CFDs on Gold (US$ / OZ)

No trades

What traders are saying

XAUUSD/GOLD 1H SELL LIMIT PROJECTION 06.02.26XAUUSD – 1H Sell Limit Projection | 06.02.26

“In this one-hour XAUUSD analysis, gold is currently moving within a broader corrective structure after a strong bearish impulse.

Price is approaching a key descending trendline, where we can also observe a double top formation developing near the resistance zone. This confluence area acts as a high-probability sell limit zone, aligned with previous price rejections.

The marked Resistance R1 and R2 levels highlight strong institutional supply, where sellers are expected to step back into the market. As long as price respects this trendline resistance, bearish continuation remains valid.

On the downside, the projected move targets Support S1, followed by the final bearish objective at Support S2, which also aligns with an upward trendline target acting as liquidity support.

Risk is clearly defined above the resistance zone, while reward is projected toward the lower supports, maintaining a favorable risk-to-reward structure.

This setup is purely based on price action, trendline confluence, and market structure, not indicators.

Always remember: manage risk properly and never exceed your predefined risk per trade.”

Bearish Rejection From Supply, Targets Below

Market Structure

Price previously made a blow-off top (sharp impulsive high, marked by the red arrow), followed by a strong bearish reversal, breaking short-term structure.

The subsequent bounce formed a lower high, confirming a bearish market structure shift on the intraday timeframe.

Key Zones

Gray zone (≈ 4,880–4,950): Former demand → now supply / resistance.

Price retested this area and rejected, which is classic bearish continuation behavior.

Blue zone (≈ 4,520–4,600): Major support / demand zone from the prior swing low.

Trade Idea Logic (as drawn)

Entry: Short on rejection from the gray supply zone after weak bullish retracement.

1st Target: Around 4,714 — interim support / liquidity pool.

2nd Target: The blue support zone — completion of the bearish leg and likely reaction area.

Price Action Clues

Retracement into resistance was corrective (overlapping candles), not impulsive → favors sellers.

Failure to reclaim the gray zone = sellers still in control.

Momentum points downward, aligning with the projected path.

Invalidation

A clean 45-min close and hold above the gray supply zone would weaken the bearish bias and suggest deeper consolidation or reversal.

Gold PA Scalping FrameworkScanning XAUUSD to filter high-quality trade setups. No trades are forced—only structure-based opportunities.

Note: There may be a delay in this video due to upload processing time.

Disclaimer: FX trading involves high leverage and substantial risk, and losses can exceed your initial investment. This content is for educational purposes only and should not be considered financial advice. Trade at your own risk.

GOLD INTRADAY LEVELS 📉 PRIMARY SETUP: SELL ON RISE (preferred)

✅ Entry

Sell zone: 4830 – 4860

Or sell on rejection candle in this zone

🎯 Targets

T1: 4765

T2: 4700

T3: 4655 (recent low)

🛑 Stop Loss

SL: 4920 (15-min close)

🟢 ALTERNATE SETUP: BUY ONLY IF REVERSAL CONFIRMS

✅ Condition

15-min close above 4920

Follow-through buying (no long wicks)

🎯 Targets

T1: 4980

T2: 5050

🛑 Stop Loss

SL: 4860

❌ NO-TRADE ZONE

4780 – 4820 (chop / balance)

