Marubozu Candlestick Pattern.....The Marubozu is a unique and powerful single candlestick pattern that signals strong momentum in the market.

📌 What is a Marubozu?

A Marubozu candlestick has "no wicks or small wicks" — just a full body from open to close. This shows that the buyers or sellers were in complete control during that period.

🔵 Bullish Marubozu

A Bullish Marubozu opens at the low and closes at the high, showing strong buying pressure. It often appears at the beginning of a bullish move or during a breakout.

🔴 Bearish Marubozu

A Bearish Marubozu opens at the high and closes at the low, indicating strong selling pressure. It can mark the start of a downtrend or a continuation of bearish strength.

🧠 Interpretation

Marubozu patterns are seen as signs of conviction. When spotted at support or resistance zones, they can strengthen breakout signals or confirm reversals.

⚠️ Tip :

Always combine Marubozu with volume analysis or other indicators to avoid false signals and improve accuracy.

🔍 Use this pattern to identify strong momentum shifts and trade in the direction of the breakout!

Disclaimer :

This post is not financial advice, it's for educational purposes only highlighting the power of coding( pine script) in TradingView, I am not a SEBI-registered advisor. Trading and investing involve risk, and you should consult with a qualified financial advisor before making any trading decisions. I do not guarantee profits or take responsibility for any losses you may incur.

GOLD.F trade ideas

XAUUSD 03/07: GOLD IN THE DRIVER'S SEATXAUUSD 03/07: GOLD IN THE DRIVER'S SEAT – WILL IT BREAKOUT OR PULLBACK BEFORE KEY EVENTS?

Gold is on a solid upward trajectory, as expected from earlier predictions this week. After a negative ADP Non-Farm Payroll report yesterday, the USD weakened, providing the fuel for gold to soar. During the US session, gold surged from the 333x level to 336x.

🔑 Key Catalysts to Watch:

1. Political Factors:

Trump's announcement that the Republicans in the House have united to push through the "Super Bill" is a significant factor that could propel gold even further in the near future. The political climate is setting the stage for gold's potential rally.

2. Macro Overview:

Federal Reserve and Rate Cuts: The market is eyeing the Fed closely, with high expectations for two interest rate cuts this year. This could put continued pressure on the USD and further support gold. With a 90% chance of a rate cut by the end of Q3, the path is clear for gold to target new highs.

US Economic Data: Disappointing ADP data, reporting a loss of -33k jobs, continues to point to a weakening labor market, strengthening the case for gold as a safe-haven asset.

🌍 Market Conditions and Trade Setup:

The market remains on edge with these political and economic factors at play. The market will also be watching the Non-Farm Payrolls (NFP) data closely. With the ADP report showing poor results, the market could experience some turbulence ahead of the NFP release, and with a long weekend ahead due to the bank holiday, traders should approach this market with caution.

📉 Technical Outlook – The Road Ahead for Gold:

Gold has been trending upward and maintaining a bullish outlook. However, a minor pullback is expected.

Resistance: 3358 – 3365 – 3374 – 3380 – 3390

Support: 3343 – 3335 – 3325 – 3316 – 3304

📊 Trading Plan – Key Levels to Watch:

Buy Scalp:

Entry: 3335 – 3333

SL: 3329

TP: 3340 → 3345 → 3350 → 3360 → 3370

Buy Zone:

Entry: 3316 – 3314

SL: 3310

TP: 3320 → 3324 → 3328 → 3332 → 3336 → 3340 → 3350 → 3360

Sell Scalp:

Entry: 3374 – 3376

SL: 3380

TP: 3370 → 3366 → 3360 → 3355 → 3350

Sell Zone:

Entry: 3388 – 3390

SL: 3394

TP: 3384 → 3380 → 3376 → 3370 → 3366 → 3360

⚠️ Key Focus for Traders:

Upcoming Data: The NFP release will be crucial, as disappointing job numbers could drive gold even higher.

Market Volatility: With the long weekend ahead and market reactions to key news, be prepared for possible volatility.

Trade with Caution: Stick to your TP/SL strategy, manage risk, and only enter trades when clear setups appear.

