V GUARD HAS TO START TRADING ABOVE 236 LVL. TODAY CLOSE IS ABOVE THE DOJI OF YESTERDAY. THEN THE NEXT TARGET WILL 260+ IN THE COMING DAYS. STOP LOSS CAN BE PLACED AT 221.

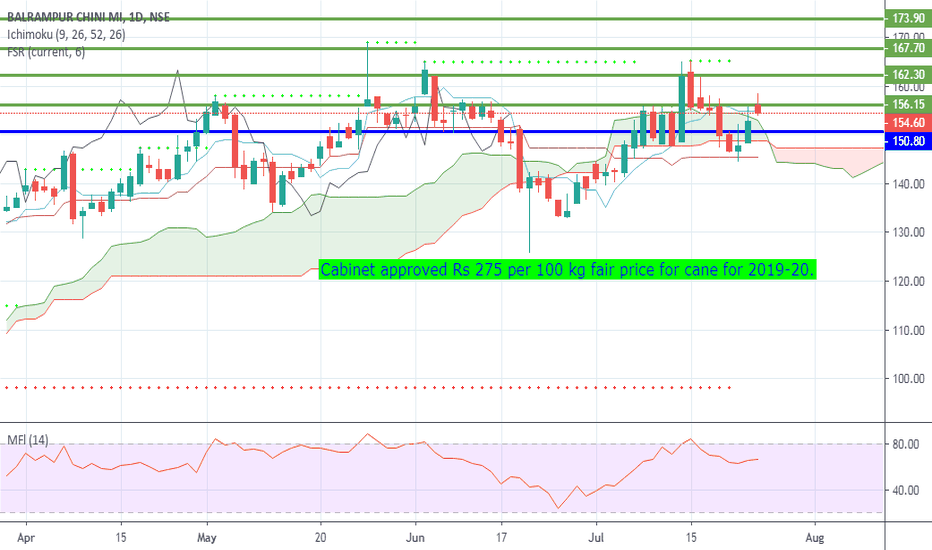

THIS SUGAR COMPANY SCRIP SEEMS TO BE POISED TO REACH THE TARGET OF 167 IN THE COMING DAYS.

ADANI ENT IS AT SUPPORT LEVEL. THE CLOSE IS NOT BELOW THE DOJI (128.7). IF IT GOES BELOW, THEN LOW SIDE TARGET IS 120. IF THE PRICE MOVES ABOVE 134.5, THEN 140 WILL BE HIGH SIDE TARGET.

COMMENTS PROVIDED IN THE CHART.

THE SHARE PRICE HAS A BUY SIGNAL IN DAY CHART AND IN BULLISH TERRITORY. THIS TIME THE LEVEL CROSSING IS TO BE CROSSED AND CLOSE AROUND 1400 IN THE COMING DAYS.

AS CAN BE SEEN FROM THE CHARTS, THE INDEX SEEMS TO BE HEADING FOR 11,178 (TWO WEEKS AGO MY POST). BUT UNLIKE YESTERDAY, IT DID NOT GET SUPPORT AT 11,296. AND, THE LEVEL WAS BREACHED. NECK LINE SEEMS TO BE AT 11,137. THE PULL BACK SHOULD BE UP TO 11,478.

ZEEL HAS A BUY SIGNAL WITH LAGGING SPAN ABOVE. THE Q1 RESULTS HAVE SHOWN 63% INCREASE IN NET PROFIT. WITH THIS WE MAY EXPECT TARGET-1 AND 2 MAY BE EASILY ACHIEVABLE IN THE COMING DAYS. PLACE A PROPER STOP LOSS AS PER YOUR RISK MEASURE OR AT 339.

ASIAN PAINTS ACHIEVED THE TARGET OF 1391 (SEE POST ON JULY 14) AND MOVED UP TO 1444 HIGH TODAY. THERE IS A BUY SIGNAL IN THE DAY CHART. IF THE PRICE CROSSES 1452, THEN 1528 WILL BE THE NEW TARGET. THERE WAS A RESISTANCE EXPECTED AT 1428 LEVELS AND THE PRICE CAME DOWN. TRY TO ENTER AT LOWER LEVEL 1410 WITH PROPER STOP LOSS.

THE SHARE PRICE IS READY TO REACH 1546 AND BEYOND. THERE IS A BUY SIGNAL IN THE BULLISH ZONE OF THE DAY CHART. STOP LOSS MAY BE PLACED AT 1431. 76 LAKHS TRADED AND 14.6 LAKHS DELIVERY TAKEN.

PVR (SEE MY POST ON 13TH JULY), IS CLEAR TO REACH TARGETS OF 1800 & 1880 IN THE COMING DAYS. WITH A PROPER STOP LOSS, TRADE FOR BUY CAN BE CONSIDERED.

AS POSTED EARLIER (JULY, 20), TCS SHARE PRICE CROSSED 2115 AND IS TRYING TO REACH 2146 LEVELS. IT IS OBSERVED, AN INVERTED H&S WITH NECK LINE AT 2146 IS BEING FORMED. ONE MAY ENTER AT 2098 LEVEL FOR TARGETS OF 2150.

HOUR CHART INDICATES IF THE PRICE AT 722 IS BREACHED THEN, 690 SHOULD BE THE TARGET. BUT THIS IS JUST DIAL COUNTER, BEWARE! IT IS OBSERVED THAT WHENEVER EVERY CHARTIST SAY TO SELL, THE PRICE STARTS SHOOTING UP, THEREBY TRAPPING EVERYONE. IT IS BETTER TO PLACE BUY ORDERS AT 699 - 710 LEVELS FOR HIGHER SIDE TARGETS UP TO 800. RECENT Q1 RESULTS ARE GOOD.

SBIN WAS ABLE TO TOUCH 374 BUT UNABLE TO CROSS IT. THE LEVEL WHERE IT SEEMS TO REACH IS 335 (NECK LINE FOR H&S). OR, IF IT WANTS TO COME DOWN, THEN 328 SHOULD BE THE LOWER LEVEL. LET THE PRICE START TRADING ABOVE 350 FOR GOING LONG.

RELIANCE HOUR CHART SHOWS THAT THE PRICE CAN REACH 1310 LEVELS IN THE COMING DAYS. THEN, THE DAY CHART WILL BE GIVING THE BUY SIGNAL. LET THE PRICE CROSS THE CLOUD INTO THE BULLISH ZONE. AT PRESENT IT HAS SUPPORT AT 1272.

THE INDEX HAD REACHED NEAR THE TARGET OF 11,296 (11,301 TWICE), AS POSTED. THE CURRENT LEVEL IS IMPORTANT SUPPORT AND DOUBLE BOTTOM IS OBSERVED. THE INDEX MAY GO UP TO 11,430 AND 11,500 IN THE COMING DAYS. WILL RELIANCE TAKE THE LEADERSHIP??

BEML SEEMS TO HAVE A TARGET OF 976 IN THE COMING DAYS. THE HURDLE IT HAS TO CLEAR IS AT 948. TRADING ABOVE 920 LEVELS WILL MAKE THE SHARE PRICE BULLISH ONCE AGAIN.

LOW TRADING AT DECREASED PRICES IS OBSERVED FOR THE LAST ONE WEEK.