Long JSWINFRA - Short term Investment# JSW Infrastructure Limited (NSE) - Technical Analysis Report

Current Price: 335.80

Key Technical Observations

**Bullish Breakout Setup**

- Breakout Level: Above 356 for conservative trade

Consolidation phase completing before potential breakout (BO) & Stock trading near resistance zone.

Price Targets

- Target 1: 352.90 (0.618 Fibonacci level)

- Target 2: 389.50 (0.786 Fibonacci level)

- Target 3: 411.30 (0.886 Fibonacci level)

- Target 4: 436.15 (1.0 Fibonacci extension)

- Moving Average: SMA showing upward momentum at 296.13

- Fibonacci Retracement : 61.8% level acting as immediate resistance

Chart Pattern Analysis

- Hidden Divergence on the chart suggesting underlying strength

- Consolidation Phase after pullback from 0.618 fib levels and Recent sideways movement indicating accumulation

Risk Management

- Support Level of the recent consolidation low around 280-300 zone

- Stop Loss: Conservative traders should consider stops below 320 on candle close basis.

Conservative Traders:

- Wait for decisive breakout above ₹356 with volume confirmation

- Enter on pullback to ₹340-345 range after breakout

- Target progressive profit booking at mentioned Fibonacci levels

Disclaimer: This analysis is for educational purposes only. Please conduct your own research and risk management before making investment decisions.

JSWINFRA trade ideas

JSWINFRA – Potential Breakout Watch Price Action

CMP: ~₹335–336 (Sept 22, 2025)

The stock is in a strong, long-term uptrend and is currently consolidating near a key resistance level.

It is trading well above its 50-day and 200-day Simple Moving Averages, which confirms the long-term bullish trend.

Multiple technical patterns, including an "inverted Head and Shoulders," have been identified, suggesting a potential breakout is imminent.

Indicators & Momentum

RSI (14): ~74.00 → The RSI is in the overbought zone, which could lead to short-term consolidation before further upside.

ADX (14): ~23.93 → The ADX indicates a "Weak Trend," suggesting a recent period of consolidation, which is consistent with the price action.

EMAs: The price is trading well above its 50-day SMA (~₹309) and 200-day SMA (~₹297), with both acting as strong support levels.

Volume & Market Structure

The recent price surge has been backed by exceptionally high volume (over 10.4 million shares), a massive increase from the average daily volume of the previous week.

This volume-backed price action confirms strong buyer interest and accumulation.

Key Levels

Resistance: The immediate resistance is the recent high around ₹339.90. A break above this can lead to a test of the all-time high of ₹360.95. The neckline of the Inverted H&S pattern is at ₹330, which is a critical level to watch.

Support: The immediate support is the previous resistance zone around ₹325–₹330. Below that, the accumulation zone and EMA cluster around ₹290–₹300 provides a solid cushion.

Upside Targets

T1: ₹357

T2: ₹381

T3: ₹420+ (Extended swing target based on analyst reports)

Invalidation

Close below ₹320 = short-term caution and pattern failure.

Close below the 50-day SMA (~₹309) = medium-term weakness.

Trading View Bias

Bias: Bullish above ₹330

Short-Term: ₹357 → ₹381

Medium-Term: Potential for a move towards ₹420 and beyond.

Cautionary Note

This analysis is for informational and educational purposes only and should not be considered as financial advice. The stock market is highly volatile, and prices can change rapidly. All investment decisions carry a degree of risk.

JSW Infra cmp 312 by Weekly Chart view since listedJSW Infra cmp 312 by Weekly Chart view since listed

- Support Zone 285 to 300 Price Band

- Resistance Zone 318 to 333 Price Band

- Bullish Rounding Bottoms repeated under the Resistance Zone neckline

- Stock making Higher High Lower High pattern within up-trending price channel momentum

- Stock traversing within Rising Support + Price Channel and attempting Falling Resistance + Price Channel Breakout

JSW-INFRA : Powering India’s Port Revolution – A Deep Dive into NSE:JSWINFRA

JSW Infrastructure Ltd.

