This one chart is enough to understand the behavior of market and how to time the investment. Look at the chart NIFTY 50 Monthly time frame. Since 2005, if Nifty corrects more than 20% then it never ever visit back that correction low. This is simple analysis, but it gives powerful ideas and decent returns. I personally benefited when i follow this. I invest only...

After consolidating period of 4 years, Infosys is currently looking for breakout opportunity, In monthly Time frame all set good, I will start my investment. No bad about company, Revenue is in USD, depreciating rupee also supports growth in company revenue forecast. #Infosys

IDFC FIRST BANK one of my long term stock list in the "Multi Bagger" Basket. Recently it pass the multiple analysis, FVG Monthly, CUP n HANDLE pattern, BREAKOUT Retest. In terms of Technically. Also fundamentals are good. In next 10 years second level Bank has the good growth when compared to the leading banks.

DEAR TRADERZ, After a 2 weeks consolidation Axis bank is set to break out, and we are going to see a rally towards 649 & 669 position and swing with a stop @600. This is absolutely swing and positional it can be achieved by next week or it takes time till this expiry. But overall its Bullish. Always trade with proper hedge, to minimize your loss suppose your stop...

DEAR TRADERS, NIFTY SPOT IS IN THE ACCURATE DEMAND LEVEL ALSO IN OVERBOUGHT ZONE , ONE CAN BUY AT THIS LEVEL WITH A STRICY STOP OF JUST BELOW THE DEMAND ZONE CAN GET DECENT PROFIT.

Dear Traders, After a formation of flag pole pattern in SBI, we are looking for the decent retracement level to 310 in SBIN. Strict stop on close above the channel. Buy nearest PE option for hedging buy 325 CE and Short in Futures. Thank You Deepak

Dear Traders, As mentioned in the chart, After a long bull run, the stock should retrace to the mentioned demand level. so if you would get the supply area buy nearest otm put option for making better money Thank you

Dear Traders, Kotak Bank is forming hanging man pattern in the 4 hr chart and it confirms with second bear candle for the target of 1630 which is at the short term demand zone and there after it starts consolidating between the current levels for few weeks. Thank you Deepak

Dear Trades, PNB is in the exact demand zones which i have marked as green and Supply exist at the red zone . One who look for the positional as a investment then this stock is in the attractive price and you can start accumulate until 55 levels, With a stop of 50. Thank you, Regards Deepak

Dear Traders, DLF is in overbought and we saw a long run since this November, also a long wick rejected 226 zone emerges as short term resistance zone, we will see the correction once the market also gets corrected. We initially sell DLF @ 220 levels for the tgt of 212. (8pts) also we buy puts 217 Nov expiry @ 2.8 with a stop of 1.5 tgt should be 4.5, 5,...

Dear Traders, ITC is in retracement phase It has Strong supply @ 271, A strong close above 271 with huge volume would resume the uptrend, until it will be in a sideways to downtrend, Its for short term view. Thanks Dpak Please Like Comment & Share for more people would get rewarded.

Dear Traders, Kotak Mahindra Bank is in Neutral trend, currently in triangular pattern, any breakout above or below decisively will confirm the short term trend. Thank you Dpak Kindly Like Comment & Share for more people would get benifit

Dear Traders, Looking for good profits, this is the evident, and make decent and good profit like a multi - bagger stock

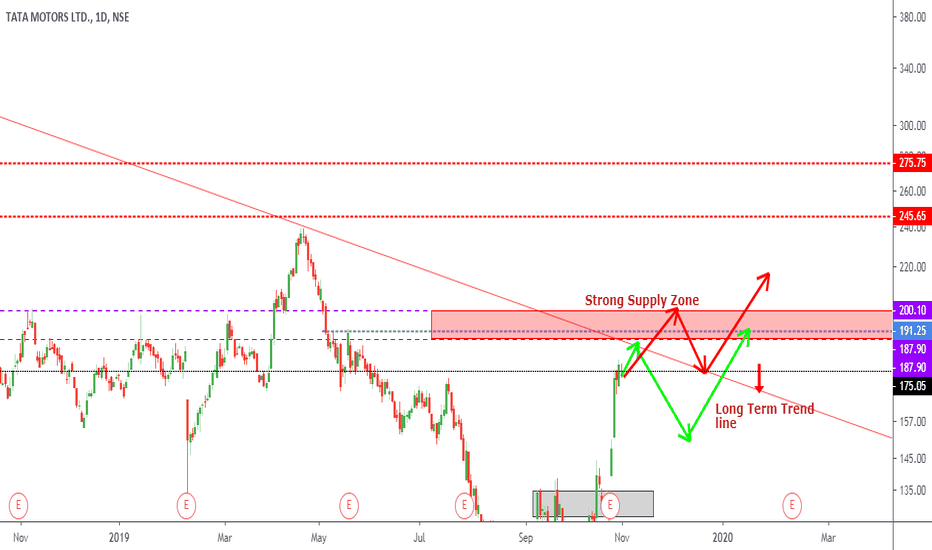

Dear Traders, Tata motors are very close to the supply zones, I am expecting the two way track method of travelling with the price action. Either it will break the long term trend line, for me it is difficult to do because need one more better results to break the trend , but if it do so then it will take rest on the trend line for a while before it take off....

Dear Traders, I have plotted the supply and demand zones for HDFC bank , on Daily time frames, I will Sell once the Supply Zones reaches with a stop above 1265 , (Buying Put), and I will Buy a little once it reaches the Demand zone 1 , (Call option Buying), But it will b bullish once it breach the supply zone on closing basis. It has strong support at Demand...

Dear Traders, As mentioned in the videos it will works well in 5min,15min, 30min, hourly and daily time frame . So time frame doesn't matter, If you are aggresive trader, you will go for shoter time frame. but please make sure you have to identify the trend or sideways market with the help of bollinger band. Thank you, Regards, Deepak Please like, Comment and...

Dear Traders, LT is in uptrend and whatever the result Q2, it will reach the demand zone levels shortly and i would prefer buy on dips in this strategy until it reaches the demand zones. If we gets there then we will short based on the time of the level it would reach the demand zones

Dear Trades, We are expecting a huge negative impact on infosys because of allegations against CEO second tie in the history, So the stock will react to this news negatively. I here by plotted the Demand Zone levels for the same, we will buy this area to cover the loss for short term uptrend once it should reach the defined area. Overall market is bearish on...