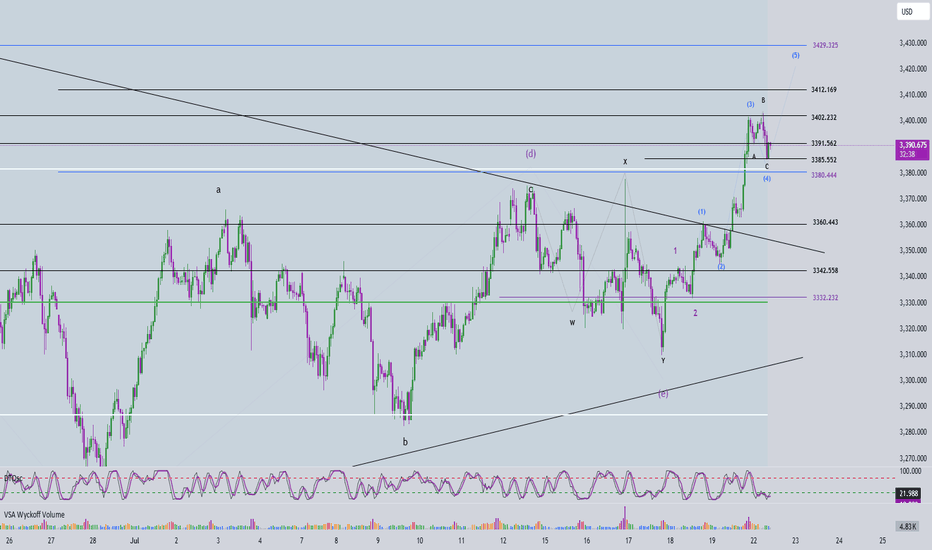

Elliott Wave Analysis – XAUUSD | July 22, 2025

🔍 Momentum Overview

• D1 timeframe: Momentum has entered the overbought zone, signaling a potential reversal within the next 1–2 sessions. That said, the current bullish leg may still extend — it’s important to wait for tomorrow’s D1 candle close for confirmation. Entering overbought territory is a warning that upside momentum is weakening.

• H4 timeframe: Momentum is currently declining. Unless a strong bullish candle closes above 3391 to trigger a reversal, the price is likely to continue moving sideways or downward today.

• H1 timeframe: There are signs of a bullish reversal. If the price holds above 3385 and posts a strong breakout candle above 3391, it could present a short-term buying opportunity.

🌀 Elliott Wave Structure Update

• Price is consolidating within the 3390 – 3402 range — a key zone to monitor closely.

• The 3380 level is a critical threshold, aligned with the 0.382 Fibonacci retracement of Wave (3). A daily close below this level would raise the possibility that the move is part of a correction rather than Wave 4.

• A flat ABC correction is currently unfolding, with the 1.618 extension of Wave A already reached at 3385.

• If price breaks below 3360, it would overlap with the previous Wave 1, invalidating the current impulsive wave count. In that case, we should consider the potential continuation of a larger abcde triangle correction.

🔗 Momentum & Wave Structure Combined

• H1 is showing early signs of a bullish reversal, but H4 momentum remains bearish. Without a strong breakout candle above 3391, price is likely to drift sideways or lower until H4 reaches the oversold zone.

• Conservative approach: Wait for H4 to enter oversold territory before considering any long positions.

• The ideal buy setup would be a bullish reaction from the 3382 – 3380 zone.

