TCS Eyes Rebound as Strong Support and Results AlignTopic Statement:

TCS is currently oversold, with upcoming quarterly results potentially driving a rebound from strong technical support levels.

Key Points:

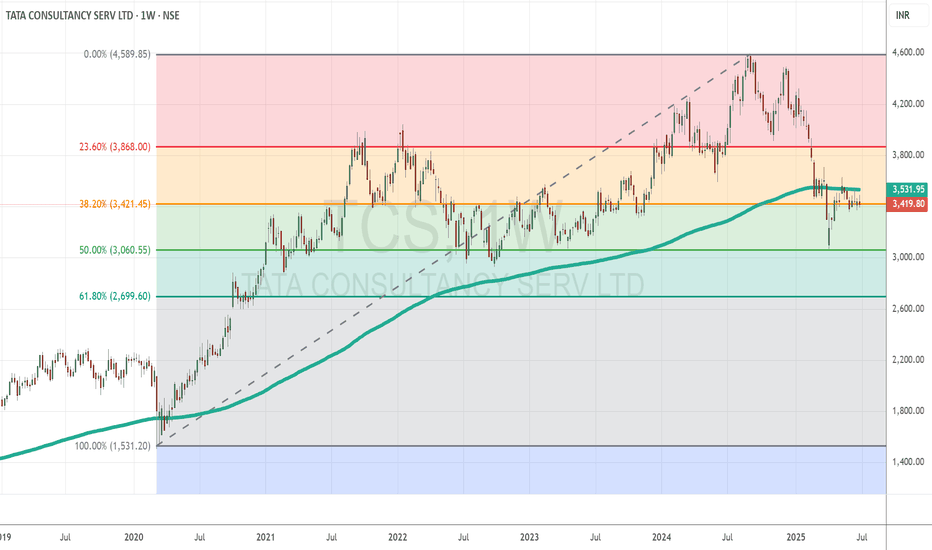

* The stock retraced to the 50% Fibonacci level at 3060, aligning with the psychological barrier around 3000 that acted as strong support

* Price is now stuck at the 38.2% retracement level at 3421, indicating a key resistance zone to watch

* Trading below the 200-day EMA suggests the stock is oversold, offering a rare and attractive investment opportunity in TCS

Trade ideas

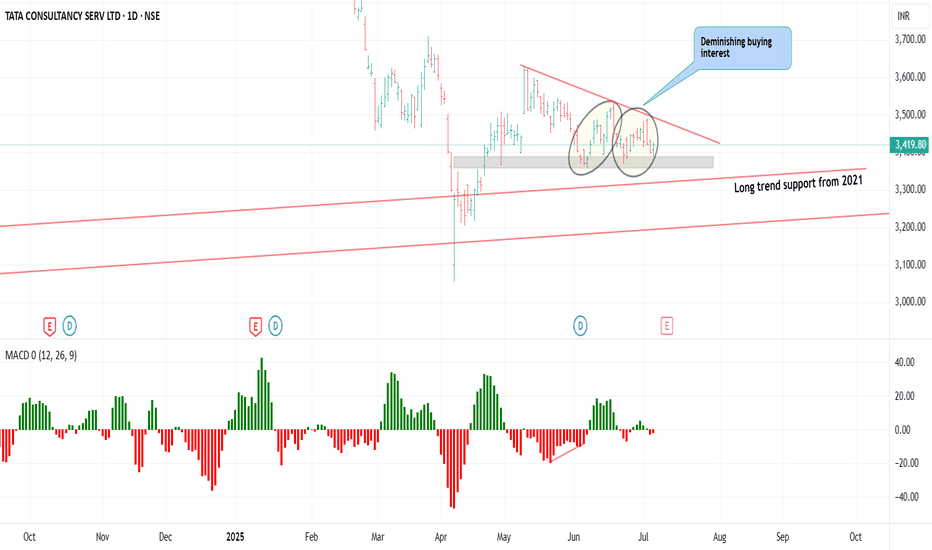

TCS descending triangle.. TCS 3419 is showing a descending triangle pattern.