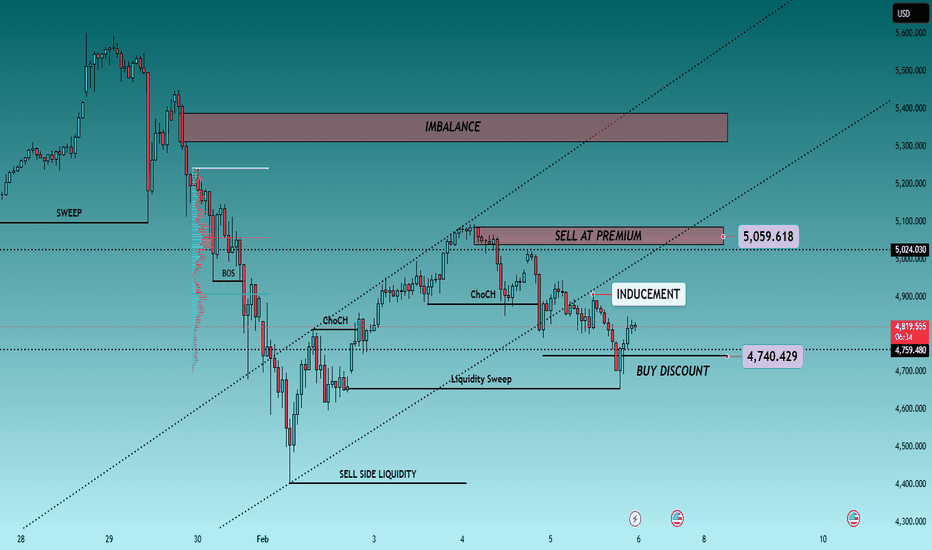

Gold Trades the Extremes as News Fuels Liquidity Games🟡 XAUUSD – Intraday Smart Money Plan (H1)

📈 Market Context

Gold remains highly sensitive today as markets react to President Trump’s announcement, keeping USD flows unstable and risk sentiment mixed. This environment favors liquidity engineering, not trend chasing. Institutions are exploiting news-driven emotions to distribute at premium and accumulate at discount.

With volatility elevated, expect false breaks, inducements, and stop hunts around key levels rather than clean directional moves.

🔎 Smart Money Technical Read

Current State:

Price is trading inside a managed range after a buy-side liquidity grab. Intraday structure shows distribution from premium, while downside moves are corrective rather than impulsive.

Core Idea:

Let price come to Smart Money — sell premium or buy deep discount only after confirmation.

Structure Observations:

• Buy-side liquidity already delivered

• Multiple CHoCH signals confirm corrective flow

• Price respecting descending internal channel

• Discount aligns with prior sell-side liquidity

• Premium capped by institutional supply & imbalance

Liquidity Zones & Key Levels

• 🔴 SELL GOLD: 5,020 – 5,060

• 🟢 BUY GOLD: 4,720 – 4,760

🧠 Institutional Expectation

Inducement → Liquidity sweep → CHoCH / MSS → BOS → displacement → OB / FVG entry → expansion

🔴 SELL Scenario — Premium Distribution

Sell Zone: 5,020 – 5,060

Conditions:

✔ Price taps premium / prior sell-high

✔ News-driven push into resistance

✔ Bearish CHoCH or MSS on M5–M15

✔ Downside BOS confirms intent

✔ Entry via bearish OB or FVG

Targets:

• 4,950 — internal reaction

• 4,820 — range low

• Trail if momentum expands

🟢 BUY Scenario — Discount Accumulation

Buy Zone: 4,720 – 4,760

Conditions:

✔ Sweep below sell-side liquidity

✔ Discount relative to HTF range

✔ Bullish CHoCH / MSS on LTF

✔ Strong displacement confirms buyers

✔ Entry from refined bullish OB

Targets:

• 4,850 — first reaction

• 4,980 — internal liquidity

• 5,050+ — if expansion resumes

⚠️ Risk Notes

• Expect fake breakouts during headlines

• No trade without structure confirmation

• Reduce size near news spikes

• Patience > prediction

📍 Summary

Gold is a Smart Money range play today:

• Sell strength at premium

• Buy weakness only at deep discount

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD / GOLD – 1H SELL PROJECTION (05-02-2026)

Gold was moving inside a rising channel, respecting the uptrend line.

However, price failed to sustain bullish momentum and clearly broke the uptrend, indicating a market structure shift.

After the breakdown:

Price retraced back into a Fair Value Gap (FVG)

The retracement got rejected near Resistance (R1)

A Three Black Crows candlestick pattern formed, confirming strong bearish pressure

This rejection from the FVG zone after an uptrend break signals a high-probability sell continuation setup.

🔍 Confluences Used

Broken uptrend line

Fair Value Gap (Sell zone)

Resistance rejection

Three Black Crows pattern

Bearish market structure

🎯 Trade Expectation

Sell from FVG zone

Stop Loss: Above recent high

Targets:

TP1: Previous support

TP2: Lower liquidity / Support S3

XAUUSD (H2) – Liam ViewXAUUSD (H2) – Liam View

USD strength continues to limit gold | Sell-side structure still active

Quick summary

Gold remains under pressure on the H2 timeframe as a firm US Dollar keeps weighing on precious metals. The recent rebound looks corrective and lacks solid acceptance above supply. With markets positioning ahead of the delayed US Non-Farm Payrolls on Feb 11, volatility may increase, but structure still favours selling rallies.