📈 Trade Setup

• Buy Zone: 3382 – 3380

• Stop Loss: 3372

• Take Profit 1: 3402

• Take Profit 2: 3412

• Take Profit 3: 3428

CFDGOLD trade ideas

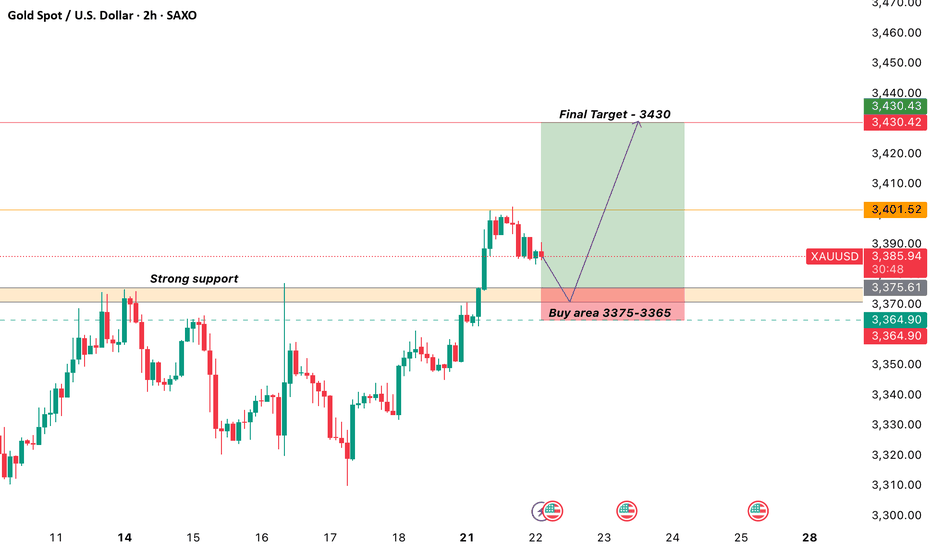

XAUUSD GOLD Analysis on (22/07/2025)#XAUUSD UPDATEDE

Current price - 3388

Buy area

If price stay above 3352 then next target 3390,3405,3430 and below that 3332

Plan;If price break 3375-3365 area,and stay above 3370,we will place buy order in gold with target of 3390,3405 and 3430 & stop loss should be placed at 3352

XAU/USD 2HRSWING TRADE

- EARN WITH ME DAILY 10K-20K –

XAUUSD Looking good for upside..

When it break level 3329 and sustain.. it will go upside...

BUY@ 3329

Target

1st 3364

2nd 3394

Enjoy trading traders.. Keep add this STOCK in your watch list..

Big Investor are welcome to join the ride ..

Like this Post??? Hit like button..!!!

Follow me for FREE Educational Post and Alert..

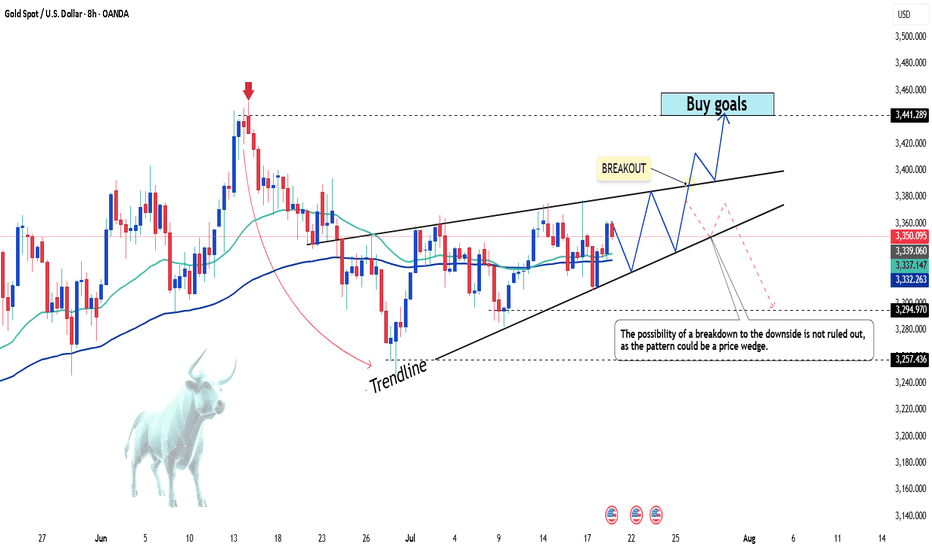

GOLD UPSIDE POSSIBLE FROM HEREHere market is at level where everyone can see that below my mark level there is open space available so market won't give everyone money so it has a probability that it will took liquidity from this zone and also currently where market is you can see there are much selling candle such as hanging man, pin bar type this show that market is weak and everyone will be at sell side but market is getting ready to move upside once the trendline is broke.