Buying interest diminishing could be seen in the chart.

3480 is resistance and 3362 is support.

Signals suggest possible short weakness drop to support and then reverse to resistance

Day PCR is bearish at 0.74 while intraday at 2.34 suggests long buildup.

PUT premiums are higher than Call Premium suggests a shakeout is possible to trap the PUT writers.

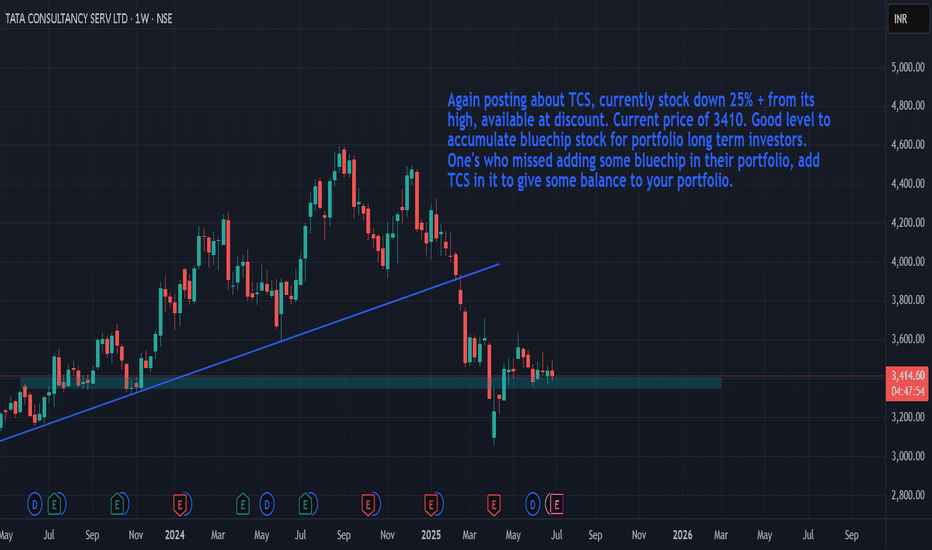

tcsAgain posting about TCS, currently stock down 25% + from its high, available at discount. Current price of 3410. Good level to accumulate bluechip stock for portfolio long term investors. One's who missed adding some bluechip in their portfolio, add TCS in it to give some balance to your portfolio.

(Not suggested/not recommended, just for educational purpose)

Will IT stocks survive? Infosys - TCSDo IT stocks like TCS, Infosys bounce back?

IT stocks are currently trading at about 30% less than their all time high. Showing signs of bounce but being sold out. To achieve the earlier high, IT stocks have to give 35%-40% profit.

Seems it may not move till financial results for current quarter proves good.

I was holding Infosys at Rs.1925. Since my last msg regarding Infosys, somehow I was not convinced on the price action and hence I posted that my call is invalid, as it fell down drastically and bounced to that level. So I sold at small profit and exited. Then it fell abt 30-40%.

Current situation - One side war, another side tariff, INR depreciation - all punching the stocks down.

To my opinion, its time for buying. I bought with confident that when I was ready to hold at Rs.1925, then why not at 1580 (30% down plus 3% money depreciation plus 4% inflation)? I missed to opportunity to buy at 1300 when it fell earlier.

For next two months, it will be on downside, and good to accumulate on every down of 5%.

As I earlier informed, Nifty range will be 23000-25000 for another 3-4 months. Breaking either side is a tough game, if do so may bounce back to this range soon.

Logic, all individuals and corporates have lot of government printed money (both US and India). To my opinion like gold, Nifty also may double in next 5 years. Same way, the stocks associated with Nifty (not all).

Above is for educational purpose only. Nothing is guaranteed. If announced bankrupt, you may loose all your money. Hence take call as per your study and analysis.

Happy Investing !!!

