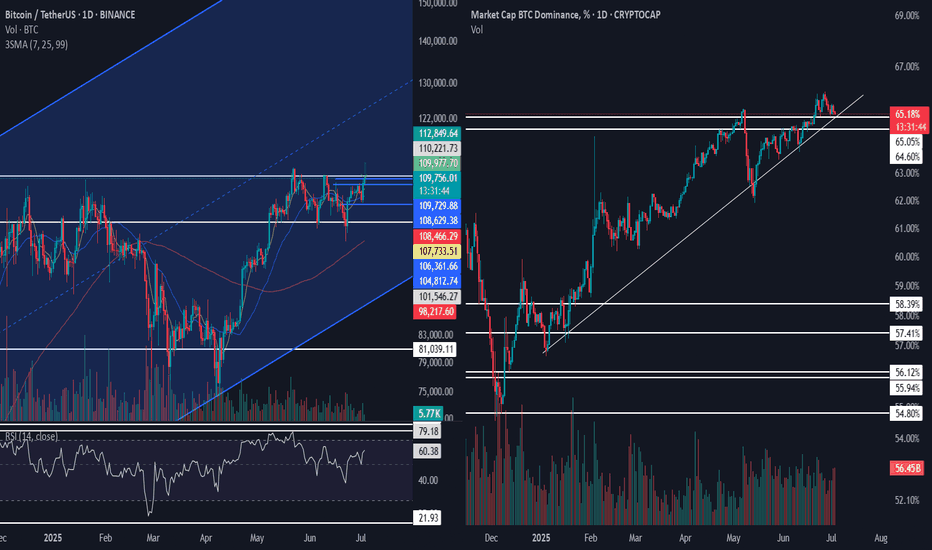

Bitcoin (BTCUSDT) Breakout Watch | Key Resistance Test at 110221Bitcoin made a strong push toward the 110221.73 resistance level with a solid bullish candle backed by notable volume. Although I personally did not enter a long position, as it did not meet the criteria of my strategy, the move had impressive momentum and clearly showed bullish intent.

🔍 Current Market Position:

We are now at a crucial technical level — our previously defined long trigger at 110221.73. If price manages to break this resistance cleanly, it could activate the High Wave Cycle (HWC) structure again and allow the primary uptrend to resume.

📌 Volume Insight:

Throughout the move from 101546 to 110221.73, volume has increased steadily — a positive sign suggesting strong buyer commitment. Moreover, the price has successfully created higher highs and higher lows within this range, signaling early signs of trend continuation.

This current test of resistance marks the third touch of our major range ceiling — a point where significant breakouts often occur. I’ll be closely watching this zone for confirmation to open a long position on BTC.

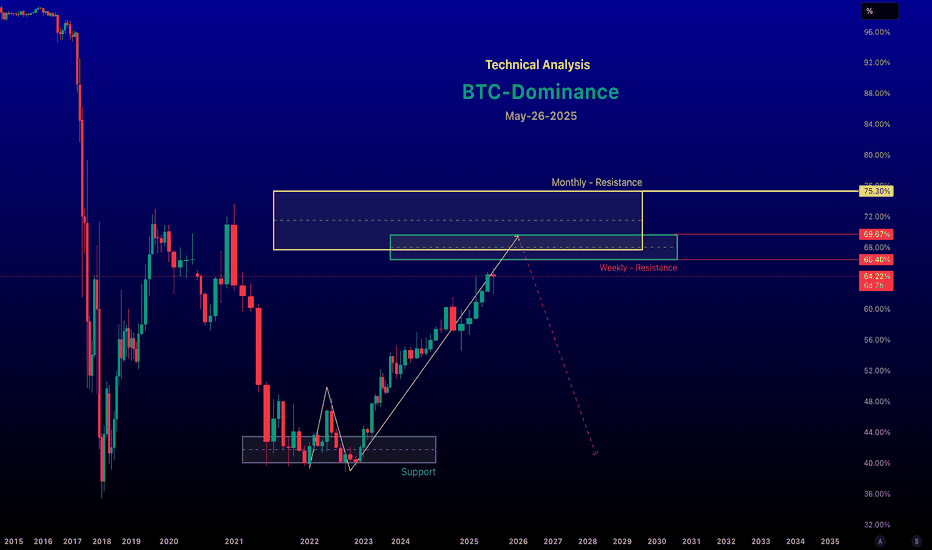

🚀 BTC Dominance & Altcoin Strategy Update:

Alongside BTCUSDT, I’m also monitoring BTC Dominance (BTC.D). Interestingly, while BTC price moved higher, BTC.D showed a slight decline — a positive signal for altcoin traders, as it often reflects capital rotating from Bitcoin to altcoins.

For a true altseason setup, we need to see BTC.D form a clear bearish structure — ideally, a downward leg, a consolidation (pause), and then another leg down. That would give us the confirmation needed to enter strong altcoin positions with better confidence and clarity.

⏰ Final Thought:

We are at a critical moment. If BTC breaks 110221.73 with momentum and volume, not only will it confirm our bullish bias, but it will also reignite the broader uptrend and give us a green light to become more aggressive in both BTC longs and altcoin plays.

#BTCUSDT #BitcoinBreakout #CryptoAnalysis #BTCUpdate #AltcoinSeason #BTCdominance #CryptoTrading #HighWaveCycle #BitcoinResistance #TechnicalAnalysis

BTC.D trade ideas

Big Altseason Is Loading... Ready for Big Altseason... but Why?BTC Dominance Showing Bearish Divergence!

Get ready... a massive Altcoin Season could be coming soon!

📉 Chart and RSI both showing weakness

📉 If dominance drops from here, money will likely flow into altcoins

📉 Next target: 50% dominance — same level where ALTs pumped 5x–10x last time!

This could be the biggest altseason of the cycle.

Don’t miss the opportunity!

Comment your top 3 altcoin picks 👇

Stay tuned for updates — we’ll post the best setups!

NFA & DYOR

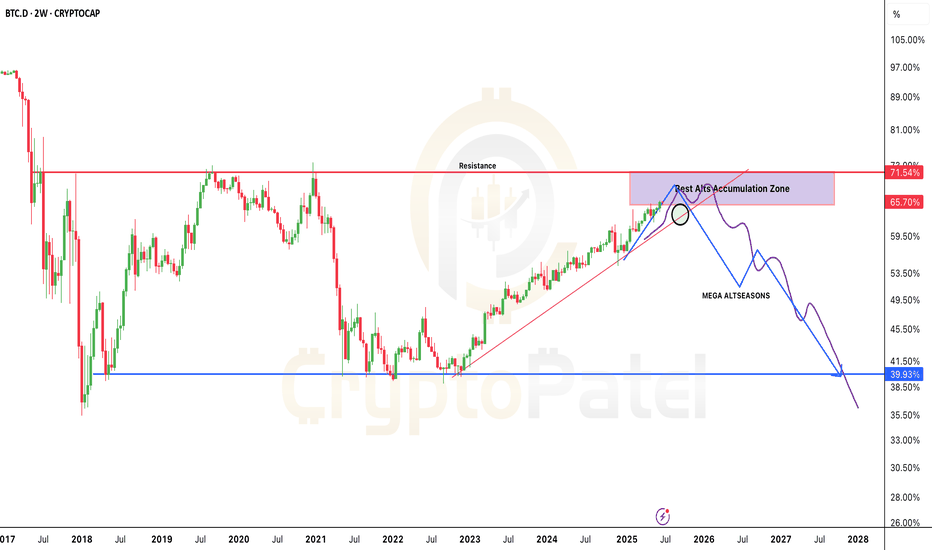

BTC Dominance About to Fall — Altcoins Will Explode Soon!BTC Dominance is currently around 64.82%, sitting at a major multi-year resistance zone (64.5%–66.5%), with strong confluence from Fibonacci extensions, Pivot Points (R1 ~66.5%), and RSI (~67.24, near overbought).

This region has historically triggered reversals, and multiple indicators suggest exhaustion. The chart also projects a potential drop toward 52%, possibly 43–40%, aligning with key support levels and a long-term trendline.

