Stock Analysis Update – Brainbees Solutions (FirstCry)🚨 Stock Analysis Update – Brainbees Solutions (FirstCry) 🚨

📊 Timeframe: 4H (NSE)

📍 Current Price: ₹400.85

✅ Support Zone: ₹350 – ₹375 (green box)

⚠️ Demand Zone: ₹285 – ₹325 (red box)

🎯 Target 3: ₹660+

The stock has taken support in the demand zone and is showing signs of reversal. If momentum co

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−3.45 INR

−1.91 B INR

76.60 B INR

215.77 M

About Brainbees Solutions Limited

Sector

Industry

CEO

Supam Satyanarayan Maheshwari

Website

Headquarters

Pune

Founded

2010

ISIN

INE02RE01045

FIGI

BBG01P2T5TK6

Brainbees Solutions Ltd. engages in the operation of an online portal for mothers’, babies, and kids' products. It operates through the following segments: India Multi-Channel, International, Globalbees Brands, and Others. The India Multi-Channel segment provides online platform, modern stores as well as general trade retail distribution in India, covering both home brand and third-party products. The International segment covers UAE and KSA operations. The Globalbees Brands segment offers products through GlobalBees Brands. The Others segment includes other businesses which are currently not material. The company was founded by Supam Maheshwari and Amitava Saha on May 17, 2010 and is headquartered in Pune, India.

Related stocks

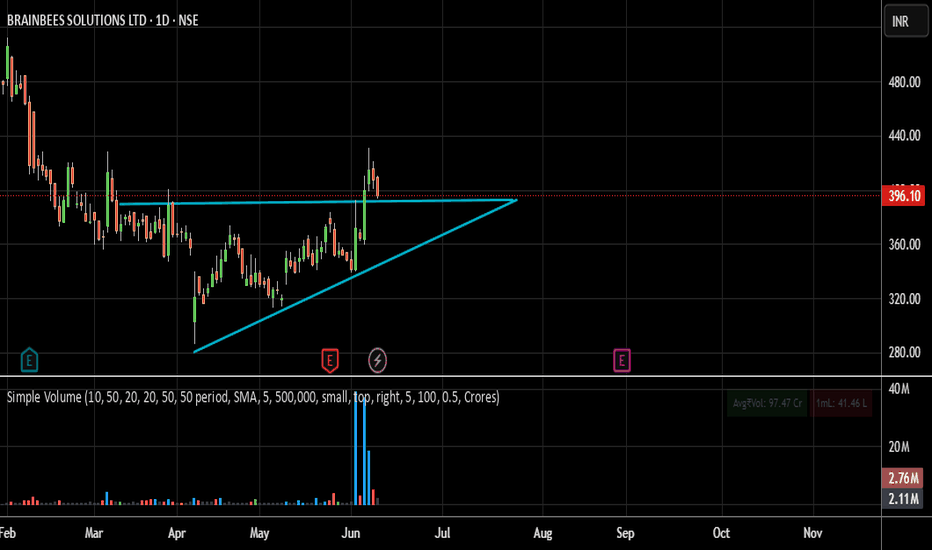

FIRSTCRY (Breakout Candidate) - Swing Pick#FIRSTCRY #stage1stock #breakoutstock #Trendingstock

FIRSTCRY : Swing / Short term (1-3 months)

>> Ready for Stage 1 breakout

>> Momentum stock

>> Volumes Spike Visible

>> Good strength in stock

>> Swing Traders can target 18% move, short term traders can look for Higher Targets

Swing Traders can

FirstCry Breakout: Bullish Momentum Returns Above ₹400". This tBullish momentum on short and medium timeframes; sustained move above ₹400 could target ₹420–₹450.

Strong support at ₹354; dips towards this level may attract buyers.

Watch for consolidation or profit booking above ₹407.80; a break above ₹400 with volume provides conviction for further gains.