Low-Risk Entry Zones Emerging in TCS and CANARA BANKTCS - Potential Nested 1-2 / 1-2 Setup

After completing a higher-degree corrective phase, TCS has likely begun a new impulse sequence. The structure so far suggests a nested 1-2 / 1-2 setup:

Higher-degree Wave 1 peaked near 3630.50, followed by a corrective Wave 2 into 3358.70.

Inside the new sequence, minor wave i topped at 3538.00, with a minor wave ii correction down to 3370.00.

This leaves the door open for a sharp upside move if the structure unfolds as a Wave 3 acceleration phase. The invalidation for this scenario remains tight below 3358.70 . As long as price holds above this level, the nested setup remains intact with Fibonacci projection targets at:

3549 (1.0x)

3660 (1.618x)

3839 (2.618x)

Risk Management Note:

The tight invalidation allows for a favorable risk-reward profile. If price breaks below 3358.70, the nested count would be invalidated and a larger degree corrective structure may still be unfolding.

CANARA BANK - Impulse in Progress with Minor Wave 5 Pending

CANARA BANK presents a slightly different but equally interesting structure. Here, we observe a clean five-wave impulse unfolding from the March low of 78.60:

Major Wave 1: 95.19

Major Wave 2: 83.70 (deep but typical retracement)

Minor Wave 1: 102.63

Minor Wave 2: 90.95

Minor Wave 3: 119.30 (strong extension)

Minor Wave 4: 104.60 (respecting 50% retracement of Minor 3)

Price is now in the early stages of Minor Wave 5, which could complete the larger degree Wave 3. Fibonacci projections for the higher degree Wave 3 stand between 123.5 and 135.2.

Risk Management Note:

The invalidation for the immediate setup lies below 104.60. As long as this level holds, the path higher remains favored.

Summary:

Both TCS and CANARA BANK are showcasing clean Elliott Wave setups with well-defined invalidation zones. Traders following these patterns should monitor the invalidation levels closely, as failure to hold these zones will require a reassessment of the wave counts. However, while price respects these structures, the potential for sharp impulsive advances remains on the table.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

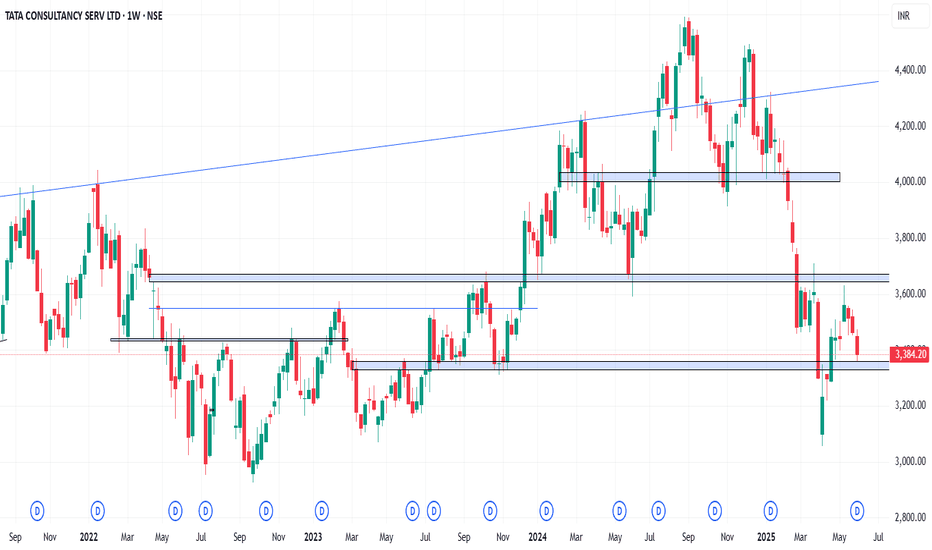

TCS Strong Support at ₹3360 | Breakout Above ₹3700ata Consultancy Services (TCS) is showing strong support near ₹3360 levels. A potential breakout will be confirmed if the price sustains above ₹3700.

