Death Crossover Strategy Explained with 50-EMA & 200-EMA line.Hello Traders! In today's post, we’ll explore the Death Crossover Strategy , a highly effective technique used by traders to identify potential trend reversals. This strategy involves the 50-EMA (Exponential Moving Average) crossing below the 200-EMA , which is considered a bearish signal.

In this chart of IndusInd Bank Ltd., we can clearly see the Death Crossover in action. The 50-EMA (green line) has crossed below the 200-EMA (red line), signaling a potential downtrend.

Key Insights:

Death Crossover : Occurs when the short-term moving average ( 50-EMA ) crosses below the long-term moving average ( 200-EMA ), suggesting the beginning of a downtrend.

Volume Confirmation : A sudden increase in volume after the crossover confirms the strength of the signal. In this case, the volume spike at the crossover indicates a strong bearish momentum.

Target Areas : After a Death Crossover , look for potential support levels to target as the price moves lower. In the chart, we can see how the price retraced and then continued its downward journey.

Price Action Post-Crossover:

In this example, the stock dropped by approximately -38.12% after the Death Crossover , highlighting how powerful this signal can be in catching major trend reversals.

Risk Management :

Stop Loss : To protect your capital, always use a stop-loss order just above the 50-EMA (green line) when entering a short trade after the crossover.

Position Sizing : Keep your position sizes small in trending markets to manage risk and ensure a favorable risk-to-reward ratio.

Note: We have used this chart just for teaching the strategy and its potential impact.

This is a great strategy to catch long-term downtrends, but as always, remember to use it alongside other technical indicators and fundamental analysis to increase your chances of success.

Happy Trading!

IDUSB trade ideas

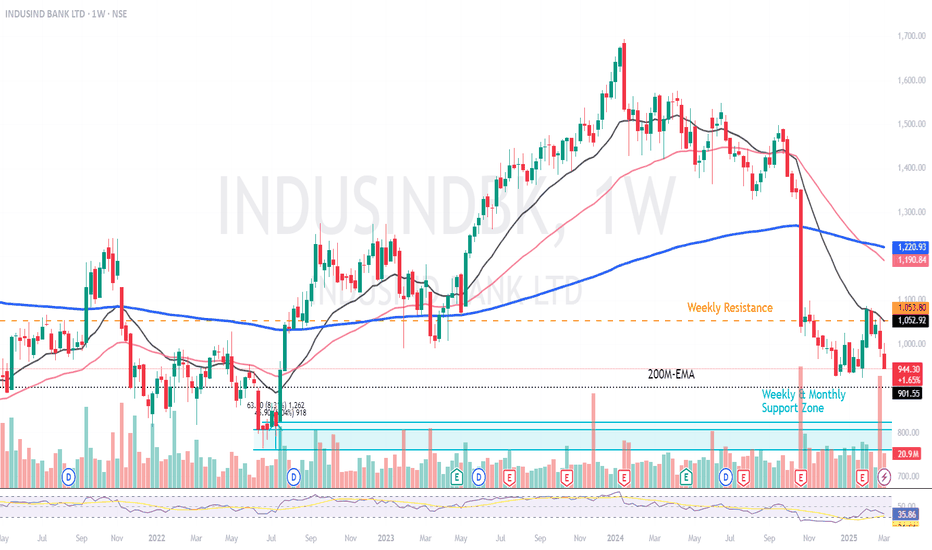

Indus Ind Bank : Sideways with negative BiasIndusInd Bank Share Prices : Make-or-Break Levels 🚨

📉 IndusInd Bank has been trading sideways with a slight negative bias for weeks.

🔻 Strong Support Zone: ₹830 - ₹770 is a rock-solid support area, backed by both Weekly & Monthly levels. Breaking below? Highly Unlikely!

🚀 Key Resistance Ahead: ₹1050 - ₹1100 is the BIG test. A breakout above could spark a trend reversal & a strong upside move!