Gold surges with explosive breakoutGold prices launched into a powerful rally yesterday, soaring from $3,350 to nearly $3,400 — a stunning $50 move, equivalent to 500 pips.

This surge was supported by a weakening US Dollar and a drop in the 10-year Treasury yield, which fell to its lowest level in over a week. On the macro front, if the Federal Reserve signals an earlier-than-expected rate cut, the bullish momentum could extend further in the long term.

Technical outlook: The H2 chart reveals a strong breakout after gold successfully breached the $3,372 resistance zone ( as highlighted in yesterday’s strategy ). Price is now completing a pullback, which may serve as the base for the next bullish wave.

Do you agree with this view? Share your thoughts and let’s discuss together.

Good luck with your trades! ✨

GOLD - Short term bullish outlook for 3500+?CMP:3330

TF: 1 hour

The recent impulse price action from 3250 suggests that the short term correction is over.

Price has broken the falling trendline and also swing high at 3350 and pulled back to 50% of the rise.

The internal counts are not complete (in my view) and we may make one more low to test the 0.618 fib level at 3300 and then head higher towards 3500

At around 3300, this looks to be a decent RR trade set up.

Most of the frontline indices in the US are at the peak and due for correction as they all had an impulse one way move up. and it makes sense to think that GOLD has bottomed out and move higher while Equities halt/correct.

Disclaimer: I am not a SEBI registered Analyst and this is not a trading advise. Views are personal and for educational purpose only. Please consult your Financial Advisor for any investment decisions. Please consider my views only to get a different perspective (FOR or AGAINST your views). Please don't trade FNO based on my views. If you like my analysis and learnt something from it, please give a BOOST. Feel free to express your thoughts and questions in the comments section.

Gold XAUUSD Trading Strategy on July 22, 2025Gold XAUUSD Trading Strategy on July 22, 2025:

Yesterday's trading session, gold prices rebounded strongly from the 3345 area to the 3402 area after the previous multi-timeframe compression.

Basic news: President Donald Trump's trade stance towards Europe became tougher; Europe plans to develop a retaliation plan.

Technical analysis: After the previous multi-timeframe compression, gold prices rebounded strongly again. The previous resistance zone of 3365 - 3370 has now become a support zone for gold prices. Currently, a strong uptrend is showing in multiple timeframes. However, the RSI on the H1 frame is currently quite overbought, we will wait for a correction to the support zone to trade.

Important price zones today: 3365 - 3370, 3347 - 3352 and 3422 - 3427.

Today's trading trend: BUY.

Recommended orders:

Plan 1: BUY XAUUSD zone 3365 - 3367

SL 3362

TP 3370 - 3380 - 3400 - 3420.

Plan 2: BUY XAUUSD zone 3347 - 3349

SL 3344

TP 3352 - 3362 - 3372 - 3400.

Plan 3: SELL XAUUSD zone 3425 - 3427

SL 3430

TP 3422 - 3412 - 3402 - 3382 (small volume).

Wish you a safe, favorable and profitable trading day.💯💯💯💯💯

Gold Trading Strategy | July 21-22✅ During today’s U.S. trading session, the gold futures-spot price spread surged sharply from $8 to a high of $17—more than doubling in a short period. This suggests that significant capital may have entered the futures market, aggressively pushing up futures prices and simultaneously lifting spot gold prices.

✅ Spot gold has now climbed to the $3400 psychological level, which was previously identified as a potential short-entry zone. However, given the unusual movements in the futures market tonight and the still-elevated spread (currently around $14), caution is advised when making trading decisions.

✅ Key Technical Levels:

🔴 Major Resistance Zone:3445–3450 Strong overhead pressure zone near previous highs; watch for volume if price breaks above.

🔴 Potential Resistance Zone:3410–3415 Corresponds to the futures key level at 3425.

🔴 Psychological Leve:3400 Currently being tested; both technically and psychologically significant.

