We are close to Support zone which is located near 26500 Zone, Until watch the market and go long from that position 26508-26558. Will gain minimum of 700 pts from there. This target will be valid till 12-09-2019. But one should accumulate after touching the strong support level of 26500+. Until we never trade on BNF. Hint: Price should reach our target level...

I would suggest buy on dips strategy for Nifty, If we are closed below the short term trend line as mentioned in chart we will see further decline towards 10850, else we will see some upside towards 11180. Looking for dips to buy. RSI Should above 50 for long position.

Here by I have plotted the long term support and resistance lines for Indus-Ind Bank . As per my own analysis the stock has formed the wedge pattern on daily chart. I'm expecting the breakout from the pattern on forthcoming days. Up on breakout the target should be the 1535. Its for swing trading ideas. If you liked my idea, give me like, comment and share....

Clear buy trend on nifty, If we get any dips in the morning we will buy for the target of 11021 For edu purpose only. make own analysis and implement

For first one hour it should sustain above todays close, and break above the 11146 level should be a buying opportunity, Then it will add another 25points Note: RSI should above 50 mark., also confirm with MA crossover. For EDU purpose only, we are not provide any recommendations.

Short below the trend line for the target of min 50 points. Then trail our stoploss. Confirmed with RSI below 50 level mark Disclaimer: For education purpose only.

It sustain at crucial support @ 28870, if 15min candle breaks and close below the target would be another 100 points, breaks above and close above 27978 then go for long. Check with rsi level should be above 50 for long and below 50 for short. Disclaimer: for educ purpose only

Marked Yellow lines are crucial Support Levels for the Bank Nifty. If Nifty Close above the yellow line, then First target would be around 28600+ If close below the yellow line then the first target is 28067 and close below that will leads to 27700. Kindly avoid buying/selling on consolidated area (Yellow line) Disclaimer: For Education purpose only

SHORT LUPIN BELOW CROSSOVER OF THE PENNANT FORMATION. CONFIRMATION: RSI ALSO NEEDS TO BREAK TREND LINE. DISCLAIMER: THIS IS FOR THE EDUCATIONAL PURPOSE, TRADE ACCORDING TO YOUR ANLYSIS.

Nifty Stayed in bearish mode and nice formation of bearish flag pattern on daily chart . Once it breaks the flag pattern then we may expect selling towards another 50-75 points. aroud 10850 levels. I usually follow the straddle and strangle strategy on weekly expiry, because of high volatility . It will limit our loss and enhace unlimited profits. Condition :...

Yes bank Is a buying Opportunity for Long term, Wait for the break out Since it shows some sign of Positive divergence. Once the trendline breaks for both rsi and price, we will go for buy. In simpler terms should close above 98. Kindly refer the support and resistance line. Disclaimer: For educational purpose only not recommending for trading. Analyze your...

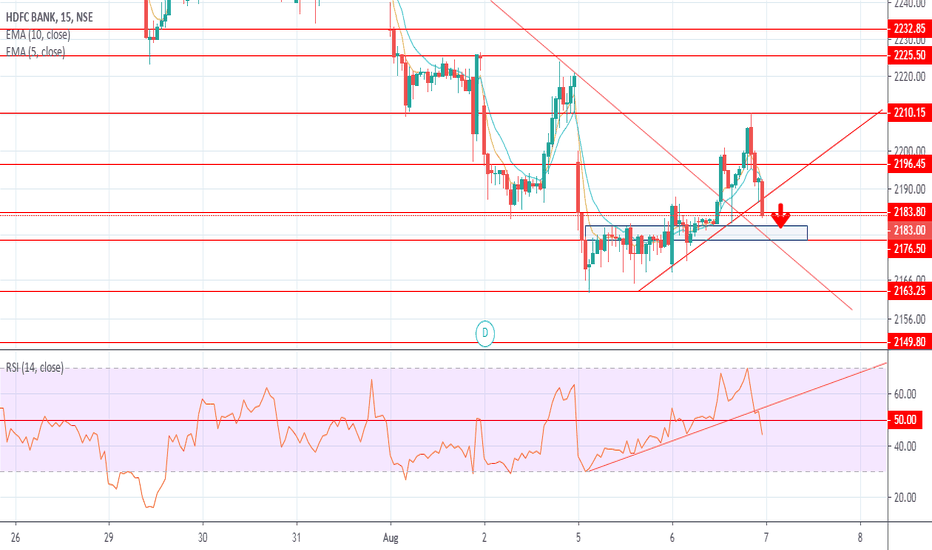

I have plotted the short term support and resistance. If there is any dip towards 2178-2175 Its a buying Oppurtunity, Because this the the value area for today's trading range. 1. Condition i) It has to sustain this level and make sure Your RSI is above 50. 2. Confirm 10 EMA crossover with 20 EMA. 3. Risk Reward ratio 1:1 for intraday. Disclaimer: solely for...

As for bank nifty tomorrow morning dip towards rising channel should be buying opportunity. As long as it is in short term rising trend. Break below the rising channel get short. Kindly consider RSI is always above 50 for confirming the bullish trade. Cross check with your MA 20 .

We will see some sharp decline from the beginning or first half as per chart analysis. Because Nifty struggling very hard and fail to close above 11000 mark. And more over our resistance zone also coincides. Above 11980 we will buy until unless stay on short side. Let us see how this technical works. Also RSI in 15min chart is below 50. This was the more advantage...

GO SHORT ON NIFTY IF YOU GET ANY UPMOVE AROUND 70 - 100 PIPS FROM HERE, RIGHT NOW ITS IN SUPORT ZONE OF 11644-11620 ANY DIPS AROUND 11550 SHOULD GET LONG AND SHORT BY CURRENT ZONE. ANY UP MOVE GET SHORT AROUND 11737-11760 FOR DOWNSIDE TARGET 11644 CURRENTLY VIX HOLDING 23% NOT GOOD FOR BULL RUN AT PRESENT

Time to make like multi bagger stock. This is great shorting oppurtunity for axis bank compared to other. Guarantee 75 points from the current level. So make your own research and trade smart. If you like this post like and share. Looking forward your comments.

Great oppurtunity to short reliance for near term. If you short around 1370-1380 you will be rewarded a minimum of 100 pips from here per lot. Do your own analysis and trade as per your potential.

STRONG RESISTANCE, OVERBOUGHT, FIBONACCI RETRACEMENT LEVEL, RAISING VIX, SO DEFINITELY NEXT WEEK WOULD BE A TUFF FIGHT FOR BULLS VS BEARS. WILL SEE WHAT HAPPEN