💰 Fundamentally Undervalued: Currently trading at a P/B ratio of just 1.2 vs. its 5-year avg. of 1.8— making it one of the cheapest private banks in the market! (Downside may be limited!)

#StockMarket #TechnicalAnalysis #learn_at_stoxsense #Learntradingwithsudhir #StockMarketIndia #Optiontrading #learntrading #sebiregisteredra #INDUSINDBK #IndusindBank

Indusind Bank is a better option in such a falling market**IndusInd Bank** is a leading private-sector bank in India, known for its strong digital banking services, corporate and retail banking solutions, and customer-centric approach. It was established in 1994 and is headquartered in **Mumbai, Maharashtra**.

### **Key Features of IndusInd Bank:**

- **Retail & Corporate Banking:** Offers savings and current accounts, fixed deposits, personal & business loans, and corporate banking solutions.

- **Digital Banking:** Provides mobile banking, net banking, UPI, and contactless banking services.

- **Credit Cards:** A wide range of credit cards with rewards, cashback, travel, and lifestyle benefits.

- **Wealth Management:** Offers investment and insurance solutions, including mutual funds, stocks, and financial planning.

- **Forex & Trade Services:** Provides foreign exchange, remittances, and trade finance services.

- **CSR & Sustainability Initiatives:** Actively involved in social responsibility projects.

Would you like details on **loan interest rates, account features, or credit card options**? Let me know how I can help! 😊

IndusInd Bank Ltd (NSE)📢 IndusInd Bank Ltd (NSE) – Strategic Trading Opportunity 📢

🚀 Maximize Your Returns with Smart Trading! 🚀

Take advantage of a structured approach for swing trading and short-term investment with clear risk management strategies.

📊 Swing Trading (1 to 3 Months) – Short-Term Profit Strategy

🔹 Entry Confirmation – Above Breaking Range ₹1,024.90

🔹 Current Price – ₹1,043.75 📈

🔹 Target Price – ₹1,088.75

🔹 Short-Term Target – ₹1,190.25 (Strong Bullish Zone)

🔹 Stop-Loss (SL) – Below ₹960.10 (Strict risk control)

🔹 Risk-Reward Ratio – Maintain a 1:3 or 1:5 strategy

🔹 Market Condition – Works best in a trending bullish market

📌 Key Strategy for Swing Traders:

✔ Enter above ₹1,024.90 to confirm breakout momentum

✔ Book partial profits near ₹1,088.75 and hold for higher targets

✔ Adjust Stop-Loss to break-even once target 1 is achieved

✔ Exit fully if momentum weakens near resistance zones

📈 Short-Term Holding (6 to 12 Months) – Growth Investment Plan

🔹 Entry Level – Around ₹990.45 (Entry Zone)

🔹 Target Potential – ₹1,190.25 🚀

🔹 Stop-Loss (SL) – Below ₹960.10

🔹 Strong Support Zone – ₹861.05 (Reassess position if breached)

🔹 Profit Booking Strategy – Gradual exit as price approaches upper target levels

📌 Key Strategy for Short-Term Holders:

✔ Accumulate in the ₹990.45 range with strict SL

✔ Monitor price action near ₹1,024.90 for confirmation

✔ Hold for at least 6-12 months for best returns

✔ Reassess holdings if price falls below ₹960.10

🔻 Bearish Scenario – Risk Management Plan

🔻 Immediate Support Level – ₹960.10 (Stop-Loss)

🔻 If Breakdown Happens – Price may test ₹861.05 (Selling Target)

🔻 Risk Reduction – Adjust SL as per market conditions

📌 Risk Management Guidelines:

✔ Always trade with predefined Stop-Loss (SL)

✔ Manage position sizing based on risk percentage

✔ Avoid overexposure; secure profits periodically

🚀 Why Follow This Strategy? 🚀

✅ Defined Entry & Exit Rules – Avoids emotional trading

✅ High Reward Potential – Short & long-term profitability

✅ Risk-Controlled Approach – Protects capital & limits losses

✅ Backed by Price Action & Technical Analysis

📢 💡 Trade Smart, Stay Profitable! 💡

⚠ Important Disclaimer ⚠

📌 This is not a buy/sell recommendation, just an educational trading idea.

