Trade ideas

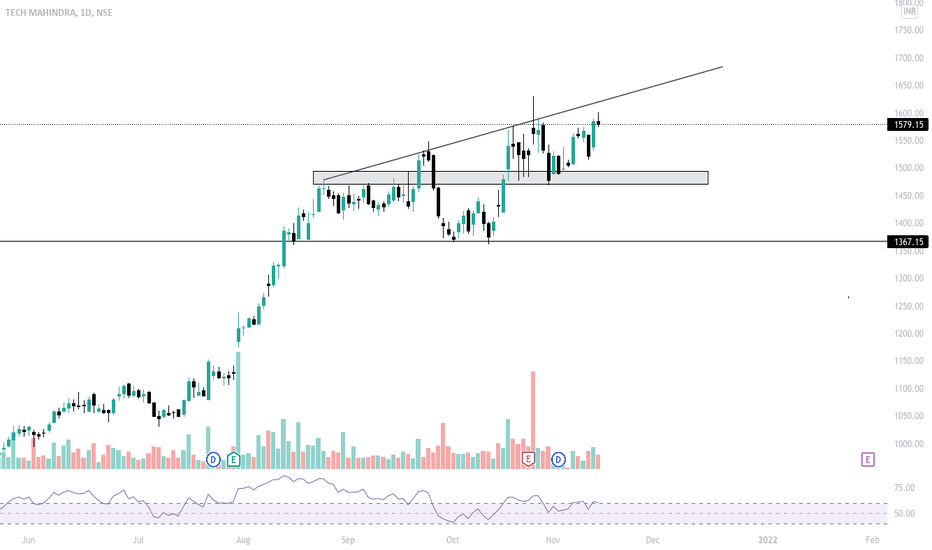

📈 Pre-open Chart #PriceAction Analysis by #KRMG (9 Nov)👉 Stock 2 - #TECHM

👉 Sector - IT

👨🏻🏫 Analysis Timeframes - Hourly and 15 min (Intra)

🎯 Commentary - It has shown good strength in Upward direction from 1470 Level as per Hourly timeframe and now trading near to its ALL TIME HIGH Level

It has continued good Higher Low pattern as per 15- Min timeframe and also yesterday after neutral opening it continued Upmove and then able to close near the Days High in Second half of Market

Now it has space till 1630 Level which is its ALL TIME HIGH Level and buy Trade can be taken only if breaks CZ with good volume

🎯 Coming to sectoral pattern - #NiftyIT after giving down move from All Time High now taken support from 34300 Level

#KRMGPriceAction

#LearnWithKRMG