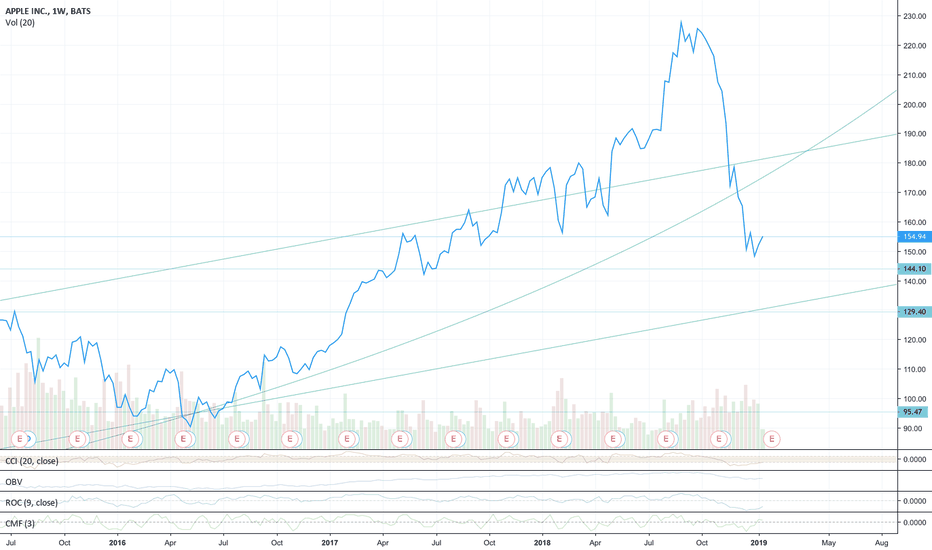

AAPL Apple stocks sitting on edge of a cliffhey guys welcome to an update of apple stocks prices, as you guys can already see that we've seen a massive decline in AAPL prices from oct 2018 and may 2019 and with the current price movement looks like apple is now entering in wave c of a zigzag correction, as you see from charts prices decline heavily from 234 in oct 2018, and forms support at 142 in jan 2019, here we also get 200 weekly SMA support, prices exactly bounce from this level and rallied upto 215, here we have also fib786 resistance, this shows the property of wave B in ABC simple zigzag corrective pattern where wave B normally retraces 78.6% of wave A.

so from this principle most likely we're now entering in wave C which could lead us to lower levels.

a normal wave c in a zigzag correction could travel upto 100-127.2% of wave A which in this case goes upto 125 and 100 dollar level respectively and wave goes in the formation of 5 sub waves.

in above chart you can see that wave 1 has already completed and now wave 2 is in the process which could go upto 198 in short term, meanwhile wave 2 could also go upto 100% of wave 1 but not more than that, which in this situation is 215 level, so its better to keep our stop loss slightly above this, i'll recommend from 217-220 is a good level to place your stops.

if wave 2 rejects from fib618 around 198-200 which is most likely than wave 3 could go upto 161.8% of wave 1, around 130-120 level, meanwhile we could also see a double bottom formation around 142 level where we made the previous low or the bottom of wave 1, but most likely bulls will fail here coz wave 3 will be the most impulsive, than wave 4 could go upto 38.2% of wave 3, around 155-160 level and finally we could see the wave 5 driving prices lower around 100-95 dollar level.

but before you jump to short apple stocks, let me clear that this complete analysis is based on elliot wave theory and there's no guarantee for this price action, apple is the biggest player and it needs huge huge fud and massive selling for this kind of price action which could wipe out billions of dollar from the market.

but hey there's also a good news for bears and that's massive fud ahead,

Bloomberg: "Apple Must Face iPhone App Antitrust Suit, Supreme Court Rules"

devil's laugh ;)

Short AAPL

Entry 195-200

T1 145

T2 130

T3 100

SL 217-220

Trade ideas

Selling Apple can earn you money !!!Apple has formed shooting star on daily chart which has emerged after a considerable bull run. Stochastic is showing negative divergence. Shooting star has been formed after a big green candle which makes it more reliable. Sellers have emerged above psychological barrier of 200. Going forward 203 would be the resistance and counter can drift towards 194-190-185 level.