📈 Conclusion:

Gold is showing strong potential for further gains, but traders should be prepared for some pullbacks as the market reacts to upcoming economic and political news. The trend remains bullish, but it’s crucial to remain cautious and follow the technical levels closely to optimize entry points. Stay alert for key developments in the USD, NFP, and Fed rate-cut expectations, and let the market guide you.

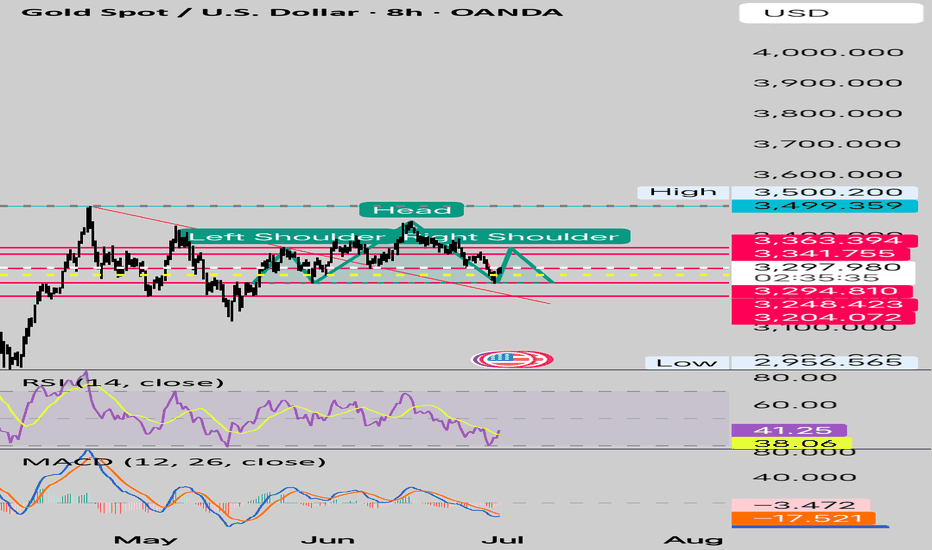

Gold Forms Classic Head & Shoulders: Breakdown or Bounce?🔎 Key Bullish Technical Levels:

Immediate Breakout Zone: ~$3355–$3360 (neckline resistance)

Current Price: ~$3344

Key Supports:

~$3320 (minor horizontal support)

~$3244 (major swing low and bullish invalidation level)

Upside Targets on Breakout:

~$3380 (near-term resistance)

~$3393–$3400 (previous high and psychological level)

🧭 Technical Observations:

✅ Price respecting rising structure since the head formation near $3244.

✅ Reduced selling on the right shoulder suggests buyers absorbing supply.

✅ Sustained move above neckline ($3360) activates bullish continuation with measured move potential.

✅ Strong momentum build-up seen in previous rally legs.

⚙️ Potential Bullish Strategy:

✅ Breakout Entry: Wait for 1H close above ~$3360 neckline.

✅ Targets: $3380 → $3393–$3400.

✅ Stops: Below ~$3320 or dynamic levels depending on risk appetite.

✅ Watch for volume confirmation on breakout.

⚡️ Pro Tip:

A Head and Shoulders isn’t bearish until it breaks down. As long as the neckline holds, it’s a resistance test – and a breakout zone for patient bulls.

Elliott Wave Analysis – XAUUSD, March 7, 2025

🌀 Elliott Wave Structure

On the H1 chart, wave 3 appears to have completed, and price is now entering a phase with an unusual structural behavior.

Wave 3 previously showed strong momentum, moving steeply and continuously, with no clear internal pullbacks – a classic impulse wave. Following this, we observed a corrective abc pattern in black, suggesting the end of wave 3.

Interestingly, although yesterday's ADP report was extremely bullish, gold only managed a mild breakout above the wave 3 high before pulling back this morning. Notably, the upward move followed a 3-wave abc structure in green, and price action is now showing overlapping waves with no clear directional momentum.

🧩 These signs suggest a high probability that:

🔹 Wave 5 is forming as an Ending Diagonal – a 5-wave structure with a 3-3-3-3-3 pattern.

🔹 This is typically seen at the end of a bullish cycle and often precedes a sharp reversal.

