PIYUSHCHAVDA

PlusECOS (India) Mobility & Hosp cmp 342 by the Daily Chart view since is listed - Support Zone 295 to 317 Price Band - Resistance Zone 347 to 369 Price Band - Bullish Rising Price Trendline and Price Channel are well sustained - Above may also be interpreted as a Bullish "W" Double Bottom pattern - *Rising Bullish Head & Shoulders pattern completed at Resistance...

DCM Shriram cmp 1410 by the Daily Chart view - Support Zone 1325 to 1375 Price Band - Resistance Zone 1430 to ATH 1474.90 Price Band - Support Zone been tested retested good and stock now consolidating - *Bullish Pole and Flag pattern made around Support Zone and Resistance Zone* - Volumes are flattish to slightly falling, need to increase for fresh upside breakout

Bajaj Finance cmp 942 by the Daily Chart view - Daily basis : Support Zone 890 to 915 Price Band - Resistance Zone seen at 955 to ATH 978.80 Price Band - Ascending Triangle pattern Breakout in the making process is seen on the stock chart

Biocon cmp 398.75 by Weekly Chart view - Support Zone at 340 to 365 Price Band - Resistance Zone at 400 to 425 Price Band - 2nd Falling Resistance Trendline Breakout attempted - 1st Falling Resistance Trendline Breakout done and sustained - Stock Price restrained below Resistance Zone after ATH 487.75 in Dec 2020 - Volumes seen galloping heavily and surging well...

EMS cmp 634 by Daily Chart view - Support Zone 570 to 598 Price Band - Resistance Zone 670 to 700 Price Band - Price momentum has well respected the Rising Support Trendline - Support Zone bottom has been tested retested repeatedly since March 2025 - *Gap Down Opening of 29-May-2025 will act as tiny hurdle resistance crossing* - Breakout attempt is seen in...

Royal Orchid Hotels cmp 428.70 by Daily Chart view - Support Zone 390 to 412 Price Band - Resistance Zone 430 to ATH 449 Price Band - Price attempting Breakout above Falling Resistance Trendline - Repeated Bullish Rounding Bottoms having Resistance Zone Neckline - Volumes are seen spiking regularly with heavy surges at intermittent intervals - Price trending with...

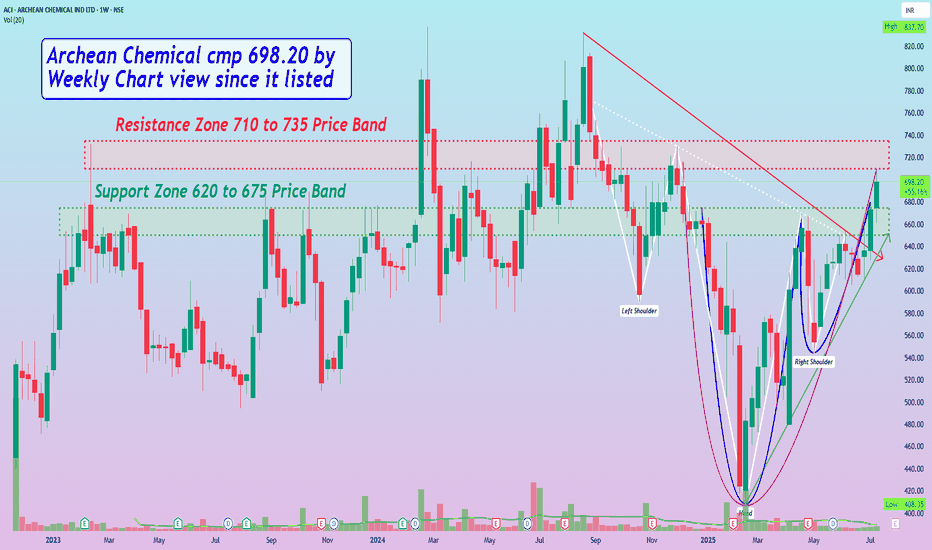

Archean Chemical cmp 698.20 by Weekly Chart view since it listed - Support Zone 620 to 675 Price Band - Resistance Zone 710 to 735 Price Band - Volumes flattish, need to increase for Resistance Zone Breakout - Bullish Rounding Bottom inclusive of Cup & Handle pattern completed - A logically considerate slanting Bullish Head & Shoulder pattern too, has completed...