Mitsui to deliver all the more heavy crude oil in 2019Mitsui to deliver all the more heavy crude oil in 2019

The new creation will be convenient as yield cuts by Saudi Arabia and US endorses on Iran and Venezuela have diminished the accessibility of high-sulfur overwhelming unrefined petroleum comprehensively and lifted spot premiums for these evaluations

Japanese exchanging organization Mitsui and Co will deliver all the more substantial raw petroleum this year once extends in Australia and Italy are finished, a senior organization official stated, partially boosting its capacity to give low sulfur marine fuel.

Overwhelming rough creation from the Tempa Rossa venture in Italy could begin soon, while the Greater Enfield venture in Australia is on track to continue generation by the center of this current year, Yuji Kikkawa, general chief of key getting ready for Mitsui's vitality specialty units, told Reuters.

The new creation will be convenient as yield cuts by Saudi Arabia and U.S. endorses on Iran and Venezuela have diminished the accessibility of high-sulfur overwhelming raw petroleum comprehensively and lifted spot premiums for these evaluations.

Substantial harsh unrefined generation at Tempa Rossa, an inland oilfield situated in the Basilicata locale in southern Italy, could crest at 50,000 barrels for each day. Absolute works the venture, while Mitsui E&P and Royal Dutch Shell each hold a 25 percent stake.

The Greater Enfield venture seaward west Australia will tie substantial sweet unrefined yield from new fields to the Ngujima-Yin drifting, creation, stockpiling and offloading (FPSO) office, situated over the Vincent oil field. Starting generation will be at 40,000 bpd while the FPSO has a creation limit of 120,000 bpd.

Exchanging houses have been mixing overwhelming sweet rough from Australia with fuel oil to diminish the fuel's sulfur content in front of harder worldwide marine fuel rules.

The International Maritime Organization (IMO) will restrict ships from utilizing powers with a sulfur content above 0.5 percent from Jan. 1, 2020, contrasted and 3.5 percent today, except if they are furnished with fumes gas cleaning frameworks.

"We surely observe that as an incredible open door for our exchanging exercises on the grounds that Mitsui has been dynamic in low-sulfur fuel oil exchanging because of past achievement in verifying Indonesian low-sulfur feedstock and having Japan as a customary fundamental market for the fuel," Kikkawa said.

Mitsui's all out oil and gas generation, through its value possessions, as of now remains at 250,000 barrels for every day oil equal.

The organization additionally hopes to see a close multiplying of its condensed flammable gas (LNG) supplies to 9 million tons for every year (tpy) when three periods of the U.S. Cameron LNG venture start up more than 2019.

Mitsui will utilize up to seven LNG tankers under long haul contracts to send fuel from Cameron LNG to purchasers and for its spot exchanging exercises, Kikkawa said.

Welcome you to the world of Best Crude Oil Tips at ExpertCrudeoil.com. Our company aims at providing the traders with excellent & sure shot mcx crude oil tips for intraday trading.

expertcrudeoil :Kuwait investigates with India to lessen on oilOil rich Kuwait is investigating to new segments of monetary organization with India to execute Kuwait's improvement plans with less reliance on hydrocarbon.

Kuwait Ambassador to India Jassim Al-Najim, tended to national meeting as boss visitor in the esteemed Jamia Millia Islamia University in New Delhi. The tradition, themed "India, China and the Arab World Exploring New Dynamics," was sorted out by Indo Arab Cultural Center at the college, in collaboration with the Kuwait Embassy

India and the Arab world relations are not limited to exchange and financial aspects but rather additionally incorporates expressive arts, design and model as a gathering of artifacts found on Kuwaiti island of Failaka demonstrates, the Ambassador noted.

"Exchange among India and Kuwait thrived since the nineteenth century as of not long ago and Kuwait has been a vital exchanging accomplice for India with complete exchange of $ 5.6 billion of every 2016-17 and seventh biggest unrefined petroleum provider to India in a similar period," he included.

