Ramkrishna Forgings - A new rise to the new high incoming!The Chart shows major divergence on weekly time frame.

RSI rising with EMA crossover and descending channle breakout post more than a year. Within a larger time set, it looks like a bigger cup and handle is in motion where consolidation of cup is happening now

Upside of 60-70% here should be a good target for this one.

Ramkrishna Forgings Ltd

No trades

What traders are saying

.Ramkrishna Forgings Ltd ₹ 680 2.57% 10 Jul 2:55 p.m..Ramkrishna Forgings Ltd

₹ 680

2.57%

10 Jul 2:55 p.m.

#chart_sab_kuch_bolta_hai*

If price breaks above RS 693in daily timeframe, then 1st Target is RS 725 2nd target is RS --Stoploss your own.

DISCLAIMER:

I am not a SEBI-registered advisor. The content shared, including charts, ideas, and analysis, is purely for educational and informational purposes only. This should not be considered as financial or investment advice. Please do your own research or consult with a SEBI-registered professional before making any trading or investment decisions. I will not be responsible for any losses incurred.

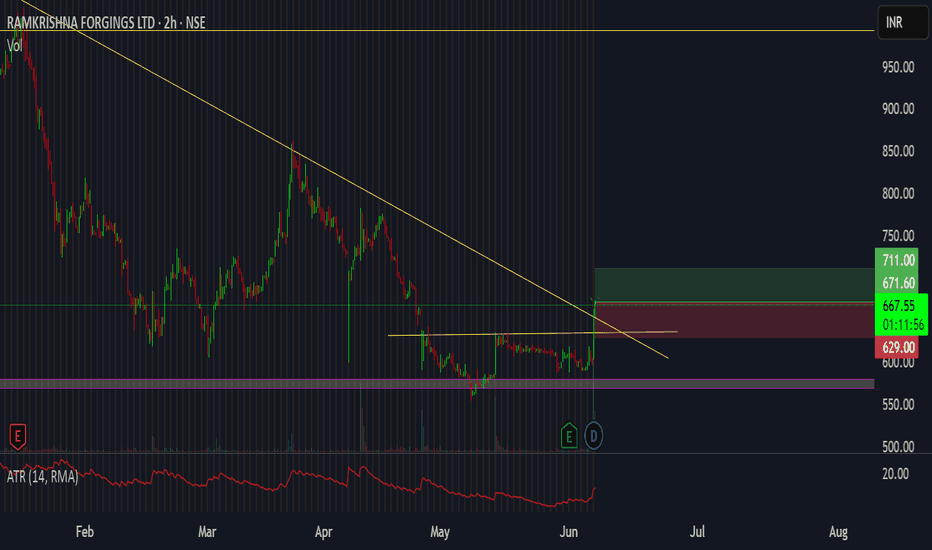

RK Forgings Short Term TradeThe area around 575 is a strong support on daily and weekly chart (long term support),

In the last four months, the stock has bounced off from around this level with a rise in volume,

every time higher than the previous,

A triangular pattern is also visible , having formed during this period, and now a small rectangular pattern is also visible,

A breakout through all of these has occurred today

Thus, for a short term trade,

tgt 711, sl 629

RKF Massive Breakout After 6-Month Consolidation.NSE:RKFORGE Hidden Auto Component Gem Ready for Massive Breakout After 6-Month Consolidation, after Breaking out Today With King Candle and Volumes.

Price Action:

- Current Price: ₹656.75 (+9.37% gain)

- Trading Range: ₹553.00 - ₹1,020.00

- Market Cap Category: Mid-cap stock with decent liquidity

- Chart Pattern: Extended consolidation phase with recent breakout attempt

Support and Resistance Levels

- Primary Resistance: ₹760-780 zone (red horizontal line)

- Secondary Resistance: ₹1,020 (previous high)

- Immediate Support: ₹620-640 zone

- Major Support: ₹553-580 zone (green horizontal rectangle)

- Critical Support: ₹553 (52-week low)

Base Formation:

- Base Type: Rectangle/Sideways consolidation base

- Duration: Approximately 6 months (January 2025 to June 2025)

