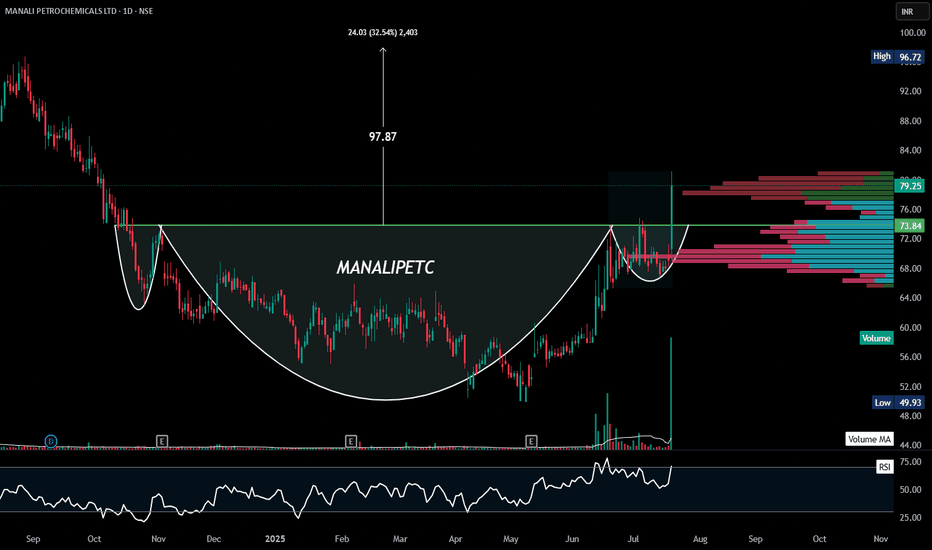

MANALIPETC | Cup & Handle | Breakout#MANALIPETC

🚨 Breakout Alert: NSE:MANALIPETC

Cup & Handle breakout above ₹73.8 with strong volume 📈

📌 Target: ₹97.8 (32% upside)

✅ Bullish structure wait for pullback

✅ Low debt, niche player

📊 RSI nearing 70 — early momentum phase

#StocksToWatch #TechnicalAnalysis #Breakout

Trade ideas

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Round Bottom Breakout in MANALIPETC

BUY TODAY SELL TOMORROW for 5%

MANALI PETCHEM, SET TO BECOME 2XMANALI PETCHEM 80 (W), after series of contraction is now set for price expansion. stock is breakoing out from ichimoku cloud with volumes backing up. Medium to long term investor can look for 150/160 range, almost 2x from cmp. Invalid below 60 closing on weekly basis

Manali Petrochemicals Ltd (Day Chart)Date 03.06.2024

A weak chart, but making inverted head & shoulder with support of 200 ema below right shoulder. Can go for longs once breaks neckline of the inverted head & shoulder

Keep 200 ema as stoploss, if slips below it, either exit or don't average

Or simply wait for price to break the neckline

Regards,

Ankur Singh

Manali Petrochemicals Ltd - Volume BreakoutAfter the bull run, price retrenched to fib level at 38.20%. The fresh movement observed in stock, aptly supported by volume and moving average.

Stop Loss - Below support level ; Target 1 - Rs 109 , Target 2 - ATH

Daily chart

9 months of consolidation, afterward symmetrical triangle breakout. The stock perfectly retested that level and uptrend continued.

Technical chart

From past 18 months, stock facing a strong resistance at 200 ema. Currently price closed above 200 ema with short average crossing over long average and supported by strong volume.

Thanks

Disclaimer: The information and publications are not meant to be, and do not constitute, financial, investment, trading or any other types of advice or recommendations.

Momentum GameIdea is Simple Invest in stocks which Breakout with Volume.

Rather than targeting 20% to 25% profits for most of your stocks, the profit goal is a more modest 10%, or even just 5%.

Rule 1 : Exit from the trade when current day closes below previous day low.

Rule 2 : Hold the Trade until the Rule 1 is not met.

Rule 3 : On result day trail your SL at 15Min Time Frame

BREAKOUT, MANALI PETROCHEM, 140% RETURNBUY - MANALI PETROCHEMS

CMP - Rs. 70

Target - 1: Rs. 100

Target - 2: Rs. 137

Target - 3: Rs. 170

.

Timeframe - 2 months - 1 year

.

Technicals - Trendline Breakout

.

This is just a breakout, by an expert analyst, please invest at your own risk.

.

Follow me for more!

I think a definite buy for swing tradeReasons for Buy

************************************************************

Candle stick patterns

Bullish Kicker Pattern

Morning star pattern

Inverted Head and shoulder pattern

Indicators

MACD 26 line crossed up by MACD 12 Line

RSI is steadily rising towards 60

Volume is suddenly increased. So may be somne big bullish players aqre entering the game

Trend

Trend reversal happened. Downtrend to up trend started

Buy @69.05 Rs

Stoploss: below 65Rs

Target1: 71.50Rs

Target2: 75.15 Rs

Target3: 83 Rs (Doubtful)

MANALI PETROCHEM - MULTIBAGGER STOCK???BUY - MANALI PETROCHEMS

CMP - Rs. 66

Target - 1: Rs. 92

Target - 2: Rs. 124

Target - 3: Rs. 150

.

.

Technicals - Bullish Flag BO

.

Note: Target 2&3 will be achieved within 1.5-2 years, while Target - 1 will be achieved within 1 year.

.

This is just a view by an expert analyst, please invest at your own risk.

.

Follow me for more!

MANALIPETC | Good RRR Short Trade opportunity !!!Short Term Trade opportunity to earn good RRR

CMP: ~ 107 ( Buy @ ~ 109.5)

SL: ~ 98.8

Target: ~ 125.30 | ~149.65 | ~189 ( Swing Traders can exit @ T2)

( Targets calculated on the basis of Fib. and previous swings )

Disclaimer:

I am not a SEBI registered analyst. My studies are for educational purposes only. Please consult your financial advisor before trading or investing. I am here just to share my views and have fun!!! Don’t take me seriously…..

Happy trading !!!