bearishbull1968

stock appears weak below 128 for target towards 124/121/118/105

ndia's most volatile and liquid asset is generally called a gold mine because of trading volume in its derivative products especially OPTIONS. so, in order to trade this, there is a need to think Beyond Technical Analysis . We need to go in to the roots of Bank Nifty formation and understand how the stocks behind Bank Nifty are performing. As our NSE don't...

stock looks weak below 932 for a target towards 922/909/901 as long as 944 is holds

once can look for entering this stock between cmp to 320 with sl placed around 328 for targets towards 302/291/272

move above 3050/3100 can expect a 100 points move on upside crucial level to watch is 2800 which might drag the prices towards lower end.

stock after a up move now in consolidation above 452 can expect 459/465/481 sl 444

sideways break out above 862 might give a bounce towards 872/882/897/915 sl 832

stock appears weak below 275 for target towards 271/266/262 as long as trades below 283

stock looks weak below 810 for a target towards 801/779/761 sl 821

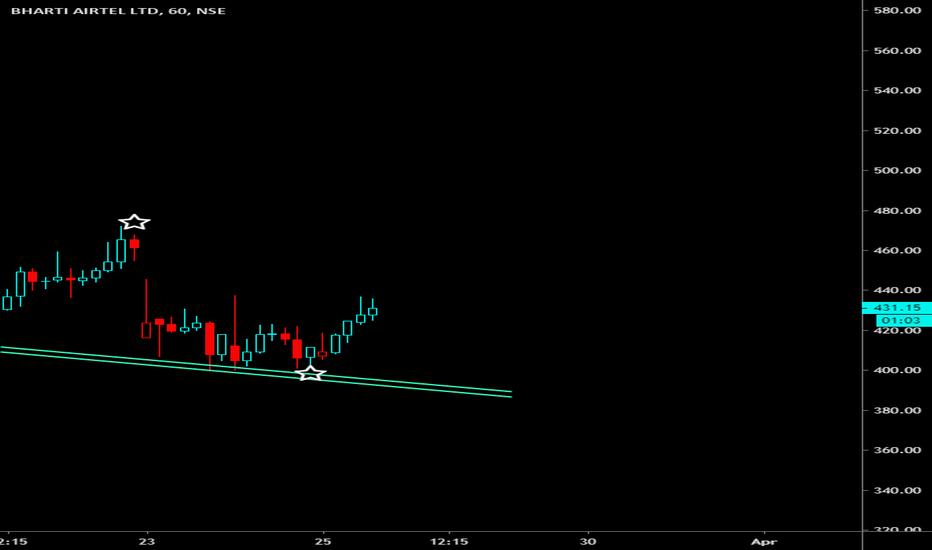

stock looks good above 431 for targets towards 439/445/449 sl 415

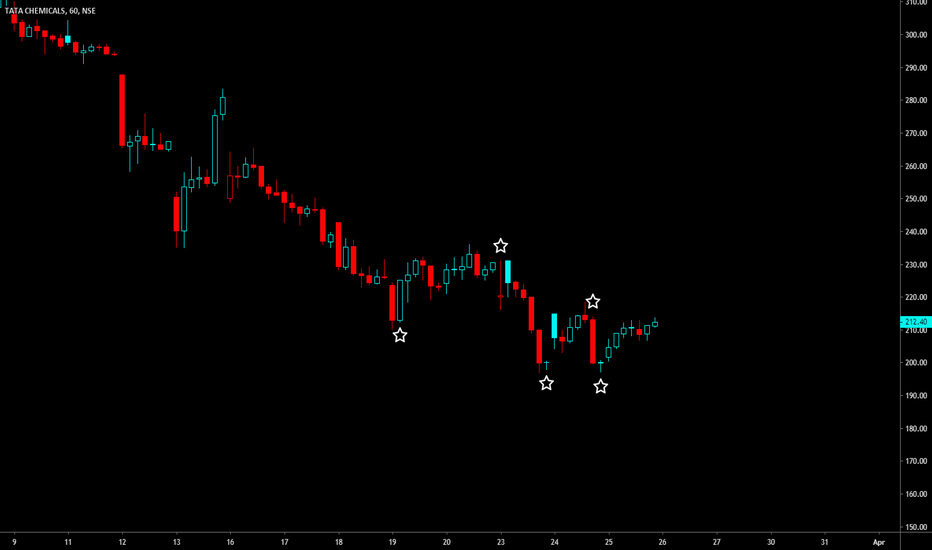

stock might see a range expansion above 213 targets 216/219/222 sl 209

stock looks good for a bounce above 300 for a target towards 305/309/318 sl 295

one can play for a bounce in this stock above 194 for targets towards 199/203 sl 190

stock looks good above 70.7 with sl around 69 for a target towards 72.7/73.7