🟢 Support Zone:3383–3385 Intraday support; converted from previous highs.

🟢 Support Level:3375 Previously a resistance level; support strength still to be confirmed.

🟢 Support Zone:3360–3362 Key defense area during pullbacks; structurally strong.

🟢 Critical Support:3355 Bullish defense level; break below may weaken the uptrend.

🟢 Mid-term Bull/Bear Line:3345 Key level for medium-term trend; break below could signal a trend reversal.

✅ Trading strategy reference:

🔻 Short Position Strategy:

🔰 Shorting is not recommended at this stage. It's better to wait for the futures-spot spread to normalize or for a clear reversal structure to form before considering any short positions.

🔰 If you must attempt a short, it is essential to set a strict stop-loss, preferably just above the 3425 futures level.

🔺 Long Position Strategy:

🔰 If you already hold long positions from before the U.S. session, consider rebalancing or partially taking profit near 3400.

🔰 If you choose to hold for potential further upside, set a stop-loss just below 3361, which corresponds to a key trend support level.

🔰 If you’re not yet in a position, current prices do not offer an ideal entry point. It’s better to wait for a pullback or a new technical setup.

XAU/USDChatGPT said:

XAU/USD presents a promising intraday trade setup with a well-defined entry, stop-loss, and exit level. The entry is placed at 3391, targeting an upside move toward 3405, with a protective stop-loss at 3384 to limit downside risk. This setup offers a favorable risk-to-reward ratio, aligning with disciplined trading principles.

Gold remains supported by global uncertainties and a softer dollar, and the price action near 3390 suggests a potential bounce from minor support, confirmed by bullish momentum on lower timeframes. The stop-loss at 3384 is strategically placed below the immediate support zone to avoid getting caught in minor noise, while protecting capital if the trend reverses.

The target at 3405 corresponds with the next resistance zone and a recent swing high, making it a realistic and technically sound exit. Traders should monitor key economic releases during the session, such as US PMI or Fed commentary, as they can trigger volatility in gold.

Stick to the plan: enter at 3391 when price confirms, use the stop-loss at 3384 to cap risk, and exit at 3405 to lock in profits. Avoid chasing moves and ensure proper position sizing to maintain risk discipline on this XAU/USD trade.

XAUUSD – The bullish surge isn't over yetGold just delivered an impressive breakout of nearly 500 pips on July 21, fueled by a weakening USD as U.S. housing and manufacturing data showed signs of slowing down. With a bleaker economic outlook and growing expectations that the Fed may cut interest rates in Q4/2025, investors are flocking back to safe-haven assets – and gold is shining bright.

Technically, XAUUSD remains firmly within a clearly defined ascending channel, with price action bouncing sharply off dynamic support. The metal is currently consolidating around the 3,400 zone – if buyers can hold this ground, the door toward 3,440 and beyond could swing wide open.

As long as gold holds above 3,347, bulls remain in full control. This might just be a healthy pullback before the next leg up – don’t miss out as the market gains momentum!

Gold Price Soars Today Amidst USD WeaknessGold prices surged unexpectedly today, surpassing the 3,350 USD/ounce mark, thanks to the weakening of the USD and falling U.S. Treasury yields. Concerns over U.S. President Donald Trump's unpredictable trade policies have also fueled demand for the precious metal as a safe haven.

Despite gold dipping several times near the 3,300 USD/ounce level in recent days, the support from bargain hunters and the continued demand for gold as a safe investment has helped maintain its high price. If this upward momentum continues, gold may soon break through the next resistance level, with 3,372 USD being the immediate target.

Target Hit in XAU/USD 21/07/2025On 21/07/2025, the XAU/USD pair successfully hit its pre-defined target level, rewarding traders who followed the technical setup. Gold prices have been moving within a well-defined range, and after forming a bullish breakout above the resistance at , buying momentum picked up strongly. The entry point was around 3350, with a upside target at 3403, aligned with Fibonacci extensions and previous supply zones.

