout Level: Near ₹2,050 (upper boundary of the descending channel)

Immedi

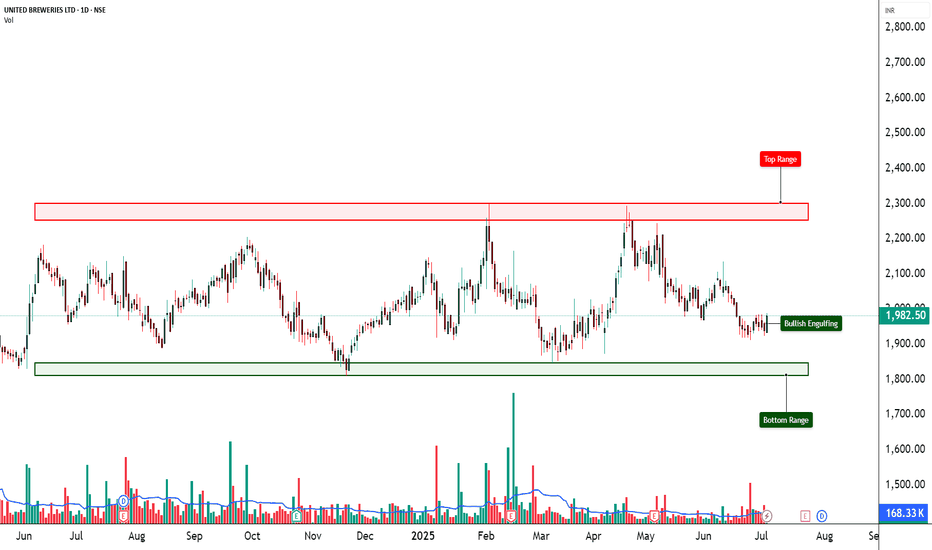

UNITED BREWERIES LTD. (UBL) – Bullish Setup from Demand Zone📈 UNITED BREWERIES LTD. (UBL) – Bullish Setup from Demand Zone | Price Action + Volume Analysis

🕒 Chart Type: Daily

📆 Date: July 3, 2025

🔍 What’s Catching Our Eye:

UBL has printed a strong bullish engulfing candle from the bottom range of ₹1,848, a zone that has historically acted as demand support

united brevages (ubl)united brevages (ubl)

Swing Trade

Stock Name - United Beverages

Chart - Dailly O

CMP2295.15

Buy 2200-2220

■ SL-2100 X

Target

2600+

Time Duration: 3-4 momths

Potential Return 17%

Keep an eye

#UBL

SOON

In June 2021, Heineken N.V. bought out Mallya's 15% stake in United Breweries Limited for ₹5,825 cr

Top 4 Swing Trading Ideas for Jan 30, 2025!🚀Top 4 Swing Trading Ideas for Jan 30, 2025! 🚀

📢 Disclaimer: The 4 stocks discussed here are for educational purposes only. 📚💡

✅ First, learn how to trade, then focus on earning! 💰📈

💬 Got a stock in mind? Drop a comment, and I'll reply! 🔍📊

#LearnBeforeYouEarn #StockMarket

UNITED BREWERIESUBL is looking good an outperformer in a sector all the time frame is in momentum and making a very good chart pattern that is flag and the retracement is also at 23% is a good signal for buying an all other indicatros is also showing it to go up side momentum so above 2144 it is a buy candidate tar

UBL's breakout could trigger a strong uptrend—short-term and lonSwing Trade Opportunity in UBL: A Potential Breakout Awaits

United Breweries Limited (UBL) is showing promising signs of a breakout. Currently trading within a channel, its RSI is around 60, signaling strength. If UBL forms a green candle and closes positively on 27th November 2024, it can confirm

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MIDCAPETF

Mirae Asset Nifty Midcap 150 ETF Exchange Traded Fund UnitsWeight

0.32%

Market value

464.37 K

USD

Explore more ETFs

Frequently Asked Questions

The current price of UBL is 1,617.90 INR — it has decreased by −0.20% in the past 24 hours. Watch United Breweries Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange United Breweries Limited stocks are traded under the ticker UBL.

UBL stock has fallen by −0.69% compared to the previous week, the month change is a −7.02% fall, over the last year United Breweries Limited has showed a −20.61% decrease.

We've gathered analysts' opinions on United Breweries Limited future price: according to them, UBL price has a max estimate of 2,270.00 INR and a min estimate of 1,500.00 INR. Watch UBL chart and read a more detailed United Breweries Limited stock forecast: see what analysts think of United Breweries Limited and suggest that you do with its stocks.

UBL stock is 1.00% volatile and has beta coefficient of 0.42. Track United Breweries Limited stock price on the chart and check out the list of the most volatile stocks — is United Breweries Limited there?

Today United Breweries Limited has the market capitalization of 428.64 B, it has decreased by −3.54% over the last week.

Yes, you can track United Breweries Limited financials in yearly and quarterly reports right on TradingView.

United Breweries Limited is going to release the next earnings report on Feb 5, 2026. Keep track of upcoming events with our Earnings Calendar.

UBL earnings for the last quarter are 1.80 INR per share, whereas the estimation was 3.98 INR resulting in a −54.72% surprise. The estimated earnings for the next quarter are 3.35 INR per share. See more details about United Breweries Limited earnings.

United Breweries Limited revenue for the last quarter amounts to 20.51 B INR, despite the estimated figure of 21.96 B INR. In the next quarter, revenue is expected to reach 21.45 B INR.

UBL net income for the last quarter is 465.20 M INR, while the quarter before that showed 1.84 B INR of net income which accounts for −74.70% change. Track more United Breweries Limited financial stats to get the full picture.

Yes, UBL dividends are paid annually. The last dividend per share was 10.00 INR. As of today, Dividend Yield (TTM)% is 0.62%. Tracking United Breweries Limited dividends might help you take more informed decisions.

United Breweries Limited dividend yield was 0.50% in 2024, and payout ratio reached 59.86%. The year before the numbers were 0.58% and 64.48% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Dec 24, 2025, the company has 2.89 K employees. See our rating of the largest employees — is United Breweries Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. United Breweries Limited EBITDA is 7.69 B INR, and current EBITDA margin is 9.54%. See more stats in United Breweries Limited financial statements.

Like other stocks, UBL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade United Breweries Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So United Breweries Limited technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating United Breweries Limited stock shows the sell signal. See more of United Breweries Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.