Currently, the stock is facing key resistance zones between ₹3512 and ₹3525. A successful close above these levels may lead to strong bullish momentum.

📌 Key Levels:

Support: ₹3360

Resistance Zones: ₹3512 – ₹3525

Breakout Confirmation: Above ₹3700

Traders should watch these levels closely for directional cues. Volume confirmation and price action around resistance will be crucial.

#TCS #TCSshare #NSEStocks #StockAnalysis #BreakoutStocks #TradingViewIndia #TCSBreakout #IndianStocks #TechnicalAnalysis #SwingTrade

🔔 Disclaimer:

This analysis is for educational and informational purposes only. It is not a buy or sell recommendation. Please do your own research or consult a financial advisor before making any trading decisions. Trading and investing involve risk.

Advanced Institutions Option Trading - Part 7Time Decay (Theta) Strategies

Options lose value over time due to Theta Decay.

Strategies to Take Advantage of Theta:

Selling options (Covered Calls, Naked Puts)

Calendar Spreads

Iron Butterflies

Caution:

Theta decay accelerates as expiry nears. Option sellers must hedge their deltas to stay safe.

Risk Management in Options

Institutions and pro traders always focus on capital protection.

🔐 Techniques:

Position sizing (no more than 2-3% risk per trade)

Hedging with opposite legs or underlying

Stop-loss on premium or delta exposure

Use of Greeks for real-time adjustment

Risk management > Strategy in the long run.

TCSTCS cmp - 3481.90

Buying & accumulating TCS at current levels will be considered as a good level. Nifty consolidating around the 25,000, a potential breakout above this level could be led by strength in the IT sector — with TCS likely to be a key contributor to that momentum.

{Not a recommendation, just for an educational purpose}

TCS – Technical Highlights (Daily Chart)Breakout from a bullish falling wedge pattern and retesting the same breakout zone gives confidence of positive reversal probably. MACD crossover with rising histogram indicates strong momentum. RSI at 58.58, rising with room for further upside. Price sustaining above the wedge confirms breakout strength. Overall setup suggests a positive short-term trend continuation.

This is just for educational purpose and I am not giving any recommendation or target for TCS.

TCS Ltd. – Riding the Wave from a Strong Support Base📊Technical Overview

TCS has consistently traded above ₹3,000 since 2021, with this level serving repeatedly as a robust support zone.

The stock reached an all-time high of ₹4,592 in August 2024.

Given strong year-on-year financial performance and support at ₹3,000, TCS currently trades at ₹3,500.

As long as the ₹2,900–₹3,050 support zone holds, the stock has potential to rise to:

🎯Target 1: ₹3,800

🎯Target 2: ₹4,200

🎯Target 3: ₹4,600(All-time high)

A breakdown below the zone would negate the bullish thesis.

💰FY24 Key Financial Highlights (vs FY23 & FY22)

Total Income: ₹255,324 Cr (vs ₹240,893 Cr; ₹225,458 Cr)

Total Expenses: ₹187,917 Cr (vs ₹176,597 Cr; ₹166,199 Cr)

Financing Profit: ₹67,407 Cr (vs ₹64,296 Cr; ₹59,259 Cr)

Profit Before Tax: ₹65,331 Cr (vs ₹61,997 Cr; ₹56,907 Cr)

Profit After Tax: ₹48,797 Cr (vs ₹46,099 Cr; ₹42,303 Cr)

Diluted Normalized EPS: ₹134.20 (vs ₹126.88; ₹115.19)

All parameters show strong YoY growth, emphasizing TCS’s consistent scale-up and profitability.

🧠Fundamental Insights

TCS crossed $30 bn in annual revenue, with a strong order book of $42.7 bn, including a record Q4 TCV of $13.2 bn

FY24 revenue rose 4.1% YoY (CC +3.4%), with net income up 7.8% YoY. Q4 margins were strong with operating at 24.6% and net at 19.3%

TCS declared a ₹30 final dividend and a combined FY25 dividend of ₹96/share (₹66 special + ₹30 final), rewarding shareholders with ~4.5% yield

Quarterly profit slipped 1.7% YoY to ₹12,224 Cr due to global headwinds, but revenue still rose 5.3%, backed by strong deal wins worth $12.2 bn (Q4) and $39.4 bn (full year) .

