SIGACHI Price ActionSigachi Industries Ltd is currently trading near ₹38.8 after facing a significant decline over the past year. The price movement remains sideways in the short term, with the stock trading close to its 52-week low of ₹30.51 and resistance around ₹43.80. The overall trend is weak, and the stock contin

Sigachi Industries Limited

35.58INRR

+0.25+0.71%

At close at Nov 14, 10:24 GMT

INR

No trades

Next report date

≈

February 4

Report period

Q2 2024

EPS estimate

—

Revenue estimate

—

−1.35 INR

695.63 M INR

4.88 B INR

185.16 M

About Sigachi Industries Limited

Sector

Industry

CEO

Amit Raj Sinha

Website

Headquarters

Hyderabad

Founded

1989

ISIN

INE0D0K01022

FIGI

BBG013BNN2R0

Sigachi Industries Ltd. engages in the manufacture and sale of microcrystalline cellulose. Its product is used as an excipient for finished dosages in the pharmaceutical, food, nutraceuticals, and cosmetic industries, as a stabilizer, anti-caking agent, fat substitute, and emulsifier in food industry and as a fat substitute, thickener, and binder in cosmetics. The company was founded on January 11, 1989 and is headquartered in Hyderabad, India.

−90%

−60%

−30%

0%

30%

Q2 '24

Q3 '24

Q4 '24

Q1 '25

Q2 '25

−1.40 B

−700.00 M

0.00

700.00 M

1.40 B

Revenue

Net income

Net margin %

Revenue

COGS

Gross profit

Op expenses

Op income

Non-Op income/ expenses

Taxes & Other

Net income

0.00

300.00 M

600.00 M

900.00 M

1.20 B

Revenue

COGS

Gross profit

Expenses & adjustments

Net income

0.00

300.00 M

600.00 M

900.00 M

1.20 B

Q2 '24

Q3 '24

Q4 '24

Q1 '25

Q2 '25

0.00

450.00 M

900.00 M

1.35 B

1.80 B

Debt

Free cash flow

Cash & equivalents

Sigachi’s Technical Surge: Next Resistance in SightOver the past month, Sigachi traded within a well-defined consolidation range, reflecting a period of equilibrium between buyers and sellers. However, in the most recent week, the stock decisively broke out above this consolidation zone on increased trading volume a classic signal of renewed bulli

Sigachi Ind (Weekly Timeframe) - Is this the trend reversal?After a period of decline following its February 2024 peak, Sigachi Industries has shown a dramatic burst of momentum. However, the stock has now reached a critical juncture, and confirmation is required to suggest a sustainable trend reversal.

## Recent Price Action

A massive +36.27% rally las

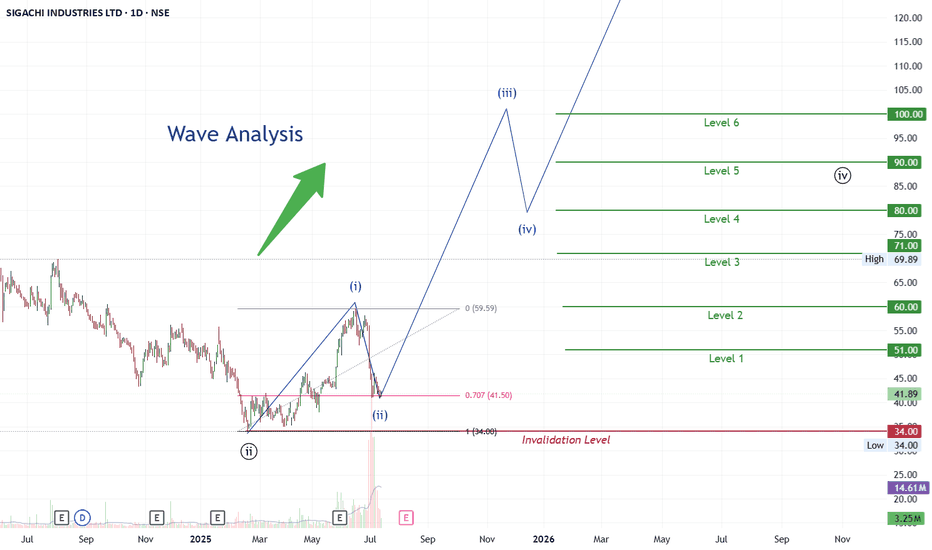

SIGACHI LONGThe Elliott Wave Theory's description of the structure and pattern of price movements in financial markets is known as the Elliott Wave Structure.

