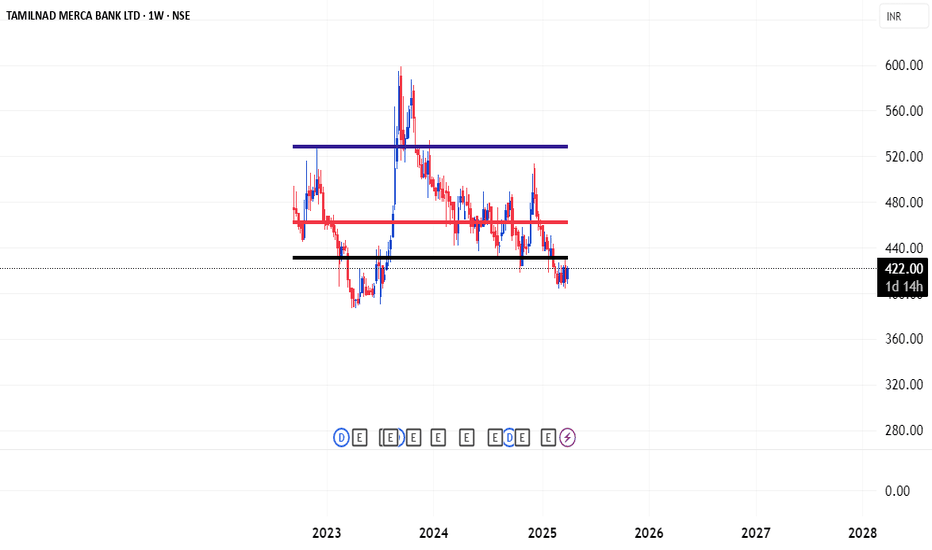

TMB : VCP Short Base BreakoutTMB has just completed a textbook VCP (Volatility Contraction Pattern) consolidation. We observed three clear rejections accompanied by consistent higher lows, along with a noticeable volume dry-up — all classic signs of tightening supply.

This was followed by a clean breakout backed by strong volu

Tamilnad Mercantile Bank Limited

No trades

79.30 INR

11.83 B INR

61.35 B INR

113.05 M

About Tamilnad Mercantile Bank Limited

Sector

Industry

CEO

Salee Sukumaran Nair

Website

Headquarters

Thoothukudi

Founded

1921

IPO date

Sep 15, 2022

Identifiers

2

ISIN INE668A01016

Tamilnad Mercantile Bank Ltd. engages in the provision of banking services. It offers loan products, current accounts, business and prepaid cards, online and foreign exchange services. It operates through the following business segments: Treasury, Corporate/Wholesale Banking, and Retail Banking. The company was founded in 1921 and is headquartered in Thoothukudi, India.

Related stocks

Tamilnad Mercantile Bank (TMB) – Update | 3.5% Move from Our Lvl🟢 Tamilnad Mercantile Bank (TMB) – Update | 3.5% Move from Our Level 🚀

Latest Update : Our analysis shared around ₹499 has played out well — TMB made an intraday high of ₹517, gaining nearly 3.5% from the mentioned level.

🏦 Company Overview:

Tamilnad Mercantile Bank Limited is one of the old

Tamilnad Mercantile Bank – 1D Chart | Strong Resistance Zone🟢 Tamilnad Mercantile Bank (TMB) – 1D Chart | Strong Resistance Zone Ahead

📊 Chart Setup:

TMB is testing its major 1-year resistance zone around ₹510, a key level that has capped price movements for months. A strong daily close above ₹510 could trigger momentum towards higher targets.

🔹 Resistance

TAMILNAD MERICA BANK LTDAs of May 21, 2025, Tamilnad Mercantile Bank Ltd. (NSE: TMB) is trading at ₹451.80, reflecting a 0.97% increase over the previous day.

📊 1-Day Support & Resistance Levels (Classic Pivot Method)

Based on the previous trading day's price range, the following support and resistance levels have been i

TMB Bullish View### **Tamilnad Mercantile Bank (TMB)**

**Tamilnad Mercantile Bank Limited (TMB)** is one of India's oldest and most trusted **private sector banks**, known for its strong presence in **Tamil Nadu** and growing footprint across India. The bank primarily serves **small businesses, traders, and the a

TMB FALLING WEDGEfalling wedge pattern is formed in weekly chart

trading below weekly pivot level

this stock should break falling wedge resistant line for bullish continuation, otherwise bearish will continue.

I don't recommend & taking trade based on this idea.

consult your SEBI registered adviser to Know the mar

TMB BANK FALLING WEDGE BREAK OUT-already falling wedge break out done at the level of 473

this falling wedge break out indicate the reversal from bearish to bullish.

- next the triple bottom break out is waiting on the line

- triple bottom breakout would happen when it crosses the level of 500 - 502

This analysis is my own idea.

TMB bullish wedge pattern4th time touching the support 1 line which creates strong support around the 450 regions

stock is trading at >75% discount rate from all time high

This analysis is my own idea.

I don't recommend taking trade based on this idea.

consult your SEBI registered adviser to Know the market risk before tra

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of TMB is 654.95 INR — it has increased by 0.82% in the past 24 hours. Watch Tamilnad Mercantile Bank Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Tamilnad Mercantile Bank Limited stocks are traded under the ticker TMB.

TMB stock has risen by 3.49% compared to the previous week, the month change is a 16.32% rise, over the last year Tamilnad Mercantile Bank Limited has showed a 54.11% increase.

TMB stock is 3.28% volatile and has beta coefficient of 0.35. Track Tamilnad Mercantile Bank Limited stock price on the chart and check out the list of the most volatile stocks — is Tamilnad Mercantile Bank Limited there?

Today Tamilnad Mercantile Bank Limited has the market capitalization of 102.75 B, it has increased by 10.97% over the last week.

Yes, you can track Tamilnad Mercantile Bank Limited financials in yearly and quarterly reports right on TradingView.

TMB net income for the last quarter is 3.42 B INR, while the quarter before that showed 3.18 B INR of net income which accounts for 7.56% change. Track more Tamilnad Mercantile Bank Limited financial stats to get the full picture.

Yes, TMB dividends are paid annually. The last dividend per share was 11.00 INR. As of today, Dividend Yield (TTM)% is 1.70%. Tracking Tamilnad Mercantile Bank Limited dividends might help you take more informed decisions.

Tamilnad Mercantile Bank Limited dividend yield was 2.68% in 2024, and payout ratio reached 14.73%. The year before the numbers were 2.06% and 14.77% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 16, 2026, the company has 4.74 K employees. See our rating of the largest employees — is Tamilnad Mercantile Bank Limited on this list?

Like other stocks, TMB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Tamilnad Mercantile Bank Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Tamilnad Mercantile Bank Limited technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Tamilnad Mercantile Bank Limited stock shows the buy signal. See more of Tamilnad Mercantile Bank Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.