−1.35 INR

−470.00 M INR

29.15 B INR

79.58 M

About Wockhardt Limited

Sector

Industry

CEO

Murtaza Habil Khorakiwala

Website

Headquarters

Mumbai

Founded

1967

ISIN

INE049B01025

FIGI

BBG000C6Z0G6

Wockhardt Ltd. engages in the pharmaceutical business. Its products include formulations, biopharmaceuticals, nutrition products, vaccines and active pharmaceutical ingredients. The company was founded by Habil Fakhruddin Khorakiwala in 1967 and is headquartered in Mumbai, India.

Related stocks

WOCKPHARMA | Strong 200 EMA Support – Bounce Trade Setup Active🧠 Analysis Summary:

The stock has bounced from 200 EMA support (~₹1,200) multiple times historically.

Current price action shows a bullish candle forming near this key level.

This setup has offered 2X+ gains in past instances.

🔍 Key Levels:

Action Price

CMP ₹1,251.60

Entry Zone ₹1,210–₹1,230

Stop

Wockhard Technical analysis study Technical analysis based on price & volume

Sma use 6month avg and 12Month avg

Circle mark 4 time , here common thing price try protect bounce from sma,

Wick rejection bullish candle made and after big bearish candle break moving average.

( Blue line zone )

Next thing price now rejection face fro

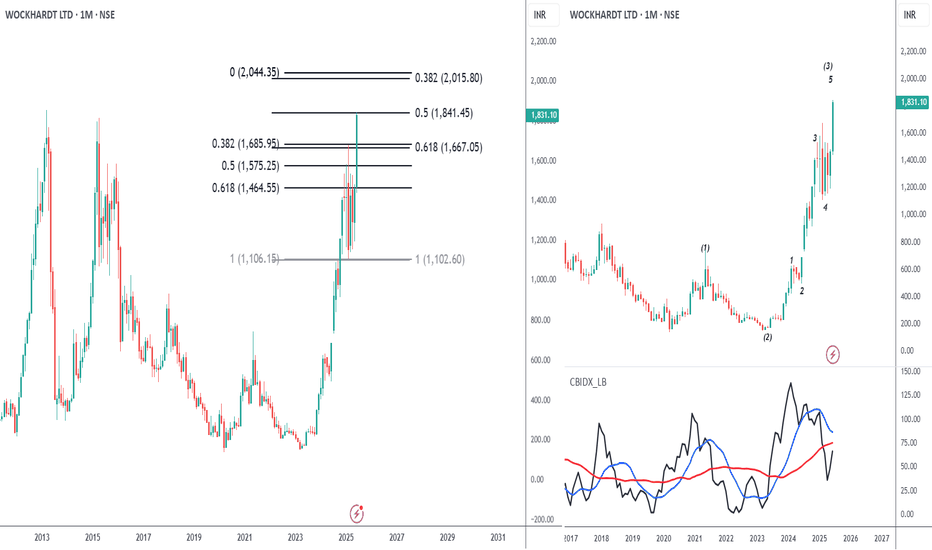

The impluse wave is overWockhardt CMP 1725

Elliott - the 5th and the last impulse is over and now a three wave correction will start from here. The correction tgts the vicinity of the 4th wave of one lesser degree. The same has been marked with a small box on the right chart. Thats 1100 to 900.

Fibs- The fib ext has c

WOCKPHARMA – Falling Wedge Breakout Watch!📊 NSE:WOCKPHARMA – Falling Wedge Breakout Watch!

📌 CMP: ₹1,739.50

📈 Structure: Falling Wedge forming after sharp uptrend

🟩 Price Action: Price compressing with narrowing range – bullish setup

📊 Volume: 447K (with prior volume spike of 1.54M on rally)

🔼 Breakout Candle: Not yet triggered – wa

Wockhardt-Bad fundamentals, Strong technicals!Wockhardt is an age old Indian pharma company which has been in loss since few years.

Stock has bounced from strong support and also gave inverted head & shoulders breakout.

Stock is consolidating post breakout.Not my usual technofunda pick but a very attractive technical breakout. Please know that

A rally is still not overWockhardt CMP 1831

Fib - the stock was up 18% today. Fib confluence is at 2015/2044, hence to me this is where the rally will halt.

Elliott- this rally will end the 5th wave of 3 and hence a deep correction will set in. This correction should end between 1400/1100. This is the vicinity of the 4

BUY TODAY SELL TOMORROW for 5% DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed t

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PHARMABEES

Nippon India Nifty Pharma ETF Units Exchange Traded FundWeight

1.32%

Market value

1.52 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of WOCKPHARMA is 1,322.00 INR — it has increased by 0.65% in the past 24 hours. Watch Wockhardt Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange Wockhardt Limited stocks are traded under the ticker WOCKPHARMA.

WOCKPHARMA stock has fallen by −11.45% compared to the previous week, the month change is a −1.73% fall, over the last year Wockhardt Limited has showed a −3.15% decrease.

WOCKPHARMA reached its all-time high on Mar 12, 2013 with the price of 1,996.05 INR, and its all-time low was 62.20 INR and was reached on Mar 13, 2009. View more price dynamics on WOCKPHARMA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

WOCKPHARMA stock is 4.03% volatile and has beta coefficient of 1.58. Track Wockhardt Limited stock price on the chart and check out the list of the most volatile stocks — is Wockhardt Limited there?

Today Wockhardt Limited has the market capitalization of 213.42 B, it has decreased by −4.24% over the last week.

Yes, you can track Wockhardt Limited financials in yearly and quarterly reports right on TradingView.

WOCKPHARMA net income for the last quarter is 780.00 M INR, while the quarter before that showed −900.00 M INR of net income which accounts for 186.67% change. Track more Wockhardt Limited financial stats to get the full picture.

No, WOCKPHARMA doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Dec 10, 2025, the company has 3.41 K employees. See our rating of the largest employees — is Wockhardt Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Wockhardt Limited EBITDA is 4.36 B INR, and current EBITDA margin is 10.29%. See more stats in Wockhardt Limited financial statements.

Like other stocks, WOCKPHARMA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Wockhardt Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Wockhardt Limited technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Wockhardt Limited stock shows the buy signal. See more of Wockhardt Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.