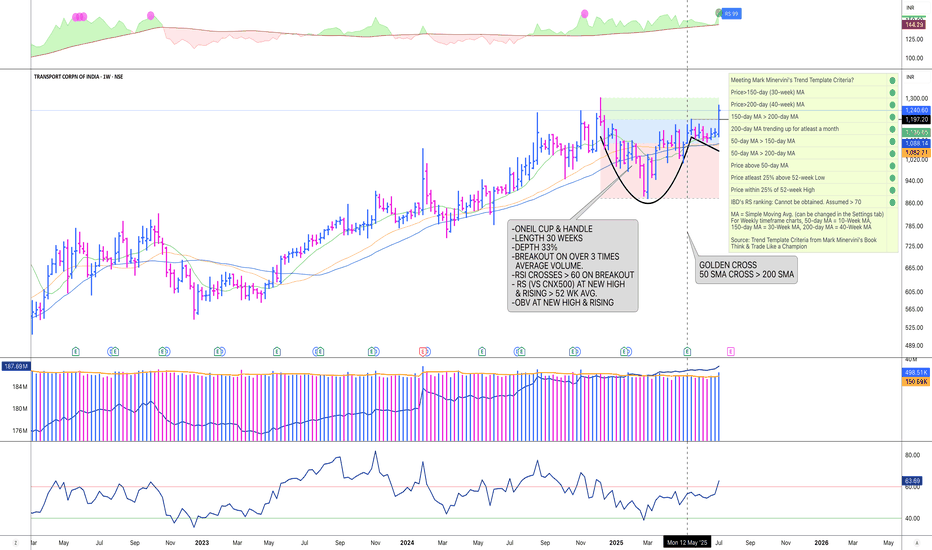

TCI BROKE OUT FROM A 30-WEEK CUP WITH HANDLE ON HUGE VOLUMETCI (Transport corp. of India) has just broken-out from an O’Neil Cup & Handle pattern on weekly chart, on over 3 times average volume.

The pattern meets O’Neil requirements as:

(1) there was a 2-year rally (Dec’22 to Dec’24) of over 100%,

(2) with substantial increase in volume (over 3 to 7 times) at some points prior to the pattern,

(3) pattern length of 30 weeks,

(4) pattern depth of 33%.

(5) During the period NIFTY corrected by 17%, & CNX 500 by 20%. Thus,

(6) the correction of 33% for TCI is well within the 2.5 times general market correction (as detailed by O’Neil).

(7) The Handle is formed in the upper half of the pattern (as per prescription), between 50% & 75% of the pattern range,

(8) volume in the Handle area is substantially low. Also,

(9) the Handle is formed on the support of 10-week (50-day) Moving Average,

(10) with Handle depth of 8.5%.

(11) The BUY Point (‘Pivot Point’ or ‘Line of Least Resistance’ as per Livermore) is 1197.2, the High of the Handle.

(12) on the Breakout Day it recorded a volume of over 12 times its 50-day average.

Coming to fundamentals, TCI has growing revenues over the last 8 quarters, & last 4 years. Also, it has growing EPS 7 out of the last 8 quarters (Dec’23 quarter was flat), & over the last 5 years.

It has 143 institutions (Funds) (increased by 3% in the last quarter) invested in 119 lakh shares (out of 238 lakhs free float) in the company.

Further health of Fundamentals of the company may be looked into as desired.

Currently, the stock is trading about 3.6% from the breakout level.

The overall picture indicates the stock has good fundamentals and strong technical strength.

DISCLAIMER: This publication is purely a personal analysis and is meant to be for informational and educational purposes. It is not intended to be any advice, suggestion, or inducement to buy, sell, or hold any stock, or any other financial instrument. Please conduct your own research and consult your financial advisor for any decision to buy, sell, hold, or otherwise deal with financial instruments, as they are prone to substantial financial risks.

Trade ideas

TCI Swing Trade ( 20% upside)Transport Corporation of India (TCI) has started new up-trend on Weekly and Daily time-frame from strong Institutional buying levels.

It is good time to build positions in this stock. Don't go for hard stop loss. Manage position as it can take 1-2 months for the targets to reach and will shake out week buyers in between.

If nifty holds above 23900, TCI has 20% upside potential with 1:7 Risk Reward.

Follow and connect with me for more such setups.

TCI Swing Trade ( 20% upside)Transport Corporation of India (TCI) has started new up-trend on Weekly and Daily time-frame from strong Institutional buying levels.

It is good time to build positions in this stock. Don't go for hard stop loss. Manage position as it can take 1-2 months for the targets to reach and will shake out week buyers in between.

If nifty holds above 23900, TCI has 20% upside potential with 1:7 Risk Reward.

Follow and connect with me for more such setups.

Transport Corporation of India (TCI) - Long Setup, Move is ON...#TCI trading above Resistance of 1198

Next Resistance is at 1666

Support is at 997

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Transport Corporation of India (TCI) - Long Setup, Move is ON...#TCI trading above Resistance of 787

Next Resistance is at 1198

Support is at 724

Here is previous chart:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

TCI (Transport Corp. of India)Here's another potential multibagger on our radar today.

This stock has an upside potential (Based on various fundamental and technical factors) till 960.

However, every analyst (Team of Analysts) have a different opinion.

Thus, here we bring to you TCI, aka, the Transport Corporation of India.

Here is the detailed analysis-

CMP- 803.10

Targets:

Short Term (Upto 6 months)- 832

Medium Term (6 Months to 1 Year)- 899

Long Term (More than 1 Year)- 956

Trailing Stoploss- 741

Let me know what you think about this.

Breakout in Transport Corporation of India (TCI)...Chart is self explanatory. Entry, Targets and Stop Loss are mentioned on the chart.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.