USDJPY MULTI TIME FRAME ANALYSISHello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

Japanese Yen / U.S. Dollar

0.006730USDR

−0.000041−0.61%

As of today at 19:49 GMT

USD

No trades

JPYUSD trade ideas

USD/JPY) Bullish trand analysis Read The ChaptianSMC Trading point update

Technical analysis of USD/JPY on the 2-hour timeframe, and it presents a bullish continuation setup. Here's a breakdown of the key elements and the idea behind the analysis:

---

1. Ascending Channel Formation

The price is trading within an ascending channel, suggesting a controlled uptrend.

Higher highs and higher lows confirm the trend structure.

2. Key Support and Fair Value Gap (FVG)

There’s a well-identified support level where price has bounced before (highlighted in yellow).

A Fair Value Gap (FVG) zone is marked slightly above the support level, which could act as a short-term demand area.

Price is currently pulling back into this zone, potentially setting up a buying opportunity.

3. EMA 200 Support

The 200 EMA (~143.78) is acting as dynamic support just below the current price.

If price drops further, this level may offer strong technical support.

4. RSI Momentum

RSI is above 50 (currently 56.37), supporting the bullish trend and showing room for continued upside.

5. Target Point

The chart anticipates a bounce off the support/FVG zone and a rally toward the upper boundary of the channel, targeting 147.153.

Mr SMC Trading point

---

Summary of the Idea:

This is a bullish continuation setup within an uptrend channel. The analyst expects a potential long entry around the FVG/support zone, with a target at the channel top (147.15). Confluence from the EMA 200, RSI, and previous structure supports this bullish bias.

Pales support boost 🚀 analysis follow)

USD/JPY Bullish Reversal: Order Block & EMA 200 TargetSMC Trading point update

This chart presents a technical analysis of USD/JPY on the 1-hour timeframe. The key insights from this analysis are:

1. Order Block & Potential Reversal

The price has dropped significantly and reached a highlighted order block zone (a key demand area).

A potential inverse head and shoulders pattern is forming, indicating a possible bullish reversal.

2. Expected Bullish Movement

The price is expected to bounce from the order block, creating a bullish structure.

The projected move suggests a retracement toward a resistance zone, which aligns with previous price action.

Mr SMC Trading point

3. Target Zone & EMA 200

The target zone is around 148.946 - 149.178, aligning with the 200 EMA, a significant resistance level.

4. RSI Indicator

The RSI is currently low (~38.93), indicating potential for a reversal as the market may be oversold.

Conclusion

The chart suggests a bullish retracement after the recent drop, targeting the resistance zone near the 200 EMA. However, confirmation is needed (e.g., bullish price action, volume increase) before taking a trade. Keep an eye on fundamental news that may impact USD/JPY volatility.

Pales support boost 🚀 analysis follow)

