PLEASE SEE THE NOTES PROVIDED IN THE CHART.

THE SHARE IS MOVING IN DAY, WEEK & MONTHLY CHARTS IN THE CHANNEL AND THAT TOO ABOVE THE TREND LINE. IN WEEK CHART PRICE HAD ENTERED INTO THE BULLISH ZONE. MIGHT TAKE UP THE PRICE TO 1043. PLACE STOP LOSS AT 926.

AS PER MY 6TH APRIL POST ON GRANULES, IT HAD TOUCHED 120 TODAY. EVERYTHING REMAINS SAME AS FAR AS TARGETS ARE CONCERNED. IN ADDITION, WE HAVE BUY SIGNAL IN DAY CHART. AND, MONEY HAS STARTED ENTERING INTO BUYING. ALL THE BEST!!

MULTIPLE BOTTOMS WILL IT HELP?? PLEASE SEE THE NOTES PROVIDED IN THE CHART.

AS PER MY APRIL 16TH OBSERVATION, THE PRICE HAD TOUCHED NEAR 533. FROM NOW ONWARDS, IT APPEARS THAT UPTREND MIGHT BE RESUMED. SEE THE NOTES IN THE CHART.

CROSSED THE RESISTANCE AT THE NECK LINE OF 114.9 WITH EASE AND WITH VOLUMES. IT IS NEARING A RESISTANCE AT 138. DO NOT ENTER AT THIS POINT. SUCH A VERTICAL MOVEMENT CALLS FOR PRECAUTION. WAIT FOR THE NEWS WHICH HAD MADE SUCH A BIG BREAK OUT. THEN DECIDE.

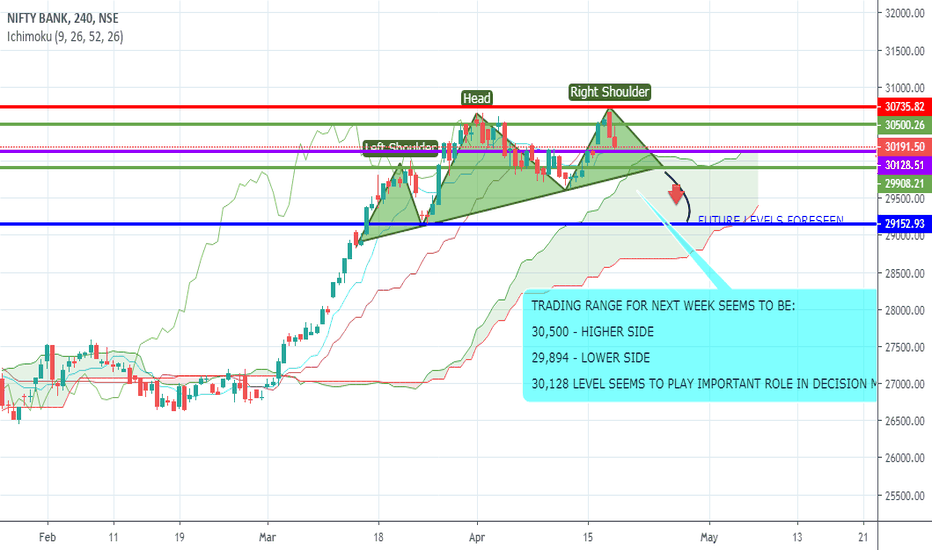

TRADING RANGE IS GIVEN IN THE CHART. PLEASE WATCH THE LEVEL OF 30,128.

BUYING RANGE 236-241. STOP LOSS 228. TARGETS OF 285 & BEYOND IN THE COMING DAYS. AS OF NOW, IT IS IN A DOWNWARD SLOPING CHANNEL WITH MOVEMENT UPTO 240. THIS IS BECAUSE OF THE HEAVY SELLING ON THURSDAY THAT TOO WITH VOLUMES (3.29 Cr traded but delivery % of 29.6).

LEVELS ARE INDICATED IN THE CHART.

IT APPEARS THAT L&T FH WILL REACH 144 LEVEL ONCE AGAIN. BUY ABOVE 150 FOR TARGETS OF 156 (RESISTANCE) AND 165. STOP LOSS 143.

AFTER ANALYZING THE HEG DAY CHART, IT APPEARS: MULTIPLE BOTTOMS @ 1980. THERE IS A STRONG TENDENCY TO REVERSE AND RISE UPTO 2953 LEVELS. STOP LOSS MAY BE TAKEN SAME AS THE SUPPORT LEVEL (RS. 1980).

A LOT OF STUDY CAN BE DONE IN THE CHART OF TORRENT PHARMA. CUP & HANDLE IS IN FORMATION IN THE 4H CHART. INVERTED H & S FORMED ALONG THE TREND LINE, IN THE HANDLE PORTION. MONEY IS FLOWING AT THE LOWER LEVELS. FOR TRADE DETAILS SEE THE NOTES IN THE CHART.

TECHNICALLY RELIANCE HAD GENERATED A "SELL" SIGNAL ON 18TH APRIL. HUGE GAP UP OPENING & BEING IN THE BULLISH ZONE CAN CHANGE THE STATUS OF THE SIGNAL. BUT, PATTERN FORMATION IS SIMILAR TO H&S. (SHOWN ABOVE). WAIT TILL 1410 IS CROSSED / CLOSED WITH VOLUMES.

L & T IS MOVING TOWARDS 1340 AS MENTIONED IN MY PREVIOUS ARTICLES ON 31ST MARCH & 11TH APRIL. THE LEVEL OBTAINED FROM THE CHARTS IS FIB.32% OF THE EARLIER RISE.

OVERALL M & M IS IN UPWARD MODE FROM 615. THE JOURNEY SEEMS TO BE UPTO 800 WITH INTERMEDIATE STOPS. AS PER THE PRESENT TREND, IT SHOULD TOUCH 717, IMMEDIATELY. STOP LOSS @ 672.