The

FirstCry 1 Day ViewIntraday Overview (1-Day Time-Frame)

Current / Last Traded Price (LTP): ₹392–₹393 range, reflecting an ~11 % gain over the previous close of ₹352.20

Previous Close: ₹352.20

Intraday Percentage Gain: Approximately +11.3 %

VWAP (Volume Weighted Average Price): ₹384.39–₹384.85

Open / High / Low

Brainbees Solutions Ltd – Possible Trend Reversal in Play!📊 After weeks of consolidation and strong base formation, Brainbees is showing signs of a potential reversal. The stock has respected its support trendline and is now approaching a crucial resistance zone.

🔑 Key Highlights:

✅ Strong consolidation with higher lows forming.

✅ Good volume spikes obs

FIRSTCRY On the daily candle chart it is clearly visible that big boys are exchanging their shares at a lower level. Look at the candles and volume bars below; you will understand. Near the completion of one year since IPO, some pre-IPO investors will sell their shares, as they could not sell after IPO till

FIRSTCRY - LONGThe triangle formed after a strong downtrend, indicating this could be a reversal triangle. Volume contraction inside the triangle, then explosion on breakout—textbook behavior.

Look at the volume bars during breakout (early June)—they’re massive compared to the base, suggesting strong institutiona

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MOSMALL250

Motilal Oswal Nifty Smallcap 250 ETF Units Exchange Traded FundWeight

0.36%

Market value

51.94 K

USD

Explore more ETFs

Frequently Asked Questions

The current price of FIRSTCRY is 288.95 INR — it has decreased by −2.97% in the past 24 hours. Watch Brainbees Solutions Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Brainbees Solutions Limited stocks are traded under the ticker FIRSTCRY.

FIRSTCRY stock has fallen by −5.60% compared to the previous week, the month change is a −16.97% fall, over the last year Brainbees Solutions Limited has showed a −52.77% decrease.

We've gathered analysts' opinions on Brainbees Solutions Limited future price: according to them, FIRSTCRY price has a max estimate of 480.00 INR and a min estimate of 370.00 INR. Watch FIRSTCRY chart and read a more detailed Brainbees Solutions Limited stock forecast: see what analysts think of Brainbees Solutions Limited and suggest that you do with its stocks.

FIRSTCRY reached its all-time high on Oct 15, 2024 with the price of 734.00 INR, and its all-time low was 286.05 INR and was reached on Apr 7, 2025. View more price dynamics on FIRSTCRY chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

FIRSTCRY stock is 3.73% volatile and has beta coefficient of 1.21. Track Brainbees Solutions Limited stock price on the chart and check out the list of the most volatile stocks — is Brainbees Solutions Limited there?

Today Brainbees Solutions Limited has the market capitalization of 150.78 B, it has decreased by −2.56% over the last week.

Yes, you can track Brainbees Solutions Limited financials in yearly and quarterly reports right on TradingView.

Brainbees Solutions Limited is going to release the next earnings report on Feb 9, 2026. Keep track of upcoming events with our Earnings Calendar.

FIRSTCRY earnings for the last quarter are −0.70 INR per share, whereas the estimation was −0.92 INR resulting in a 23.50% surprise. The estimated earnings for the next quarter are −0.70 INR per share. See more details about Brainbees Solutions Limited earnings.

FIRSTCRY net income for the last quarter is −350.52 M INR, while the quarter before that showed −464.29 M INR of net income which accounts for 24.50% change. Track more Brainbees Solutions Limited financial stats to get the full picture.

No, FIRSTCRY doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Dec 7, 2025, the company has 6.33 K employees. See our rating of the largest employees — is Brainbees Solutions Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Brainbees Solutions Limited EBITDA is 2.08 B INR, and current EBITDA margin is 2.89%. See more stats in Brainbees Solutions Limited financial statements.

Like other stocks, FIRSTCRY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Brainbees Solutions Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Brainbees Solutions Limited technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Brainbees Solutions Limited stock shows the sell signal. See more of Brainbees Solutions Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.