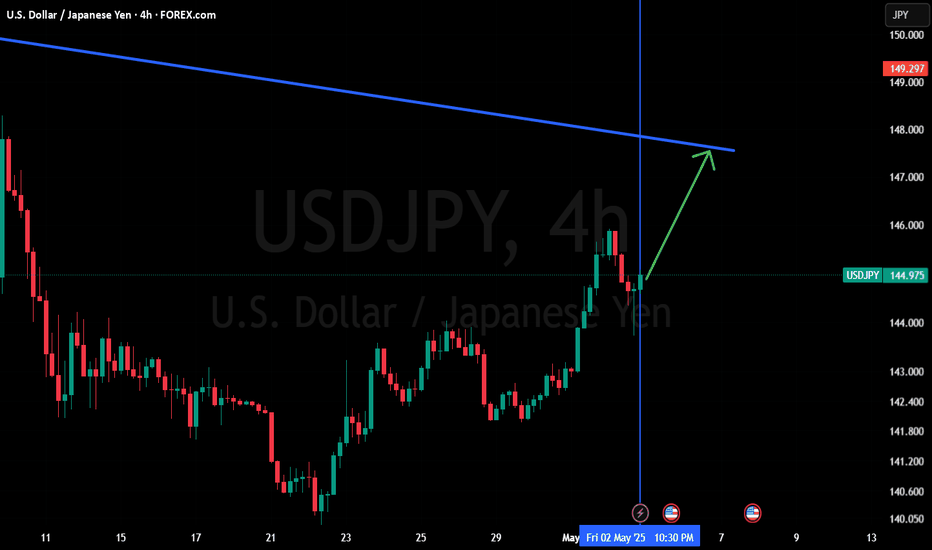

USD/JPY Weekly analysis (04-05-25 to - 10-05-25)🟨 USD/JPY – 4-Hour Outlook

📉 Move

USD/JPY is currently trading at 144.975 and could see an upside move toward 146.000–147.000 if bullish momentum holds.

📌 Reason

The pair is consolidating near 144.975, with potential support around 144.000.

A breakout above 145.086 (recent high) could confirm bullish continuation.

🔮 Outlook

Bullish scenario: A sustained move above 145.00 may target 146.00–147.00.

Bearish risk: Failure to hold 144.00 could lead to a drop toward 143.00–142.40.

📅 Next 24–48 Hours

Watch for a break and close above 145.00 for long entry confirmation.

Key resistance levels: 146.00, 147.00.

Key support levels: 144.00, 143.00.

USD/JPY Bearish Breakdown: Trendline Breach and Retest TargetingChart Breakdown:

1. Rising Channel

⬆️ Uptrend inside a channel marked by a support line

Price moved up steadily within the boundaries

Support line = channel bottom (🔵 Blue line)

2. Trendline Breakout

⚠️ Bearish breakout occurred when price broke below the support

This is a sell signal as it invalidates the upward trend.

3. Retest Zone (Resistance)

After the breakout, price came back to test the previous support — now resistance

🔄 Retest happened inside the blue box zone

This zone is crucial — if price fails here, it confirms resistance.

4. EMA 70 (Exponential Moving Average)

🔴 Red curve = EMA 70, currently above price

This suggests downward momentum is building.

5. Target Point

🎯 Target = 139.869

Based on projected move from the breakout

🔽 Bearish target shown by vertical arrow.

Summary :

Trendline break: ✂️⬇️

Retest at resistance: 🔄❌

EMA direction: 🔴↘️

Final target: 🎯139.869

Current mood: 🐻 Bearish Bias

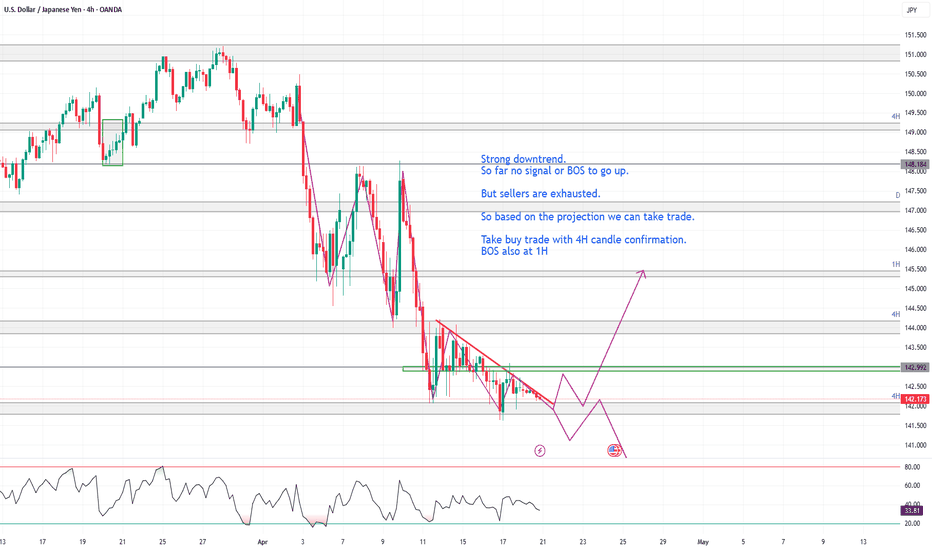

USDJPY I Weekly CLS, KL - OB Midpoint, Model 1 Target 50%Hey, Market Warriors, here is another outlook on this instrument

If you’ve been following me, you already know every setup you see is built around a CLS range, a Key Level, Liquidity and a specific execution model.