Although it's too early to confirm, we should patiently observe the upcoming price action. If the ending diagonal completes, it may present a strong sell opportunity.

🎯 Target for wave 5: around 3395, provided all 5 sub-waves within the diagonal complete.

⚠️ If price breaks below 3324, we must consider that the full 5-wave structure is already done, and a new abc corrective phase may have begun.

🔍 Momentum Analysis

Daily (D1): Momentum is about to turn bearish from overbought territory → suggests a weakening uptrend.

H4: Momentum is turning upward → likely a mild rally or sideways movement today before H4 reaches overbought again.

📌 Trading Plan

Given the current wave behavior and overlapping structure, it is best to remain patient and wait for confirmation before taking a strong position. If the Ending Diagonal structure is confirmed, it could signal a major reversal.

SELL Zone: 3392 – 3395

Stop Loss: 3403

Take Profits:

• TP1: 3368

• TP2: 3340

• TP3: 3324

NF news and gold buying pressurePlan XAU day: 03 July 2025

Related Information:!!!

Gold prices (XAU/USD) are struggling to build on a modest intraday rebound from the $3,340 area, holding relatively steady near the upper boundary of the weekly range during the first half of the European session. Market participants appear cautious, opting to await the release of the US Nonfarm Payrolls (NFP) report for further clarity on the Federal Reserve’s (Fed) potential rate-cut trajectory. This data is expected to play a pivotal role in shaping near-term demand for the US Dollar (USD) and could provide significant directional impetus for the non-yielding yellow metal.

personal opinion:!!!

Weak DXY is still the driving force for gold price to increase and recover around 3400, along with NF news not very positive for USD

Important price zone to consider : !!!

SELL point: 3395 zone

Sustainable trading to beat the market

Will Gold Break Higher Ahead of US Jobs Data?Hello traders, what’s your take—will gold rise or fall today?

So far, the precious metal remains quiet, hovering around $3,345 without much movement since yesterday.

According to the CME FedWatch Tool, although the probability is still low, expectations are rising that the Federal Reserve might cut interest rates later this month. That’s a strong supportive factor for gold in the near term.

Technically, the next bullish target is a confirmed daily close above the key resistance level at $3,400.

On the news front, Thursday marks the most important data release of the month for the US—the June Non-Farm Payrolls (NFP) report, released a day early due to the Independence Day holiday. The market is expecting an increase of 110,000 jobs, down from 139,000 in May.

This release could be a gold mover: If the actual number is weaker than expected, it would likely reinforce Fed rate cut expectations—giving gold a bullish push.

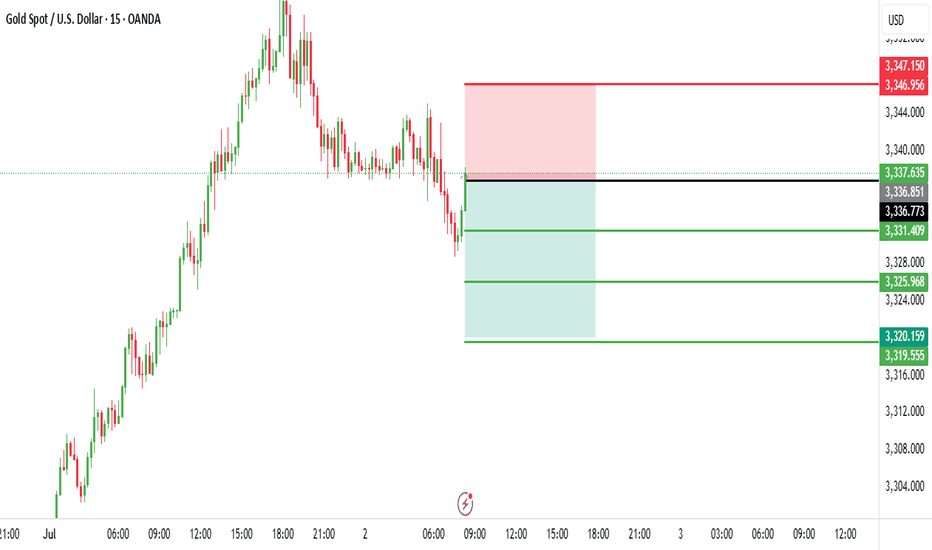

Gold XAUUSD 15M ORB & Trade PlanPrice testing ORB + supply zone at 3349–3352 near trendline resistance.