Continued investment in AI, digital innovation, and a strong cash flow (over $5.3 bn free cash flow in FY24) support long-term growth outlook .

🧭Conclusion

TCS remains fundamentally strong with robust growth in revenues, profits, and cash generation. Technically, it is maintaining a firm base above ₹3,000, setting the stage for a potential upside toward ₹3,800 → ₹4,200 → ₹4,600. The key is to watch for sustained support at ₹3,000–₹3,050.

Disclaimer: lnkd.in

TCS Ltd. – Riding the Wave from a Strong Support Base📊 Technical Overview

TCS has consistently traded above ₹3,000 since 2021, with this level serving repeatedly as a robust support zone.

The stock reached an all-time high of ₹4,592 in August 2024.

Given strong year-on-year financial performance and support at ₹3,000, TCS currently trades at ₹3,500.

As long as the ₹2,900–₹3,050 support zone holds, the stock has potential to rise to:

🎯 Target 1: ₹3,800

🎯 Target 2: ₹4,200

🎯 Target 3: ₹4,600(All-time high)

A breakdown below the zone would negate the bullish thesis.

💰 FY24 Key Financial Highlights (vs FY23 & FY22)

Total Income: ₹255,324 Cr (vs ₹240,893 Cr; ₹225,458 Cr)

Total Expenses: ₹187,917 Cr (vs ₹176,597 Cr; ₹166,199 Cr)

Financing Profit: ₹67,407 Cr (vs ₹64,296 Cr; ₹59,259 Cr)

Profit Before Tax: ₹65,331 Cr (vs ₹61,997 Cr; ₹56,907 Cr)

Profit After Tax: ₹48,797 Cr (vs ₹46,099 Cr; ₹42,303 Cr)

Diluted Normalized EPS: ₹134.20 (vs ₹126.88; ₹115.19)

All parameters show strong YoY growth, emphasizing TCS’s consistent scale-up and profitability.

🧠 Fundamental Insights

TCS crossed $30 bn in annual revenue, with a strong order book of $42.7 bn, including a record Q4 TCV of $13.2 bn

FY24 revenue rose 4.1% YoY (CC +3.4%), with net income up 7.8% YoY. Q4 margins were strong with operating at 24.6% and net at 19.3%

TCS declared a ₹30 final dividend and a combined FY25 dividend of ₹96/share (₹66 special + ₹30 final), rewarding shareholders with ~4.5% yield

Quarterly profit slipped 1.7% YoY to ₹12,224 Cr due to global headwinds, but revenue still rose 5.3%, backed by strong deal wins worth $12.2 bn (Q4) and $39.4 bn (full year) .

Continued investment in AI, digital innovation, and a strong cash flow (over $5.3 bn free cash flow in FY24) support long-term growth outlook .

🧭 Conclusion

TCS remains fundamentally strong with robust growth in revenues, profits, and cash generation. Technically, it is maintaining a firm base above ₹3,000, setting the stage for a potential upside toward ₹3,800 → ₹4,200 → ₹4,600. The key is to watch for sustained support at ₹3,000–₹3,050.

⚠️ Disclaimer

This report is for educational purposes only and does not constitute investment advice. Please consult a financial advisor before making any investment decisions.

Institution Option Trading Part-3How Option Database Trading Works (Step-by-Step)

Step 1: Data Collection

Real-time data from NSE, BSE, CBOE, or broker APIs (Zerodha, Interactive Brokers, etc.).

Store tick-level or EOD snapshots into SQL/NoSQL databases.

Step 2: Data Cleaning & Normalization

Remove missing values, align timestamps, convert formats.

Normalize values like IV to make models consistent.