Conclusion: BTC.D looks primed for a pullback, signaling the potential beginning of an altcoin rotation or altseason.

Disclaimer: This analysis is for educational purposes only and is purely speculative. It does not constitute financial advice. Always do your own research.

Ready for Big Altcoin season and Why?BREAKING: CRYPTOCAP:BTC Dominance is about to DUMP hard!

And that means one thing…

👉 A MASSIVE #Altseason is coming.

We’ve all been bleeding, waiting, questioning.

But this dip right now? It’s your golden ticket.

📉 Dominance is topping between 65%–72%

📈 Next stop? 40% — and altcoins will fly.

This is your chance to accumulate 10x–20x gems before the real move begins.

You may not see these prices again.

This is the final test of patience.

Survive now, thrive later.

Are you ready or still sleeping on alts?

Retweet if you're stacking.

NFA & DYOR

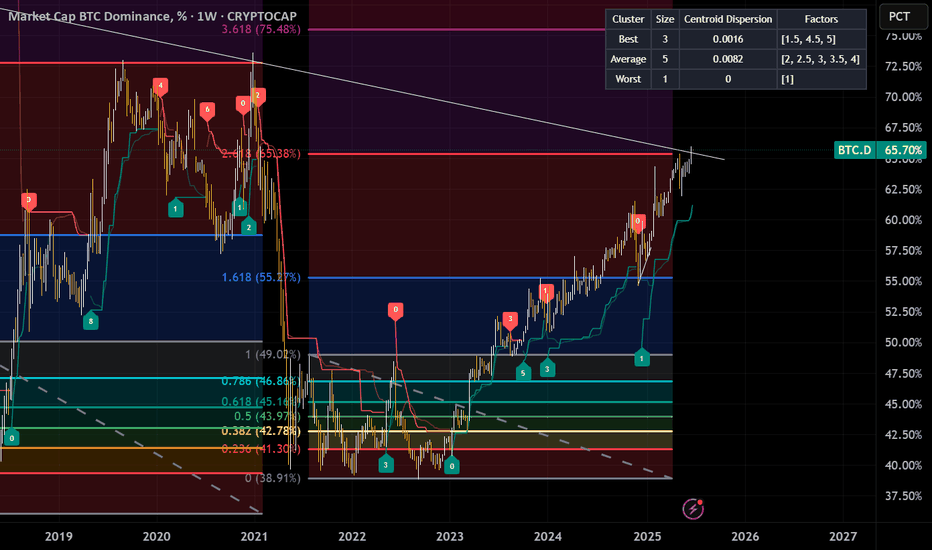

Is this the Top of BTC.D ?The Fibonacci levels suggest that it might be the top of BTC.D for this cycle. We can see that the top of the last cycle was the red line(2.618). Initially, I was not sure it would go up to that level, but it reached there slowly. We might see a drop in BTC.D from this level and, finally, ALT coins going up. Hang in there for ALT season!!!

BITCOIN DOMINANCE ANALYSIS – Altseason Loading?BITCOIN DOMINANCE ANALYSIS – Altseason Loading?

This is the Bitcoin Dominance (BTC.D) chart.

Remember: BTC Dominance moves inversely with altcoins —

✅ When dominance goes down, altcoins usually go up.

✅ When dominance goes up, altcoins often struggle.

Current Situation

🔹 BTC Dominance is now testing a major resistance level, also known as the Altcoins Accumulation Line.

🔹 This level has historically marked the end of altcoin sell-offs and the beginning of altseason.

🟥 A clear Bearish Order Block and a Fair Value Gap (FVG) zone have formed at this resistance.

These are signs of potential reversal and weakness ahead for BTC Dominance.

If Rejected...

If BTC.D fails to break above this resistance, we could see a sharp drop of ~36%, targeting the long-term support line — an area that often signals profit-taking from alts.

Historical data shows a repeating pattern every ~4 years. This structure lines up perfectly with that cycle — a strong signal.

🔹 We’re likely at the final stage of the altcoin correction.

🔹 The market structure hints that a strong altcoin season could follow if dominance starts falling from this zone.