We have two bearish scenarios:

✅ Scenario 1: Short from 3349–3352 on rejection.

✅ Scenario 2: Direct entry short on clean break of 3342 ORL(Open range low)

Targets: 3345 → 3338 → 3332.

Invalidation: Above 3352, bias shifts bullish toward 3356–3360.

Trade on levels, avoid unplanned trades, and align with structure.

#Gold #XAUUSD #PriceAction #ORBStrategy #SupplyDemand #SmartMoney #BreakOfStructure #TradingView #Scalping #TradePlan

XAUUSD: Breakout Confirms Bullish ReversalGold has successfully broken out of the descending channel after consolidating around the $3,276 area, signaling a strong return of bullish momentum. The breakout occurred precisely at a confluence of multiple Fair Value Gaps, propelling price toward the $3,357 resistance zone.

Despite a slight rebound in the US dollar, growing concerns over the US fiscal deficit and proposed tax reforms are driving investors back into gold as a safe haven. Meanwhile, US bond yields remain low, and the dollar lacks the strength to suppress gold demand.

As long as price holds above $3,320, any pullback can be seen as a buying opportunity in this newly confirmed uptrend. The next target sits around $3,357, with potential for a move toward previous highs.

Gold Trading Strategy for 03rd July 2025-(UTC +5.30 HRS)📊 GOLD INTRADAY TRADE PLAN – JULY 2, 2025

(Instrument: Spot Gold in USD – Technical Strategy Based on 1-Hour Candle Close)

📈 BULLISH TRADE IDEA – BUY SETUP

🔹 Entry Condition:

Initiate a Buy position ONLY IF a 1-Hour candle closes ABOVE $3366.

This confirms bullish strength and a potential upward breakout.

🔸 Entry Point:

➤ After a valid 1-hour candle close above $3366

🎯 Upside Target Levels:

Target 1: $3376 – Short-term resistance / psychological level

Target 2: $3388 – Previous swing high zone

Target 3: $3399 – Round number target and potential breakout extension

🛑 Stop Loss:

Set SL at or below $3355 (previous resistance-turned-support or recent swing low)

📌 Risk Management Tips:

Risk-to-reward should be minimum 1:2.

Trail stop loss to breakeven after Target 1 is hit.

Exit partial quantity at each level for safer profit booking.

📉 BEARISH TRADE IDEA – SELL SETUP

🔹 Entry Condition:

Initiate a Sell position ONLY IF a 1-Hour candle closes BELOW $3343.

This indicates bearish momentum and possible downside continuation.

🔸 Entry Point:

➤ After a valid 1-hour candle close below $3343

🎯 Downside Target Levels:

Target 1: $3331 – Immediate support

Target 2: $3321 – Demand zone support area

Target 3: $3210 – Major support zone, long-range move

🛑 Stop Loss:

Set SL above $3354 (above recent structure or failed breakdown level)

📌 Risk Management Tips:

Maintain position sizing discipline.

Avoid over-leveraging.

Reassess if price shows reversal signs before hitting stop loss.

📌 GENERAL GUIDELINES:

✅ Use this plan only after the 1-hour candle closes — no early entries.

🕒 Avoid trading during high-volatility news (like FOMC, NFP, CPI) unless you're an experienced trader.

📉 Always manage trades actively – don’t set and forget.

💡 Keep a trading journal to track these setups and outcomes.

📜 DISCLAIMER:

This trading idea is for educational and informational purposes only and does not constitute investment advice. Trading commodities, including gold, involves a high level of risk and may not be suitable for all investors. Always conduct your own analysis or consult with a licensed financial advisor before making trading decisions. The author and publisher assume no liability for any financial losses incurred.

1 hour gold technical analysis This is a clean breakout setup I’m watching on XAUUSD. After forming a bullish flag and respecting key levels, price has returned to a major resistance zone. I’m looking to enter long on a confirmed breakout, with a clearly defined target above and a tight stop loss below to manage risk effectively.

