ParimalDevnath

Stock closed at 202.15. Since 8.1.19 price could not close the day below 200 because of highest OI on 200 Put. There is a positive divergence visible. High speed of Theta (time decay) in the last days of expiry should be able to generate profit. a) Sell 200 Put at 5.15 or 4 (lot size 3000=approximately 15000 or 12000 premium will be received). 200 Put has the...

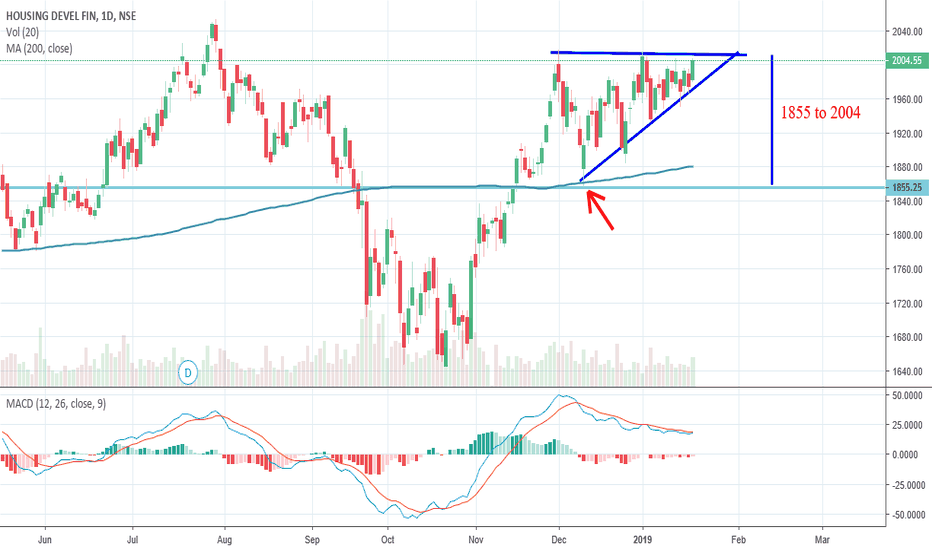

Probable Ascending Triangle pattern on day chart. Supports and Resistances are marked. The spread of price is shrinking as the time passes. Price once more at the support line which was respected many times in the past. Price is hanging around 200 DMA. After the big fall Nifty has retraced more than 50% of the fall. For bears breaking the level of 10800 decisively...

Ascending Triangle Breakout, breakout of Triple Top chart pattern. Now any correction towards breakout zone will give buying opportunity with small SL. Target is 1500 to 1515. At 1500 Call bears are holding onto the highest OI position --total 70700 shares. So this will be a stiff resistance area-- wont be easy to be cleared by bulls. OI support comes at 1360...

Hourly chart. Breakout has been in place after three days of consolidation. Now resistance of previous high has made the bulls wary of crossing the resistance zone. So it was another day of consolidation and profit booking. As per OI Table 11000 Call is the resistance. But bulls have created huge positions at 10700, 10800 and 10900 Puts out pacing the bears. Our...

Three-Drive pattern clubbed with Double Top Resistance and two consecutive Negative Divergences. Target could be 200 DMA. SL or hedging for safety.

iii wave probability on hourly chart. Resistance has built up for last three sessions. If a breakout happens, target could be 11090.

Hitting at the same roof for more than two days. Breakout above this roof. Resistance is the previous high- 10977.

Being optimistic will see a target of approximately 150 points if the breakout of Ascending Triangle happens. Price reached the tipping point. Often on such breakout, a Negative Divergence occurs. If a divergence is negated, then target can be realized. MACD crossing above the zero line alongwith price breakout will boost the process of breakout.

Consolidation followed up by a Double Top Patter. Now price is about to give a breakout. New high may be made on the back of good quarterly numbers.

100 DMA is 10855, 200 DMA is 10802 and 50 DMA is 10710. On closing basis Nifty should break either 100 DMA or 50 DMA to give meaningful trade. Union budget is to be tabled in 15 days time. It is observed that in general, before the budget market cuts down a lot. Though OI Table is slightly tilting in favour of bears, but bulls have not yet lost the battle. Bears...

Bearish AB-CD pattern. Minor mismatch in parameters. Target could be 164 when fully retraced. SL 1.5 to 2.00% of total investment. Fundamental: Jaguar sales not doing well.

Contracting Triangle. It may give a breakdown. But we need to be quite careful. 200 DMA provided support many times previously. If price breaks below 200 DMA, we may see the level of 1000 and below.

Bulls not able to give a breakout of the Contracting Triangle within which there is a formation of Rising Wedge in hourly chart. Some more failed attempt and bears may take up the reins.

Price at crucial level-- to move either of the directions. Today's heavy volume indicates to strong bullish undertone.

Day of high volatility. Bulls tried four times to give a breakout of the Contracting Triangle. Nifty halted at 100 DMA. On OI Table there has not been any big change from yesterday. Both sides are equally ready with their writing of Puts and Calls almost of the same quantity. 10700 Put has 3825525 shares whereas 11000 Call has 3814275. Bulls have a little upper...

Rising Wedge within a Contracting Triangle. Second attempt to breakout of the Triangle has failed so far!!

Nifty is stuck at 200 DMA. If Nifty moves above 200 DMA, resistance comes at 100 DMA and above 100 DMA, a Negative Divergence will be created and it will be the third consecutive Divergence. In case of Negative Divergence, bulls will not take a chance. Below 200 DMA, 50 DMA is providing strong support. So if the Contracting Triangle has to give a breakout either...