IDFCFIRSTB trade ideas

Database TradingIn trading, "database" refers to the collection and organization of market data, used for analysis and decision-making. This data, often including real-time quotes, historical prices, and other relevant information, is stored and managed within a database system for efficient retrieval and manipulation.

Advanced Database TradingIn trading, "database" refers to the collection and organization of market data, used for analysis and decision-making. This data, often including real-time quotes, historical prices, and other relevant information, is stored and managed within a database system for efficient retrieval and manipulation.

PCR (PUT and CALL) RatioThe Put-Call Ratio (PCR) is a popular technical indicator used by investors to assess market sentiment. It is calculated by dividing the volume or open interest of put options by call options over a specific time period. A higher PCR suggests bearish sentiment, while a lower PCR indicates bullish sentiment.

Option and Database TradingOption trading involves buying or selling contracts that grant the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specific price within a certain time frame. It's a form of derivative trading, where the value of the option is linked to the price of the underlying asset, such as stocks, indices, or ETFs.

IDFC First Bank Be Ready For Rs 50 To Rs 55**IDFC First Bank** is a private sector bank in India, formed in **2018** after the merger of **IDFC Bank and Capital First**. It offers a range of banking services, including **retail banking, wholesale banking, and asset management**. The bank focuses on consumer loans, MSME financing, and infrastructure lending. Known for its **customer-friendly digital services** and competitive interest rates, IDFC First Bank has rapidly expanded its presence in India's banking sector. While it is a significant player in the industry, **it is not currently a part of the Bank Nifty index**, which includes only the top 12 most liquid and large-cap banking stocks.

IDFC First BankIDFC First Bank Trade Setup - Key Levels to Watch! 📊🚀

Stock: IDFC First Bank Ltd (NSE)

Timeframe: 1D Chart

Current Price: ₹58.39

Entry Level: ₹56.45 - ₹57.18

Stoploss: Below trendline break

Again Entry 51 Around.. 3 to% Stoploss

🎯 Bullish Targets:

✅ ₹66.23 (Breaking Range)

✅ ₹75.16

✅ ₹86.30 (Final Target)

🔻 Bearish Breakdown Levels:

⚠ Trendline breakdown → Next major support at ₹51

Wave Pattern Unfolding Example I have Made an efforts in Explaining the Current Pattern as per wave theory

I have also Explained How to confirm using Price based Measurement so that we get more

confirmation on our Methods we follow in the Market

The ideal patterns shown in the Text book differ in the market due to variation in participants

behavior, most pattern do give an ideal clue .

I hope you like this explanation if Yes please hit the like button and share it with other

If you have Questions please comment i will try to address it

Thanks

IDFC FIRST BANK by KRS Charts5th Nov 2024 / 2:34 PM

Why IDFCFIRSTB ❓❓

1. First thing BULLS COUNTER ATTACK visible after correction.

2. Previous Gap got filled last Candle.

3. On higher TF Price is at Old Support zone.

4. Swing Entry Due to B.C. Attack setup what it means, mentioned in Chart.

Target - 86 Rs & 100 Rs.

SL 1D Closing - 63.80 Rs.

IDFC FIRST BANK LONGTERM GAMEIDFC FIRST BANK one of my long term stock list in the "Multi Bagger" Basket. Recently it pass the multiple analysis, FVG Monthly, CUP n HANDLE pattern, BREAKOUT Retest. In terms of Technically. Also fundamentals are good. In next 10 years second level Bank has the good growth when compared to the leading banks.