TVC:GOLD

Elliott Wave Analysis – XAUUSD | February 7, 2025

🌀 Elliott Wave Structure (H1 Timeframe)

Looking at the current price structure, we can see that the price is moving sharply and steeply—this suggests the formation of a 5-wave impulsive structure.

Specifically:

- Waves 1, 2, and 3 (green) appear to have completed.

- Currently, wave 4 is forming as a 3-wave corrective structure (abc in black).

- Once wave 4 completes, we anticipate the next upward move as wave 5, which will complete the full 5-wave cycle (green).

🎯 Potential Price Targets for Wave 4

Based on the structure of the abc correction and support zones, we identify two key target areas:

+ Target 1: 3324

+ Target 2: 3311

When the price breaks above the top of wave b (black), it will serve as a strong confirmation that wave 4 has ended and wave 5 is beginning.

📈 Momentum Analysis

Daily (D1): Momentum is still rising and likely needs 2–3 more days to enter the overbought zone, supporting the continuation of the uptrend.

H4: Momentum is about to turn upward, signaling wave 4 may be nearing completion.

H1: Momentum is also preparing to turn up, suggesting the price is approaching the end of the wave 4 correction zone.

💼 Trading Plan

BUY ZONE: 3325 – 3322

STOP LOSS: 3215

TAKE PROFIT 1: 3345

TAKE PROFIT 2: 3368

TAKE PROFIT 3: 3395

📌 Wait for H1–H4 momentum alignment before triggering a BUY entry for wave 5.

Buy Opportunity in GoldI am watching it since 1 month. The Gold had taken its retracement.

On lower (1h and 4H) timeframe, It traded in strong trends' zones which were broken yesterday. Now the crocodile traders should wait for its resistance zone and get a signal on 1 h or 4h timeframe to buy above resistance zone, above 3360.

An H4 healthy candle closing above this resitance zone will pave the way into another test of 3422 area, not putting any TP though as my target is 5000 (fundamentaly).

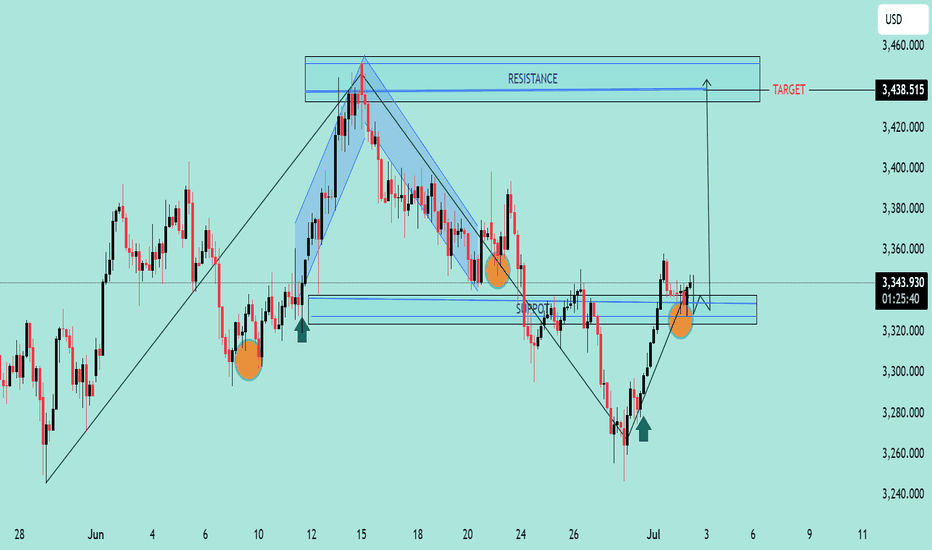

GOLD/USD Bullish Reversal and Breakout Target GOLD/USD Bullish Reversal and Breakout Target 🎯 ✨📈

🔍 Technical Analysis Overview:

The chart illustrates a clear bullish reversal pattern following a strong downtrend, with price reacting from a key support zone (highlighted in blue).

Multiple bullish rejection wicks and confirmation candles (green arrows) indicate buying interest at this support.