📌 Market conditions can change; always conduct your own research.

📌 Understand risks before investing and take full responsibility for decisions.

Indus Ind BankI have found interesting patterns in different time frame. In lower time frame price has formed an ascending triangle, and it is testing the bottom of the channel. Also price is consolidating in a narrow range.

In daily time frame, price is forming a descending triangle and testing the upper trend line of the channel.

So two time frames with different direction. In which direction price will move?

We can expect more range move if price fails to gain trend strength.

Buy above 974 with the stop loss of 966 for the targets 982, 990 and 998.

Sell below 960 with the stop loss of 970 for the targets 950, 938 and 926.

Do your own analysis before taking any trade.

Indusind Bank Ltd view for Intraday 14th Jan #INDUSINDBK

Indusind Bank Ltd view for Intraday 14th Jan #INDUSINDBK

Resistance 950 Watching above 953 for upside movement...

Support area 930 Below 940 ignoring upside momentum for intraday

Watching below 926 or downside movement...

Above 940 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

Potential upcoming reversal for IndusInd bank IndusInd bank has recently had a breakout from a strong consolidation zone. The MACD indicator and the RSI indicator currently show great bullish potential for this stock as well. IndusInd is also currently at a strong tested level of support at 976, and thus could continue moving upwards with a potential target of 1256. There is also a chance that IndusInd continues its original move to the downside, in this case it is likely that IndusInd will continue moving downwards, hit a very strong support level at 797 and then reverse to upside once again.

I am not a sebi registered advisor, this idea is posted for educational purposes only.

INDUSINDBK LevelsAs of January 5, 2025, IndusInd Bank Limited (INDUSINDBK) is trading at ₹970.15. Key support and resistance levels are as follows:

Immediate Support Levels:

₹930.73

₹952.32

₹956.88

₹964.72

₹980.08

Immediate Resistance Levels:

₹973.58

₹969.28

₹977.12

₹1009.28

₹1031.08

These levels are derived from various technical analyses, including pivot points and moving averages, and are crucial for traders and investors to monitor for potential price movements.

Please note that stock prices are subject to market volatility, and it's advisable to consult financial advisors or conduct further research before making investment decision

Can 2025 Be A Reversal For INDUSINDBK?NSE:INDUSINDBK has been falling since 1700 rupees and is all the way down about 50% from the last swing low. Recently the bank has shown a short term crash like structure where a Divergence build-up usually results in a reversal.

The 61.8% level which is considered a good retracement level is still far below at 780. But considering the current sharp fall, the divergence buildup, and 50% retracement, it might not be a bad idea to enter an early buy position.

Currently the major challenge for this bank is 1000 level which is somehow acting as a psychological resistance. 925 can be a hard stop with reconsideration of second buy at 780.

~ Trading Idea by Dr. Sagar Bansal via @jyotibansalanalysis

INDUSINDBK Support and Resistance As of December 29, 2024, IndusInd Bank Limited (INDUSINDBK) closed at ₹953.40 on the National Stock Exchange (NSE), marking a 2.30% increase from the previous close.

Technical analysis indicates the following support and resistance levels:

Immediate Support: ₹943.23

Immediate Resistance: ₹981.28

Short-term Support: ₹939.16

Short-term Resistance: ₹973.93

Medium-term Support: ₹925–908

Medium-term Resistance: ₹942–959

These levels suggest that if the stock price declines, it may find support around ₹943, potentially preventing further decreases. Conversely, if the price rises, it may encounter resistance near ₹981, which could impede further gains.

Additionally, the Relative Strength Index (RSI) is at 49.395, indicating neutral momentum.

