About Silver / U.S. Dollar

Silver Prices have been followed for centuries. Silver (XAG) is a precious metal used in jewelry, silverware, electronics, and currency. Silver prices are widely followed in financial markets around the world. Silver has been traded for thousands of years and was once used for currency backing. Silver continues to be one of the most commonly traded commodities today. Silver prices are highly volatile due to speculation and supply and demand. Ag is the chemical symbol for silver on the periodic table of elements and its ISO currency symbol is XAG.

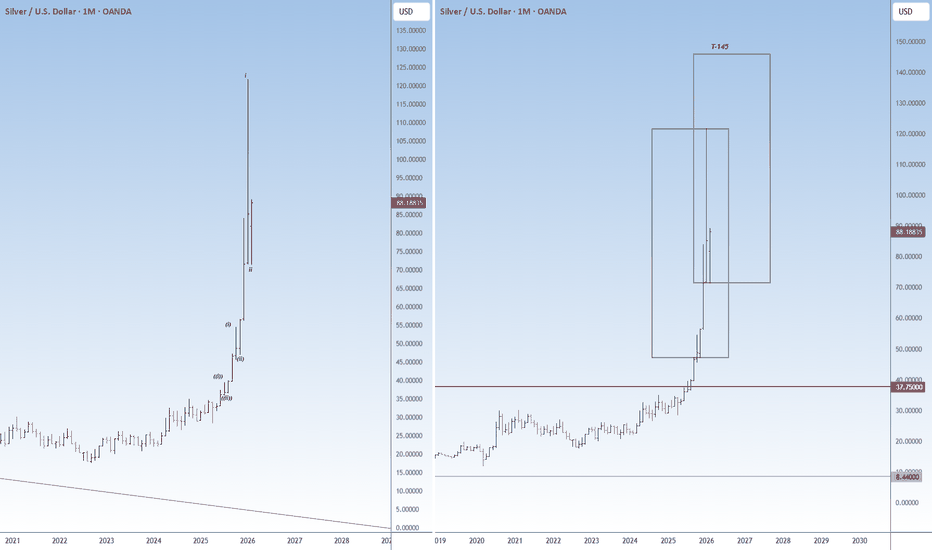

SILVER – How Greed and Fear Build Every Market MoveThis chart shows the complete market cycle in real time — not indicators, not theory, but pure price action and human behavior.

First, smart money slowly accumulates in the stealth phase while price moves quietly.

Then institutions step in and price starts trending higher during the awareness phase

whats next on Silver?Silver CMP $88

Elliott- this is the 3rd wave there is no doubt on that. The question is where will this 3rd wave get over. If in the next two months the precious metal cannot go past $145 then the last move was iii of 3.

Conclusion- in my view in the next two months silver will go past $145. So

Long on SilverSilver (XAGUSD) has taken a reversal from a key support zone of $74. It might go back and retest once more before heading to the upside. Overall quite bullish on Silver and, expecting the price pattern to play out like i have highlighted on the chart.

This is not an advice to buy or sell anything,

XAGUSD : Break & Retest Setup After Liquidity SweepSilver has completed a clear liquidity sweep from lower levels , followed by a strong bullish recovery. Price has now broken above a key range and is currently retesting the breakout area, which may act as a potential continuation zone if buyers defend it.

🔍 What the Chart Is Showing

➤ Sharp sell

Silver - Falling WedgeSilver (XAUUSD) price action has evolved into a falling wedge pattern. Which fits with my previous thesis (refer to my previous post) where i was planning to go long. Once the upper resistance of this wedge get's breached, I am going long. Ideally once the price corsses $78 !!!

Not financial advice

XAGUSD - Parallel ChannelThe price of silver has already borken out from this parallel channel that it was trading inside for the past few days. If the Bullish momentum continues, expect to have quick pullback to approx $74-$75 before continuing the next leg up. Also the RSI has now returned to neutral territoriy, which wou

Silver’s Breakdown Points to Much Lower LevelsSilver’s recent price action is not showing signs of strength or accumulation.

Instead, it reflects a clean structural breakdown followed by weak, corrective consolidation — the kind of behavior that usually precedes another leg lower.

After losing the key $84 level, silver didn’t stabilize or recl

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.