🧾 Company Overview

Role: JSW Infrastructure is India's second-largest commercial port operator (after Adani Ports), and forms a core part of the JSW Group.

Operations: The company manages and operates major ports across both the east and west coastlines of India.

Revenue Streams: Primarily driven by port operations (handling bulk, breakbulk, containerized cargo), as well as integrated logistics services.

📊 FY24 Financial Snapshot

Revenue ₹3,200+Cr

EBITDA Margin 55–60%

Net Profit ₹750+Cr

Debt to Equity ~0.6x

ROCE ~15%

ROE ~13%

Positive aspects:

Asset Turnover Strong

Double-digit revenue CAGR (>20%) over the past three years.

High EBITDA margins consistent with best-in-class infra businesses.

Well-diversified cargo and customer profile, with increasing non-JSW business.

Stable long-term contracts & beneficiary of India’s logistics and trade reforms.

Risks / Weaknesses:

~70% revenue is from group companies, though diversification is underway.

Aggressive capex plans elevate financial risk.

Susceptible to regulatory, tariff, and environmental compliance changes.

📈 Technical Analysis (July 2025)

• Share Price: Trading in the ₹260–₹280 range. IPO was at ₹119 (Sep 2023); strong price appreciation since listing.

• Trend: Intact uptrend; recently consolidated between ₹240–₹260.

• Support/Resistance: Key support at ₹230–₹235; resistance at ₹285–₹300.

• Moving Averages: Stock remains above both its 50-EMA and 200-EMA — a structurally bullish indicator.

• Momentum:

o RSI: 60–65 (bullish, but approaching overbought)

o MACD: Fresh bullish crossover; volume shows accumulation near breakout.

• Outlook: Breakout above ₹285 could trigger medium-term upside toward ₹320–₹340. Buy-on-dips is favored, with strong accumulation likely in the ₹230–₹240 zone.

🚀 Growth Prospects & Strategic Moves

• Capacity Expansion: Plans to nearly double port capacity by FY30 (from ~160 MTPA to ~300 MTPA).

• Cargo Diversification: Targeting major reduction of group dependency (from ~70% to ~50%) by growing third-party cargo traffic.

• New Projects: Investment pipeline includes both greenfield and brownfield projects in Odisha, Maharashtra, and other states.

• Integrated Logistics: Deeper backward integration into rail connectivity and warehousing to capture higher value from logistics value chain.

• Macro Tailwinds

o Major government initiatives (e.g., Sagarmala) catalyzing sector growth.

o India’s trade/exports rising; strong outlook for cargo and container volumes.

o Shifts in supply chains to coastal shipping and blended logistics.

o Demand uptrend in containerization and warehousing services.

⚠️ Key Risks & Limitations

• High Capex Cycle: Expansion could elevate debt and financial leverage.

• Macro Sensitivity: Lower industrial/output growth would hit cargo volumes.

• Regulatory Overhang: Tariff and ESG regulations present chronic uncertainty.

• Group Concentration: Third-party cargo growth remains an execution challenge.

• Rivalry: Competitive intensity from Adani, DP World, and others is ramping up.

📌 Conclusion & Investment Verdict

Parameter Verdict

Fundamentals Strong, superior margins, efficient operations

Valuation Fair to premium (due to uptrend and growth)

Technical Trend Bullish, ready for potential breakout

Growth Outlook High (supported by sector tailwinds)

Risk Profile Moderate (driven by capex & regulatory factors)

For long-term investors:

JSW Infra presents a compelling case for portfolio inclusion, offering robust growth visibility, sectoral leadership, and operating excellence. Accumulation is best near ₹230–₹240 on dips.

Short-term view:

Stocks in strong uptrends may see minor corrections but are well-placed for fresh breakouts above ₹285, targeting ₹320–₹340.

The stock is ideal for investors seeking infrastructure-sector exposure with high growth potential, but one must remain mindful of execution and regulatory risks.

==============================

==============================

⚠️ Disclaimer:

This analysis is for educational and informational purposes only.

We are not SEBI-registered analysts or advisors.

This is our personal view based on available data and market trends.

