TRANS & RECTI. LTD

491.25INRR

−4.35−0.88%

At close at Jul 25, 10:27 GMT

INR

No trades

TARIL trade ideas

Stock Analysis: Transformers & Rectifiers India LtdIntroduction:

Transformers and Rectifiers (India) Ltd. is a manufacturer of Power, Furnace and Rectifier Transformers. The company is a leading Indian manufacturer of transformers & reactors. Its product portfolio includes Single-phase power transformers up to 500MVA & 1200kV Class, Furnace Transformers, Rectifier & Distribution Transformers, Specialty Transformers, Series & Shunt Reactors, Mobile Sub Stations, Earthing Transformers, etc. It operates on a B2B model, catering to power generation, transmission, distribution, & industrial sectors.

Fundamentals:

Market Cap: ₹ 16,348 Cr.;

Stock P/E: 77.2 (Ind. P/E: 46.35); 👎

ROCE: 23.4% 👍 ; ROE: 28.0% 👍;

PEG Ratio: 0.17 👍; (Stock price is fairly valued relative to its growth prospects)

3 Years Sales Growth: 20% 👍

3 Years Compounded Profit Growth: 148% 👍

3 Years Stock Price CAGR: 210% 👍

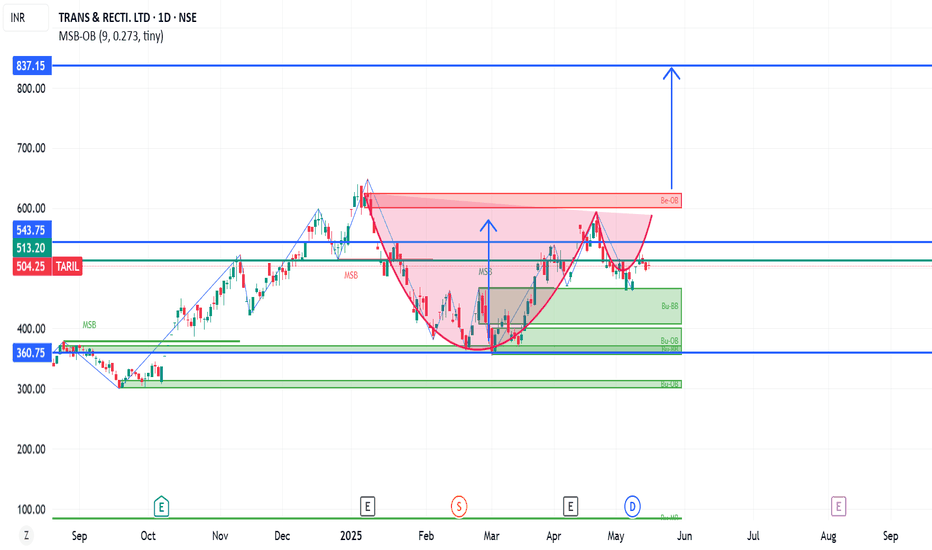

Technicals:

The stock has given a good breakout of over 52% from the 355 levels in March 2025.

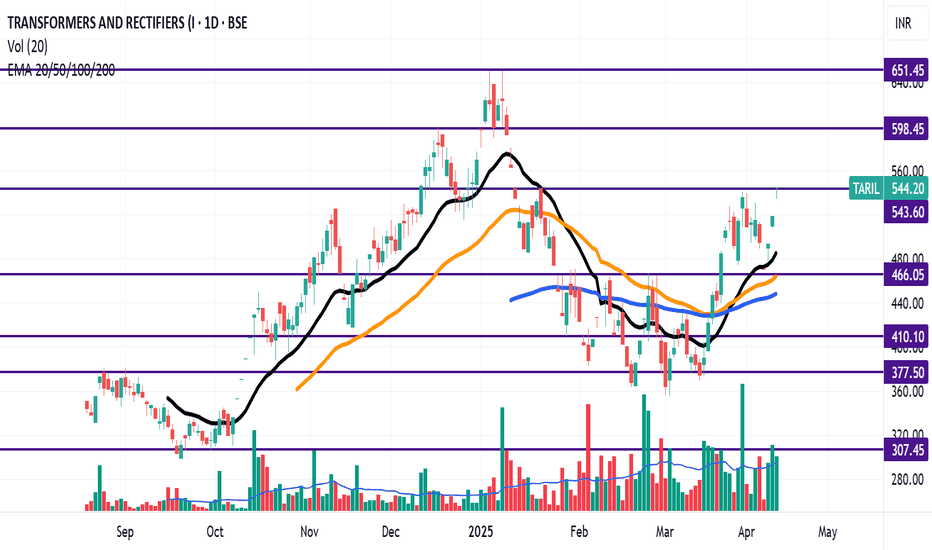

The stock price is trading above all the important resistance levels like 20 EMA(Black Line), 50 EMA (Orange Line), and 100 EMAs (Blue Line)

Bullish Momentum - Above Short, Medium and Long Term Moving Averages

We can expect good movement if it crosses the current price level of 544 in the weekly chart.

Resistance levels: 544, 598, 651

Support levels: 410, 377, 307

16.07% away from 52 week high

117.84% away from 52 week low

Outperformer - Transformers and Rectifiers India up by 29.33% v/s NIFTY 50 up by 1.47% in last 1 month

Pros:

Good quarterly growth in the recent results

Effectively using its capital to generate profit - RoCE improving since last 3 year

Growth in Net Profit with increasing Profit Margin (QoQ)

Company low Debt

Increasing Revenue every quarter for the past 3 quarters

FII Increasing their shareholding in the last quarters

Cons:

DIIs decreased their shareholding last quarter

TARIL - Breakout Setup, Move is ON...#TARIL trading above Resistance of 1024

Next Resistance is at 1300

Support is at 846

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Power and transformer sector trend in IndiaAs demand for power (renewable energy) demand keeps increasing, due to surging power demand domestic and industrial, with go green initiative and new sectors like data centers and EV's. keep an eye on major players in transmission and transformer sector, As India tends to invest heavy in transmission and EPC sector, I have plotted some major stocks that still have gas to go to moon. keep an eye on TARIL & SHILCHAR. this is one year performance in this high growth sector.