Expert Oil close to 2019 highs on OPEC supply cuts, US sanctionsExpertcrudeoil.com - Oil close to 2019 highs on OPEC supply cuts, US sanctions

Brent crude oil fates were up 10 pennies at USD 67.64 per barrel, additionally near the current year's pinnacle of USD 68.14 achieved before the end of last week.

Oil costs were almost 2019 highs on Tuesday, upheld by supply cuts driven by maker club OPEC.

US sanctions against oil makers Iran and Venezuela are likewise boosting costs, in spite of the fact that dealers said the market might be topped by rising US yield.

US West Texas Intermediate (WTI) fates were at USD 59.10 per barrel at 0314 GMT, for all intents and purposes unaltered from their last settlement and near the 2019 high of USD 59.23 achieved the earlier day.

Brent crude oil fates were up 10 pennies at USD 67.64 per barrel, likewise near the current year's pinnacle of USD 68.14 achieved before the end of last week.

In China, Shanghai rough fates, propelled in March a year ago, ricocheted 4.5 percent from their last near 467.6 yuan (USD 69.64) per barrel, additionally close to 2019 highs of 475.7 yuan a barrel came to amid a short spike in February.

In dollar-terms, this pushed Shanghai unrefined into a premium over Brent.

The Organization of the Petroleum Exporting Countries (OPEC) on Monday rejected its arranged gathering in April, viably broadening supply cuts that have been set up since January until at any rate June, when the following gathering is booked.

OPEC and a gathering of non-subsidiary makers including Russia, known as OPEC+, began retaining supply to end a sharp value drop in the second-50% of 2018, when markets went under weight from flooding yield just as a financial log jam.

"The OPEC+ bargain has conveyed security to unrefined costs and indications of an expansion have taken rough higher," said Alfonso Esparza, senior market examiner at fates financier OANDA.

Costs have been additionally bolstered by US sanctions against oil sends out from Iran and Venezuela, brokers said.

As a result of the more tightly supply standpoint for the coming months, the Brent forward bend has gone into backwardation since the beginning of the year, implying that costs for quick conveyance are more costly than those for dispatch further later on, with May Brent costs as of now around USD 1.20 per barrel more costly than December conveyance Brent.

Outside OPEC, experts are peering toward US crude oil creation, which has taken off by in excess of 2 million barrels for each day (bpd) since mid 2018, to around 12 million bpd, making America the world's greatest maker in front of Russia and Saudi Arabia.

Week by week yield and capacity information will be distributed by the Energy Information Administration (EIA) on Wednesday.

On the interest side, there is worry that a financial lull will dissolve oil utilization.

Bank of America Merrill Lynch said in a note that financial "dangers are skewed to the drawback" and that "we conjecture worldwide interest development of 1.2 million bpd year-on-year in 2019 and 1.15 million bpd amid 2020."

The bank said it anticipated "Brent and WTI to average USD 70 for every barrel and $59 per barrel individually in 2019, and $65 per barrel and USD 60 for each barrel in 2020."

Oil prices firm as supply deficit emerges amid disruptions.Oil prices firm as supply deficit emerges amid disruptions.

Oil costs were firm on Friday in the midst of generation cuts driven by OPEC and as US sanctions against Venezuela and Iran likely made a slight deficiency in worldwide supply in the main quarter of 2019. In any case, oil costs have been topped by worries that a financial lull will before long begin marking development in fuel request.

Brent raw petroleum fates were at USD 67.27 per barrel at 0425 GMT, 4 pennies over their last close, and inside a dollar of the USD 68.14 2019-high achieved the earlier day.

US West Texas Intermediate (WTI) crude oil prospects were at USD 58.63 per barrel, 2 pennies over their last settlement, and not far-removed their 2019-high of USD 58.74 from the earlier day.

In spite of Friday's plunges, oil has mobilized around a quarter since the beginning of the year.

"crude oil keeps on crushing higher...in reaction to progressing generation cuts from the OPEC+ gathering of makers just as another (yield) droop from a passed out Venezuela," said Ole Hansen, head of product methodology at Denmark's Saxo Bank.