If you haven't followed me yet, start now.

My trading system is completely mechanical — designed to remove emotions, opinions, and impulsive decisions. No messy diagonal lines. No random drawings. Just clarity, structure, and execution.

🧩 What is CLS?

CLS is real smart money — the combined power of major investment banks and central banks moving over 6.5 trillion dollars a day. Understanding their operations is key to markets.

✅ Understanding the behaviour of CLS allows you to position yourself with the giants during the market manipulations — leading to buying lows and selling highs - cleaner entries, clearer exits, and consistent profits.

🛡️ Models 1 and 2:

From my posts, you can learn two core execution models.

They are the backbone of how I trade and how my students are trained.

📍 Model 1

is right after the manipulation of the CLS candle when CIOD occurs, and we are targeting 50% of the CLS range. H4 CLS ranges supported by HTF go straight to the opposing range.

📍 Model 2

occurs in the specific market sequence when CLS smart money needs to re-accumulate more positions, and we are looking to find a key level around 61.8 fib retracement and target the opposing side of the range.

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

⚔️ Listen Carefully:

Analysis is not trading. Right now, this platform is full of gurus" trying to sell you dreams based on analysis with arrows while they don't even have the skill to trade themselves.

If you’re ever thinking about buying a Trading Course or Signals from anyone. Always demand a verified track record. It takes less than five minutes to connect 3rd third-party verification tool and link to the widget to his signature.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️

USDJPYPrice action trading is a methodology in financial markets where traders make decisions based on the actual price movements of an asset over time, rather than relying heavily on technical indicators or fundamental analysis. It involves observing and interpreting patterns and trends in price charts to predict future price movements.

USD/JPY) bullish trend analysis Read The ChaptianSMC Trading point update

Technical analysis of USD/JPY chart shows a bullish reversal setup. Here’s a breakdown behind the analysis:

1. Downtrend & Channel Breakout:

Price was trending downward within a descending channel (marked “channel trend”).

Recently, the price broke out of the channel, signaling a potential trend reversal.

2. Demand Zone (Diamond Zone):

The yellow box labeled “Diamond Zone” represents a demand/support zone where price previously found buyers.

A retest of this zone is expected before the bullish move.

3. EMA (200):

The EMA (200) is currently above the price but close. A break above this level (142.522) could add to bullish momentum.

4. RSI Indicator:

RSI is showing a bounce off a mid-level (~50), suggesting bullish momentum is gaining.

5. Target Level:

The analysis targets 147.838, which aligns with a prior resistance zone.

The move projects a 5.19% gain (~778.5 pips) from the current setup.

Trading Idea Summary:

Entry: Around the “Diamond Zone” after a successful retest.

Confirmation: Watch for bullish candlestick patterns or a break above EMA 200.

Target: 147.838

Stop Loss (implied): Below the Diamond Zone (~140.000)

Pales support boost 🚀 analysis follow)

"USD/JPY Supply Zone Short Setup | High R:R Trade Plan (1H Chart📉 Short (Sell) Setup

🔵 Supply Zone (Resistance Area)

Marked in the blue box

⚠️ Price may reverse here

Sellers dominated this area before.

🔄 Expected behavior:

Price goes up to the zone and then drops

➡️🔼🔽

🔹 Entry Point: 142.841

✍️ Enter a sell trade here

Right in the supply zone.

🔴 Stop Loss: 143.371

⛔ Placed above the supply zone

To avoid stop hunts.