Macro context

A stronger USD generally acts as resistance for gold and silver.

If the current USD rebound sustains, downside pressure on gold can continue.

Positioning ahead of US labour data increases the risk of liquidity-driven moves.

Technical view (H2)

After a sharp sell-off, price bounced from demand but stalled below previous distribution.

Key zones

Major sell zone: 5115 – 5130, extending toward 5535

Current reaction area: around 5000

Key demand / liquidity base: 4550 – 4580

Lower highs below resistance keep sell-side control intact unless price reclaims 5115 decisively.

Trading scenarios

Primary: Sell rallies into 5000 → 5115, targeting 4550

Continuation: Clean break below 4550 opens further downside

Invalidation: Only strong H2 acceptance above 5115 shifts bias bullish

Execution notes

Expect stop runs near data releases.

Wait for level reaction, not candle chasing.

Bias: sell rallies until structure changes.

— Liam

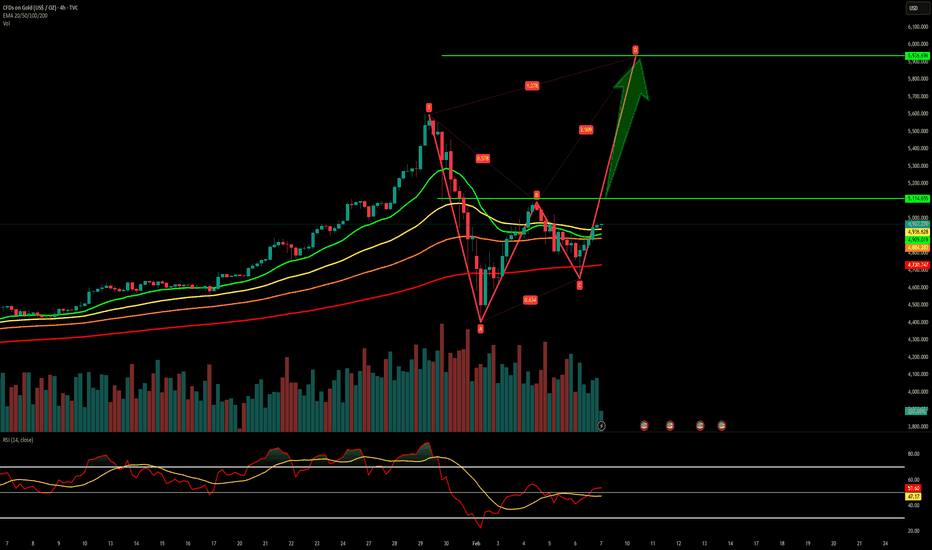

Gold Breaks Falling Resistance– Structure Shift Signals PossibleGold has finally broken above the falling resistance trendline, and more importantly, the market structure has flipped. This is the key reason why breakout trades start working better after long corrections.

Earlier, price was respecting the falling trendline, but once sellers failed to push it lower, buyers stepped in with strength. The breakout candle shows a clear momentum shift, and price is now holding above the previous resistance area.

This zone is important. As long as price stays above it, the bias remains bullish, and the upside continuation zone becomes active. Pullbacks into this area are not weakness, they are retests.

However, if price fails to hold below the marked risk zone, the breakout idea gets invalidated. Until then, the structure favors buyers.

Strong trends don’t reverse instantly, they pause, flip structure, and then continue.

What I’m Watching now on chart:

Breakout Level: Falling resistance trendline

Bullish Sign: Strong close and hold above breakout

Upside Zone: Green highlighted area

Risk Area: Below the red zone

Rahul’s Insight:

Most traders chase breakouts too early. The real edge comes when structure flips and holds, not just when a line breaks.

Disclaimer :This analysis is for educational purposes only and should not be considered financial advice. Markets involve risk. Please do your own analysis and manage risk properly before taking any trade.