Please consult your SEBI-registered investment advisor before making any investment or trading decisions.

You are solely responsible for any financial decisions you make based on this content.

========================

Trade Secrets By Pratik

========================

Update idea

Add note

Trade_Secrets_By_Pratik

Also on:

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

English (India)

Select market data provided by ICE Data services.

Select reference data provided by FactSet. Copyright © 2025 FactSet Research Systems Inc.

© 2025 TradingView, Inc.

More than a product

Supercharts

Screeners

Stocks

ETFs

Bonds

Crypto coins

CEX pairs

DEX pairs

Pine

Heatmaps

Stocks

ETFs

Crypto

Calendars

Economic

Earnings

Dividends

More products

Yield Curves

Options

News Flow

Pine Script®

Apps

Mobile

Desktop

Tools & subscriptions

Features

Pricing

Market data

Trading

Overview

Brokers

Special offers

CME Group futures

Eurex futures

US stocks bundle

About company

Who we are

Athletes

Blog

Careers

Media kit

Merch

TradingView store

Tarot cards for traders

The C63 TradeTime

Policies & security

Terms of Use

Disclaimer

Privacy Policy

Cookies Policy

Accessibility Statement

Security tips

Bug Bounty program

Status page

Community

Social network

Wall of Love

Refer a friend

House Rules

Moderators

Ideas

Trading

Education

Editors' picks

Pine Script

Indicators & strategies

Wizards

Freelancers

Business solutions

Widgets

Charting libraries

Lightweight Charts™

Advanced Charts

Trading Platform

Growth opportunities

Advertising

Brokerage integration

Partner program

Education program

Look First

HDFC BANK LTD

NSE•Real-time•Market closed

Edit Idea

Minimize

Close

JSW INFRA : Powering India’s Port Revolution – A Deep Dive into

NSE:JSWINFRA

JSW Infrastructure Ltd.

🧾 Company Overview

Role: JSW Infrastructure is India's second-largest commercial port operator (after Adani Ports), and forms a core part of the JSW Group.

Operations: The company manages and operates major ports across both the east and west coastlines of India.

Revenue Streams: Primarily driven by port operations (handling bulk, breakbulk, containerized cargo), as well as integrated logistics services.

📊 FY24 Financial Snapshot

Revenue ₹3,200+Cr

EBITDA Margin 55–60%

Net Profit ₹750+Cr

Debt to Equity ~0.6x

ROCE ~15%

ROE ~13%

Positive aspects:

Asset Turnover Strong

Double-digit revenue CAGR (>20%) over the past three years.

High EBITDA margins consistent with best-in-class infra businesses.

Well-diversified cargo and customer profile, with increasing non-JSW business.

Stable long-term contracts & beneficiary of India’s logistics and trade reforms.

Risks / Weaknesses:

~70% revenue is from group companies, though diversification is underway.

Aggressive capex plans elevate financial risk.

Susceptible to regulatory, tariff, and environmental compliance changes.

📈 Technical Analysis (July 2025)

• Share Price: Trading in the ₹260–₹280 range. IPO was at ₹119 (Sep 2023); strong price appreciation since listing.

• Trend: Intact uptrend; recently consolidated between ₹240–₹260.

• Support/Resistance: Key support at ₹230–₹235; resistance at ₹285–₹300.

• Moving Averages: Stock remains above both its 50-EMA and 200-EMA — a structurally bullish indicator.

• Momentum:

o RSI: 60–65 (bullish, but approaching overbought)

o MACD: Fresh bullish crossover; volume shows accumulation near breakout.

• Outlook: Breakout above ₹285 could trigger medium-term upside toward ₹320–₹340. Buy-on-dips is favored, with strong accumulation likely in the ₹230–₹240 zone.

🚀 Growth Prospects & Strategic Moves

• Capacity Expansion: Plans to nearly double port capacity by FY30 (from ~160 MTPA to ~300 MTPA).

• Cargo Diversification: Targeting major reduction of group dependency (from ~70% to ~50%) by growing third-party cargo traffic.

• New Projects: Investment pipeline includes both greenfield and brownfield projects in Odisha, Maharashtra, and other states.

