Aarti Industries Limited (AARTIIND)Aarti Industries Limited:- Manufacturing and supplying specialty chemicals, intermediates, and pharmaceuticals, catering to diverse industries such as agrochemicals, pharmaceuticals, polymers, additives, and energy.

Integrated Manufacturing: The company leverages backward and forward integration

Next report date

In 3 days

Report period

Q1 2025

EPS estimate

2.06 INR

Revenue estimate

19.40 B INR

9.10 INR

3.31 B INR

72.71 B INR

205.80 M

About AARTI INDUSTRIES LTD

Sector

Industry

CEO

Suyog Kalyanji Kotecha

Website

Headquarters

Mumbai

Founded

1984

ISIN

INE769A01020

FIGI

BBG000CMRR35

AARTI Industries Ltd. is a holding company, which engages in the development and manufacture of specialty chemicals, pharmaceuticals, and home and personal care intermediates. It operates through the following segments: Specialty Chemicals and Pharmaceuticals. The Specialty Chemicals segment offers benzene, sulphur, and toluene product chains. The Pharmaceuticals segment focuses on active pharmaceutical ingredients, custom synthesis, and contract research. The company was founded by Chandrakant Vallabhaji Gogri and Shantilal Tejshi Shah on September 28, 1984 and is headquartered in Mumbai, India.