The Elliott Wave analysis indicates that the stock has completed waves (i) and (ii) which are shown as black circle numbers on the daily chart. Wave (ii

NLong

SIGACHI: supply zone breakout5. SIGACHI

-supply zone breakout in the offing

-weekly volume uptick has been sharp in the last two weeks

-the financial results reflect the highest ever sales in the last fy which may result into a higher profit margin eventually when the company can increase margins

NLong

Found a Stock On WTFFound a stock on wtf with good increased volume if it closes we can buy for a long positional trade on WTF

Price Action Case Study: Weekly Price action chart of SIGACHI 🔹 Key Structural Elements:

-White Solid Line: Primary Counter-Trendline (CT) connecting multiple swing highs, acting as dynamic resistance over several months.

-White Dotted Lines: Hidden supply lines derived from intermediary highs, often acting as secondary resistance.

-Yellow Lines: Higher time

NLong

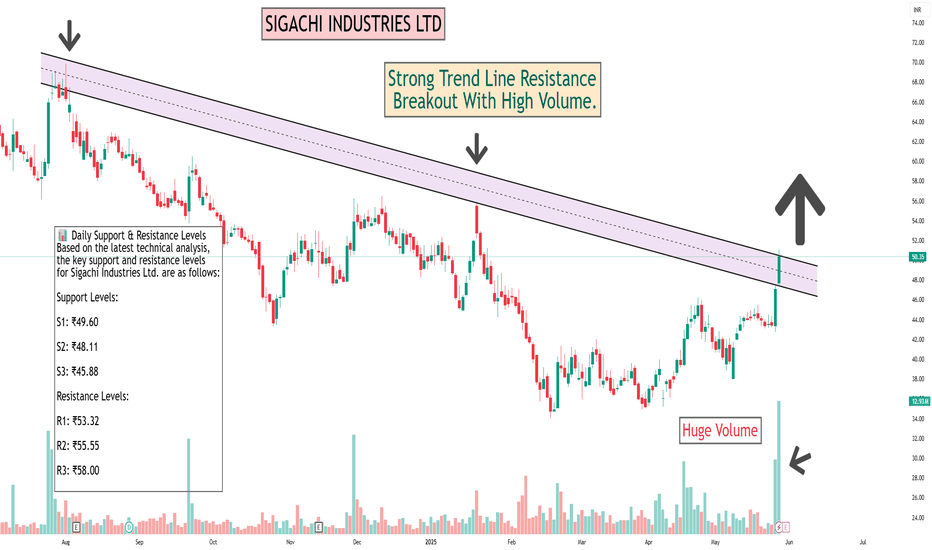

SIGACHI INDUSTRIES LTDAs of May 29, 2025, Sigachi Industries Ltd. (NSE: SIGACHI) is trading at ₹50.35, reflecting a 6.95% increase over the previous close.

📊 Daily Support & Resistance Levels

Based on the latest technical analysis, the key support and resistance levels for Sigachi Industries Ltd. are as follows:

Suppo

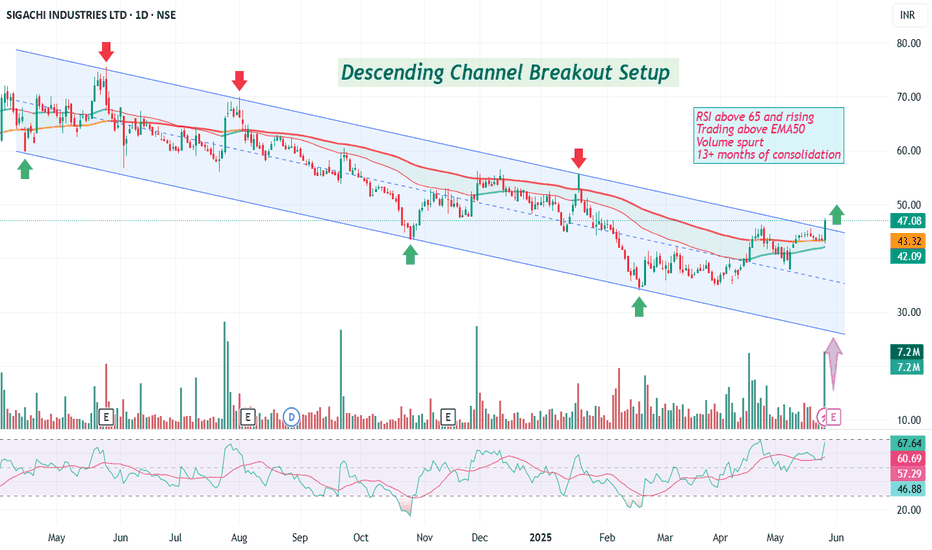

Breakout in Sigachi Sigachi Industries is one of the largest manufacturers of Microcrystalline Cellulose worldwide and has three Multi locational Facilities in Telangana and Gujarat.

Breakout Screener:

Descending Channel Breakout Setup

RSI above 65 and rising

Trading above EMA50

Volume spurt

13+ months of consolida

NLong

SIGACHI (Sigachi Industries Ltd)- AnalysisBullish Levels -day closing above 53 (early entry risky) then 63 to 72 (safe entry if day closing above this) first target is areond 82 then 92 and then 102 if sustains above this then long term targets can be around 800 some intermittent targets are marked on chart

Bearish levels :- Day closing b

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of SIGACHI is 35.58 INR — it has increased by 0.71% in the past 24 hours. Watch Sigachi Industries Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Sigachi Industries Limited stocks are traded under the ticker SIGACHI.

SIGACHI stock has risen by 0.91% compared to the previous week, the month change is a −6.12% fall, over the last year Sigachi Industries Limited has showed a −30.03% decrease.

SIGACHI reached its all-time high on Feb 27, 2024 with the price of 95.90 INR, and its all-time low was 21.98 INR and was reached on Mar 29, 2023. View more price dynamics on SIGACHI chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SIGACHI stock is 2.43% volatile and has beta coefficient of 1.40. Track Sigachi Industries Limited stock price on the chart and check out the list of the most volatile stocks — is Sigachi Industries Limited there?

Today Sigachi Industries Limited has the market capitalization of 13.60 B, it has increased by 1.56% over the last week.

Yes, you can track Sigachi Industries Limited financials in yearly and quarterly reports right on TradingView.

Sigachi Industries Limited is going to release the next earnings report on Feb 4, 2026. Keep track of upcoming events with our Earnings Calendar.

SIGACHI net income for the last quarter is 106.89 M INR, while the quarter before that showed −1.00 B INR of net income which accounts for 110.65% change. Track more Sigachi Industries Limited financial stats to get the full picture.

Yes, SIGACHI dividends are paid annually. The last dividend per share was 0.10 INR. As of today, Dividend Yield (TTM)% is 0.28%. Tracking Sigachi Industries Limited dividends might help you take more informed decisions.

Sigachi Industries Limited dividend yield was 0.28% in 2024, and payout ratio reached 4.85%. The year before the numbers were 0.18% and 5.52% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Nov 16, 2025, the company has 1.81 K employees. See our rating of the largest employees — is Sigachi Industries Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Sigachi Industries Limited EBITDA is 933.60 M INR, and current EBITDA margin is 21.10%. See more stats in Sigachi Industries Limited financial statements.

Like other stocks, SIGACHI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Sigachi Industries Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Sigachi Industries Limited technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Sigachi Industries Limited stock shows the sell signal. See more of Sigachi Industries Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.