The recent higher low formation confirms shift in market structure towards bullish bias.

📌 Key Zones:

🟦 Support Zone: Around 3,280 – 3,320 USD

Price respected this zone multiple times (marked with orange circles), confirming its strength.

🟥 Resistance Zone / Target: 3,430 – 3,460 USD

This area aligns with previous swing highs and is the projected target for this bullish move.

📈 Chart Structure:

Break of descending trendline and bullish momentum above support suggests potential continuation towards the marked target.

Falling wedge breakout also aligns with reversal logic.

🎯 Price Target:

3,438.515 USD (resistance area), as labeled on chart with arrow and breakout projection.

🛑 Invalidation Level:

A sustained break below the support zone (3,280 USD) would invalidate this bullish outlook.

📌 Conclusion:

Gold is exhibiting strong bullish behavior with confirmation from price action and structure break. As long as price sustains above support, the path toward 3,438 remains

Gold price recovered break 3340, price increasedPlan XAU day: 02 July 2025

Related Information:!!!

Gold Demand in China Expected to Rise Further

"Gold prices (XAU/USD) fluctuated between modest gains and slight losses during the first half of the European session on Wednesday, remaining below the one-week high reached the previous day. The US Dollar has regained some positive momentum, appearing to break a seven-day losing streak that had brought it to its lowest level since February 2022. This renewed strength in the greenback is acting as a headwind for the precious metal. Additionally, a broadly positive risk sentiment in the market is seen as another factor limiting the upside potential for the safe-haven asset.

personal opinion:!!!

Gold price continues to recover after breaking the 3340 price zone, buying power maintained before ADP-NF news today

Important price zone to consider : !!!

SELL point: 3366 zone

Sustainable trading to beat the market

Gold Still Above Support Zone 3300Bears have Some reason to worry.

Rightly so, since we are Hovering around Right Shoulder

If Bears Fail to capitalise on this opportunity to Enter Shorts again..

We could well be Looking at ATH Aiming 3600 3700

Rationale

Taking Support at 20 50 DEMA

Weekly support at 3300

Prolonged Consolidation has allowed RSI and MACD to cool down and Yet Trade in Bullish Territory

Gold Analysis and Trading Strategy | July 2✅Macro Factors Supporting Gold Bulls:

🔶Escalating Trade Tensions: Former U.S. President Donald Trump has explicitly stated that he will not extend the reciprocal tariff suspension set to expire on July 9. He also threatened to impose 30%–35% tariffs on countries including Japan, significantly increasing global trade uncertainty.

🔶Rising Geopolitical Risks: The Russia-Ukraine conflict has intensified again in the Zaporizhzhia region. Additionally, Iran’s nuclear facility activities are triggering concerns over potential U.S. military strikes. These factors continue to drive up geopolitical risk premiums, supporting gold as a safe haven.

🔶Fiscal and Monetary Policies Favor Gold: The U.S. Senate recently passed a significantly larger tax cut bill, projected to increase the federal deficit by approximately $3 trillion over the next decade. This may further erode confidence in the U.S. dollar’s long-term creditworthiness, making gold more attractive as a store of value. Meanwhile, the market still expects the Fed to cut rates in September, possibly twice this year, reinforcing the outlook for lower real interest rates and boosting gold’s appeal.

✅Key Technical Levels:

🔴Resistance Levels: $3344–$3347 is the immediate resistance area. A firm breakout above this zone could lead to further gains toward $3358, and potentially open up room for an extension to $3374.

🟢Support Levels: Initial support lies at $3315–$3310, while strong support is found at $3302–$3300. A break below this zone may trigger a further decline toward $3289.

🟠Consolidation Range Reference: During the European session, gold is expected to maintain a mildly bullish consolidation pattern, with a key trading range of $3310–$3358. Overall bias remains to the upside, but caution is advised near major resistance.

✅Trading Strategy Recommendations:

🔰If gold holds above $3335 and breaks out with volume above the $3344 resistance, consider entering light long positions, targeting $3358, with a potential extension to $3374. A suggested stop-loss is below $3325.