The Organization of the Petroleum Exporting Countries (OPEC) and non-subsidiary partners, for example, Russia - known as the OPEC+ collusion - vowed to retain 1.2 million barrels for each day (bpd) in rough supply from the beginning of the year to fix markets and prop up costs.

OPEC+ will meet in Baku, Azerbaijan, throughout the end of the week to audit its yield arrangement, albeit most anticipate that the cuts should proceed until further notice.

"We don't assume anything will be concurred this end of the week. Be that as it may, we presume the gathering will attempt to keep this market in parity," ANZ bank said on Friday.

In the interim, US sanctions against Venezuela, just as Iran, have additionally fixed oil markets.

With OPEC deliberately retaining supply and US sanctions keeping Iranian and Venezuelan oil from entering markets, worldwide rough stream information in Refinitiv demonstrated a slight supply shortfall likely showed up in the main quarter.

Expertcrudeoil.com - NYMEX, Brent Crude oil costs Expertcrudeoil.com - NYMEX, Brent Crude oil costs gain unassumingly

Light, sweet raw petroleum costs picked up on the New York showcase Mar. 7 as did Brent unrefined petroleum costs in London in spite of markers of debilitating world financial development.

The European Central Bank slice its 2019 development estimate to 1.1% from 1.7%. Already, the Organization for Economic Cooperation and Development downsized its development conjectures for the G20.

"All things considered, positives are progressively hard to come by for the world economy, and this will just serve to obscure the viewpoint for oil request," Stephen Brennock, PVM Oil Associates Ltd. examiner, told the Wall Street Journal.

On Mar. 8, the US and China still couldn't seem to plan a summit between US President Donald Trump and Chinese pioneer Xi Jinping, demonstrating neither one of the sides trusts an understanding is impending to the two countries' progressing exchange question.

Terry Branstad, US agent to Beijing, said arbitrators keep endeavoring to work out contrasts, including subtleties on authorization of any inevitable arrangement.

"The two sides concur that there must be huge advancement, which means an inclination that they're extremely close before that occurs," before meeting arrangements are made, Branstad told WSJ from the US government office in Beijing. "We're not there yet. In any case, we're nearer than we've been for an exceptionally lengthy time-frame."

Energy prices

The April contract for light, sweet raw petroleum on the New York Mercantile Exchange expanded 44¢ to settle at $56.66/bbl on Mar. 7. The agreement for May conveyance additionally expanded 41¢ to settle at $57.03/bbl.

NYMEX flammable gas for April expanded 2¢ to an adjusted $2.86/MMbtu on Mar. 7.

Ultralow-sulfur diesel for April diminished under 1¢ to stay at $2.01/lady. The NYMEX reformulated gas blendstock for April picked up 1¢ to an adjusted $1.80/lady.

Brent rough for May conveyance increased 31¢ to $66.30/bbl while the June contract expanded 29¢ to settle at $66.26/bbl.

The gas oil contract for March picked up $2.25 to $622.25/ton on Mar. 7.

The normal cost for the Organization of Petroleum Exporting Countries' container of crudes was $65.57/bbl on Mar. 7, up 53¢.

Expert Crude Oil Provides MCX Crude Oil Tips, Crude Oil Tips, Free Crude Oil Tips in India.

Expertcrudeoil.com : Best MCX commodity tips provider

MCX (Multi commodity exchange) is regulatory body of commodity market and commodity like base metals, valuable metals, oil,crude oil and gas are exchanged on it. Most effectively traded product over the MCX is gold and crude oil as all things considered of it are profoundly fluid in nature.Like other trade MCX has its opening and shutting time between which brokers can trade on it.

Following are few hints to choose best MCX tips provider:

1.Please visit their site , facebook, twitter and other social profiles.

2.Find out objections of that specific warning.

3.Check history of their organization like how long they have spent in this industry and how much satisfied or unsatisfied customers they have.

4.Don't ever believe on their excel sheet of past performance. That can be effectively made .

5.Learn about their consistency.

6.Ensure they are satisfying all SEBI rules.

7.Ask about qualification of their research analyst.