The move was supported by weaker U.S. dollar sentiment due to . dovish Fed comments, lower Treasury yields, or geopolitical tensions], which boosted demand for gold as a safe-haven asset. On the technical side, the pair maintained support above the 50-period moving average and held a strong RSI reading, confirming bullish momentum.

When price action approached the target zone, traders observed profit-taking and reduced volume, signaling a potential short-term correction. Those who booked profits at the target locked in gains of approximately 50 on the trade.

This trade highlights the importance of clear planning, risk management, and discipline in trading XAU/USD. Sticking to your strategy and respecting support/resistance levels remains key when trading this volatile pair. Patience paid off as the target was achieved successfully.

Ask ChatGPT

Gold Trading Strategy for 22nd July 2025📊 GOLD Intraday Strategy - July 22, 2025

📌 Trade Setup (Based on 1-Hour Candle)

🟢 Buy Setup

📍 Condition: Wait for a 1-hour candle to close above $3415

✅ Entry: Buy when price breaks the high of that candle

🎯 Targets:

1st Target: $3427

2nd Target: $3439

3rd Target: $3451

🔐 Stop Loss: Below the low of the breakout candle

🔴 Sell Setup

📍 Condition: Wait for a 1-hour candle to close below $3369

✅ Entry: Sell when price breaks the low of that candle

🎯 Targets:

1st Target: $3355

2nd Target: $3341

3rd Target: $3330

🔐 Stop Loss: Above the high of the breakdown candle

⚠️ Important Notes:

📌 Always wait for the 1-hour candle to close before planning the trade.

📌 Enter only after price breaks the high/low of that candle.

📌 Use proper risk management and position sizing.

📉💰 Disclaimer:

This is not financial advice. This information is shared for educational purposes only. Always consult your financial advisor before making trading decisions. Trading in the financial markets involves significant risk of loss and is not suitable for all investors.

XAUUSD GOLD Analysis on (21/07/2025)#XAUUSD UPDATEDE

Current price - 3350

If price stay above 3330 then next target 3365,3375,3390 and below that 3320

Plan;If price break 3348-3342 area,and stay above 3350,we will place buy order in gold with target of 3365,3375,3390 & stop loss should be placed at 3330

GOLD PLAN 21/07 – START OF THE WEEK FACES STRONG RESISTANCE GOLD PLAN 21/07 – START OF THE WEEK FACES STRONG RESISTANCE – WAIT FOR CONFIRMATION!

Market Overview:

Gold rebounded swiftly after a minor correction late last week, mainly fueled by ongoing geopolitical tensions. While there are no major economic events scheduled this week, macro headlines and global conflicts will likely drive volatility and direction for gold prices in the coming sessions.

Technical Outlook:

Price is quickly approaching a key resistance zone and may retest the Buy Side Liquidity area around 3377 – 3380.

A short-term reaction from sellers is possible, aiming to fill the Fair Value Gaps (FVG) below.

⚠️ Selling at current levels carries higher risk unless clear reversal signals appear. Patience is key!

Trading Plan for Today:

🔹 BUY ZONE: 3331 – 3329

SL: 3325

TP Targets:

3335 – 3340 – 3344 – 3348 – 3352 – 3358 – 3364 – 3370

🔹 SELL ZONE (risky – confirmation needed): 3377 – 3379

SL: 3383

TP Targets:

3372 – 3368 – 3364 – 3360 – 3350

Key Notes:

The 3347 zone currently acts as short-term support for bulls. If this breaks, gold may slide back to fill lower FVG zones.

Watch closely for volume activity during the London session to confirm intraday bias.

Always respect your SL/TP levels to protect your capital, especially early in the week when volatility can spike unpredictably.

💬 Stay patient, trust the structure, and let price come to your zones. Trading is a game of waiting, not chasing!

Good luck, traders!

Elliott Wave Analysis – XAUUSD | July 21, 2025🔍 Momentum Analysis

- D1 Timeframe: Momentum is currently rising → the dominant trend over the next 3 days is likely to remain bullish.

- H4 Timeframe: Momentum is approaching the oversold area → just one more bearish H4 candle could complete the entry into oversold territory.