2.5%

3.8%

5.1%

6.4%

7.7%

Q4 '23

Q1 '24

Q2 '24

Q3 '24

Q4 '24

0.00

5.00 B

10.00 B

15.00 B

20.00 B

Revenue

Net income

Net margin %

Revenue

COGS

Gross profit

Op expenses

Op income

Non-Op income/ expenses

Taxes & Other

Net income

0.00

5.00 B

10.00 B

15.00 B

20.00 B

Revenue

COGS

Gross profit

Expenses & adjustments

Net income

0.00

5.00 B

10.00 B

15.00 B

20.00 B

Q4 '23

Q1 '24

Q2 '24

Q3 '24

Q4 '24

0.00

10.00 B

20.00 B

30.00 B

40.00 B

Debt

Free cash flow

Cash & equivalents

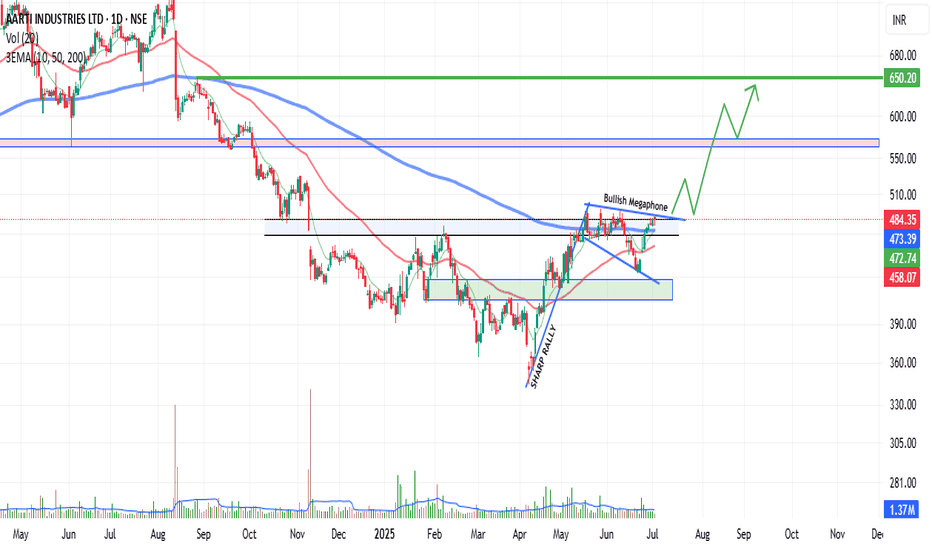

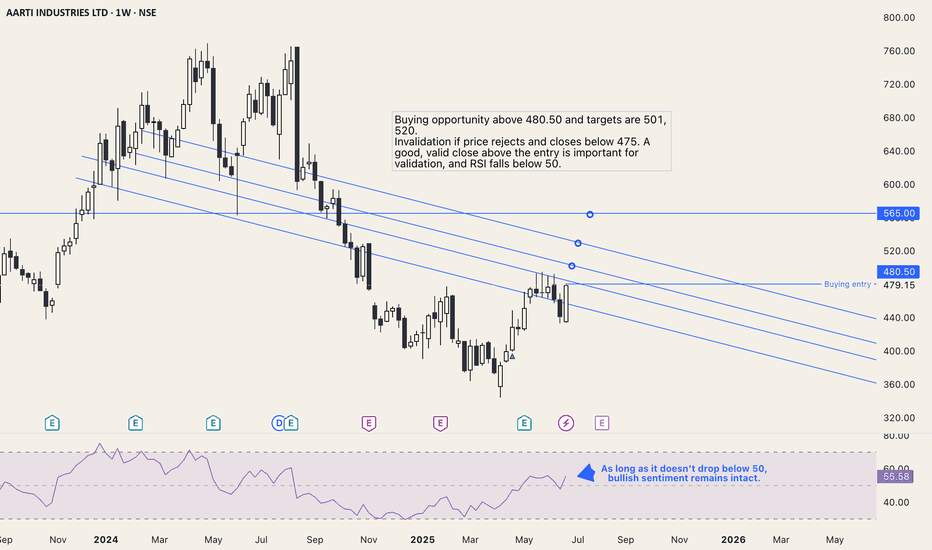

AARTIIND trading strategyBuying opportunity above 480.50 and targets are 501, 520.

Invalidation if price rejects and closes below 475. A good, valid close above the entry is important for validation, and RSI falls below 50.

NLong

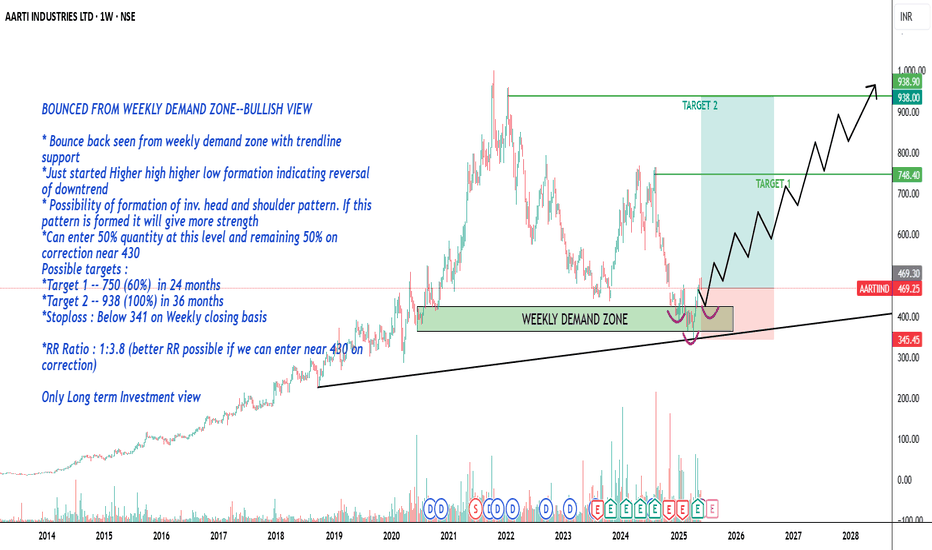

AARTI IND-- Bullish view-Educational PurposeAARTI IND--BOUNCED FROM WEEKLY DEMAND ZONE--BULLISH VIEW

* Bounce back seen from weekly demand zone with trendline support

*Just started Higher high higher low formation indicating reversal of downtrend

* Possibility of formation of inv. head and shoulder pattern. If this pattern is formed it will

