Don't miss the great buy opportunity in XAGUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (17.87). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. SILVER/U.S. DOLLAR is in a range bound and the resumption of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 59.

Take Profits:

TP1= @ 18.33

TP2= @ 18.73

TP3= @ 19.65

SL= Break below S2

XAGUSD trade ideas

Silver fall coming soonSilver rallies look like fake and could fall steeply if it fails to rise above $18.5 in near short term. This is the same time some videos were published by Robert Kiyosaki on May 22nd, 2019 where he believes silver will go up. There are many other people propagating the same ideas trying to boost up silver which actually happened but failed to go past $18.5 or sustain above $18.1 many times in the last 7 months. I see a serious fall if it fails to rise above the $18.5 levels with people holding it liquidating positions soon. See the video on youtube search for Why Robert Kiyosaki buys Gold and Silver -Robert Kiyosaki and see the date of posting.

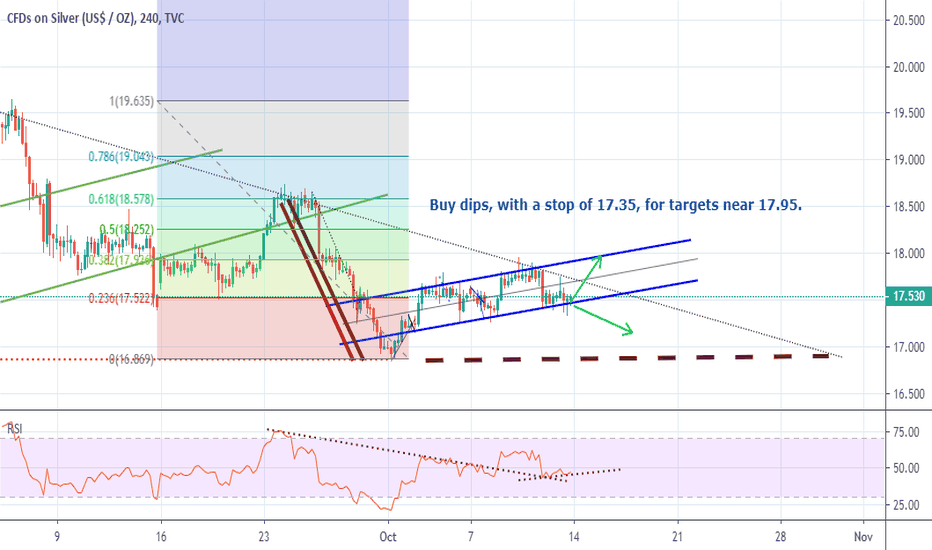

Don't miss the great buy opportunity in XAGUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (17.45). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XAGUSD is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 70.

Take Profits:

TP1= @ 18.17

TP2= @ 18.70

TP3= @ 19.63

SL= Break below S2

Next Move One can look for one more small move with in the structure , Once it completes its corrective nature it will make high likely up to 21.00 +

Silver basically its in side ways pattern form Quite Years , Expect to be with in the range of 21 as top and 13.7 as bottom ,

for your personal understanding you can have a look on weekly time frame and you will understand the same

Don't miss the great buy opportunity in XAGUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (17.80). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XAGUSD is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 62.

Take Profits:

TP1= @ 18.32

TP2= @ 18.72

TP3= @ 19.63

SL= Break below S2

A second Chance to Buy in SilverMidterm forecast:

While the price is above the support 16.55, resumption of uptrend is expected.

We make sure when the resistance at 18.75 breaks.

If the support at 16.55 is broken, the short-term forecast -resumption of uptrend- will be invalid.

We will close our open trades, if the Midterm level 16.55 is broken.

Technical analysis:

The Falling Wedge taking shape and as a bullish pattern suggests we will soon see another leg higher if price breaks and closes above downtrend.

A trough is formed in daily chart at 16.90 on 10/01/2019, so more gains to resistance(s) 18.10 and maximum to Major Resistance (18.75) is expected.

Price is below WEMA21, if price rises more, this line can act as dynamic resistance against more gains.

Relative strength index (RSI) is 48.

New trading suggestion:

*There is still a possibility of temporary retracement to suggested support line (16.55). if so, traders can set orders based on Price Action and expect to reach short-term targets.

* If you missed our first HUNT , you have a second chance to buy above the suggested support line (16.55).

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Trade Setup:

We opened 6 BUY trade(s) @ 15.21 based on 'Valley' entry method at 2019.07.10.

Total Profit: 861 pip

Closed trade(s): 630 pip Profit

Open trade(s): 231 pip Profit

Closed Profit:

TP1 @ 15.30 touched at 2019.07.11 with 8 pip Profit.

TP2 @ 15.60 touched at 2019.07.16 with 38 pip Profit.

TP3 @ 16.20 touched at 2019.07.18 with 98 pip Profit.

TP4 @ 17.20 touched at 2019.08.07 with 198 pip Profit.

TP5 @ 18.10 touched at 2019.08.27 with 288 pip Profit.

8 + 38 + 98 + 198 + 288 = 630 pip

Open Profit:

Profit for one trade is 17.53(current price) - 15.21(open price) = 231 pip

1 trade(s) still open, therefore total profit for open trade(s) is 231 x 1 = 231 pip

All SLs moved to Break-even point.

Take Profits:

TP6= Free

Silver - the news is out, is it absorbed in the prices ?Silver moving in a flag pattern, in on the lower point of the channel. If the channel is broken on the downside, a slide upto 16.82 can be expected.

It has been correcting for some time, there is a possibility that after all the news flow, the short positions will start to unwind and push the prices higher.

Since my ideas can be seen in India only, by the time our exchanges will open, prices will probably settle down. 16.80 is an important support while a breach of 17.8 will aid the bulls to push the prices higher.

Silver is at Make or Break Point.Silver has been correctly sharply for past 3 days, at the moment (17.46) it is at a make or break level.

If it slides further, it may touch 16.8 followed by 16.2 levels.

Technical indicators are showing weakness at this stage (27-09-19).

Traders taking short positions must exercise caution and keep monitoring charts for trend reversal.

18.04 on the upside will change the trend upwards.

It is probably reacting to news of US China trade talk resumption, but there are enough of news flow that can keep the prices higher.

Please consider liking this chart or follow me on this forum if you find it worthy.

Trend-lines on Silver daily charts indicating a reversal.

Silver was seen attempting to re-enter the trend lines channel, after a few days of consilidation.

It did respected the doji that was formed day before yesterday.

RSI 21 also appears to honor support of 50 as it as reversed from there several times.

CCI indicator too is indicating a reversal from lower band of range (-70 to -80).

Chances of an upside from these levels are strong.

Beyond technical, the much awaited correction followed by consolidation is probably over, the news flow is neutral to positive and argue for a gradual recovery.

Any positive news flow can force the short positions to cover and push the prices higher at a much faster pace.

17.40 should be the STOP LOSS for all long positions.