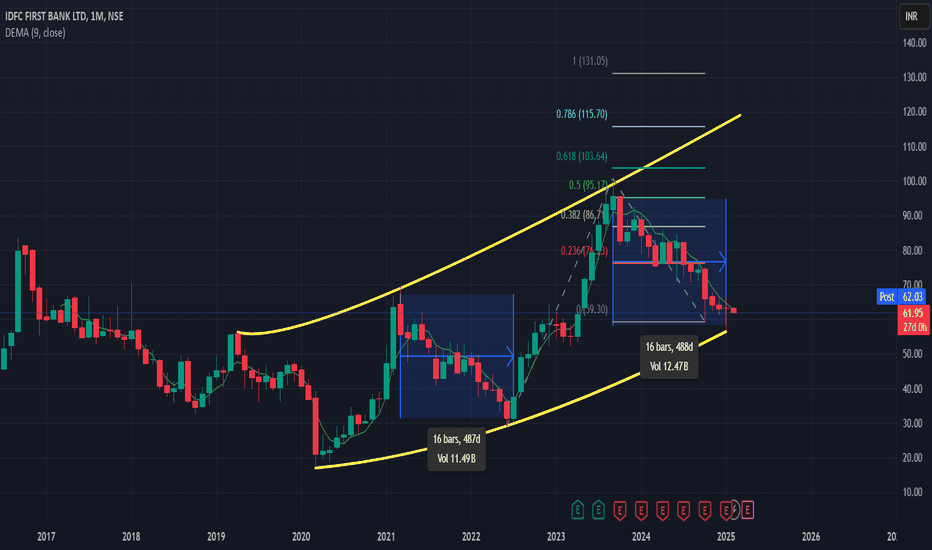

MY first choice IDFC FIRST BANK IDFC FIRST BANK have previous records and pattern and that repeat again

Technical points

1 - down rising channel

2- Strong support on bottom

3 - hold the top of fab. point

4 previous bull run was came when is go down in channel pattern

First channel performance

Date 31-jan-2022 to 6-dec-2022

first reached on top of 50 and came down 28 in the channel when given reversal to 62

second channel performance

6-dec-2022 to 5-sep-2023

on the top of 62 he came down and reached 52 and than get reversal and make top of 100

third 6-sep-2023 to 27-november today

now its reached at same price of 62 and create bottom now we looking for a fresh reversal and channel breakout

First TRG - 86

Second TRG -98 & 102

Third TRG 120 and above 140

SL 48

only for the long term time duration minimum 1 year

IDFC first bank inverted head & shoulder view- first breakout failed at the range of 82

- 2nd breakout failed at the range of 70

- crossed below the parallel channel midline (range 70)

- Oct monthly candle already touched pivot S1 due to market correction.

- In case monthly pivot S1 does not support. This fall might continue

important zone for accumulation / fib golden ratio 61.80 / range below 59-50

I don't recommend taking trade based on this idea.

consult your SEBI registered adviser to Know the market risk before trade.

in.tradingview.com/pricing/?share_your_love=johnbritto2088

IDFCfirst Bank CUP & Handle Breakout RetestHello Everyone,

HDFC First Bank making Retest from Cup & handle Chart pattern Breakout restest with trendline also taking Support of 200ema.

Fibbo 61% retracement completed and rsi oversold with making repeated pattern as earlier.Stock price cmp 66 is 34% down from lifetime high of 100.

"It’s been a year now—could this be the turning point?"❓What do you think about this merger and future growth of IDFC First Bank?

⭕️"Can IDFC First Bank still become the next HDFC Bank?"⭕️

📍An order block zone is a price range where large institutions have placed significant buy or sell orders, creating strong support or resistance. These zones often lead to price reversals or consolidations

📍It help traders identify where the "smart money" (institutional money) has previously influenced the market, giving insight into likely future price reactions around these levels.

✅Technical Analysis:-

"For now, there is a bearish trend with a strong sell sentiment. However, once the order block is confirmed, the price may shoot up like any other stock."

✅Fundamental Analysis:-

⚡️A rise in IDFC Ltd could enhance sentiment towards IDFC First Bank.

⚡️Increased stock may improve the combined entity's market valuation.

⚡️profit after tax of ₹201 crore for Q2 FY25, up 28% compared to last year

⚡️The merger aims to enhance operational efficiencies and align management practices with leading private sector banks

✍️Nifty50 is officially below the BUDGET2024 swing low as of today. The support level of 23900 was tested and sustained today. Considering the chart structure more weakness is expected.(Take this into consideration too, while investing or trading)

👀IDFC First Bank's stock has declined recently due to the following issues:

⭕️The bank experienced a 10% drop in net profit for Q4 FY24

⭕️Provisions increased to ₹722 crore, raising concerns about managing non-performing assets effectively

💡Conclusion🎯

IDFC First Bank has established itself as a significant player in the Indian banking sector, focusing on retail and corporate banking services. The recent merger with IDFC Ltd. is expected to enhance its growth trajectory and operational efficiency.

✅Check out my TradingView profile to see how we analyze charts and execute trades.

⭕️ Swing Trading opportunity: Price Action Analysis Alert !!!⭕️

🙋♀️🙋♂️If you have any questions about this stock, feel free to reach out to me.

📍📌Thank you for exploring our idea! We hope you found it valuable.

🙏FLLOW for more !

👍LIKE if useful !

✍️COMMENT Below your view !