Bank Nifty Index 56283 as is visible by Weekly Chart view - Bank Nifty has formed a very close cut Bearish 3 Black Crows Technical Pattern indicating about probable negative sentiment might just continue

Nifty Index 24968.40 as visible by Weekly Chart view - Nifty 50 Index has formed a Bearish 3 Black Crow Technical Pattern indicating about the probable negative sentiment might continue - Nifty is also closely forming a sliding Bearish Double Top from ATH 26277.35 to current top 25669.35, which again syncs with the negative sentiment trend trajectory

Nifty 50 spot 24968.40 by the Daily Chart view - Weekly update - Support Zone 24900 to 25100 Price Band just sustained - Next Support Zone seen at 24325 to 24500 of the Nifty Index - Breakdown from Falling Resistance Trendline might just continue - Rising Price Channel Breakdown indicates weakness might continue - Resistance Zone 25250 to 25400 then ATH 26277.35...

Bank Nifty spot 56283.00 by Daily Chart view - Weekly update - Resistance Zone 56840 to 57200 and then ATH Level 57628.40 - [ b]*Bank Nifty Index Spot Breakdown below Rising Support Channel* - Support Zone 59550 to 56285 of Bank Nifty Index *still sustained* - Next fairly decent Support Zone 55050 to 55450 of Bank Nifty Index Levels - Bank Nifty Index Gap Down...

SWSolar cmp 335.10 by Daily Chart view - Support Zone 280 to 305 Price Band - Resistance Zone 340 to 365 Price Band - Bullish VCP Pattern completed on stock chart - Volumes spiking heavily at regular intervals by demand based buying - Resistance Zone Neckline Breakout maybe seen unfolding in the near future

Escorts Kubota cmp 3410.90 by the Weekly Chart view - Support Zone 3000 to 3150 Price Band - Resistance Zone 3450 to 3600 Price Band - 2 Bullish Rounding Bottoms done, 3rd in completion stage - Volumes needed to push for fresh breakout across Resistance Zone - Falling Resistance Trendline Breakout attempted by the current status - Rising Support Trendline is well...

Thangamayil Jewellery cmp 1911 by Daily Chart view - Support Zone 1850 to 1900 Price Band - Resistance Zone 2050 to 2100 Price Band - Symmetrical Triangle Breakout in the making process - Price is currently testing retesting the Support Zone band - Price action momentum respecting Rising Support Trendline - Volumes are flat and need to increase for the upside momentum

Nuvoco Vistas Corp cmp 381.50 by Weekly Chart view since listed - Support Zone 335 to 355 Price Band - Resistance Zone 395 to 415 Price Band - Volumes generated over past few days based on expected good results outcome - Darvas Box - Stock trading between 292 to 415 price range since Breakdown in Feb 2022 - Multiple Bullish Rounding Bottoms completed within...

Sterlite Technologies cmp 114.55 by Weekly Chart view - Support Zone 71 to 81 Price Band - Resistance Zone 120 to 132 Price Band - 2nd Falling Resistance Trendline Breakout attempted - 1st Falling Resistance Trendline Breakout done and sustained - Volumes spiked heavily over past few days by demand based buying - Repeated Bullish Rounding Bottoms indicate...

LIC Housing Finance cmp 637.05 by Daily Chart view - Support Zone 600 to 625 Price Band - Resistance Zone 660 to 685 Price Band - Rising Support Trendline seen well respected - Volumes have spiked heavily today by demand based buying - Breakout seemingly sustained for Double Falling Resistance Trendlines - Support Zone acting as neckline for Multiple Bullish...

Vascon Engineers cmp 55.70 by Weekly Chart view - Support Zone 49.50 to 53.50 Price Band - Resistance Zone 49.50 to 53.50 Price Band - Volumes are getting close to average traded quantity - Common Technical Indicators BB, EMA, SAR, MACD, RSI indicating positive trend - Multiple Bullish Technical Chart patterns have emerged on the Daily and Weekly Charts -...