Gold at a Make-or-Break Harmonic ZoneGold is approaching a critical harmonic completion area, where price action, Fibonacci geometry, and momentum structure are converging. This setup demands attention.

🧠 Market Structure Snapshot

Price has completed a well-defined X–A–B–C structure

The market is currently progressing through the final C → D leg

This leg is projected into a high-confluence Fibonacci resistance zone (PRZ)

📌 Key Insight:

This is not a blind buy or sell zone. Opportunities exist only with structure and confirmation.

📐 Harmonic Breakdown (Step by Step)

🔹 XA — Base Impulse

Strong impulsive decline

Defines the corrective framework

🔹 AB — Corrective Retracement

AB retraced ~0.50–0.618 of XA

Current level ~0.575

✅ Valid harmonic behavior

🔹 BC — Secondary Correction

BC retraced ~0.382–0.886 of AB

Current level ~0.633

✅ Structure intact

🔹 CD — Final Expansion (Current Leg)

CD extension aligning near 1.618

⚠️ Pattern maturity approaching

🎯 PRZ — Potential Reversal Zone (Decision Zone)

🔺 Resistance Cluster

5,279 – Harmonic confluence

5,377 – Intermediate resistance

5,518 – Extreme / invalidation

📍 PRZ Range: 5,279 – 5,518

Expect high volatility and reaction inside this zone.

🟢 If You Want to BUY (Leg D Continuation Trade)

📌 This is a short-term continuation trade, not a trend reversal

Buy Zone: Near 5,000 – 5,050

Stop Loss: Below 4,944

Target (Leg D): 5,279 → 5,377

👉 This trade is valid only if price holds above support and momentum stays positive.

👉 Book profits near PRZ — do not overstay longs.

🔴 If You Want to SELL (After D Completion)

Sell Zone: 5,279 – 5,377 (after rejection)

Stop Loss: Above 5,518

🎯 Downside Targets

T1: 5,000

T2: 4,944

🧪 Confirmation Is Mandatory

Trade only after:

Rejection candles / bearish engulfing

RSI divergence or rejection

Stochastic RSI rollover

MACD momentum slowdown

🧩 Final Takeaway

Gold is in the final phase of a harmonic cycle.

📌 Two-sided Plan:

Buy from support for Leg D

Sell at PRZ after completionhase trade.

Bearish Pullback Into Resistance, Downside Target in FocusMarket Structure

Price previously made a strong impulsive drop, followed by a rounded bottom / corrective recovery.

That recovery looks corrective, not impulsive (overlapping candles, curved structure), suggesting a bearish continuation setup rather than a trend reversal.

Key Zones

Major Resistance (≈ 5,100 – 5,130)

This zone previously acted as support, then flipped to resistance (classic S/R flip).

Price is projected to retest this zone before rejecting.

Support / Target Zone (≈ 4,750)

Strong demand zone where price previously reacted sharply.

Labeled clearly as the downside target.

Pattern & Bias

The white projection suggests a pullback → lower high → continuation down.

This resembles a bearish retracement into resistance, aligned with:

Prior breakdown level

Failure to reclaim key resistance

Momentum on the right side is weaker than the prior sell-off → bearish divergence in structure.

Trade Idea (Based on the Drawing)

Bias: Bearish below resistance

Entry Area: Near the resistance zone (~5,100)

Invalidation: Clean break and hold above resistance

Target: Support zone around ~4,750

Summary

Gold appears to be in a bearish continuation phase, with price likely retracing into resistance before rolling over. As long as resistance holds, the path of least resistance remains downward toward the marked support.

If you want, I can:

XAUUSD – Brian | H2 Technical AnalysisXAUUSD – Brian | H2 Technical Outlook – Consolidation & Range-Building Phase

After the recent sharp sell-off, gold is now transitioning into a consolidation phase on the H2 timeframe. The strong bearish impulse has slowed, and current price action suggests the market is shifting from directional movement into range-building and accumulation, rather than continuing lower immediately.

This type of behavior is typical after aggressive volatility, as the market reassesses value and balances supply and demand.

Market Structure & Current Behavior

Structurally, price has broken below the prior bullish leg and is now trading within a defined value range:

Selling pressure has eased following the downside expansion.

Price is rotating around the VAL and lower value areas, indicating acceptance rather than rejection.

