VA Tech Wabag Limited

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

51.45 INR

2.95 B INR

32.94 B INR

44.42 M

About VA Tech Wabag Limited

Sector

Industry

CEO

Rajiv Devaraj Mittal

Website

Headquarters

Chennai

Founded

1995

Identifiers

2

ISININE956G01038

VA Tech Wabag Ltd. engages in the design, supply, installation, and operational management of drinking water and waste water treatment plants. It offers design, engineering, procurement, construction, erection, commissioning, operation, and maintenance solutions for drinking water, industrial waste water, municipal waste water, industrial and process water, sea water and brackish water desalination, and industrial and municipal waste water treatment. The company was founded on February 17, 1995 and is headquartered in Chennai, India.

Related stocks

WABAG Price ActionVA Tech Wabag Limited (WABAG) is trading at approximately ₹1,523 as of today, showing a slight positive movement with prices fluctuating between ₹1,502 and ₹1,527. The stock has a market capitalization nearing ₹9,477 crore and is positioned within a yearly price range of ₹1,109 to ₹1,944.

The compa

WABAG Price Action## VA Tech Wabag Ltd – Price Analysis (August 2025, without references)

### Price & Market Metrics

- Current share price is around ₹1,580 to ₹1,585.

- Market capitalization is close to ₹9,850 crore.

- The stock's 52-week price range is roughly ₹1,110 (low) to ₹1,944 (high).

- Daily trading range re

VA Tech Wabag Ltd (Weekly Timeframe) - Potential BreakoutOn weekly timeframe the stock has made-up for all those past 7 weeks of loss with a 9.30% gain with huge volume. The stock also BrokeOut of a longterm weekly angular resistance zone. The coming week if it can BreakOut of the short-term weekly resistance with some good volume, then it may go up

WABAG — : Full Swing Trade SetupWABAG — Step 1: Confidence & Readiness

Criteria Observation

Price Trend Range breakout attempt.

EMAs Cluster Price above 10, 20, 50, 100 EMAs. Bullish.

200 EMA Far below at ₹1,427. Clear trend support.

RSI (14) 56.3 — Stable and rising.

Volume Above average volume (611K vs 294K).

Relative Strength (

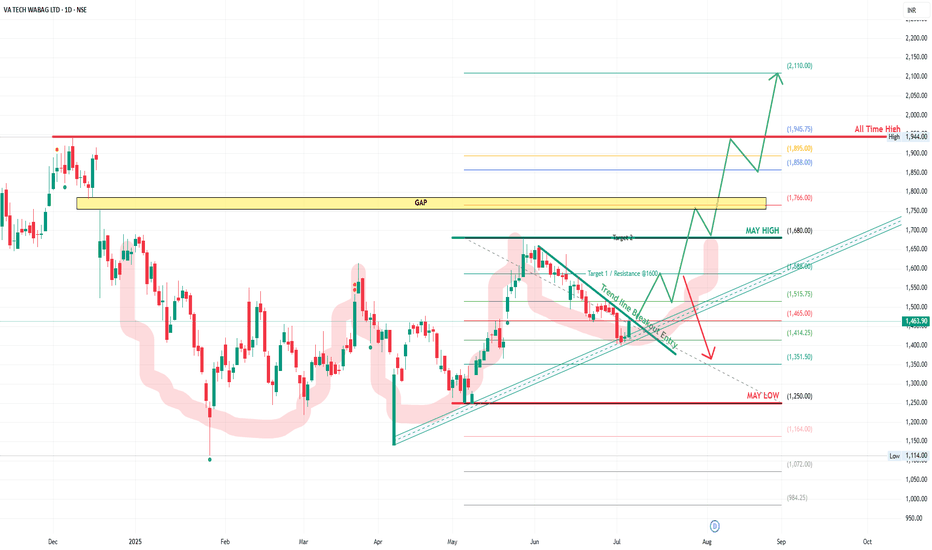

VA TECH WABAG – Trendline Breakout Setup | Target ₹2,110VA TECH WABAG is showing a classic trendline breakout setup, with a well-formed falling wedge structure now broken to the upside. This breakout aligns with the broader bullish market structure and trendline support from May lows, suggesting strong upside potential.