NLong

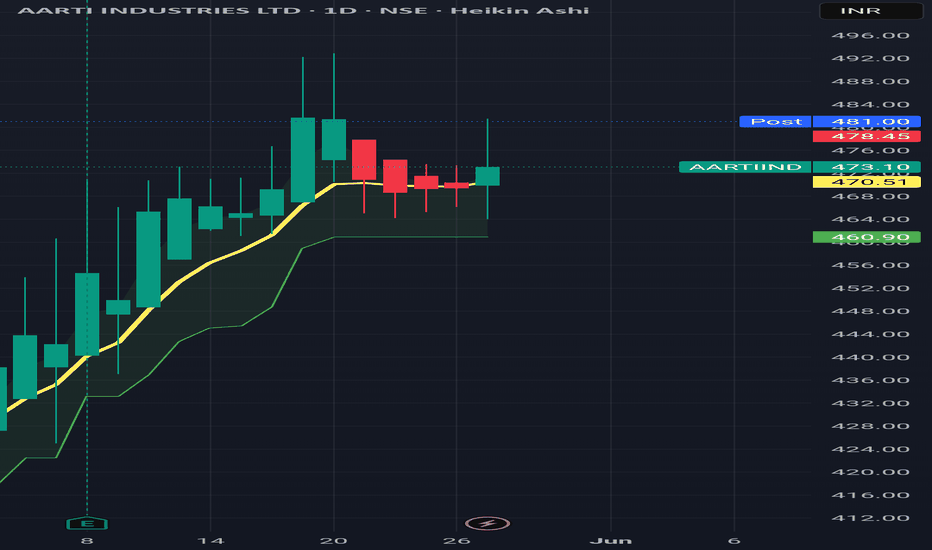

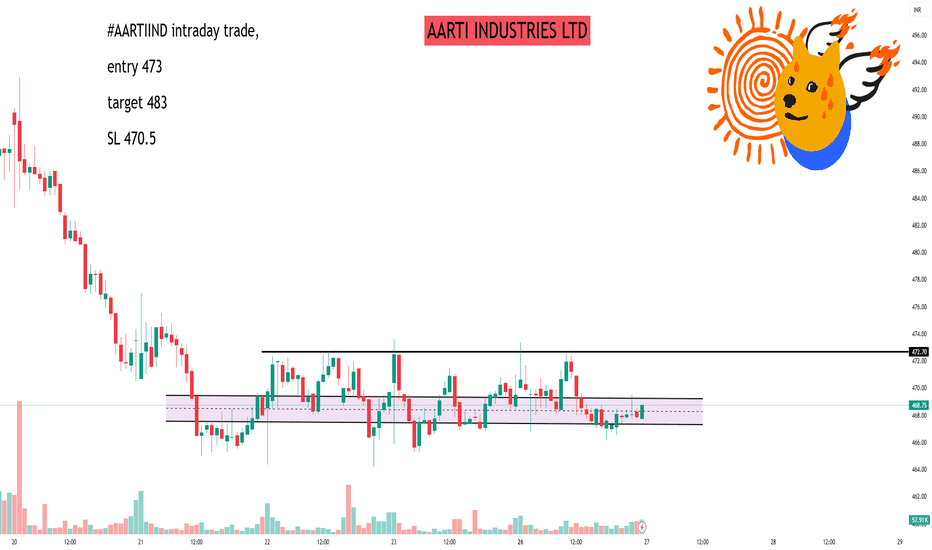

AARTI INDUSTRIES LTD📊 Intraday Support & Resistance Levels (15-Minute Interval)

Based on recent technical data, the following are the key support and resistance levels for AARTIIND:

Support Levels:

S1: ₹466.67

S2: ₹464.97

S3: ₹462.22

Resistance Levels:

R1: ₹472.17

R2: ₹473.87

R3: ₹476.62

These levels are deriv

NShort

Aarti industries after hitting YDZ There is simple and heavy YDZ as you price took support and now continuously going up 😔. Whenever stock came to this type of zone there is a investment opportunity. Try to learn and find these type of zones in every stock.