• Integrated Logistics: Deeper backward integration into rail connectivity and warehousing to capture higher value from logistics value chain.

• Macro Tailwinds

o Major government initiatives (e.g., Sagarmala) catalyzing sector growth.

o India’s trade/exports rising; strong outlook for cargo and container volumes.

o Shifts in supply chains to coastal shipping and blended logistics.

o Demand uptrend in containerization and warehousing services.

⚠️ Key Risks & Limitations

• High Capex Cycle: Expansion could elevate debt and financial leverage.

• Macro Sensitivity: Lower industrial/output growth would hit cargo volumes.

• Regulatory Overhang: Tariff and ESG regulations present chronic uncertainty.

• Group Concentration: Third-party cargo growth remains an execution challenge.

• Rivalry: Competitive intensity from Adani, DP World, and others is ramping up.

📌 Conclusion & Investment Verdict

Parameter Verdict

Fundamentals Strong, superior margins, efficient operations

Valuation Fair to premium (due to uptrend and growth)

Technical Trend Bullish, ready for potential breakout

Growth Outlook High (supported by sector tailwinds)

Risk Profile Moderate (driven by capex & regulatory factors)

For long-term investors:

JSW Infra presents a compelling case for portfolio inclusion, offering robust growth visibility, sectoral leadership, and operating excellence. Accumulation is best near ₹230–₹240 on dips.

Short-term view:

Stocks in strong uptrends may see minor corrections but are well-placed for fresh breakouts above ₹285, targeting ₹320–₹340.

The stock is ideal for investors seeking infrastructure-sector exposure with high growth potential, but one must remain mindful of execution and regulatory risks.

==============================

==============================

⚠️ Disclaimer:

This analysis is for educational and informational purposes only.

We are not SEBI-registered analysts or advisors.

This is our personal view based on available data and market trends.

Please consult your SEBI-registered investment advisor before making any investment or trading decisions.

You are solely responsible for any financial decisions you make based on this content.

========================

Trade Secrets By Pratik

========================

JSWINFRA Weekly Reserch AnalysisChart Pattern: Inverted Head and Shoulders (H&S) Pattern Identified

Neckline Resistance: ₹330

FII Accumulation Zone: Around ₹290

Price Action: Price has formed a classic inverted H&S pattern and is currently consolidating just below the neckline at ₹330.

Volume: Rising volume indicates institutional interest.

Conclusion:

=====================

A weekly close above ₹330 may lead to a bullish breakout.

Target levels post-breakout could be in the range of ₹360-₹390 short term, with medium-term potential above ₹400 if volume supports.

Shareholding & Institutional Activity

=========================================

FII Holding Zone: ₹290

High Institutional Interest: Visible from both volume and price breakout attempts.

Retail Participation: Healthy based on consolidation and absorption of supply.

Financial Analysis

====================

Company has demonstrated robust earnings growth and excellent cost management.

Strong operating leverage.

JSW INFRAs very well consolidated making higher lows with a proper Fibonacci retracement of 0.618 , which is an ideal correction. the stock is on the verge of breakout and have attempted breakout . if breakout happens with volume stock can go past 370 .

Recently stock has won port project in Kolkata and today it got an approval for railway infra in NCR.