🟣 Target Point: 140.000

🎯 Take profit here

Strong support level

Good place to close the trade.

⚖️ Risk to Reward Ratio

❗ Risk: ~53 pips

✅ Reward: ~284 pips

⭐ R:R = 1:5.4 – Excellent setup!

📈 EMA (7)

Current price is below the EMA

Confirms bearish bias

🧭 Used as a trend guide.

Summary

🚨 Plan:

Wait for price to enter the supply zone

Enter a sell at 142.841

SL at 143.371 ⬆️

TP at 140.000 ⬇️

USD/JPY Bullish Reversal Setup – Long Entry at 141.964 Targeting ahemdsaeed25: USD/JPY Long Setup – Eyeing 150.537 Target"

"Potential Bullish Reversal on USD/JPY"

"Swing Trade Alert: USD/JPY Long from 141.964"

"USD/JPY Breakout Play – Buy Zone Identified"

Let me know your tone preference (technical, casual, professional, etc.) and I can tailor the title further.

ahemdsaeed25: This chart is for the USD/JPY (U.S. Dollar / Japanese Yen) pair on the 1-hour timeframe, and it's displaying a bullish setup with a clear trade idea. Here's a breakdown of the analysis:

Key Components:

Current Price: Around 142.574.

Entry Point: 141.964

Stop Loss: 140.547

Take Profit / Target Point: 150.537

Reward-to-Risk Ratio: Favorable (approximately 5.94% upside, large potential move).

Indicators:

EMA 50 (Red Line): 142.798 — acting as near-term dynamic resistance.

EMA 200 (Blue Line): 144.699 — major resistance and a trend filter (downward trend visible).

Zone Analysis:

Support Zone (Purple Box near 141.964 - 140.547): This is the accumulation/buy zone.

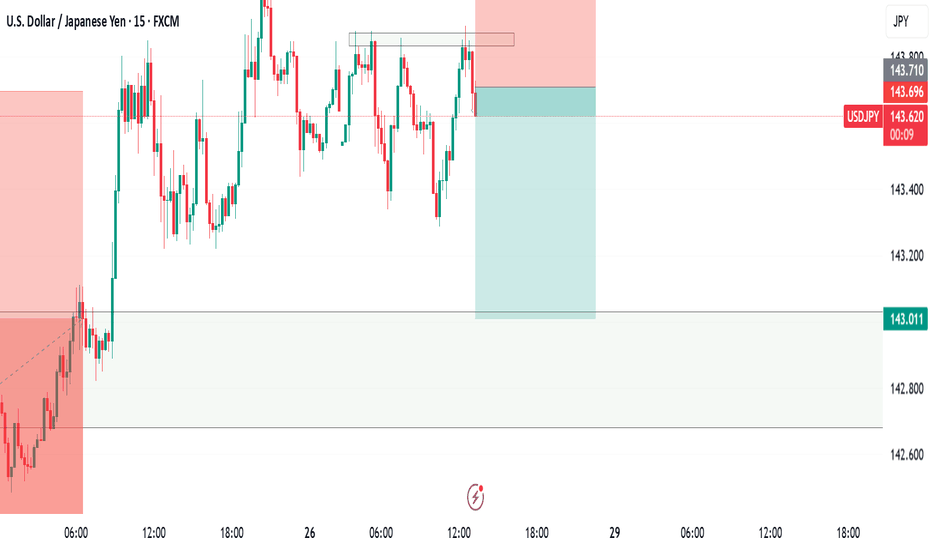

USD/JPY Bullish Breakout Setup – Entry, Stop Loss & Target AnalyPair: USD/JPY

Timeframe: 15 minutes

Indicators Used:

EMA (30-period) – Red line

EMA (200-period) – Blue line

Chart Features:

Downward channel (declining trendline)

Identified entry point, stop loss, and target

Key support/resistance zones shaded in purple

🟢 Trade Idea Summary:

🔹Entry Point: 143.126

🔹Stop Loss: 142.702

🔹Target (Take Profit): 148.249

🔹Risk/Reward Ratio: ~1:5 (Excellent R/R)

🔍 Technical Analysis:

✅ Bullish Breakout Signal

Price has broken above the descending channel and has retested the breakout area (highlighted purple zone) – a classic bullish breakout structure.