🔰If the price pulls back from the $3344 resistance, watch the $3315–$3310 support area for potential buying opportunities on a rebound. Place stops below $3300.

🔰If $3300 support is broken, short-term long positions should be exited, and traders are advised to stay on the sidelines and observe.

✅Key Short-Term Drivers:

🔷Whether gold can break above the $3344 technical resistance level.

🔷Upcoming U.S. economic data and whether it strengthens expectations for Fed rate cuts.

🔷Any surprise geopolitical escalations or trade-related developments that may act as catalysts.

✅Summary of Trading Outlook:

Gold remains in a short-term upward consolidation phase. The $3350 level serves as a key pivot point between bulls and bears. Until a clear breakout occurs, it is prudent to avoid chasing highs and instead adopt a range-trading strategy, waiting for confirmed breakouts before positioning in the direction of the trend.

Trading Analysis for Gold Spot / U.S. Dollar (15-Minute Chart)Based on the provided 15-minute chart for Gold Spot / U.S. Dollar (XAU/USD) and the specified data, here’s a suggested trading setup for a sell position:

Current Price and Trend: The current price is not explicitly provided, but the entry price is set at 3,336.00. The chart suggests a potential resistance zone near this level, with a recent uptrend showing signs of exhaustion.

Sell Entry: Enter a sell position at 3,336.00, aligning with the specified entry price where the price may face rejection due to resistance.

Stop Loss: Place a stop loss at 3,346.00, above the recent high, to protect against an upward breakout. This level is 10.00 points above the entry, defining the risk.

Take Profit Levels:

Take Profit 1: 3,331.00, a conservative target 5.00 points below the entry.

Take Profit 2: 3,326.00, a mid-range target 10.00 points below the entry.

Take Profit 3: 3,321.00, a deeper target 15.00 points below the entry, aligning with a potential support zone.

Price Action: The chart indicates a peak near the entry level, with a bearish reversal signal suggested by the candlestick pattern and resistance line.

Risk-Reward Ratio: The distance to the stop loss (10.00 points) compared to the take profit levels (5.00 to 15.00 points) offers a mixed risk-reward profile. Take Profit 2 and 3 provide a 1:1 and 1:1.5 ratio, respectively, making this a balanced short-term trade.

Conclusion

Enter a sell at 3,336.00, with a stop loss at 3,346.00 and take profit levels at 3,331.00, 3,326.00, and 3,321.00. Monitor the price action for confirmation of a downtrend, and be cautious of a potential upward move if the price breaks above the stop loss level.

Trading Analysis for Gold Spot / U.S. Dollar (15-Minute Chart)

Based on the provided 15-minute chart for Gold Spot / U.S. Dollar (XAU/USD) and the specified data, here’s a suggested trading setup for a sell position:

Current Price and Trend: The current price is not explicitly provided, but the entry price is set at 3,336.00. The chart suggests a potential resistance zone near this level, with a recent uptrend showing signs of exhaustion.

Sell Entry: Enter a sell position at 3,336.00, aligning with the specified entry price where the price may face rejection due to resistance.

Stop Loss: Place a stop loss at 3,346.00, above the recent high, to protect against an upward breakout. This level is 10.00 points above the entry, defining the risk.

Take Profit Levels:

Take Profit 1: 3,331.00, a conservative target 5.00 points below the entry.

Take Profit 2: 3,326.00, a mid-range target 10.00 points below the entry.

Take Profit 3: 3,321.00, a deeper target 15.00 points below the entry, aligning with a potential support zone.

Price Action: The chart indicates a peak near the entry level, with a bearish reversal signal suggested by the candlestick pattern and resistance line.

Risk-Reward Ratio: The distance to the stop loss (10.00 points) compared to the take profit levels (5.00 to 15.00 points) offers a mixed risk-reward profile. Take Profit 2 and 3 provide a 1:1 and 1:1.5 ratio, respectively, making this a balanced short-term trade.

Conclusion

Enter a sell at 3,336.00, with a stop loss at 3,346.00 and take profit levels at 3,331.00, 3,326.00, and 3,321.00. Monitor the price action for confirmation of a downtrend, and be cautious of a potential upward move if the price breaks above the stop loss level.

