Mamata Machinery Ltd.

No trades

17.15 INR

407.54 M INR

2.51 B INR

8.54 M

About Mamata Machinery Ltd.

Sector

Industry

CEO

Apurva N. Kane

Website

Headquarters

Sanand

Founded

1979

Identifiers

2

ISIN INE0TO701015

Mamata Machinery Ltd. engages in the manufacture and wholesale of plastic bag and pouch making machines. It operates through the following geographical segments: India, United States of America, Canada, Mexico, South Africa, and Rest of the World. The company was founded on April 17, 1979 and is headquartered in Sanand, India.

Related stocks

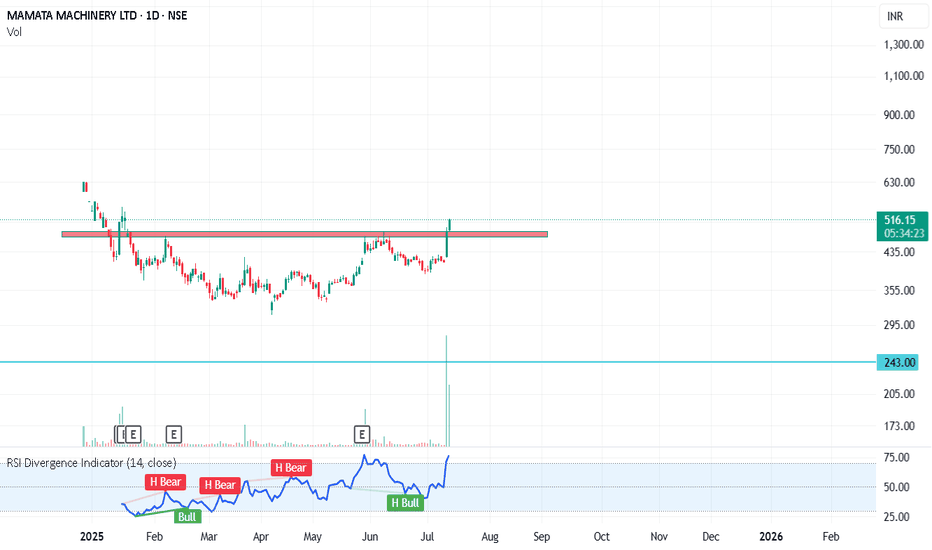

Mamata Machinery Ltd – Support Reversal & Retest Zone (75-min)Mamata Machinery is showing early signs of reversal from a strong support zone around ₹425–₹430. After forming a double-bottom-like structure, the stock has bounced sharply with rising volumes, indicating a possible short-term trend reversal.

Currently, price action is approaching a retest zone (Ta

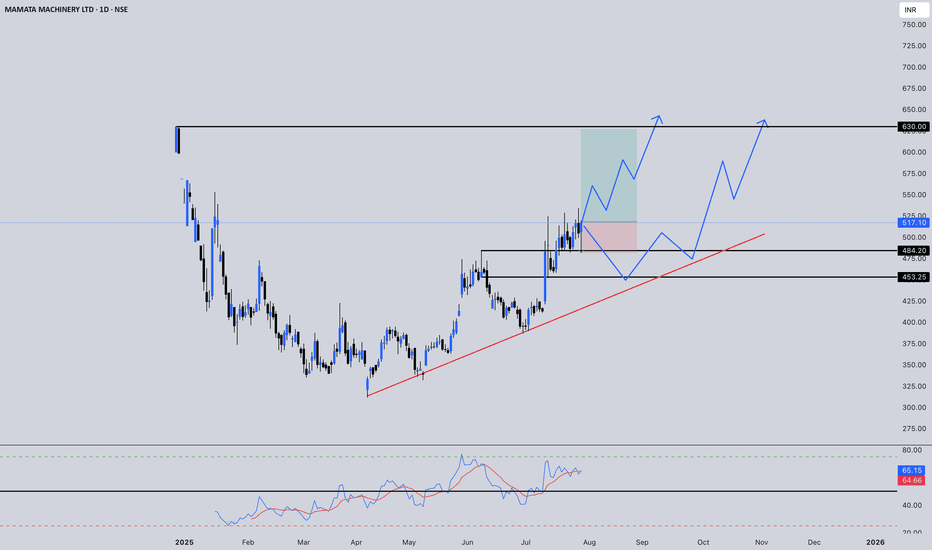

MAMATA: 2 Possibilities for the Bullish MomentumIn either cases RRR is favourable but at current levels the trade looks slightly risky due to higher downside risk.

⚠️ Disclaimer: This is NOT a buy/sell recommendation. This post is meant for learning purposes only. Views are personal. Please, do your due diligence before investing.⚠️

💬 Share you

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that

Eve-Adam Pattern Forming? A Rare Double Bottom Pattern Explained📉 Pattern Study (Not a Buy/Sell Tip/Not Forecasting anything)

On the weekly chart of Mamata Machinery Ltd, we’re potentially witnessing a classic yet uncommon pattern — the Eve-Adam Double Bottom.

🔍 What is the Eve-Adam pattern?

🧑🦰 Eve Bottom: Broad, rounded, and forms slowly with increased volum

Mamata Machinery Ltd ₹ 424 2.75% 10 Jul 10:00 a.mIf price breaks above RS 430 in daily timeframe, then 1st Target is RS 461, 2nd target is RS 485 Stoploss your own.

DISCLAIMER:

I am not a SEBI-registered advisor. The content shared, including charts, ideas, and analysis, is purely for educational and informational purposes only. This should not

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of MAMATA is 426.45 INR — it has increased by 0.22% in the past 24 hours. Watch Mamata Machinery Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Mamata Machinery Ltd. stocks are traded under the ticker MAMATA.

MAMATA stock has risen by 1.30% compared to the previous week, the month change is a 6.10% rise, over the last year Mamata Machinery Ltd. has showed a 1.85% increase.

MAMATA reached its all-time high on Dec 30, 2024 with the price of 630.00 INR, and its all-time low was 311.55 INR and was reached on Apr 7, 2025. View more price dynamics on MAMATA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MAMATA stock is 5.67% volatile and has beta coefficient of 1.70. Track Mamata Machinery Ltd. stock price on the chart and check out the list of the most volatile stocks — is Mamata Machinery Ltd. there?

Today Mamata Machinery Ltd. has the market capitalization of 10.47 B, it has increased by 3.84% over the last week.

Yes, you can track Mamata Machinery Ltd. financials in yearly and quarterly reports right on TradingView.

MAMATA net income for the last quarter is 78.66 M INR, while the quarter before that showed 45.30 M INR of net income which accounts for 73.64% change. Track more Mamata Machinery Ltd. financial stats to get the full picture.

Yes, MAMATA dividends are paid annually. The last dividend per share was 0.50 INR. As of today, Dividend Yield (TTM)% is 0.12%. Tracking Mamata Machinery Ltd. dividends might help you take more informed decisions.

As of Feb 13, 2026, the company has 199 employees. See our rating of the largest employees — is Mamata Machinery Ltd. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Mamata Machinery Ltd. EBITDA is 548.37 M INR, and current EBITDA margin is 20.96%. See more stats in Mamata Machinery Ltd. financial statements.

Like other stocks, MAMATA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Mamata Machinery Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Mamata Machinery Ltd. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Mamata Machinery Ltd. stock shows the buy signal. See more of Mamata Machinery Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.