The breakout retest near 143.126 is acting as support, with potential to launch a new bullish move.

📈 Moving Average Analysis

EMA 30 is starting to flatten and curve up – indicating potential shift in momentum.

EMA 200 is still above price, but a breakout above it could strengthen the bullish case.

🔁 Support and Resistance

Strong support zone around 143.000 – 143.200 area (highlighted zone).

Major resistance and target zone is between 148.000 – 148.250.

🔔 Trade Plan Suggestion:

Go Long at or near 143.126

Place Stop Loss below support at 142.702

Target 148.249 for profit

Reasoning:

This setup offers a trend reversal potential from a downtrend to uptrend, with a clean breakout-retest-confirmation pattern. The wide take profit range gives room for extended upside as momentum builds.

⚠️ Watch For:

Reaction to the 144.325 (EMA 200) level

Increased buying volume to confirm breakout

Any re-entry into the channel (would invalidate setup)

USD/JPY Bearish Trade Setup – SBR + DBD Zone Rejection📉 Trend Analysis:

🔴 Downtrend confirmed by lower highs and lower lows.

📉 Descending trendline indicates continuous bearish pressure.

🔹 Key Levels & Zones:

🔵 Resistance Zone (SBR + DBD) – 144.123 📍 (Sell Entry Point)

🟠 Stop Loss – 145.209 🚫 (Above resistance to avoid fake breakouts)

🟢 Target Point – 139.694 🎯 (Strong support area)

🏹 Expected Price Action:

🔸 Scenario:

🔺 Price moves up toward the resistance zone (🔵 SBR + DBD Zone)

🔻 Bears take control (Rejection expected)

⚡ Drop towards target at 139.694

📊 Trade Plan:

✅ Entry – Wait for rejection at 144.123 (🔵)

✅ Stop Loss – Keep at 145.209 (🛑🔺)

✅ Take Profit – Aim for 139.694 (✅🎯)

💡 Risk-Reward Ratio: Good (More reward than risk)

JPY/USD Bullish Breakout – Targeting 0.0072802 After Retest (AprEntry Point: ~0.0069539

Take Profit (TP): 0.0072802

Stop Loss (SL): 0.0068579

Risk/Reward Ratio:

Risk: ~0.000096

Reward: ~0.000326

Approx. R/R = 1:3.4 → Excellent reward-to-risk

🧠 Strategy Insight

Trade Type: Long (Buy)

This is a bullish continuation setup aiming for higher highs after a breakout from a consolidation range.

Price Action:

Strong bullish trend visible since early April.

Price consolidated in a purple zone (likely a demand/support zone), then broke out and is now retesting that zone — classic breakout and retest pattern.

Indicators:

Two moving averages (likely 50 EMA in red and 200 EMA in blue) are in bullish alignment:

Price is above both EMAs.

50 EMA is above the 200 EMA, confirming bullish momentum.

Support & Resistance Zones:

Entry near previous resistance turned support — solid structure for long positioning.

TP zone near prior highs, possibly based on historical resistance (purple shaded zone above).

SL placed below the most recent demand zone and 200 EMA — a conservative and safe stop.

🔁 Trade Scenarios

✅ Bullish Outcome (Preferred):

Price respects the retest zone and pushes toward 0.0072802.

Strong momentum or fundamental catalysts could support the breakout continuation.

❌ Bearish Risk:

Price dips below the entry and breaks the demand zone and EMAs.

SL at ~0.0068579 helps manage this risk effectively.