Momentum is no longer impulsive, pointing to sideways development rather than trend continuation.

As long as price remains inside this value range, range trading conditions dominate.

Key Value & Liquidity Zones Upper Resistance / Supply

Sell Liquidity: 5,330

Sell Zone POC: 5,045

These zones act as overhead supply where upside attempts may be capped during consolidation.

Lower Support / Demand

VAL zone

Buy scalping POC: 4,673

This lower area represents short-term demand, where downside moves are more likely to stall during the accumulation phase.

Intraday Expectation

For today’s session:

Primary expectation: Sideways consolidation within the established range

Price is likely to rotate between value extremes rather than trend strongly

Breakouts require clear acceptance above resistance or below support to shift bias

Until such acceptance occurs, patience and range awareness are more effective than directional conviction.

Key Takeaway

After strong volatility, markets often pause to rebuild structure. For now, gold appears to be absorbing orders and forming balance, making consolidation the higher-probability scenario.

Refer to the chart for highlighted value zones and projected range behavior.

✅ Follow the TradingView channel to receive early market structure updates and intraday outlooks.

XAUUSD – Brian | M15 Liquidity ReactionXAUUSD – Brian | M15 Liquidity Reaction & Short-Term Structure

Gold is currently trading within a short-term recovery leg after sweeping downside liquidity earlier in the week. The rebound from the lows shows clear liquidity absorption, but price is now approaching a critical sell-side reaction zone, where sellers previously defended aggressively.

On the M15 structure, price has formed a sequence of higher lows, indicating short-term strength. However, this move is still unfolding inside a broader corrective phase, not a confirmed trend reversal. The upper zone around 5034 – 5067 remains a key SELL liquidity area, aligned with prior distribution and intraday resistance.

From a fundamental perspective, recent news around the US commitment to partial UN payments helped stabilize risk sentiment but did not create strong directional conviction. This supports the view of range-based trading rather than impulsive continuation.

Key zones to watch:

Sell zone: 5034 – 5067 (liquidity & resistance)

Intraday reaction zone: current consolidation area

Demand support: previous liquidity sweep lows below

➡️ Scenario:

Price may attempt a final push into upper liquidity before facing rejection. Failure to hold above intraday support would open the door for a pullback back into demand.

In this phase, reaction at liquidity zones matters more than prediction. Patience and structure confirmation remain key.

Follow the TradingView channel to stay updated on real-time market structure and liquidity behavior.

XAUUSD: Liquidity Swap Near PDL – Relief Bounce Into Sell ZoneDescription

Gold is currently trading inside a key liquidity zone after a strong bearish impulse.

Price swept sell-side liquidity and is now showing a short-term corrective bounce.

What I’m seeing:

Clear bearish market structure (lower highs & lower lows)

Price reacting from sell-side liquidity grab

PDL (Previous Day Low) acting as a magnet and reaction point

Current move looks like a retracement into supply / imbalance

Marked Liquidity Swap zone above → high probability rejection area

Expectation:

Short-term upside correction into the highlighted zone

Once liquidity is taken, continuation to the downside

Targets remain towards lower liquidity pools

Bias:

📉 Sell on rallies, not buys

⚠️ Invalidation if price holds and accepts above the liquidity zone

This is a probability-based idea, not financial advice.

Manage risk accordingly.

(Gold) 45-Minute Chart — Support Hold & Upside Retest Scenario

Chart Analysis:

Market Structure:

Gold is in a short-term corrective phase after a strong bearish impulse. Price made a lower low, then started forming higher lows, suggesting a potential short-term recovery within a broader downtrend.

Key Support Zone (Red):

The marked support around 4,850–4,900 has been respected multiple times. Buyers stepped in aggressively here, confirming it as a demand zone. The current price is consolidating just above this area, which is constructive.

Resistance Zone (Green):

The resistance around 5,150–5,200 aligns with a prior breakdown area and supply imbalance. This zone is the logical upside target if bullish momentum continues.

Price Behavior:

After bouncing from support, price is grinding higher with smaller candles, indicating controlled buying rather than impulsive selling. This favors a pullback-and-push scenario rather than immediate rejection.