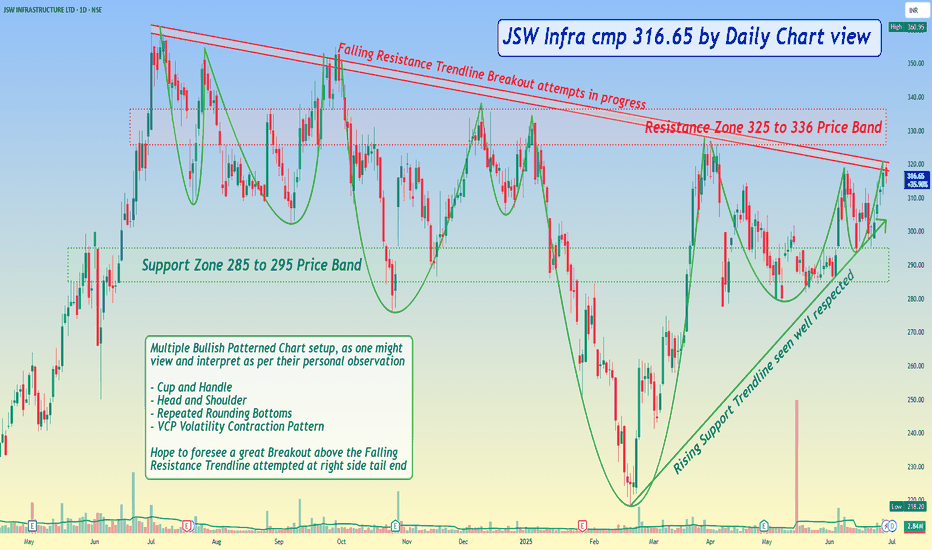

JSW Infra cmp 316.65 by Daily Chart view*JSW Infra cmp 316.65 by Daily Chart view*

- Support Zone 285 to 295 Price Band

- Resistance Zone 325 to 336 Price Band

- Rising Support Trendline seen well respected

- Falling Resistance Trendline Breakout attempts in progress

- [ b]Multiple Bullish Patterned Chart setup, as one might view and interpret as per their personal observation

- Cup and Handle

- Head and Shoulder

- Repeated Rounding Bottoms

- VCP Volatility Contraction Pattern

- [ b]Hope to foresee a great Breakout above the Falling Resistance Trendline attempted at right side tail end

JSWENERGY – Breakout Watch Near ₹307JSWENERGY has been consolidating in a tight range between ₹298–₹307 after a previous dip, and is now showing signs of a potential breakout setup.

🔍 Key Observations:

📉 After a sharp correction, price found support near ₹300 and has since been trading sideways.

📊 Multiple bounces from ₹300–₹301 show strong buyer interest at that zone.

🔼 ₹305–₹307 remains a stiff resistance; price needs to break this zone with volume for upside momentum.

🔕 Volume has remained low during this consolidation, which is typical before a breakout move.

✅ Bullish Scenario (65% Probability)

🔔 Trigger: Breakout above ₹307 with high volume

🎯 Target 1: ₹315

🎯 Target 2: ₹325

🔒 Stop-loss: Below ₹298

❌ Bearish Scenario (35% Probability)

🔻 Trigger: Breakdown below ₹298

🎯 Target 1: ₹290

🎯 Target 2: ₹280

📌 Trading Plan:

Wait for a breakout above ₹307 with volume. Ideal setup would be a breakout and retest of the ₹305–₹307 zone, followed by momentum continuation. Avoid pre-emptive entries inside the range.

💬 What do you think — will the ₹307 barrier break this week?

Drop your views, chart setups, or alternate levels in the comments!

#JSWENERGY #BreakoutSetup #TechnicalAnalysis #StockMarketIndia #SwingTrading #PriceAction #TradingViewIndia #EnergyStocks

JSW Infrastructure Ltd. – Strong Q4 Boost as it Eyes Breakout📈Technical Analysis

IPO & Rally: Since its listing on October - 2023 at ₹140–150, the stock surged to ₹360 by July 2024.

Correction & Support: A pullback followed, finding solid demand at ₹220, which held firm.

Recent Rally: Strong Q3 and Q4 2024 results triggered a rebound starting February 2025.

Resistance Zone: The stock now faces resistance at the ₹320 area, aligned with recent lower highs.

Higher Volume: A surge in trading volume on 5th June confirmed investor interest.

Breakout Signal: If JSW Infra breaks above ₹320 and retests it as support with bullish candlestick confirmation, it may rally further.

🎯 Targets: ₹340 → ₹360 → ₹380

🔻 Supports: ₹280 → ₹220 (major demand zone)

Caution Alert: A failure to hold above these supports could trigger further downside.