The stock has reclaimed momentum

#WABAGAsset: Va Tech Wabag Ltd (WABAG)

Breakout Level: 1526

Potential Target: 1785

Stop Loss: 1470

Timeframe: Short to Medium term

Risk to Reward ratio : 1:2.4

Rationale:

Fundamentals -

Fundamentally decent stock with the following attributes:

* ROCE - 20%

* ROE - 14.9%

* Debt to Equity - 0.17

* Stock P

VA TECH WABAG LTDBREAKOUT STOCK

Stock: VA TECH WABAG

Chart: weekly

View: bullish

Resistance Levels:

R1: ₹1,644.17

R2: ₹1,736.33

R3: ₹1,875.87

Support Levels:

S1: ₹1,412.47

S2: ₹1,272.93

S3: ₹1,180.77

▸ Va Tech Wabag is trading 1.78% upper at Rs 1,552.10 as compared to its last closing price.

Va Tech Wab

VA TECH WABAG LTD (NSE: WABAG) is about to break to the upsideRight now, it is completing a descending trendline breakout, which is a bullish pattern.

The stock has been consolidating for the past 4 months in a corrective phase and is now attempting a strong breakout.

All important levels have been marked on the chart.

Looking at the chart, we can say tha

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of WABAG is 1,296.00 INR — it has increased by 0.58% in the past 24 hours. Watch VA Tech Wabag Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange VA Tech Wabag Limited stocks are traded under the ticker WABAG.

WABAG stock has risen by 2.81% compared to the previous week, the month change is a −8.91% fall, over the last year VA Tech Wabag Limited has showed a −17.76% decrease.

We've gathered analysts' opinions on VA Tech Wabag Limited future price: according to them, WABAG price has a max estimate of 2,100.00 INR and a min estimate of 1,835.00 INR. Watch WABAG chart and read a more detailed VA Tech Wabag Limited stock forecast: see what analysts think of VA Tech Wabag Limited and suggest that you do with its stocks.

WABAG reached its all-time high on Dec 9, 2024 with the price of 1,944.00 INR, and its all-time low was 73.00 INR and was reached on Apr 7, 2020. View more price dynamics on WABAG chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

WABAG stock is 3.33% volatile and has beta coefficient of 1.62. Track VA Tech Wabag Limited stock price on the chart and check out the list of the most volatile stocks — is VA Tech Wabag Limited there?

Today VA Tech Wabag Limited has the market capitalization of 80.09 B, it has increased by 3.94% over the last week.

Yes, you can track VA Tech Wabag Limited financials in yearly and quarterly reports right on TradingView.

VA Tech Wabag Limited is going to release the next earnings report on Feb 6, 2026. Keep track of upcoming events with our Earnings Calendar.

VA Tech Wabag Limited revenue for the last quarter amounts to 8.35 B INR, despite the estimated figure of 8.29 B INR. In the next quarter, revenue is expected to reach 9.43 B INR.

WABAG net income for the last quarter is 848.00 M INR, while the quarter before that showed 658.00 M INR of net income which accounts for 28.88% change. Track more VA Tech Wabag Limited financial stats to get the full picture.

Yes, WABAG dividends are paid annually. The last dividend per share was 4.00 INR. As of today, Dividend Yield (TTM)% is 0.31%. Tracking VA Tech Wabag Limited dividends might help you take more informed decisions.

VA Tech Wabag Limited dividend yield was 0.28% in 2024, and payout ratio reached 8.42%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Dec 24, 2025, the company has 1.27 K employees. See our rating of the largest employees — is VA Tech Wabag Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. VA Tech Wabag Limited EBITDA is 4.26 B INR, and current EBITDA margin is 12.93%. See more stats in VA Tech Wabag Limited financial statements.

Like other stocks, WABAG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade VA Tech Wabag Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So VA Tech Wabag Limited technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating VA Tech Wabag Limited stock shows the neutral signal. See more of VA Tech Wabag Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.