Step 3: Exploratory Data Analysis (EDA)

Use Python (Pandas, Matplotlib) or R to analyze:

Option volume spikes

Volatility contraction/expansion

Unusual OI build-ups

Step 4: Backtesting Trading Strategies

Strategies like Straddle, Strangle, Iron Condor, or IV Crush are tested.

Entry/exit logic coded, and trades simulated on historical data.

Step 5: Deploying Models

Successful strategies get automated using APIs or Trading Bots.

Regular performance metrics tracked and refined.

TCS Buy Opportunity Why ? Here is a **detailed business model of TCS (Tata Consultancy Services)** in a structured and simplified format.

This is suitable for business studies, strategy analysis, or presentations.

---

## 💼 **TCS (Tata Consultancy Services) – Business Model Overview**

---

### 📘 **1. Introduction**

Tata Consultancy Services (TCS) is one of the world’s leading IT services, consulting, and business solutions companies. It is a part of the Tata Group and operates in more than 50 countries. TCS helps global businesses with **digital transformation, IT services, and consulting**.

---

### 🧩 **2. Value Proposition**

* **Cost-effective, high-quality IT services**

* **Digital transformation solutions** (AI, cloud, analytics)

* **Global delivery with consistent execution**

* **Domain expertise across industries**

* **Trusted long-term IT partner**

---

### 🏗️ **3. Business Segments**

TCS operates mainly in the following service segments:

1. **IT Services**

* Application development and maintenance (ADM)

* IT infrastructure management

* Quality engineering and testing

2. **Consulting and Enterprise Solutions**

* Business transformation

* ERP (SAP, Oracle), CRM, supply chain

3. **Digital & Cloud Services**

* Artificial Intelligence (AI)

* Cloud computing (AWS, Azure, Google Cloud)

* Internet of Things (IoT)

* Cybersecurity

4. **Platforms & Products**

* TCS BaNCS (for banking & finance)

* Ignio (AI/ML ops)

* TCS MasterCraft (for automation)

* TCS ADD (for life sciences research)

---

### 💸 **4. Revenue Model**

TCS earns revenue through:

* **Time and Material Contracts** (based on work hours)

* **Fixed-Price Projects**

* **Long-Term Outsourcing Contracts**

* **Subscription Fees** (for platforms like BaNCS)

* **Consulting and Transformation Projects**

---

### 🌍 **5. Target Markets / Customer Segments**

* Large Enterprises (Fortune 500 companies)

* Governments and Public Sector

* Banks and Financial Institutions

* Telecom & Media Companies

* Retailers, Manufacturers, Healthcare Providers

---

### 🔄 **6. Delivery Model**

* **Global Network Delivery Model (GNDM™)**

Combines global presence with offshore delivery centers in India and abroad, ensuring 24/7 delivery, speed, and cost efficiency.

---

### 🔗 **7. Channels**

* Direct B2B enterprise sales teams

* Strategic partnerships (AWS, Microsoft, SAP, etc.)

* Digital marketing and online presence

* Consulting engagements and referrals

---

### 🧱 **8. Key Resources**

* Skilled workforce (600,000+ employees globally)

* Intellectual Property and in-house platforms

* Global delivery centers and IT infrastructure

* Tata brand and group synergies

* Research and Innovation Labs

---

### 👥 **9. Customer Relationships**

* Long-term IT outsourcing contracts

* Dedicated account managers and delivery teams

* Joint development and co-innovation

* 24/7 service desk and support

---

### 💰 **10. Cost Structure**

* Employee salaries and training

* Infrastructure and technology tools

* R\&D and IP development

* Marketing and client acquisition

* Legal, compliance, and administrative costs

---

### 🛡️ **11. Competitive Advantages**

* **Global delivery model** for scalability and cost control

* **High employee retention and training**

* **Large IP portfolio and platforms**

* **Diversified client base** across all industries

* **Brand reputation and Tata Group trust**

---

### 🧭 **12. Future Strategy**

* **Expand AI, cloud, and cybersecurity services**

* Grow **platform-based recurring revenue**

* Lead in **sustainable IT and green data centers**

* Enhance **customer experience with GenAI**

* Strengthen **partnerships with hyperscalers** (cloud providers)