Bullish Scenario (as drawn):

A successful hold above support, followed by a clean push, opens the door for a move toward the resistance zone (target). A brief dip into support with rejection wicks would strengthen this bias.

Invalidation:

A strong close below the support zone would invalidate the bullish setup and expose price to further downside continuation.

Bias:

🔹 Short-term bullish toward resistance

🔹 Medium-term still cautious / corrective

XAUUSD/GOLD PMI NEWS FORECAST 02.02.26XAUUSD / GOLD – ISM Manufacturing PMI Trade Plan

Date: 02-02-2026

Hello traders,

Welcome back to Tamil Trading Education.

Today we are analyzing XAUUSD (Gold) based on the ISM Manufacturing PMI news.

This is a news-based breakout and retest strategy, so please avoid emotional or early entries.

🔑 Key Levels Marked on the Chart

Resistance R2 – Major upside target

Resistance R1 – Breakout decision zone

Support S1 – First downside confirmation

Support S2 – Major bearish target

We will trade only after confirmation.

📈 Scenario 1: ISM PMI is NEGATIVE (Bullish for Gold)

If the ISM Manufacturing PMI comes out negative:

Gold is expected to move upward

Wait for a clear breakout above Resistance R1

After breakout, wait for a proper retest

👉 BUY Entry:

Enter BUY only after breakout and retest confirmation

🎯 Targets:

First target near Resistance R

XAUUSD – High volatility, monitor key reaction zones.📌 Market Context

Gold is currently trading in a high-volatility environment after a sharp drop below the $5,000 level, reflecting aggressive repricing ahead of major macro uncertainty. The market has shifted away from smooth trend behavior into a liquidity-driven, fast-reaction phase, where price moves sharply between key technical zones.

With ongoing changes in Fed leadership and uncertainty around future monetary policy direction, gold remains extremely sensitive to expectations, flows, and headlines.

➡️ Current state: Volatile conditions – wait for confirmation, avoid emotional trades.

📊 Structure & Price Action (M30)

The prior bearish impulse is losing momentum, with short-term higher lows starting to form.

Price is currently in a technical recovery phase, not a confirmed trend reversal yet.

Market continues to respect Demand and Key Levels, producing sharp reactions.

No confirmed bullish CHoCH at this stage — further validation is required.

🔎 Key insight:

Gold is trading inside a decision zone, where each key level can trigger strong directional moves.

🎯 Trading Plan – MMF Style

🔵 Primary Scenario – Buy the Technical Pullback

Focus on reaction-based execution, not anticipation.

BUY Zone 1: 4,667 – 4,650

(Near-term demand + first recovery base)

BUY Zone 2: 4,496 – 4,480

(Deep demand + prior liquidity sweep low)

➡️ Execute BUYs only if:

Clear bullish candle reaction appears

Or a Higher Low structure forms on M30

Upside Targets:

TP1: 4,932

TP2: 5,124 (Major recovery resistance/supply zone)

🔴 Alternative Scenario – Sell at Resistance Reaction

If price retraces into supply and fails to hold bullish momentum:

SELL Zone: 5,120 – 5,140

→ Look for short-term rejection following M30 structure

❌ Invalidation

A confirmed M30 close below 4,480 invalidates the recovery structure and requires a full reassessment.

🧠 Summary

Gold is in a high-volatility, structure-building phase, not an environment for emotional or aggressive positioning. The edge lies in:

Trading key levels, not impulses

Waiting for price confirmation

Prioritizing risk management over prediction

📌 In volatile markets, discipline outperforms frequency.

Gold Trading Strategy for 28th January 2026🟡 GOLD ($) TRADING PLAN

📊 TREND TRADING (Intraday)

📈 BUY SETUP

🟢 Condition:

➡️ Buy above the high of 30-min candle

➡️ Candle must close above $5244

🎯 Targets:

💰 $5255

💰 $5266

💰 $5277

🛑 Stop Loss:

🔻 Below the low of the breakout candle

📉 SELL SETUP

🔴 Condition:

➡️ Sell below the low of 1-hour candle

➡️ Candle must close below $5125

🎯 Targets:

💰 $5115

💰 $5105

💰 $5095

🛑 Stop Loss:

🔺 Above the high of the breakdown candle

⚡ SCALPING STRATEGY

🔻 SELL SCALPING (Resistance – $5244)