Please note that stock prices are subject to market volatility. For the most current information, it's advisable to consult real-time data sources or financial advisors.

INDUSINDBK Support & ResistanceAs of December 24, 2024, IndusInd Bank Limited (INDUSINDBK) closed at ₹935.30, reflecting a decrease of 0.51% from the previous close.

The following support and resistance levels have been identified for INDUSINDBK:

Support Levels:

S1: ₹924.45

S2: ₹907.75

S3: ₹875.00

Resistance Levels:

R1: ₹940.65

R2: ₹948.15

R3: ₹955.00

These levels are derived from various technical analyses, including pivot point calculations and moving averages.

Please note that support and resistance levels are dynamic and can change based on market conditions.

It's advisable to consult real-time data and consider multiple technical indicators before making any trading decisions.

just the beginning of the fall much more left INDUS IND BANKfundamentally in the past also indus ind has internal issues

management is not good (hinduga group )

better stay away from it can go below 700-500 also

below 790 can go to covid low

Also stay away from Rbl Bank and Bhandhan Bank

Disclaimer- Just my view and opinion trade at your own risk not an investment advice

these are only for educational purposes

Indusind Bank Ltd view for Intraday 23rd Dec #INDUSINDBK

Indusind Bank Ltd view for Intraday 23rd Dec #INDUSINDBK

Resistance 940 Watching above 942 for upside movement...

Support area 914-915 Below 930 ignoring upside momentum for intraday

Support 914-915 Watching below 913 or downside movement...

Resistance area 940

Above 925 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

Indusbank | Trendline Breakout ⭕️ Swing Trading opportunity: Price Action Analysis Alert !!!⭕️

💡✍️Technical Reasons to trade or Strategy applied :-

✅Inverted Head & Shoulder Chart Pattern Bull Breakout

✅Breakout confirmed

✅Rise in Volume

✅Good 3 touches Trendline Breakout with volume

✅Clear uptrend with HH & HLs sequence

✅ Order block as potential Supports

✅Check out my TradingView profile to see how we analyze charts and execute trades.

🙋♀️🙋♂️If you have any questions about this stock, feel free to reach out to me.

📍📌Thank you for exploring our idea! We hope you found it valuable.

🙏FLLOW for more !

👍LIKE if useful !

✍️COMMENT Below your view

Indusind bank will multibagger Indusind corrected more than 30% from top after a bad result and after give dead cat bounce it almost corrected 10-11% again with very small go long and hold it it will give massive return in 3-6 months my first tgt is 1325 and after breaking 1375 with strong closing I will long till 1500 and then closing above 1575 will go long for fresh high...

INDUSINDBANK A BREAKDOWN BELOW MAJOR SUPPORT WILL IT SUSTAIN ?IndusInd Bank Ltd. is another weak and weaker chart structure with following

1. RSI on both daily and weekly slipped below 40

2. Price trading below major moving averages

3. Price closed just below major support area of 1350 levels, if it sustains below this level for few more days one can see more down side.

CAUTION : markets are volatile keep strict stop losses

Lets See How it Evolves.

Disclaimer: NOT A BUY / SELL RECOMMENDATION I am not an expert I just share interesting charts here for educational purpose and not to be taken as buy/sell recommendation. Please seek expert opinion before investing and trading as trading/ investing in market is subject to market risks. I do not hold any position in the stock as on date but I may look to take some position with my own Risk Reward matrix.

INDUSIND BANK is ready for a big bullish reversalINDUSIND BANK was trading in a downtrend from many days and now it is trying to reverse as it has broken its structure at the level of 1055.80 and changed its character at the level of 1084.65 i've entered a long position at the level of 1055.80 with a stop loss of 1035 and i'm targeting a big reversal 1167.65, 1258.20, 1355.15, 1498.80. It is going to be a great risk :reward trade in the short term hold as it has filled its FVG(1065.85-1081.05) on the retest