UJJIVANSFB trade ideas

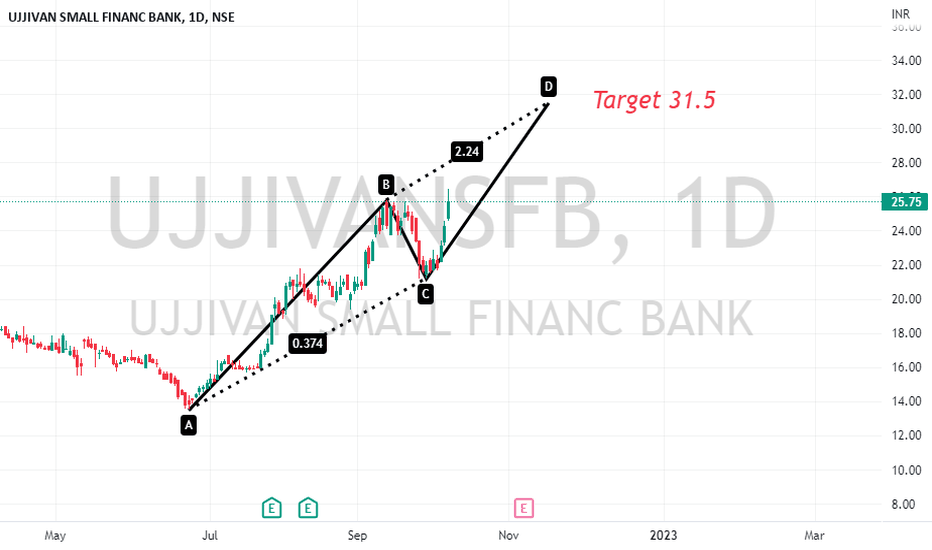

Pattern Breakout in Ujjivan Small Finance BankThis is swing trade for a bullish breakout which can be observed in ujjivan small finance bank. An inverted head and shoulders pattern can be easily spotted on the chart which appears very clean.

ENTRY- 28.15

TARGET 1- 30.60

TARGET 2- 33.35

TARGET 3- 34.70

All these targets are listed by keeping in mind the price action of this stock and the strength behind the breakout.

Also, consider a time frame of about 20-25 days for this trade to reach its outcome.

At micro-level, markets may look choppy and uncertain which makes it difficult to trade. But if you observe it from a higher glance you may find opportunities very well.

Ujjivan SFB... small bank big profitsSomething about the business performance of Ujjivan SFB keeps getting me to be optimistic about it... however the market is wary of its largely unsecured lending book but the NIMs, capital adequacy ratios, investments in book etc. seems to me that it is in a strong spot currently..

In about a fortnight it will release its Q4 business highlights.. looking at the monthly charts which is still about a week early, the share price is interestingly poised pulling back from its highs to be precariously balancing at the downward sloping trendline.. the pain in he share price may linger for another month or could dissipate earlier as the street gets ready to receive its Q4 results

An opportunity for a short term trade on the reboundSince July of 2022, as long as the 10 SMA and 20 SMA are both in an ascending direction and when the lines are coming close to converging, the price has taken a jump...

today the price is at a similar juncture and is also at support level within a symmetrical triangle in formation.... the target of the triangle comes to Rs. 33.35/-

Stop loss will be price closing below 20 SMA or below support line of the triangle.. till now triangle is only in formation and price is far from any breakout, rather it is threatening to breakdown.. its a trade on anticipation only

Approaching the support line of the parallel channelStock is giving a good opportunity to accumulate as the price comes to the lower band of the parallel channel

T1 30.10

T2 33.75

T3 resistance line of the channel

Stop Loss can be if price closes below the wedge or support line of the parallel channel

Ujjivan SFB, a change in trend with the INHS breakoutMy view is biased due to being invested in it.

The pattern I am seeing is an inverse head and shoulder from which a breakout and retest is taking place...the immediate target appears to be around Rs. 38/- and the stop loss would be price closing below the red line. Although an INHS at the bottom could also be a trend change signal for a longer term scenario. The relative strength on a 200 day period over bank nifty has turned positive after the Q1 results.

Ujjivan SFB, results playAscending Triangle in formation here on the hourly charts giving a target of Rs. 30.30. Breakout confirmation will be when price closes above Rs. 25.75. It can trigger by 25 October, first half, and max time to reach price target is 7 November, first half. Price closing below the blue ascending line is the stoploss for the trade. Monday, November 7 is the day when it declares its Q2 results so maybe it is shaping up in anticipation, good or bad.

Small Finance Banks are set to make it Big!Good times for Small Banks ahead! With the interest cycle turning in their favor, they could be making super profits going ahead...

technically USFB is in a downward sloping channel and is fighting its way up breaking above a flag and pole with the first target coming to Rs. 29.60/- support available at 23.80 to add more if it comes there with stoploss at close below Rs. 22.30/- If it does manage to break out from the parallel channel on WCB then bigger targets come into play... may be profitable to get in early on this one as it faces many headwinds ahead

Buy Today, Sell Tomorrow: UJJIVANSFBDON'T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Book profits within the first 30 minutes of the market opening

- Try to exit by taking 3-5% profit of each trade

- SL can be taken when the 5/15 min candle closes below 44EMA

- SL can also be maintained as 1% or closing below the low of the breakout candle

The levels mentioned on the chart are calculated using the BREAKOUT INDICATOR

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Breakout in UJJIVANSFB

Buy Today, Sell Tomorrow: UJJIVANSFB

Falling wedge on UJJIVANSFB 1W - great time to buy The Falling Wedge is a bullish pattern that begins wide at the top and contracts as prices move lower. This price action forms a cone that slopes down as the reaction highs and reaction lows converge. In contrast to symmetrical triangles, which have no definitive slope and no bias, falling wedges definitely slope down and have a bullish bias. However, this bullish bias cannot be realized until a resistance breakout occurs.

My idea is to take the RSI into account which is breaking out the trend line.

Ujjivan SFB showing bottoming out signs.Stock has given a breakdown from 24 rs levels. But clearly lacks follow through.

This shows stock is being accumulated by market makers by narrow price range and high volumes.

The narrow range formed is just below the breakdown, usually retailers exit on breakdown and market makers take advantage of to accumulate the stock. Stock is trading around 15 16 % form the breakdown level, insignificant down move after such structural breakdown of around 1 year consolidation.

On Daily charts

Increase in volumes after breakdown, shows stock moving in strong hands.

Why anyone would buy aggressively after breakdown as evident by high volume after such breakdown?

Retailers would have exited on breakdown candle with highest volume. Usually known as blow off candle.

This blow off candle here is clearly telling there is panic selling here.

How to trade or accumulate such stocks?

make 5 to 6 parts of total allocation invest 1 or 2 parts at current levels. On every dip closer to 17-18 rs area keep buying. Below 17-18 exit full position.

Make sure you park such amount that you are ready to loose and overall allocation should not exceed 5 to 10% of account size. This might change from person to person.

Please note these are reversal trades with lower success rate but give multibagger returns.

Kindly analyse and then take positions. These are risky trades.

Long Ujjivan Small Finance BankUjjivan Small Finance Bank

NSE:UJJIVANSFB

CMP - 31.9

Stop - 25 on DCB

Expectation -

T1 - 45

T2 - Open, Review at 45

Expected Holding Period - 80 trading days or earlier for T1

View:- Swing/Positional

Disclaimer:-

Ideas being shared only for educational purpose

Please do your own research or consult your financial advisor before investing