---

### 📊 Summary (Business Model Canvas)

| **Key Partners** | **Key Activities** | **Value Proposition** | **Customer Relationships** | **Customer Segments** |

| ---------------------------------------- | -------------------------------------------- | ---------------------------------------------- | ---------------------------------- | ------------------------------------------------------- |

| Tech Partners, Academia, Cloud Providers | IT Services, Consulting, Product Development | Digital Transformation, Efficiency, Innovation | Long-term Contracts, Support Teams | Enterprises in BFSI, Retail, Telecom, Govt., Healthcare |

| **Key Resources** | **Channels** | **Cost Structure** | **Revenue Streams** |

| --------------------------------------- | ----------------------------------------- | --------------------------------- | -------------------------------------------- |

| Talent, Platforms, Delivery Centers, IP | Direct Sales, Digital Platforms, Partners | Workforce, R\&D, Infra, Marketing | Services (T\&M, Fixed), Products, Consulting |

---

thanks & Regards

Mohinder Singh

The Golden Farms of Equity

What does the chart of TCS say and how will it move after June 4Here is a **detailed business model script** for **Tata Consultancy Services (TCS)**, one of the world’s largest IT services companies. It follows a structured format ideal for reports, presentations, or strategic overviews.

---

### 📘 **TCS – Detailed Business Model Script**

---

#### 🎯 **1. Introduction**

Tata Consultancy Services (TCS), a part of the Tata Group, is a global leader in IT services, consulting, and business solutions. Headquartered in Mumbai, India, and operating in over 50 countries, TCS delivers IT-enabled services to clients across multiple industries, helping them digitally transform their operations.

---

#### 🧩 **2. Value Proposition**

* **Digital Transformation:** Enabling enterprises to adopt AI, cloud, analytics, IoT, and blockchain.

* **Operational Efficiency:** Outsourcing IT operations to reduce cost and improve agility.

* **Innovation at Scale:** Offering domain-specific platforms and IP-driven solutions.

* **Global Delivery Excellence:** Leveraging the Global Network Delivery Model (GNDM™) for consistent, high-quality services.

---

#### 🏗️ **3. Key Business Segments**

**A. IT Services & Consulting**

* Application Development & Maintenance (ADM)

* Infrastructure Services

* Enterprise Solutions (ERP, CRM, etc.)

* Cybersecurity

* Quality Engineering

**B. Digital & Cloud Services**

* Cloud migration, cloud-native development

* Data analytics and AI/ML services

* Intelligent automation and RPA

* Internet of Things (IoT)

* Blockchain applications

**C. Platforms & Products**

* **Ignio (AI/ML Ops)**

* **TCS BaNCS** (for financial institutions)

* **TCS MasterCraft** (for DevOps and delivery automation)

* **TCS ADD** (for life sciences R\&D)

**D. Industry-Specific Services**

* Banking & Financial Services

* Retail & Consumer Goods

* Manufacturing

* Communications & Media

* Healthcare & Life Sciences

* Energy, Utilities & Resources

---

#### 🔗 **4. Key Partnerships**

* **Technology Partners:** Microsoft, AWS, Google Cloud, SAP, Oracle, IBM

* **Academic Institutions:** For research and talent development

* **Startups & Innovators:** Through TCS Co-Innovation Network (COIN™)

---

#### 🛠️ **5. Revenue Model**

TCS earns revenue through:

1. **Time & Material (T\&M):** Billing based on effort hours

2. **Fixed-Price Projects:** Deliverables and budgets are pre-agreed

3. **Managed Services:** Long-term outsourcing contracts

4. **Subscription-Based Models:** For platforms like BaNCS

5. **Consulting Fees:** Strategy and transformation advisory services

---

#### 🌐 **6. Geographic Footprint**

* **North America (50%+ of revenue)**

* **Europe & UK**

* **India**

* **Asia Pacific, Middle East & Africa (MEA)**

* Delivery centers in India, LATAM, Europe, and Asia

---

#### 🧱 **7. Key Resources**

* Global workforce (over 600,000 employees)

