UPLPP trade ideas

United Phosphorous Ltd Intra-day Trading (Sell) opportunitiesNSE:UPL

TRADE ANALYSIS

This stock is very bullish and making new highs, the stock had created higher highs, However in the last 30 minutes trading session it closed below 20 Moving Average (MA) and below volume weighted average price (VWAP) with a strong bearish move and a negative RSI Diversion which means that the stock is losing its momentum and might touch its deep retracement zone.

POSSIBLE SCENARIOS

1) If Market opens sideways- and touches the price of 842 also making any bearish pattern or price rejection from 842 zone then look for confirmation candle and sell, put stop loss at 847, take profit at 823.

2) If market opens Gap Down- check for the 15 mins bearish candle then straightaway sell and put stop loss above 15 mins candle take profit at 806 or according to your risk to reward ratio.

3) If market opens Gap up- Do similarly like sideways market.

NOTE: In case the market opens gap up above 842 price then I would recommend not to trade UPL LTD.

CORONA or Stocks: 2nd Wave Always hits hardCOVID has impacted our lives in so many ways and Stock markets were no exception which saw drastic falls and steep recoveries as well.

SO I have tried to make a correlation between both.

Major scrips saw a minor downtrend which lasts for few weeks with minor corrections. Similarly COVID 1st wave caused saw minor casualities for few weeks.

The scrip entered into the resting phase with no major movement like COVID.

Then came the big fall where prices corrected upto 50-60% , this 2nd falling wave was stronger than ever and had major casualties like COVID 2nd wave.

Wave 1 of recovery started and prices goes back to pre-COVID levels.

2nd Wave in uptrend was even more stronger to fuel the prices in a drastic manner. Major scrips gained more than 70-80% price rise.

Chart is self-explanatory.

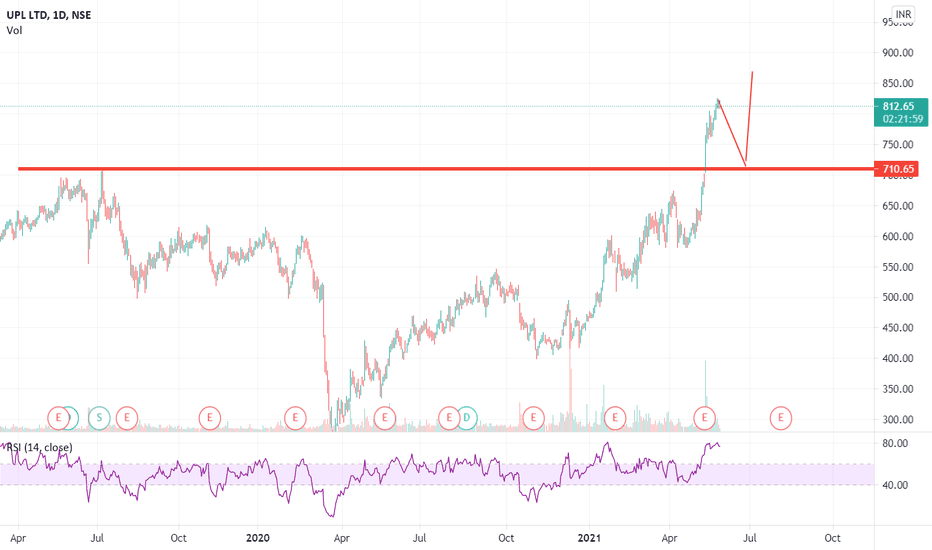

UPL Correction Starts - Trading @ PRZBook profits in upl. Higher chances to correct from here. Do not initiate long here. You can be trapped.

See, charts for more information. According to Elliot Waves also . its time for ABC correction.

Note:- I am not SEBI registered . All Views and trade setups are my personal view and my personal trade setup.

Do follow us

Like Us

Share with fellow traders

Also check the below related ideas for other stocks.

UPL : rally to end here.....UPL : CMP 811.70

triggered zone 1 today 824

stock is highly valued & now multiple bearish harmonics pattern formed in the stock.

PRZ ( 822-824 ZONE 1 & 834-836 ZONE 2 )

keeping stop loss as 859 on weekly closing basis sell for

targets : 794/778/763 (short term)

751/742/728/705 ( max )

Trade's Journey 1 |UPL| EquityThis is the beginning of a blog or rather a series of blogs which will track the trading journey from selecting trade to getting in, subsequent changes in position sizes (in any) and finally exiting, along with the rationale behind the same.

1. Pre-Trade

Price: UPL came to my notice on 10th May when priced went above the previous high, made in last month (7th April 2021). The closing price of 10th May and the high of 7th April were almost same (around 674). However, in closing basis 10th May was clearly a breakout. Previous closing high was 662 which was actually obtained a day prior i.e. 6th April 2021. In short then, on 10th of May we got a new 52 W high both on day's high as well as closing basis. Perhaps, a slight lingering issue in this regard was it failed to close definitely above the previous high's zone. That is had it closed say around 685 the signs would have been more obvious. Nevertheless, it was a 52 W breakout, period.

Also it should be noted the ATH price of 709 recorded on 1st July 2019 was within the range (around 5% higher from 674). Though truth be told, I didn't notice it at the time. Needless to say this was slightly sloppy while planning the trade.

Volume: The other aspect is of course volume. The volume on 10 of May wasn't anything spectacular but it was the highest in last couple of months time.

Results: The earning's date was around the corner (12 May 2021). It's always tricky with the earnings after all. However when the dust settled on 10th of May, that is when the market closed the signs were bullish.

Broader Sentiment: Despite, all this the main concern of course was, and still remains, the broader market. Globally the market's had been correcting through out the week.

2. Trade

Entry: On 12 May 2021, I entered at 685. The previous day i.e. on 11th the price has made fresh high with decent volume. And yet, luckily, it hadn't swelled up too much. So even in 12th May it provided good opportunity to get in. The Results were still not out though and it made sense not to be risk much. So got with 1x amount, keeping the decision of whether of scaling in or out for future.

Stoploss: I kept a initial stoploss at 5% below the entry price, which comes to 650 (rounded).

Target: If we check the chart we would see that 585 acted as a resistance and then as a support for several time earlier this year. Now if the previous high of 674 is taken as a new resistance point, then we have roughly 90 points transition zone or box. This comes to a 15% price movement. So the initial target could be either another 90 odd points or 15%. This comes to around 765 or slightly higher in percentage basis. So the first target can be around 760-775. Subsequent targets could be decided later.

Update 1: The very next trading day the price touched the targeted zone, high of 764, and closed at 743, having gained 7.5%. And this happened in a day when nifty closed in red. The volume for the day was highest this year so far. And hence, the trade looks fine as of now.

Trailing Stoploss: I am not updating the stoploss for now. Though it could be kept at price (685). I need to check the next two trading days before coming to a decision in this regard.

Will keep updating about the trade, as and when something significant happens. Meaning I change position sizes, exit, or any sudden change in price/volume, etc.

-----------------

This is not a trading/investing advice blog. This is my personal trading journal post and if you are reading it please see it from a purely analytical perspective.

Thanks for reading.

Target 2 (51%) achieved. Target 3 is ON...This is follow-up on UPL . Can check link to related ideas.

Target 2 achieved. More than 51%. Target 3 is ON.

Chart is self explanatory. Entry, Targets and Trailing Stop Loss are mentioned on the chart.

Disclaimer: This is for demonstration and educational purpose only.