- Base Depth: ~45% correction from highs

- Base Quality: Tight consolidation with reduced volatility

- Breakout Characteristics: Recent volume spike suggests potential base completion

Technical Patterns:

- Rectangle Pattern: Clear horizontal support and resistance boundaries

- Volume Accumulation: Declining volume during consolidation, spike on recent move

- Flag Formation: Potential bull flag pattern forming at current levels

- Double Bottom: Possible formation around ₹553-580 support zone

Volume Spread Analysis

- Volume Characteristics: 21.57M shares traded (above average)

- Volume Pattern: Higher volume on up days, lower on down days

- *Accumulation Signs: Volume spike coinciding with price breakout attempt

- Volume Confirmation: Recent breakout supported by increased participation

Trade Setup:

Entry Strategy:

- Primary Entry: ₹650-665 (current levels on pullback)

- Aggressive Entry: ₹680-690 (on breakout above resistance)

- Conservative Entry: ₹620-630 (on retest of support)

Exit Levels:

- Target 1: ₹750-760 (15% upside)

- Target 2: ₹850-880 (30% upside)

- Target 3: ₹980-1,000 (50% upside)

Stop Loss Levels:

- Tight Stop: ₹620 (5% risk)

- Swing Stop: ₹580 (12% risk)

- Position Stop: ₹550 (16% risk)

Position Sizing:

- Conservative Allocation: 2-3% of portfolio

- Moderate Allocation: 4-5% of portfolio

- Aggressive Allocation: 6-8% of portfolio (for risk-tolerant investors)

Risk Management:

- Risk-Reward Ratio: Minimum 1:2 for all entries

- Portfolio Risk: Maximum 2% portfolio risk per position

- Position Monitoring: Weekly review of technical levels

- Profit Booking: 25% at Target 1, 50% at Target 2, remainder at Target 3

Sectoral Backdrop:

Auto Components Sector Overview

- Sector Performance: Recovery phase post-COVID disruptions

- Growth Drivers: EV transition, export opportunities, aftermarket demand

- Challenges: Raw material inflation, supply chain disruptions

- Government Support: PLI schemes, Make in India initiatives

Forging Industry Dynamics

- Market Position: Specialised manufacturing with high entry barriers

- Demand Drivers: Commercial vehicle recovery, export growth

- Competitive Advantage: Technical expertise, established client relationships

- Cyclical Nature: Linked to auto industry cycles and capex spending

Fundamental Backdrop

Company Overview

- Business Model: Automotive forging components manufacturer

- Key Clients: Major OEMs in domestic and international markets

- Product Portfolio: Crankshafts, connecting rods, front axle beams

- Manufacturing Facilities: Multiple locations with modern equipment

Financial Health Indicators

- Revenue Growth: Recovery trajectory expected post-consolidation

- Margin Profile: Improving operational efficiency

- Debt Levels: Manageable debt-to-equity ratios

- Cash Flow: Positive operating cash flow generation

Growth Catalysts

- Export Expansion: Increasing share in global supply chains

- Product Diversification: Entry into new automotive segments

- Technology Upgrades: Investment in advanced manufacturing

- Market Recovery: Commercial vehicle segment revival

Risk Factors

- Cyclical Demand: Vulnerability to auto industry downturns

- Raw Material Costs: Steel price volatility impact

- Competition: Pressure from low-cost manufacturers

- Regulatory Changes: Environmental and safety compliance costs

My Take:

NSE:RKFORGE presents a compelling technical setup after a prolonged consolidation phase. The stock appears to be breaking out from a well-defined base with strong volume support. The risk-reward profile is attractive for medium-term investors, with clear support and resistance levels providing good trade management opportunities. However, investors should remain mindful of the cyclical nature of the auto components sector and size positions accordingly.

Keep in the Watchlist.

NO RECO. For Buy/Sell.

📌Thank you for exploring my idea! I hope you found it valuable.

🙏FOLLOW for more

👍BOOST if you found it useful.

✍️COMMENT below with your views.

Meanwhile, check out my other stock ideas on the right side until this trade is activated. I would love your feedback.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

RK FORGE: New All-Time-High Coming Soon!⚡ Price Analysis:

1️⃣ Price bouncing from the demand zone

2️⃣ Strong candle formation near the demand zone.