NLong

Right Chemistry for a Brighter TomorrowAarti Industries Ltd, the flagship company of the Aarti group, manufacturing organic and inorganic chemicals at its major facilities in Vapi, Jhagadia, Dahej and Kutch, in Gujarat and in Tarapur in Maharashtra. The company has a strong market position in the NCB-based specialty chemicals segment.

A

NLong

AARTI IND BUY ZONEPrices are jumbled up here check kite for better understanding.

Entry and stoploss are marked.

Risk reward= 1:2

If stoploss hits and you get a chance to re-enter the trade then don't take risk more than 3%.

NLong

Aarti Industries - In supply zoneStock currently in weekly, daily, 125 mins supply zone

Zone ranges from 460 to 470

Currently at 467

Looks a good area to sell with strict SL above 475

Downside targets at least 430

NShort

Aarti Industries.This stocks likely to be finishing double correction and may rise in counter trend for B or X

Rsi and price action suggesting some reversal at this levels. lets see

# disclaimer : this chart is only for educational purpose of Elliott wave practitioners.

Do not take this as a recommendations as El

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of AARTIIND is 432.85 INR — it has increased by 0.60% in the past 24 hours. Watch AARTI INDUSTRIES LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange AARTI INDUSTRIES LTD stocks are traded under the ticker AARTIIND.

AARTIIND stock has fallen by −5.71% compared to the previous week, the month change is a −5.74% fall, over the last year AARTI INDUSTRIES LTD has showed a −38.18% decrease.

We've gathered analysts' opinions on AARTI INDUSTRIES LTD future price: according to them, AARTIIND price has a max estimate of 625.00 INR and a min estimate of 385.00 INR. Watch AARTIIND chart and read a more detailed AARTI INDUSTRIES LTD stock forecast: see what analysts think of AARTI INDUSTRIES LTD and suggest that you do with its stocks.

AARTIIND reached its all-time high on Oct 19, 2021 with the price of 1,012.40 INR, and its all-time low was 0.75 INR and was reached on Mar 5, 1999. View more price dynamics on AARTIIND chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AARTIIND stock is 0.14% volatile and has beta coefficient of 1.34. Track AARTI INDUSTRIES LTD stock price on the chart and check out the list of the most volatile stocks — is AARTI INDUSTRIES LTD there?

Today AARTI INDUSTRIES LTD has the market capitalization of 155.99 B, it has increased by 1.70% over the last week.

Yes, you can track AARTI INDUSTRIES LTD financials in yearly and quarterly reports right on TradingView.

AARTI INDUSTRIES LTD is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

AARTIIND earnings for the last quarter are 2.64 INR per share, whereas the estimation was 1.56 INR resulting in a 68.96% surprise. The estimated earnings for the next quarter are 2.06 INR per share. See more details about AARTI INDUSTRIES LTD earnings.

AARTI INDUSTRIES LTD revenue for the last quarter amounts to 19.46 B INR, despite the estimated figure of 19.10 B INR. In the next quarter, revenue is expected to reach 19.40 B INR.

AARTIIND net income for the last quarter is 960.00 M INR, while the quarter before that showed 460.00 M INR of net income which accounts for 108.70% change. Track more AARTI INDUSTRIES LTD financial stats to get the full picture.

Yes, AARTIIND dividends are paid annually. The last dividend per share was 1.00 INR. As of today, Dividend Yield (TTM)% is 0.23%. Tracking AARTI INDUSTRIES LTD dividends might help you take more informed decisions.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AARTI INDUSTRIES LTD EBITDA is 10.02 B INR, and current EBITDA margin is 13.77%. See more stats in AARTI INDUSTRIES LTD financial statements.

Like other stocks, AARTIIND shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AARTI INDUSTRIES LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AARTI INDUSTRIES LTD technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AARTI INDUSTRIES LTD stock shows the sell signal. See more of AARTI INDUSTRIES LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.