🧩 Summary

This is a well-structured trend continuation long setup with textbook breakout-retest logic. The high R/R makes it an attractive opportunity assuming bullish conditions persist.

📌 Suggested Title

"JPY/USD Long Trade Setup – Breakout Retest Toward 0.0072802 (April 11, 2025)"

USD/JPY) bullish trend analysis Read The ChaptianSMC Trading point update

This chart is an analysis of the USD/JPY currency pair on a 2-hour timeframe, and it presents a possible bullish scenario. Here’s a breakdown of the idea:

---

Key Points of the Analysis:

1. Support Level & Change of Character (ChoCH):

Price found strong support around 144.556.

A ChoCH (Change of Character) is noted, indicating a potential shift from a bearish to a bullish trend.

2. Bullish Reversal Setup:

The price is forming higher lows, suggesting the start of a "New Up Trend".

There's a clear zig-zag bullish projection, suggesting potential long opportunities.

3. Target Zones:

The first target point is in the range of 149.692 – 150.493.

This area is also marked with a resistance zone, making it a logical TP (Take Profit) level.

4. Risk/Reward Ratio:

The risk is around -3.75% (-564.8 pips), and the reward is around +3.94% (+569.2 pips), suggesting a 1:1.05 R/R ratio.

5. RSI Indicator (Below):

RSI is showing a bullish divergence (price made lower lows while RSI made higher lows).

This divergence supports the idea of a possible bullish reversal.

6. 200 EMA:

The 200 EMA is at 148.767, acting as a dynamic resistance. Price may react around that level before hitting the final target zone.

Mr SMC Trading point

---

Conclusion:

This analysis suggests a potential long trade setup on USD/JPY based on:

A support zone,

Bullish RSI divergence,

Market structure shift (ChoCH),

And projected movement toward 149.692–150.493.

Idea: Buy near the support zone (~144.556) and target the resistance zone (~150.493) while managing risk carefully.

---

Pales support boost 🚀 analysis follow)

USD/JPY) Bullish reversal analysis Read The ChaptianSMC Trading point update

This chart is for USD/JPY on the 1-hour timeframe, and it presents a bullish trade setup. Let’s break down the idea

---

Key Observations:

1. Current Price:

USD/JPY is trading around 146.281.

2. Overall Bias:

Bullish setup expecting a bounce from demand into a higher target zone.

3. EMA 200:

Price is currently below the 200 EMA (147.942), which usually suggests a bearish trend — but this setup is aiming for a short-term bullish retracement.

4. Demand Zone (Buy Area):

Marked in yellow between 145.822 and slightly above.

Labeled as "FVG orders" (Fair Value Gap), suggesting institutional interest or imbalance fill.

5. Trendline Support:

The price is approaching a rising trendline, adding confluence for a potential bounce.

6. Expected Move:

Price is expected to bounce from the demand zone, form a higher low, and then move up toward the target zone at 148.221.

Two upside targets are drawn:

First Move: ~1.12% (30.6 pips)

Full Target: ~1.76% (256.1 pips)

Mr SMC Trading point

7. RSI (Relative Strength Index):

RSI is around 37.66, nearing oversold territory, supporting a bullish reversal idea.

---

Trade Idea Summary:

Bias: Bullish

Entry Zone: Around 145.822 (fair value gap & trendline support)

Target Zone: 148.221

Stop Loss: Likely just below the demand zone or trendline

Confluence Factors:

Trendline support

RSI nearing oversold

Fair value gap zone

EMA 200 overhead (target acts as resistance)

---

Pelas support boost 🚀 analysis follow

JPY/USD 30-Min Chart – Bearish Setup from Resistance Zone with 2200 EMA (blue): 0.0067930

30 EMA (red): 0.0068478

Current Price: 0.0068313

Price Position: Currently between the EMAs, showing consolidation and potential indecision.