Strong Bullish Momentum or a Short-Term Setback?XAUUSD Analysis – 02/07: Strong Bullish Momentum or a Short-Term Setback?

Gold has made a strong recovery after a brief period of consolidation last month, and it continues to show signs of strong bullish momentum. The price has been fluctuating, yet the overall trend remains positive. Let’s dive into the technical setup for today’s trading session.

📊 Market Overview:

Recent Price Action: After confirming a bullish reversal on the H1 timeframe earlier this week, Gold has surged significantly. Yesterday, it reached 3358, completing wave 3 of an Elliott structure on the M30 chart, followed by a slight correction during the US and Asian sessions.

Short-Term Correction: Wave 4 is currently underway, and there are two potential outcomes for this correction:

It could find support at 3328-3330, leading to a continuation of the bullish trend.

Alternatively, it may dip further to the 330x range before resuming the uptrend.

🧭 Key Levels to Watch:

Support: 3328 – 3313 – 3304 – 3294

Resistance: 3344 – 3360 – 3368 – 3388

🧠 Trading Strategy for Today:

Buy Scenario:

Watch for a potential bounce around the 3328-3330 range. If this area holds, we can look for buying opportunities with a target towards 3358 and 3360.

If the price breaks through the 3340 level, consider entering long positions and setting targets around 3350-3360.

Sell Scenario:

Sell Near Resistance: A quick scalping opportunity could arise near the 3388-3390 resistance zone. Tight SL and reasonable TP at 3384-3380 are the targets to aim for.

For a longer-term Sell position, wait for a clearer breakdown below 3370 to target deeper levels like 3360.

🎯 Trading Plan for Today:

BUY ZONE:

Entry: 3306 – 3304

SL: 3300

TP: 3310 → 3315 → 3320 → 3325 → 3330 → 3340

SELL ZONE:

Entry: 3388 – 3390

SL: 3394

TP: 3384 → 3380 → 3376 → 3370 → 3365 → 3360 → 3350

⚡️ Key Considerations:

The US macroeconomic data release and potential volatility from ADP NonFarm Payrolls today could provide significant movement, so stay alert and monitor the data closely.

In Summary:

Bullish bias remains intact with strong buy opportunities around key support levels like 3328-3330.

For short-term traders, focus on quick scalping within the resistance zones, but don’t forget to follow the trend for the longer-term buy strategy.

💡 Stay cautious with your Stop Loss (SL) and Take Profit (TP) to manage risk effectively. Happy trading! 🌟

Gold Holds Strong Above $3,335 – Is $3,390 the Next Target?Hey traders!

Let’s take a quick look at what’s happening with gold today

Gold continues to hold its impressive bullish momentum, trading firmly above the $3,335 mark. The rally is fueled by a sliding US dollar and declining US Treasury yields, which are driving investors toward safe-haven assets like gold.

The US Dollar Index (DXY) has dropped to its lowest level since early 2022, while the 10-year Treasury yield sits around 4.19%. These conditions give the Federal Reserve more room to consider rate cuts—supporting gold’s upside.

Adding to the bullish case, fresh data shows a recovery in US manufacturing, further boosting demand for gold.

📈 On the technical side, gold is moving just as we anticipated: it’s broken out of the descending channel and is currently forming a bullish inverse head and shoulders pattern. If the pattern completes, we could see the next leg higher pushing toward $3,390.

What do you think — is gold ready for another breakout?

Drop your view below! 💬

XAUUSD ORB Breakout PlanXAUUSD ORB Breakout Plan 🚀

Gold is consolidating within a falling channel inside the 3344–3349 supply zone post Asian open. We are watching for a clean 15-min candle close above ORH + channel breakout for a bullish continuation toward 3349 → 3353–3356.

✅ Entry: Above ORH and channel.

✅ Stop: Breakout Candle low.

✅ Target: 3353–3356.

If price fails above ORH and breaks ORL, wait for a retest at 3338–3332 for the next decision.

Trade on levels, in trend direction, and avoid unplanned areas.

#Gold #XAUUSD #PriceAction #ORBStrategy #TradingView #AsianSession #SupplyDemand #Breakout #SmartMoney #TradePlan