💰Q4 FY24 Key Financial Highlights:

Total Income: ₹1,283 Cr (vs ₹1,182 Cr in Q3 FY24; ₹1,096 Cr in Q4 FY23)

Total Expenses: ₹642 Cr (vs ₹596 Cr in Q3 FY24; ₹515 Cr in Q4 FY23)

Total Operating Profits: ₹641 Cr (vs ₹586 Cr in Q3 FY24; ₹581 Cr in Q4 FY23)

Profit Before Tax: ₹581 Cr (vs ₹276 Cr in Q3 FY24; ₹417 Cr in Q4 FY23)

Profit After Tax: ₹516 Cr (vs ₹336 Cr in Q3 FY24; ₹329 Cr in Q4 FY23)

Diluted Normalized EPS: ₹2.43 (vs ₹1.57 in Q3 FY24; ₹1.57 in Q4 FY23)

📌All major metrics show strong sequential growth, demonstrating robust quarterly momentum.

🔍Fundamental Insights

Revenue Growth: Q4 FY25 saw a 17% YoY increase to ₹1,283 Cr

Profit Surge: Net profit jumped 57% YoY to ₹516 Cr

Operating Margin: EBITDA rose 7% YoY to ₹730 Cr, with margin at 39%

Cargo Volume: Handled 31.2 million tonnes in Q4 FY25 — up 5% YoY; third-party cargo share reached 50% from 47%

Dividend Declared: ₹0.80 per share for Q4 FY25, showcasing shareholder returns

Strategic Projects: Interim operations began at Tuticorin & JNPA terminals, reinforcing growth in coal & logistics verticals

Industry Edge: Heavy reliance on bulk cargo provides resilience against global container market volatility

🧭Conclusion

JSW Infrastructure is fundamentally and technically well-positioned after its strong Q4 showing:

🔹 Key Watchpoint: Break above ₹320 and retest as support.

🔹 Bullish Scenario: Sustained move may target ₹340 → ₹360 → ₹380.

🔹 Bearish Signal: Failure to hold ensuing supports (₹280 / ₹220) could lead to correction.

Disclaimer: lnkd.in

JSW Infrastructure Ltd. – Strong Q4 Boost as it Eyes Breakout📈 Technical Analysis

IPO & Rally: Since its listing on October - 2023 at ₹140–150, the stock surged to ₹360 by July 2024.

Correction & Support: A pullback followed, finding solid demand at ₹220, which held firm.

Recent Rally: Strong Q3 and Q4 2024 results triggered a rebound starting February 2025.

Resistance Zone: The stock now faces resistance at the ₹320 area, aligned with recent lower highs.

Higher Volume: A surge in trading volume on 5th June confirmed investor interest.

Breakout Signal: If JSW Infra breaks above ₹320 and retests it as support with bullish candlestick confirmation, it may rally further.

🎯 Targets: ₹340 → ₹360 → ₹380

🔻 Supports: ₹280 → ₹220 (major demand zone)

Caution Alert: A failure to hold above these supports could trigger further downside.

💰 Q4 FY24 Key Financial Highlights:

Total Income: ₹1,283 Cr (vs ₹1,182 Cr in Q3 FY24; ₹1,096 Cr in Q4 FY23)

Total Expenses: ₹642 Cr (vs ₹596 Cr in Q3 FY24; ₹515 Cr in Q4 FY23)

Total Operating Profits: ₹641 Cr (vs ₹586 Cr in Q3 FY24; ₹581 Cr in Q4 FY23)

Profit Before Tax: ₹581 Cr (vs ₹276 Cr in Q3 FY24; ₹417 Cr in Q4 FY23)

Profit After Tax: ₹516 Cr (vs ₹336 Cr in Q3 FY24; ₹329 Cr in Q4 FY23)

Diluted Normalized EPS: ₹2.43 (vs ₹1.57 in Q3 FY24; ₹1.57 in Q4 FY23)

📌All major metrics show strong sequential growth, demonstrating robust quarterly momentum.