🟪 Key Zones Identified

Entry Zone (Sell Area): Around 0.0068740

Stop Loss Zone: Above the resistance area at 0.0069118

First Target Zone (EA Resistance Point Target): Around 0.0067636

Final Target Zone (EA Target Point): Around 0.0066745

📉 Short Trade Plan

Entry Point: Price re-tests the resistance zone at 0.0068740

Stop Loss: Above key resistance at 0.0069118

Target 1 (TP1): 0.0067636

Target 2 (TP2): 0.0066745

Risk-to-Reward: Approx. 2.89x, with a -2.89% drop expected from entry to final target.

📊 Price Structure & Trend Insight

The chart shows bearish intent, with repeated rejections from the resistance zone.

A break below the 200 EMA and the support near 0.0067930 would signal stronger downside momentum.

The downward arrow and projection reflect a swing short setup based on market structure and key zones.

✅ Strategy Confirmation

Watch for:

Price rejection from the 0.0068740 level.

Bearish candlestick patterns in that zone (like bearish engulfing or shooting star).

Volume confirmation or momentum slowdown at resistance.

USD/JPY 4H Chart Analysis:Trend Break & Support-Based Long Setup1. Previous Uptrend Channel

📈

Price moved in a rising channel

Lower trendline acted as support ✅

Then came the trend line break ⚠️ — signal of trend reversal

2. Major Drop

🔻💥

After breaking support, the price fell sharply

Strong bearish momentum took over

Sellers dominated the market

3. Support Zone Identified

🟦 Support Box (146.110 - 145.156)

Buyers stepped in at this level

Possible bounce or consolidation

Price currently at 147.014 — just above support

4. Trade Setup Idea

🛒 Buy Opportunity (if price holds support)

📌 Entry Zone: Around 146.110

🎯 Target: 150.260

🛑 Stop Loss: 145.156

📊 Risk:Reward = ~1:2 — solid R:R setup!

5. Indicators & Confirmations

🟠 DEMA (9): Sitting at 146.110 — aligns with support!

✅ Extra confluence for the bounce!

Summary

If price holds above support:

Buyers might push toward 150.260

If it breaks below 145.156:

Sellers may regain control

USD/JPY BREAKS DOWN USD/JPY BREAKS DOWN – SAFE HAVEN YEN STRENGTHENS AS GLOBAL MARKETS REACT

After the latest U.S. tariff announcement, global financial markets went into risk-off mode, with U.S. Treasury yields dropping sharply. As investor fear rises, money quickly rotates into safe-haven assets — and the Japanese Yen is taking the spotlight.

🔻 USD/JPY just hit its lowest level in over 3 weeks, reflecting both global sentiment shifts and domestic tailwinds for the Yen.

🔍 What's Fueling Yen Strength?

Risk-off sentiment:

Global equities declined after the U.S. tariff update. Investors are fleeing risky assets, favoring traditional safe havens like the Yen.

Yield dynamics:

U.S. bond yields fell, dragging the dollar down.

If the Fed begins cutting rates to counteract trade impacts, it would further narrow the U.S.–Japan yield gap, supporting JPY.

BoJ policy outlook turning hawkish:

With inflation on the rise, expectations are growing that the Bank of Japan (BoJ) may continue rate hikes, reinforcing the Yen’s appeal.

Japan’s political stance:

Prime Minister Shigeru Ishiba announced intentions to revisit tariff policy negotiations with the U.S., potentially shaping Japan’s economic roadmap and investor confidence.

📈 Market Outlook:

If trade tensions persist and the Fed moves toward rate cuts, we could see further downside on USD/JPY, with JPY demand accelerating in both fundamental and technical terms.

This setup offers key opportunities for traders watching:

Safe-haven flow dynamics

Central bank divergence (Fed vs BoJ)

Potential macro breakout zones on JPY crosses

💬 What’s your view on USD/JPY heading into the next Fed and BoJ meetings?

Drop a comment and let’s discuss the bias!

✍️ Follow @MoneyMarketFlow for daily macro + technical insights across majors and metals.