❌ Price tests $5244 zone

❌ 15-min candle rejection observed

📍 Entry:

➡️ Sell below the low of rejected 15-min candle

🛑 Stop Loss:

🔺 Above the high of rejected candle

⏱️ 5–10 points max or trail SL

📌 Trade Management:

🔄 Trail stop once price moves in favor

🔺 BUY SCALPING (Support – $5125)

✅ Price tests $5125 zone

✅ 15-min candle rejection observed

📍 Entry:

➡️ Buy above the high of rejected 15-min candle

🛑 Stop Loss:

🔻 Below the low of rejected candle

⏱️ 5–10 points max or trail SL

📌 Trade Management:

🔄 Trail stop once price moves in favor

⚠️ DISCLAIMER

🚨 This is not investment advice.

📉 Trading in commodities involves high risk.

💸 Past performance does not guarantee future results.

🧠 Trade only with proper risk management.

📌 Always consult your financial advisor before trading.

❗ Author is not responsible for any profit or loss.

XAUUSD – H2 Technical AnalysisXAUUSD – H2 Technical Outlook: Bullish Structure Rebuild as Precious Metals Surge | Lana ✨

Precious metals are back in focus as silver surges sharply, adding momentum to the broader metals complex. In this context, gold is showing signs of structure rebuilding after a healthy correction, setting the stage for potential continuation.

📈 Market Structure & Technical Context

After a strong impulsive drop, gold successfully defended the 4,420–4,450 strong support zone, where buyers stepped in decisively. Since then, price has been forming higher lows along an ascending trendline, signalling a shift from distribution into recovery.

The current price action suggests this move is corrective-to-bullish, not just a short-lived bounce.

🔍 Key Levels to Watch

Strong Support: 4,420 – 4,450

This zone remains the structural base. As long as price holds above it, bullish scenarios stay valid.

Mid Resistance / Reaction Zone: ~5,050 – 5,080

Price is currently consolidating here, absorbing supply after the rebound.

Next Resistance: ~5,135

A clean break and acceptance above this level would confirm continuation strength.

Upper Targets: ~5,300 – 5,350

Aligned with Fibonacci extensions and prior supply zones.

Higher Objective: ~5,580

Only in play if bullish momentum accelerates across the metals market.

🎯 Bullish Scenarios

If gold continues to respect the upper trendline and holds above the 5,000 psychological level:

A brief pullback into 5,000–5,050 could offer structure for continuation.

Acceptance above 5,135 opens the path toward 5,300+.

Strong momentum, supported by silver’s breakout, could extend moves toward 5,580.

Any pullbacks toward support are currently viewed as constructive corrections, not weakness.

🌍 Intermarket Insight

Silver’s sharp rally highlights renewed demand across precious metals, often acting as a leading signal for broader sector strength. This backdrop supports the idea that gold’s recent correction was a reset, not a reversal.

🧠 Lana’s View

Gold is rebuilding its bullish structure step by step. The focus is not on chasing price, but on how price reacts at key levels. As long as structure and momentum remain aligned, the broader trend stays constructive.

✨ Stay patient, respect the zones, and let the market confirm the next expansion.

XAUUSD/GOLD 1H RISING WEDGE SELL PROJECTION 03.02.26XAUUSD / GOLD – 1H Rising Wedge Sell Projection

Date: 03-02-2026

Hello traders,

In this video, I’m going to explain a clear sell setup on XAUUSD (Gold) based on price action and chart patterns.

📉 Market Structure Overview

Gold is currently trading under a 1-hour major downtrend line, which shows the overall bearish market structure.

Price has moved up inside a Rising Wedge pattern, which is a bearish reversal pattern when it forms during a downtrend.

⚠️ Key Technical Observations

At the top of the rising wedge, price is facing a strong resistance zone (R1).

We can clearly see a double top formation expectation, which signals weak buying strength.

This area also aligns with the trendline rejection, increasing the probability of a downside move.

🔴 Sell Trade Plan

Sell Entry: Near the wedge top and resistance zone

Stop Loss: Above the resistance and wedge breakout area

Target Price: Support S1 zone (previous demand area)

This setup offers a good risk-to-reward ratio, with sellers likely to take control after rejection.