3️⃣ Breakout above the marked golden zone will trigger the confirmation for the new ATH

⭐ Key Observations:

➡️ Strong bounce back from the demand zone.

➡️ EMA is also acting as a dynamic support.

➡️ RRR is not favourable since the SL is big, so I'll not plan a trade here. Just watching it.

⚠️ Disclaimer: This is NOT a buy/sell recommendation. For learning ONLY. Views are personal. Please, do your due diligence before investing.⚠️

🍀Cheers! 🔥

Buy RKForge above 1040 Target 1120 SL 998Buy Ramakrishna Forging above 1140 SL 998 Target 1120

Vloume on 15-10-2024 was 3 X of average volume, trendling breakout as per chart & stong outlook

Company has delivered good profit growth of 23.2% CAGR over last 5 years

Debtor days have improved from 102 to 78.4 days.

Company's median sales growth is 23.9% of last 10 years

Company's working capital requirements have reduced from 117 days to 88.6 days

#investing #nseindia #Bseindia #RKforge

BUY TODAY SELL TOMORROW for 5% DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Support in RKFORGE

BUY TODAY SELL TOMORROW for 5%

Ramkrishna Forgings cmp 957.10 by Weekly Chart viewRamkrishna Forgings cmp 957.10 by Weekly Chart view

- Price Band 880 to 905 Support Zone

- Next Support Zone at 695 to 720 Price Band

- Price shouldering along Rising Support Trendline

- Price has sustained above Falling Resistance Trendline

- Volumes surged heavily last week Friday by a demand based buying

- Weekly Support at 880 > 788 > 695 with Resistance seen at 995 > ATH 1065.05

- Technical Indicators inching towards positive mode for MACD, RSI and Price trending above EMA 21, 50, 100, 200

RAMKRISHNA FORGINS - Swing Trade Analysis - 21st April #stocksRAMKRISHNA FORGINS (1W TF) - Swing Trade Analysis given on 21st April, 2024

Pattern: AT WEEKLY RESISTANCE BREAKOUT LEVELS

- Volume Buildup at Resistance - Done ✓

- Weekly Resistance Breakout - In Progress

- Demand Zone Retest & Consolidation - In Progress

* Disclaimer

RKFORGE - CLEAN BREAKOUT WITH VERY CLOSE 50/200 SMAA very positive breakout where all the moving averages converge & then expand.

1 Yr Breakout with strong sectoral tailwinds as all forging stocks doing well

Strong upsurge in Volume indicates sustained price action upside from the present levels

Supply and demand zones clearly marked in the chart with no extra indicators to cause any confusion.

RKFORGEI'm not a SEBI registered analyst, Views are personal, not any buy or sell recommendations.

Today i found RKFORGE ,which has given breakout in Daily along with good volumes, Based on volume and current price action movement in the RKFORGE chart, I anticipate a short-term upswing. Please refer to the chart for a detailed analysis.

RKFORGE - 10 Months Consolidation Breakout / All Time HighRamkrishna Forgings Ltd

1) Time Frame - Weekly.

2) The Stock has been Consolidating since (August, 2023). Now It has given a Consolidation breakout & Closed at it's Life Time High with good volume & good bullish momentum candle in weekly Time Frame.

3) The stock may find it's next resistance around the price (1100 - 22.30% from the price 899.10).

4) Recommendation - Strong Buy.

Amazing breakout on Weekly / Daily Timeframe - RKFORGECheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favour that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN LOWER TIMEFRAME AND RETRACE IF NEEDED. SL IS NEARER SUPPORT ZONE IN Daily TIMEFRAME.

PS: No new Nifty500 script can escape from me when making a breakout. :-)

Rk forging (going to be RocKing Forge) RK forge going to be RocKing forge

Looks good in Parabolic uptrend pattern.

Time Frame Monthly.

On closing above 813+ in monthly chart makes it more bullish and can rally to

Tgt 1 : 1298±

Tgt 2 : 1500±

Shared it for EDUCATIONAL purpose based on chart pattern and My STUDY.

Do your analysis from your side too.

This is not a BUY or SELL RECOMMENDATION from my side.