➡️ It’s a good time to start accumulating strong altcoins before momentum shifts.

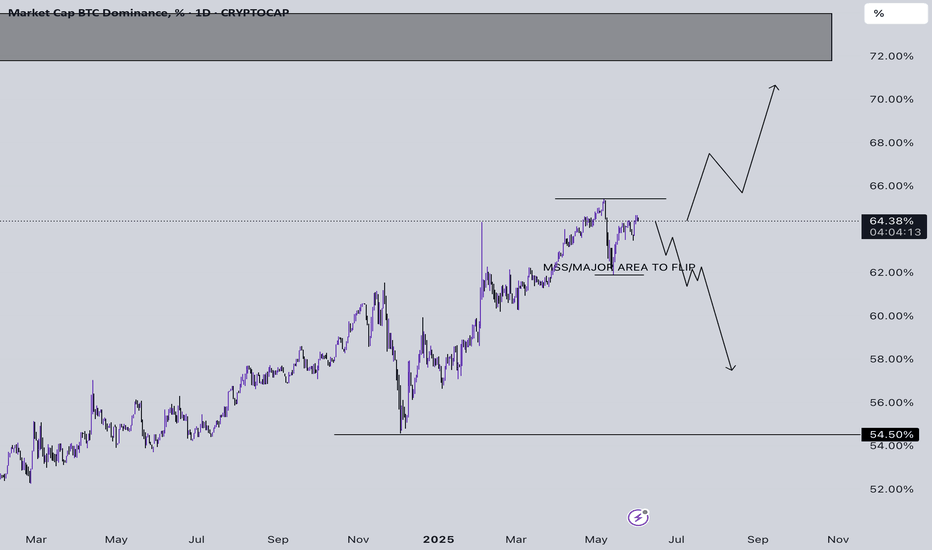

Bitcoin Dominance 1D Chart - Major Altcoins Rally Depends On Thi- BTC.D is currently trading at 64.36% and is trying to flip a bearish bias by making a Lower High

- Instead of asking everyone the same question when will we see an Altcoin Run/Rally the answer to all your questions is here

- You will only see an Altcoin run when you see BTC.D crashing and BTC either staying stable or pumping hard

- BTC D depicts the flow and rotation of money in BTC when compared to other Cryptos

- Once money starts revolving out of BTC it usually flows into major alts and other Alts

- Easy explanation: Once Bitcoin D and USDT D flips majorly bearish you will see a major rally in alts as shown in the Bearish Path if not you will see a huge dump in Alts if BTC D jumps to 72%

Bitcoin Dominance (BTC.D) about to hit the given levelBitcoin Dominance (BTC.D) measures Bitcoin’s market capitalisation as a percentage of the total cryptocurrency market cap. It’s a key metric for understanding market sentiment, reflecting whether investors favor Bitcoin (BTC) over alt coins or vice versa. Technical analysis of BTC.D involves studying its chart patterns, indicators, and levels to gauge potential market trends, such as Bitcoin strength or alt coin season.

Chart for your reference

-- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources and X posts. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

Bitcoin Dominance Rejected — Mini Altseason Incoming!Bitcoin dominance is showing early signs of weakness. It has been consistently supported by a long-term trendline, but recent price action indicates rejection from a critical resistance zone. A bearish RSI divergence confirms the weakening structure.

If BTC dominance pulls back to the 58% level, we may see a mini altseason ignite. However, a break below 54% would confirm a full-fledged altseason, unlocking massive upside potential for altcoins.

Watch levels:

Resistance zone: 60.5% – 61%

Support zone: 58%

Breakout trigger: Below 54% = Full Altseason Mode

Be ready to rotate into strong alts!

#BitcoinDominance #Altseason #CryptoAnalysis #BTC #Altcoins #CryptoBreakout

Bitcoin Dominance (BTC.D) waiting for the level to hitBitcoin Dominance (BTC.D) measures Bitcoin’s market capitalisation as a percentage of the total cryptocurrency market cap. It’s a key metric for understanding market sentiment, reflecting whether investors favor Bitcoin (BTC) over alt coins or vice versa. Technical analysis of BTC.D involves studying its chart patterns, indicators, and levels to gauge potential market trends, such as Bitcoin strength or alt coin season.

