INDIGO trade ideas

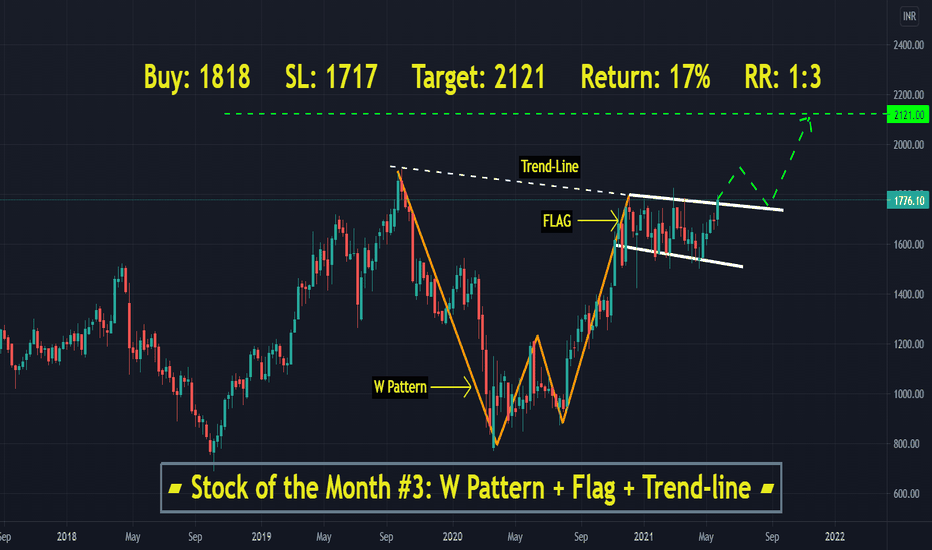

▰ Stock of the Month #3: INGIDO ▰▰ Stock of The Month #3: JUNE ▰

📌 I have found 15 new patterns on the charts. These are original and unique patterns that can achieve their target almost 80-90% times. Here, I have posted one of my favourite 💕 chart patterns.

☆ I will post the remaining patterns one by one every month. For more, you can check out my previous studies 😍 as well. Kindly see my announcement section for all the latest.

▣ Key Highlights:

➟ Time frame Weekly ₩

➟ W pattern ⓦ

➟ Trend line ⍩

➟ Flag Pattern 🎌

➟ Unique Confluence Ⓤ

📌 Levels are:

Entry: ▲ 1818

SL: ☢ 1717

Target: ➚ 2121

RR: ☈ 1:3

Return: 17%+

☆ Follow me @ tradingview for more updates. Kindly like the chart 💗 & share this analysis.

☆ Thank you. Happy Trading!!!

Best Regards,

𝘿𝙧. 𝙎𝙝𝙖𝙢𝙧𝙖𝙟𝙖 𝙉𝙖𝙙𝙖𝙧

𝙋𝙝𝘿 𝙞𝙣 𝙏𝙚𝙘𝙝𝙣𝙤𝙡𝙤𝙜𝙮.

✮ Disclaimer ✮

--------------------------------------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

--------------------------------------------------------

INDIGO: Bullish Triangle BreakoutAfter a long consolidation for almost 6 months , finally the stock has given a breakout of the triangular structure. Assuming wave (e) completed around 1655 , Indigo is ready to give an upthrust out of the bullish triangular wave.

One should buy the stock on cmp and add on dips (if any), maintain the SL of 1655 which is the area of wave(e) and look for the target of 1880/1960/2020

INDIGO : HIGH BETA SCRIPTNote:

1. Views are personal and for educational purposes only. Recheck and take the trade as per your RR.

2. Always remember SL is your lifeline, not the big target...

3.Follow us for more patterns and like, share so that we feel it is helpful to many and share more patterns...

3. Views given here is not a tip rather it is for educational purpose... Aftermarket opens, the condition might change so learn to handle different conditions...

4. To learn more about patterns, Psychology behind the trade, and price action trading... contact us... Thanks...

Keep an eye ladies and gentlemen. Cheers and Happy Trading.

INDIGO Breakout, Golden Crossover supportedCurrently playing on a level field of 1690s and rangebound in 1680-1700 range. Tried to break resistance in the last 15 min of Friday closing, but eventually slipped down. Ready for an upmove as confirmed by 50-200 EMA Crossover. Green Buy signals for INDIGO at Current Market Price. Set your targets according to the marked or observed levels.

Indigo Airlines : Looking forward to enter into positionIndigo Airlines is a market leader in Airline sector in India. Currently the price is in a channel. Looking forward to buy the stock if it touches the bottom channel line again in the coming days and will be targeting a profit of about 20%. If price crashes, then will be adding on to the position only if it falls to the bottom of the ascending channel.

Indigo Airlines - Short developingAs countries around the world start shutting India out because of our high cases Airline travel will start to suffer even more. The crude prices are not helping either.

Indigo has been in a box for a while now and could break down from this box.

Short below 1500 with a 3% stoploss of approx 1545/1550.

First target 1420 and then potentially 1275.

[Positional] Indigo Short Idea - Bullish Flag BreakdownNote -

One of the best forms of Price Action is to not try to predict at all. Instead of that, ACT on the price. So, this chart tells at "where" to act in "what direction. Unless it triggers, like, let's say the candle doesn't break the level which says "Buy if it breaks", You should not buy at all.

=======

I use shorthands for my trades.

"Positional" - means You can carry these positions and I do not see sharp volatility ahead. (I tally upcoming events and many small kinds of stuff to my own tiny capacity.)

"Intraday" -means You must close this position at any cost by the end of the day.

"Theta" , "Bounce" , "3BB" or "Entropy" - My own systems. Please refer to the link to my footer and explore further if You want.

=======

I won't personally follow any rules. If I "think" (It is never gut feel. It is always some reason.) the trade is wrong, I may take reverse trade. I may carry forward an intraday position. What is meant here - You shouldn't follow me because I may miss updating. You should follow the system I share.

=======

Like -

Always follow a stop loss.

In the case of Intraday trades, it is mostly the "Day's High".

In the case of Positional trades, it is mostly the previous swings.

I do not use Stop Loss most of the time. But I manage my risk with options as I do most of the trades using derivatives.

I also do my trades live, Please refer to the link to my footer if you want to tail me.

=======