- H1 Timeframe: Momentum is about to reverse downward → suggesting a short-term corrective pullback in the current session.

🌀 Elliott Wave Structure Update

On the H4 chart, price continues to consolidate within a corrective triangle structure. According to our previous plan, price approached the 3358 zone, and we expect:

- Wave 1 (black) may have completed at the 3358 high.

- Currently, Wave 2 (black) is likely unfolding:

+ Wave A appears to have completed.

+ The current upward leg is part of Wave B.

+ A final drop in Wave C is expected, with two key target zones:

- Target 1: 3342

- Target 2: 3332

🔎 Combining Momentum & Wave Structure

- If price breaks above 3358, we want to see a sharp, impulsive, and steep rally to confirm the beginning of Wave 3.

- If price movement remains choppy or overlapping, the market is likely still in a corrective phase.

- Key resistance zone to monitor: 3390–3402 – a clean breakout above this range would significantly strengthen the Wave 3 scenario.

📌 Trade Plan

1️⃣ BUY Setup #1

Entry Zone: 3343 – 3341

Stop Loss: 3337

Take Profit 1: 3358

Take Profit 2: 3390

2️⃣ BUY Setup #2

Entry Zone: 3333 – 3331

Stop Loss: 3323

Take Profit 1: 3358

Take Profit 2: 3390

📎 Note: Prioritize entries that come with clear confirmation signals from price action and momentum. Avoid buying during choppy or indecisive market conditions.

XAUUSD - ASCENDING TRIANGLE BREAKOUT POSSIBLEXAUUSD - BULLISH BREAKOUTS

We can see a good momentum above the marked levels with a possible breakout of Ascending triangle pattern.

Wait for a candle CLOSE above the marked levels i.e. 3368-3369.

Expected targets can be 100$ from the marked levels or more can be captured by trailing SL.

Stoploss could be placed at 3268.

1st Target - $3468

2nd Target - $3500

3rd Target - $3568

Please consult your advisor before taking any trade.

#swingtrade

#xauusd

#technicals

Gold price increased, broke 3360Plan XAU day: 21 July 2025

Related Information:!!!

Gold prices (XAU/USD) are extending their upward momentum for the second consecutive session on Monday, as buyers remain cautiously optimistic and await a decisive breakout above a multi-week trading range before committing to further gains. The US Dollar (USD) begins the new week on a softer footing amid mixed signals regarding the Federal Reserve’s (Fed) interest rate outlook—an important factor currently supporting the precious metal.

Additionally, persistent concerns over the potential economic consequences of former President Donald Trump’s unpredictable trade policies are bolstering gold’s appeal as a safe-haven asset.

personal opinion:!!!

Short term H1 frame, gold price breaks 3360 forming bullish structure. Uptrend continues to maintain

Important price zone to consider : !!!

resistance zone point: 3377 zone

Sustainable trading to beat the market

XAUUSD – Breakout or Continued Accumulation?Gold continues to respect a solid bullish structure within an ascending price channel. After a healthy pullback from recent highs, the price has retested a key technical support area and is showing signs of a strong rebound.

Current price action reveals that the market is respecting both the FVG zone and the rising support line—clear signals that smart money is still leaning toward the buy side. The next bullish targets lie around the upper resistance zone.

From a macro perspective, weaker-than-expected U.S. retail sales have placed downward pressure on the dollar, fueling speculation that the Fed may soon pivot toward easing. This adds momentum to gold’s upside potential.

Gold Prices Rise Amidst USD WeaknessAmong precious metals, prices are increasing due to the weakening of the USD. There are no negative scenarios for gold in the medium term, considering the current developments: US government spending is out of control, ongoing trade tensions, uncertain inflation, and increasing criticism aimed at the Fed.

As of the time of writing, gold has risen by 0.3% in the past 24 hours, equivalent to an increase of 100 pips, currently trading at 3,350 USD.

The current environment is highly favorable for gold, especially as investors lose confidence in the stability of US monetary policy. If the Fed begins to concede to political pressure, gold prices could break previous highs and head toward 3,440 USD/ounce in the short term.

Do you agree with this view?