Adani is highly volatile at the moment and can go either way based on events on the next two days. As per indicators it turned bearish more than a week back. Best time to short was post report publication on 27th morning. Points to observe : 1. The critical support of 3000-3100 is broken heavily. 2. The next near support is close to 2000-2200 followed by 1500....

Nifty is highly volatile given two events : 1: Adani group & Hindenburg saga 2: Budget 2023 Current it seems to be bearish with indicators pointing towards a free fall to support zones of 17100, 16000 and 14500 respectively. But given the volatility there might be sharp upturn in nifty and breakout if some positive announcements are made in Budget or ...

BAnknifty has given a min breakout. Asian markets seems to be a positive mood , so went long in the last 15 mins of todays trade. here's the position | 2nd Feb expiry Shorted 42900 pe and ce with a premium of 967 | taken since this is a congestion zone Shorted 43500 pe at 800 | Overall trend seems to be positive , hence carrying long position Position is...

Kotak Bank Bank is in bear zone for long, looks like to rebound as per dour indicators Hence taking bullish trade with hedges Shorted 1900 PE Hedged around ~1750 Target 20k+ per lot Updates to follow

Showing how signals help in predicting BNF futures movement, contact for details.

Good to buy Bitcoin. It's at consolidation level. If it holds 40-45k Level in the next weeks, then we can expect it to shoot around 60-75k by next March In near future, this might breakdown following the Head & Shoulder pattern. If it breaks this level, the next consolidation zone will be 30k. SO be ready with your deposits in crypto exchanges & buy on dips....

Taken short at SBI at 362 and hedged by 355 CE at Rs.16 Reason to trade : 1.System generated Signal 2. Triangle pattern break Target will be 10-20k SL if 365 is taken out decisively. Can do adjustments also . will update

Century might rebound from this level as depicted by system. Pattern wise it is forming a cap ; might end up forming a cup handle Trading Levels: Added at 340 , will add more quantity if price drops until my stop loss is taken out . Stop loss at 317 300 is a crucial level for this scrip. as long as 300 is not taken out, we can expect bounce back & upmove...

Stock has been following a perfect price action. As per levels & critical pivots , it's heading south straight

Expecting Indusind to move up from 900 level. Supported by our Signal Systems, it is looking to go up from critical pivot. Boundary Limit : We should be profitable if it expires between 850-1040 in May series. Target : Idea here is to make ~10K-20K to gain from here. Things to look out for : Decisive break on 1000 might cause steep upside provided Nifty...

Nifty has been at the all time highs and people buying pretty much everyday or the other. We need to have a bit of reality check here. It's totally fine to hold your Long positions unless and until some real negativity pops up (eg, Newton's First Law ~ An object in motion will continue to be in motion unless and until some external force acts upon it :D ) But...

Bank nifty has shot near to it's all time high, and starting a new month today. we should relook at the patterns created by BNF in the past few months in order to predict the possibilities of the current month. The enthusiasm about vaccine & economic recovery has helped it reach the current high levels. Though we are pretty far from recovery I believe. On...

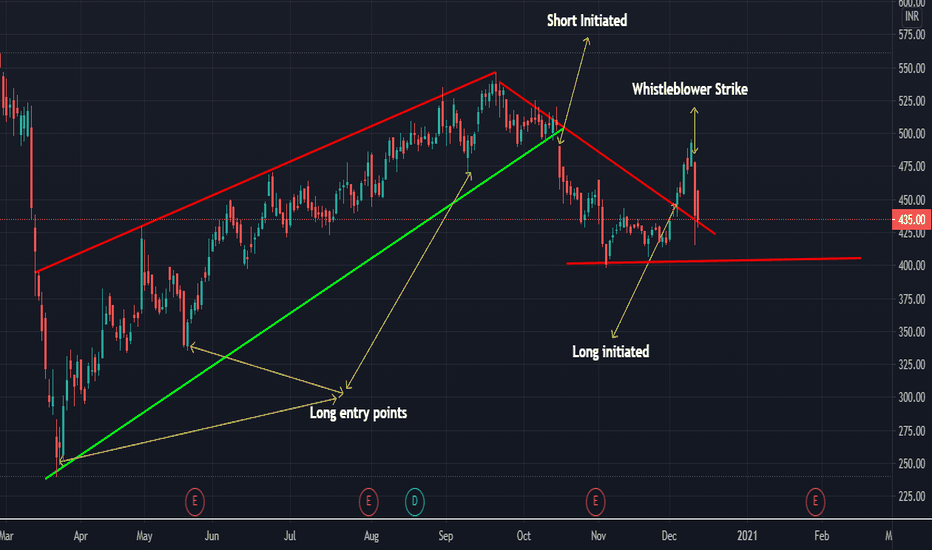

UPL had dropped to 250 levels in the corona meltdown. it majorly moved within a channel. It gave 3 major entry points in long positions : 1. 250 2. 340 3. 475 It broke the Trend line at 500 giving entry for short opportunity. Shorts has to booked at 400. Again it broke the Trend Line (TL) at 444 giving fresh long position entry. 10th Dec there was some...

11 Dec was as range bound day. In these scenarios our key objective is to sell at the highs & buy the lows as much as possible with rapid execution times. It's preferable to be in either long/short at any point in the market. Entry 1: Short at 30780 Reason : TL break, Signal generated & cash flow negative Exit 1: Booked at 30550 Reason : Critical pivot is...

BNF started the day with strong bullish bias indicated by the first long green candle of 9.15. Ideal to go long at 9.30. why ? 1. Strong bearish rejection happened 2. Inspite of gap down, it attained the previous day close levels of 29600. 3.It broke the critical pivot in the first bullish candle. Continue as long as the trend continues (Trend line is held...

NDX is showing first signs of profit booking currently. Driven by hopes of vaccine , it has shot up significantly but unable to cross the resistance of 12200-12400. This will only cross by significant economic boost or positive bottom line impact from top firms. In this case it can blast off 200-400 points from current levels before consolidating. In case it...

Apollo Hospital has has broken the dynamic support resistance at 1800 and sped upwards very fast , we can continue to buy on dip till TL is taken out. Also any positional long should not be sustained once 1800 is broken. Using indicators confirmation may help

Nifty is about to take a down turn. It might go up further a bit before nose diving for the trend line retest. We have seen the trend line being tested at all critical levels such as 7600, 9000, 10800 , 11600. Now we need to watch out for the next BIG SHORT. A horizontal time tested support line is being drawn which intersects the TL at 12300-12400. This level...