* Intellectual Property and proprietary platforms

* Global Network Delivery Model (GNDM™)

* R\&D labs and innovation centers

* Brand equity of Tata Group

---

#### 🔄 **8. Key Activities**

* Application development and support

* System integration and implementation

* Cloud and digital transformation

* Business process outsourcing

* Co-innovation with customers

---

#### 👥 **9. Customer Segments**

* Large enterprises (Fortune 500)

* Government and public sector

* Financial institutions

* Retailers and manufacturers

* Healthcare providers

---

#### 📞 **10. Channels**

* Direct enterprise sales

* Consulting engagements

* Online marketing and digital channels

* Strategic alliances and partnerships

* TCS COIN™ and Innovation Hubs

---

#### 🤝 **11. Customer Relationships**

* Long-term IT outsourcing contracts

* Dedicated account managers

* Co-innovation partnerships

* Custom-built delivery teams

* 24/7 global support

---

#### 💰 **12. Cost Structure**

* Employee compensation and training

* Infrastructure and delivery centers

* R\&D and IP development

* Sales and marketing expenses

* Regulatory and compliance costs

---

#### 📈 **13. Competitive Advantages**

* **Global Delivery Excellence:** Seamless execution across geographies

* **Scale & Talent:** Largest IT workforce globally

* **Strong Financials:** High profit margins, low debt

* **IP & Platforms:** Differentiated service offerings

* **Trusted Brand:** Part of the Tata conglomerate

---

#### 🧭 **14. Future Strategy**

* Strengthen presence in AI and GenAI solutions

* Expand platform-based services

* Grow in high-margin digital services

* Invest in sustainable and green IT practices

* Build deeper client partnerships in non-traditional markets

---

### 📊 Summary (Business Model Canvas Snapshot)

| Key Partners | Key Activities | Value Propositions | Customer Relationships | Customer Segments |

| --------------------------------- | -------------------------------------------------- | ------------------------------------------------ | ----------------------------------------- | ----------------------------------------------------------------- |

| Tech Partners, Academia, Startups | IT Services, Digital Innovation, Cloud, Consulting | Cost Savings, Innovation, Digital Transformation | Long-Term Managed Services, Co-Innovation | Enterprises across BFSI, Retail, Manufacturing, Healthcare, Govt. |

| Key Resources | Channels | Cost Structure | Revenue Streams |

| ---------------------------------------------- | ------------------------------- | ------------------------------- | ---------------------------------------- |

| Talent, IP, Platforms, Delivery Infrastructure | Direct Sales, Alliances, Online | Workforce, Infrastructure, R\&D | T\&M, Fixed Price, Platforms, Consulting |

---

Thanks & Regards

Mohinder Singh

The Golden Farms of Equity

Database Trading **Database trading**, often referred to as **algorithmic trading** or **quantitative trading**, involves using large sets of structured data to make trading decisions and execute trades automatically. It relies heavily on databases to store, process, and analyze market data (historical prices, volumes, order books, etc.) and other relevant information (like economic indicators, news, etc.). The goal is to identify patterns, trends, or anomalies that can be leveraged for profitable trading strategies.

PCR Trading part 2In the context of trading, PCR stands for Put-Call Ratio. It's a technical indicator used to assess market sentiment, specifically in the options market. The PCR is calculated by dividing the volume (or open interest) of put options by the volume (or open interest) of call options over a specific period.

PCR Trading part 1PCR trading refers to using the Put-Call Ratio (PCR) indicator to assess market sentiment and potentially predict future price movements. It's a contrarian indicator, meaning it suggests trading against the prevailing market sentiment. For example, a high PCR (suggesting a bearish market) might signal an opportunity to buy, as the market might be over-sold.