🔍 Fundamental Insights

Revenue Growth: Q4 FY25 saw a 17% YoY increase to ₹1,283 Cr

Profit Surge: Net profit jumped 57% YoY to ₹516 Cr

Operating Margin: EBITDA rose 7% YoY to ₹730 Cr, with margin at 39%

Cargo Volume: Handled 31.2 million tonnes in Q4 FY25 — up 5% YoY; third-party cargo share reached 50% from 47%

Dividend Declared: ₹0.80 per share for Q4 FY25, showcasing shareholder returns

Strategic Projects: Interim operations began at Tuticorin & JNPA terminals, reinforcing growth in coal & logistics verticals

Industry Edge: Heavy reliance on bulk cargo provides resilience against global container market volatility

🧭 Conclusion

JSW Infrastructure is fundamentally and technically well-positioned after its strong Q4 showing:

🔹 Key Watchpoint: Break above ₹320 and retest as support.

🔹 Bullish Scenario: Sustained move may target ₹340 → ₹360 → ₹380.

🔹 Bearish Signal: Failure to hold ensuing supports (₹280 / ₹220) could lead to correction.

⚠️ Disclaimer

This information is for educational purposes only. It is not investment advice. Please consult with professional advisors before making any decisions.

20% TechnoFunda IdeaFundamental:

The company has shown a good profit growth of 42.63% for the Past 3 years. The company has shown a good revenue growth of 18.61% for the Past 3 years. The Company has been maintaining an effective average operating margins of 45.17% in the last 5 years. Company's PEG ratio is 0.56.

Technical:

Its a Type 2 Trade with the marking of Wave 4c,its all set for a Wave 5 rally.

Formation of a Bullish Pennant is there with a support on its 200 Dma.

A positive close above 297 (SL290) will trigger a BUY for a target of 340-360 levels.

JSW Infra cmp 322.90 by the Daily Chart view since listedJSW Infra cmp 322.90 by the Daily Chart view since listed

- Support Zone at 268 to 281 Price Band

- Resistance Zone at 330 to 340 Price Band

- Volumes are gradually picking up closely in sync with average traded quantity for this stock

- Stock has formed a Bullish Rounding Bottom with the neckline coinciding at Resistance Price Band

- Probable Breakout is in the making process basis Price closure above Resistance Zone for few days

"JSW Infra: Climbing the Crane of Success!""JSW Infra: Sailing Toward the Fibonacci 0.618 Dock! 🚢📈"

This means the stock is likely retracing to the golden ratio (61.8%) level, a key Fibonacci retracement point often seen as strong support or resistance in technical analysis.

🚨 Disclaimer: Not Financial Advice! 🚨

** This is for educational purposes only! 📚😂 Do your own research, consult a professional, and remember—stocks can go up, down, or sideways faster than your morning coffee spills! ☕📉📈 Invest responsibly! 🚀💸 **

JSW INFRA : Breakout or VCP formation#JSWINFRA #breakoutsoon #Vcppattern #swingtrade

JSWINFRA : Breakout or VCP Formation - there are 2 scenarios

Breakout Scenario :

>> Enter with 30% of position Sizing now

>> If Breakout happens u wont be in FOMO

>> If Breakout Sustains u can add more win Retest or Retracement

>> Swing Traders can look to book close to 10 % profits

VCP Formation :

>> Enter 30% position sizing now

>> If it starts falling, Its a Confirmation of VCP formation

>> Start Accumulatig during the Downpart of VCP

>> when VCP upside Starts it can Give Good Spike

>> In Case of VCP Breakout, Swing Traders can Look to target min 10-15% profits.

I want you all to Observe this stock setup and see what scenario plays out.

If u Like the Setup & analysis, Pls give us a Boost, Comment & Follow us

Disc : Charts Shared are for Educational purpose, so that u can Learn how to analyse Stocks and How u can plan ur Entries etc. Do not take position in it unless u consult ur Financial advisor also do ur own analysis

JSW Infrastructure Ltd Support & Resistance #JSWINFRA 👑👑

Trendline breakout candidate.

Looks good if holds well above 355

For JSW Infrastructure Ltd. (JSWINFRA), here are the current support and resistance levels based on recent technical analysis:

Support Levels:

S1: 320.43

S2: 316.27

S3: 312.33

Resistance Levels:

R1: 328.53

R2: 332.47

R3: 336.631