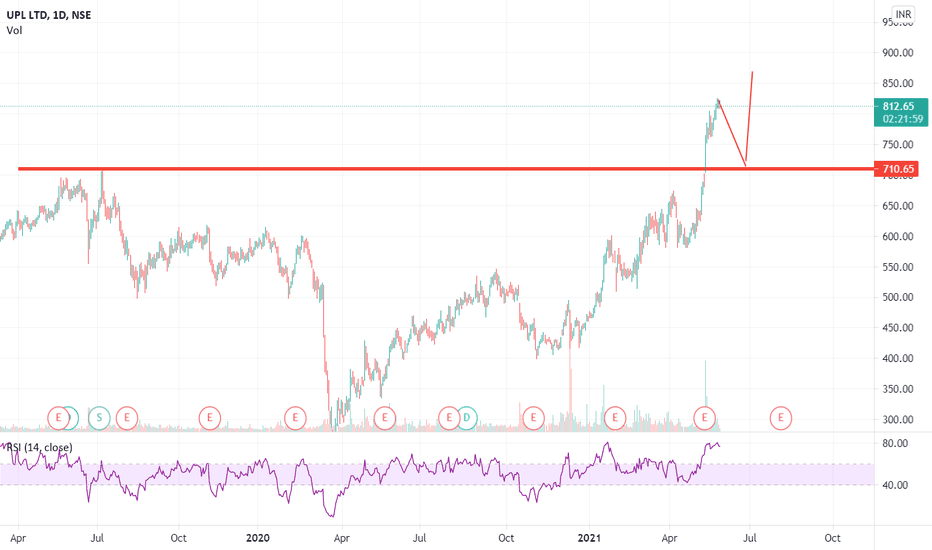

[Intraday] UPL 3BB Continuation TradeNote -

One of the best forms of Price Action is to not try to predict at all. Instead of that, ACT on the price. So, this chart tells at "where" to act in "what direction. Unless it triggers, like, let's say the candle doesn't break the level which says "Buy if it breaks", You should not buy at all.

=======

I use shorthands for my trades.

"Positional" - means You can carry these positions and I do not see sharp volatility ahead. (I tally upcoming events and many small kinds of stuff to my own tiny capacity.)

"Intraday" -means You must close this position at any cost by the end of the day.

"Theta" , "Bounce" , "3BB" or "Entropy" - My own systems. Please refer to the link to my footer and explore further if You want.

=======

I won't personally follow any rules. If I "think" (It is never gut feel. It is always some reason.) the trade is wrong, I may take reverse trade. I may carry forward an intraday position. What is meant here - You shouldn't follow me because I may miss updating. You should follow the system I share.

=======

Like -

Always follow a stop loss.

In the case of Intraday trades, it is mostly the "Day's High".

In the case of Positional trades, it is mostly the previous swings.

I do not use Stop Loss most of the time. But I manage my risk with options as I do most of the trades using derivatives.

I also do my trades live, Please refer to the link to my footer if you want to tail me.

=======

UPL trade ideas

UPL LTD. rounding bottom pattern !1) As per analysis, chart formed rounding bottom pattern, which indicates bullish momentum.

2) 1 Year trend line break out

Possible targets as per Fibonacci are:

1) 600

2) 630

3) 700

Feel Free To Ask For Any Technical/Fundamental Query

Comment Down Below

Educational Purpose Only.

United Phosphorous Ltd Intra-day Trading (Sell) opportunitiesNSE:UPL

TRADE ANALYSIS

This stock is very bullish and making new highs, the stock had created higher highs, However in the last 30 minutes trading session it closed below 20 Moving Average (MA) and below volume weighted average price (VWAP) with a strong bearish move and a negative RSI Diversion which means that the stock is losing its momentum and might touch its deep retracement zone.

POSSIBLE SCENARIOS

1) If Market opens sideways- and touches the price of 842 also making any bearish pattern or price rejection from 842 zone then look for confirmation candle and sell, put stop loss at 847, take profit at 823.

2) If market opens Gap Down- check for the 15 mins bearish candle then straightaway sell and put stop loss above 15 mins candle take profit at 806 or according to your risk to reward ratio.

3) If market opens Gap up- Do similarly like sideways market.

NOTE: In case the market opens gap up above 842 price then I would recommend not to trade UPL LTD.

CORONA or Stocks: 2nd Wave Always hits hardCOVID has impacted our lives in so many ways and Stock markets were no exception which saw drastic falls and steep recoveries as well.

SO I have tried to make a correlation between both.

Major scrips saw a minor downtrend which lasts for few weeks with minor corrections. Similarly COVID 1st wave caused saw minor casualities for few weeks.

The scrip entered into the resting phase with no major movement like COVID.

Then came the big fall where prices corrected upto 50-60% , this 2nd falling wave was stronger than ever and had major casualties like COVID 2nd wave.

Wave 1 of recovery started and prices goes back to pre-COVID levels.

2nd Wave in uptrend was even more stronger to fuel the prices in a drastic manner. Major scrips gained more than 70-80% price rise.

Chart is self-explanatory.

UPL Correction Starts - Trading @ PRZBook profits in upl. Higher chances to correct from here. Do not initiate long here. You can be trapped.

See, charts for more information. According to Elliot Waves also . its time for ABC correction.

Note:- I am not SEBI registered . All Views and trade setups are my personal view and my personal trade setup.

Do follow us

Like Us

Share with fellow traders

Also check the below related ideas for other stocks.

UPL : rally to end here.....UPL : CMP 811.70

triggered zone 1 today 824

stock is highly valued & now multiple bearish harmonics pattern formed in the stock.

PRZ ( 822-824 ZONE 1 & 834-836 ZONE 2 )

keeping stop loss as 859 on weekly closing basis sell for

targets : 794/778/763 (short term)

751/742/728/705 ( max )