Chart for your reference

Bitcoin Dominance Just Hit a 1,505-Day High — Are You Paying Att🚨 Bitcoin dominance has been climbing non-stop for 959 days... and it just broke a 1,505-day high, hitting 64.34%.

That’s not just a stat — that’s a clear signal.

Bitcoin is still the king. 👑

Rejection Level: 66%-72%

Be honest… do you own any?

BTC.Dominance trading in symmetrical triangleBTC.D is trading in a clear symmetrical pattern, with target highlighted in the chart for a breakout and dreakdown.

Bitcoin dominance needs to drop significantly for alt-season to begin.A break of 58% would confirm lower low and and new bearish structure on the dominance.

This could be the start of massive and final alt season. Untill then we are bullish BTC and ould advice against swapping your bags for ALTS.

BTC Becomes a National Reserve Asset, What’s the Best Investment

In the near future, BTC Dominance (BTC.D) might fluctuate, but currently, Bitcoin holds over 60% of the crypto market capitalization. This means that if the total market cap is $3 trillion, BTC alone accounts for $1.8 trillion. With this level of dominance, institutional investors and financial institutions primarily focus on Bitcoin, treating it as the core of the crypto market.

What If Bitcoin Becomes a National Reserve Asset?

If countries start holding BTC as a reserve asset—similar to gold—its long-term value could skyrocket. Bitcoin would shift from being a speculative asset to becoming a crucial part of the global financial system.

So, how should you adjust your investment strategy in this scenario?

Prioritize BTC: Allocate at least 60-70% of your portfolio to BTC, as it would be the safest and most valuable asset in the crypto space.

Keep ETH & BNB: Even if BTC is recognized as a reserve asset, Ethereum and Binance Smart Chain will still have strong utility, making ETH and BNB worth holding.

Be Selective with Altcoins: A BTC-dominated market will filter out weak Altcoins. Only invest in fundamentally strong projects with real-world use cases.

In short, if Bitcoin is widely accepted as a reserve asset, the crypto market will mature and stabilize. Investors need to adapt, follow global trends, and adjust their portfolios to maximize returns in this new era.

WHAT DOES BITCOIN'S DOMINANCE TELL US?CRYPTOCAP:BTC.D 1D

1. From the point of view of technical analysis, the classic double top has formed

2. From the point of view of volume patterns, the downward movement of dominance will confirm the pattern highlighted by the red arc

EXPECTATIONS: Given the stable inflows into the ETHERIUM of ETF, which is the driver of the altseason and the main factor in reducing dominance, I expect a drop to 56.75% in the next 2-3 months, correction and further drop to 55.2%

(pleasant aroma of the altseason in the air)

Bitcoin Dominance 1D Setup - Bitcoin D is currently trading at 58.26%

- Bitcoin D is going to be the biggest indicator to track when Alts will bounce

- Bitcoin D has changed its market structure and can soon shift its bias to bearish once we see a weekly close below 56.18%

- 90% of altcoins are struggling to make a comeback and stay strong for long as BTC D and Bitcoin is outperforming ETH since quite long

- One thing to notice for all Trader/Investors is going to be ETH/BTC pair, ETH/BTC on a weekly TF has already bottomed out and it has recently reacted strong and at the same time TRUMP's inaugural is tomorrow where we can see that Trump has added ETH worth 5Million $

- Ethereum is going to be the biggest indicator clubbed with ETH/BTC USDT D once these start outperforming and USDT D underperforming ETH will print 50-60% and maybe purge a new high and that will lead to an altcoins rally

BTC.D Breakdown Signals Start of Altcoin SeasonBTC.D has broken its rising wedge support and retested the lower wedge support, which is now acting as resistance. Additionally, the MA 50 and MA 200 have formed a bearish cross, signaling a potential decline of CRYPTOCAP:BTC.D at least 10%. This scenario could trigger altcoin rallies, potentially delivering returns of 5x to 25x, marking the start of the altcoin season.