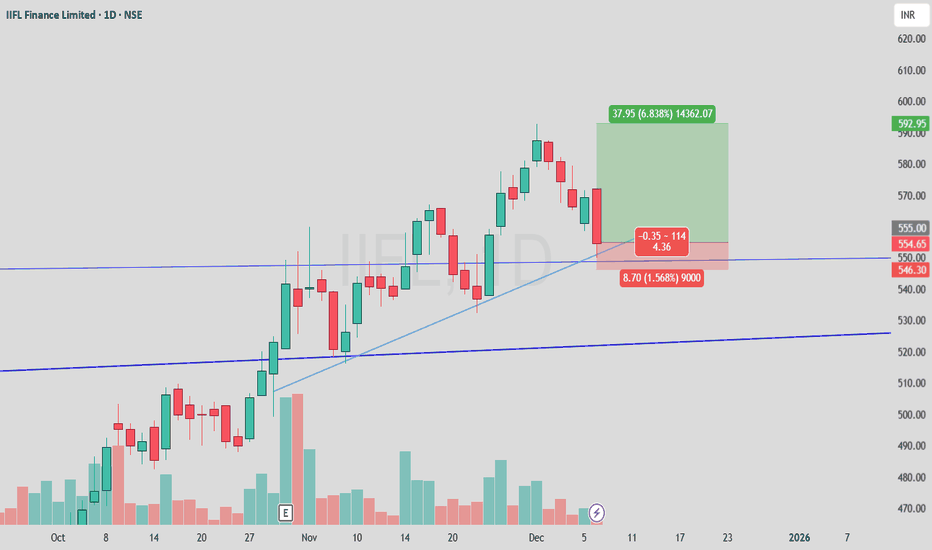

IIFL 1 Day Time Frame 📊 Daily Pivot & Key Levels (1‑Day Timeframe)

📍 Daily Pivot:

• ₹520.28 (reference level for bias)

📈 Resistance Levels:

• R1: ₹532.57 — first upside hurdle

• R2: ₹543.28 — next barrier above

• R3: ₹555.57 — extended resistance zone

📉 Support Levels:

• S1: ₹509.57 — immediate support

• S2: ₹497.28 —

IIFL Finance Limited

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

30.15 INR

3.79 B INR

93.60 B INR

230.70 M

About IIFL Finance Limited

Sector

Industry

Website

Headquarters

Mumbai

Founded

1995

IPO date

Apr 21, 2005

Identifiers

2

ISIN INE530B01024

IIFL Finance Ltd. engages in the provision of providing financial services. It offers loan products such as gold, personal, and business loans. The company was founded by Nirmal Bhanwarlal Jain on October 18, 1995 and is headquartered in Mumbai, India.

Related stocks

IIFL 1 Week Time Frame 📊 Current Price Snapshot

IIFL Finance share price: ~₹560–₹565 on NSE (today’s range) — with highs around ₹565 and lows near ₹540.45 earlier in today’s session.

📈 Weekly Support & Resistance (Key Levels)

These levels are derived from weekly pivot and longer‑term technical distribution — useful for s

LongKey Points About Strategy

1. Identify breakouts using recent pivot highs and lows.

2. For entry or exit, wait for the candle to close above or below the given level; do not wait for the target.

3. Obey the risk–reward ratio strictly.

4. Do not create positions that you cannot manage, and avoid taki

IIFL FINANCE - BULLISH, purely based on TECHNICALS IIFL FINANCE - BULLISH, purely based on TECHNICALS

Technical Outlook

CMP : 520.9

Chart Pattern

Stock has formed a cup and handle formation and looks poised to scale greater heights.

The stock has almost neatly recovered the March'24 Gapdown zone

Once it is completely recovered, I expect that st

IIFL Finance (W): Strongly Bullish - Turnaround BreakoutTimeframe: Weekly | Scale: Logarithmic

The stock has confirmed a decisive breakout from a multi-year consolidation phase. This move marks the end of the post-embargo correction and is supported by strong fundamental catalysts and technical alignment.

🚀 1. The Fundamental Catalyst (The "Why")

Th

IIFL Finance - Double Bottom & Head & Shoulder PatternIIFL is read to rock by 70%-80% rise from current price on account of following:

1. 52% increase in QnQ profits

2. Double Bottom Pattern on Weekly Time Frame

3. Inverted Head & Shoulder Pattern on Weekly Time Frame

4. Weekly Breakout is already done - see last weeks candle

5. Volumes are steady

K

IIFL Finance LimitedPrice is breaking out above a long consolidation range, but the move is short term overextended, so both upside continuation and a pullback retest are likely scenarios rather than a one way move. This is educational analysis, not personalized financial advice; position sizing and risk must match you

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

I

925IHFL31.N1

IIFL Home Finance Ltd. 9.25% 26-DEC-2031Yield to maturity

11.28%

Maturity date

Dec 26, 2031

See all IIFL bonds

SMALLCAP

Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF Units Exchange Traded FundWeight

1.79%

Market value

1.49 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of IIFL is 508.80 INR — it has decreased by −2.72% in the past 24 hours. Watch IIFL Finance Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange IIFL Finance Limited stocks are traded under the ticker IIFL.

IIFL stock has risen by 0.93% compared to the previous week, the month change is a −20.50% fall, over the last year IIFL Finance Limited has showed a 54.14% increase.

We've gathered analysts' opinions on IIFL Finance Limited future price: according to them, IIFL price has a max estimate of 800.00 INR and a min estimate of 600.00 INR. Watch IIFL chart and read a more detailed IIFL Finance Limited stock forecast: see what analysts think of IIFL Finance Limited and suggest that you do with its stocks.

IIFL reached its all-time high on Oct 16, 2023 with the price of 683.20 INR, and its all-time low was 7.25 INR and was reached on May 17, 2005. View more price dynamics on IIFL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

IIFL stock is 4.72% volatile and has beta coefficient of 1.70. Track IIFL Finance Limited stock price on the chart and check out the list of the most volatile stocks — is IIFL Finance Limited there?

Today IIFL Finance Limited has the market capitalization of 216.33 B, it has increased by 1.77% over the last week.

Yes, you can track IIFL Finance Limited financials in yearly and quarterly reports right on TradingView.

IIFL Finance Limited is going to release the next earnings report on Apr 23, 2026. Keep track of upcoming events with our Earnings Calendar.

IIFL Finance Limited revenue for the last quarter amounts to 19.96 B INR, despite the estimated figure of 20.92 B INR. In the next quarter, revenue is expected to reach 20.97 B INR.

IIFL net income for the last quarter is 4.64 B INR, while the quarter before that showed 3.76 B INR of net income which accounts for 23.38% change. Track more IIFL Finance Limited financial stats to get the full picture.

IIFL Finance Limited dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 1.18% and 8.64% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 15, 2026, the company has 38.72 K employees. See our rating of the largest employees — is IIFL Finance Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. IIFL Finance Limited EBITDA is 38.44 B INR, and current EBITDA margin is 54.62%. See more stats in IIFL Finance Limited financial statements.

Like other stocks, IIFL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade IIFL Finance Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So IIFL Finance Limited technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating IIFL Finance Limited stock shows the buy signal. See more of IIFL Finance Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.