The Hydrogen Policy will benefit Refex Industries going forward. Travelling in channels having witnessed accumulation and a good breakout. Price is above the Ichimoku Cloud as well.

Nifty has been moving in a descending channel forming 3 VCP. A breakdown could prove fatal and unfortunately chances for a break down are more. Watch out for very strict breakdown below 14250 because MACD is already weak and it could trigger a bigger fall. The bullish divergence could see a minor pullback but under the situation don't construe it as a recovery....

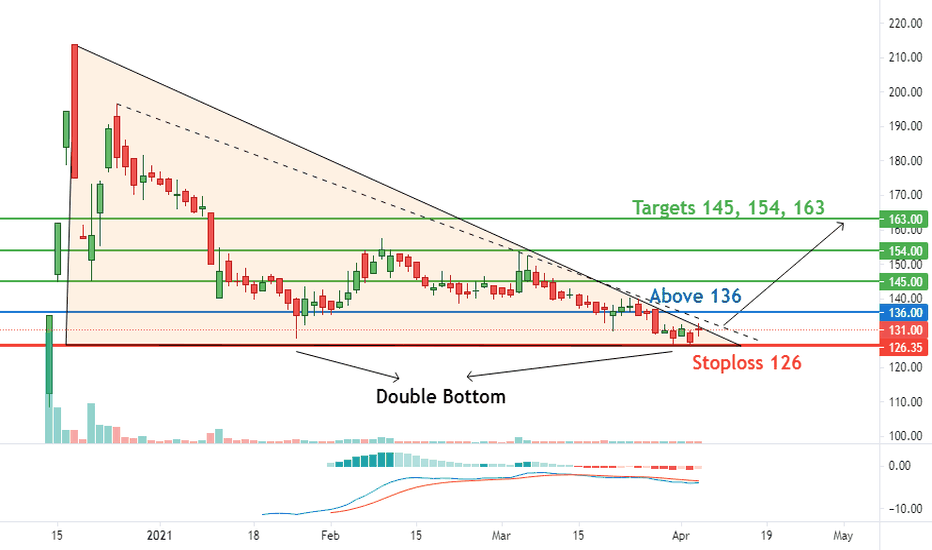

Simple Price Action. Awaiting a breakout preferably on the upper side with volume. The confidence I'm deriving for an upside breakout is from the MACD which is about to undergo a positive crossover. If Double Bottom is to be believed then the risk reward ratio here is MAGNIFICENT.

Pure price action analysis here. -Breakout with a long pole. -Reversed at the Golden Ratio and trend line support. -First candle - Doji (indecision) -Second candle - Marubozu (Bulls taking over) -Dragonfly Doji candle - Bears tried but Bulls won again.

This chart is at the request of a well wisher. The stock has been moving in channels within a bigger channel and is now hanging in near the top of the channel for quite some time with accumulation going on. A positive divergence suggests the stock is quite ready for an up move.

After the recent correction, the stock has now turned tides. Awaiting a breakout of the falling channel. MACD also looks set for a positive crossover. Usually , technical analysts recommend buy on horizontal breakouts but when there are more factors to suggest an up move right at the bottom, it is worth taking a risk of 30% of your planned investment in a stock.

Simple Price Action. A beautiful classic conventional Flag Pattern on display. Ride the Trend after the breakout. Time to make Hay while the Sun shine.

A Symmetrical Triangle pattern on weekly charts. There has been a lot of tension around the 93 level and the volumes suggest this time it could breakout well. This chart call is a bit pre mature awaiting a breakout, but just with a hunch that it could do well , I'm taking a risk before the breakout. Safe investors can take it only after it closes above and...

After the quick zoom after a 3 Volatility Contraction Pattern last time around, here is now another 3VCP if not more. Low Overhead Supply makes the journey faster to its target.

Travelling in a Parallel Channel. Along the way it formed a Cup and Handle pattern and most importantly it broke out with good volumes. Retested back to the line of least resistance and is now all set for anew journey. All this is happening at the bottom of the Parallel Channel is great for the stock to head back to the top of the Channel. Low Risk and High Reward

While many TV analysts are still pretty bullish on the steel sector due to global factors on steel, I believe we could witness a small/medium correction in the days to come although the overall picture is still very bullish. I see long Bearish Divergence. I have broken down the major divergence into smaller blocks and as seen in the chart every time a bearish...

After a long uptrend, there has been a good consolidation in turn forming a Pole Pennant Pattern. There has been 4 unsuccessful attempts to breakout past 1280 and with many indexes gearing up for an up move, so shall the IT midcap index and MASTEK looks one of the front runners in this space.

A double bottom pattern right at the base of the parallel channel along with a bullish divergence indicates upward continuation in the stock for the targets mentioned.

Riding the parallel channel, it repeats a 3 VCP pattern to move higher and the stock is ripe for yet another move. Just basic price action analysis. Nothing much to add from indicators.