Bank Nifty corrected over 500 points today and formed an bearish engulfing candlestick. It is looking weak on other indicators / oscillators too, 9 EMA on 21 RSI indicator did gave an SELL signal neat 30980 levels. Bank Nifty closed at 30541, if it sustains below 30512, 30390 and 30240 can be expected. Any move and sustaining above 30680 may strengthen the...

Nifty was dragged by Banks today, Reliance and some non bank nifty components tried to support but that was not enough to beat the drag. Nifty formed a full body bearish candle, breaking below an important support level of 11850. It also initiated a pattern of lower tops and bottoms. Nifty spend major part of the day below the lower line of the channel. ...

The chart has highs and lows of first 15 min. candle marked for a few trading days, and backtest results of trades taken on breaking of these levels in either direction. A friend has told me about this system, I decided to back test out of curiosity, surprisingly it works. The system gave 100+ points on Bank nifty on 9 out of 11 days. I believe, if we use...

Gold has given a Buy signal on daily charts, triangle pattern breached on up side. Other indicators are giving positive signals too. A long position can be considered near 1501-1505 levels, with a stop loss of 1488 for first targets of 1530, once the resistance of 1530-1534 is crossed, it easily retest 1550-1555 levels. Keep in mind, there is an important...

Nifty is moving in a narrow downward channel since it started consolidating on 22nd Oct. Breakout from the channel in either direction will decide the trend, for confirmation pls refer to volume and some other indicators that you are comfortable with. 9 EMA on 21 RSI on a two hour chart is still indicating weakness. Other solo indicators are also showing...

The correction or consolidation continues, Nifty is looking a little more weak on charts. Today's low has been the lowest level since Oct. 17th, but Nifty did recover towards the end and managed to close exactly on the Trendline connecting previous highs since June. Value of RSI on daily chart is well above 50, but on our tried and tested 9 EMA on 21 RSI...

Nifty was volatile but within a small range. It did gave a brief buy signal during the day on my EMA over RSI indicator (two hours chart), but by the the time two hour candle completed, it was again in Sell Mode. In the process, it did gave 30-40 points trade opportunity while the RSI was above EMA. RSI value on daily chart, is at 57, which indicates...

Bank Nifty expressed good strength throughout the day and closed in the positive zone. Even the "EMA on RSI Indicator" did not give any SELL signal, it crossed an important Resistance / Supply zone of 29325 to 29400, and traded above that for some time and even closed a tad over 29400. Long positions can be retained as long as 29230 holds, target on the upside...

Those of you who have been following my ideas for some time, know how reliable I find the Nine period EMA over 21 period RSI on a two hour Nifty chart. As you can see, the system has given a clear SELL signal around 12:00 P.M. Nifty near 11640 level. I would hold my shorts till there is a clear BUY signal on above EMA over RSI system. 11580 is another...

Nifty has indeed given a long term Trendline Breakout on closing basis on 18th Oct., but : This breakout has come after a steep uptrend of approx. 600 points, in an local as well as global environment that is not as comfortable to support a big uninterrupted rally. FIIs buying on 18th Oct is so small, though on a weekly basis, their buying is pretty decent...

Nifty surpassed the trend line that was connecting previous three highs since June 2019, this is a good sign of strength. Keep holding longs, or utilise the dips to create fresh longs. also remember to use trailing stop loss or follow some indicators you are comfortable with. I recommend EMA on RSI as shown in the chart. (21 RSI, 9 EMA, 2 hours chart is a time...

Nifty did consolidate between Yesterday's (16th Oct.) DOJI low and high levels for some time, only towards afternoon it crossed the top and kept rising till end of the session. You may see on the above chart, Nifty has made several higher highs and higher lows since Oct. 9. A channel has been mared showing Nifty's lows n highs since Oct. 9. Beyond technicals,...

Nifty as expected has been going up for past five sessions, it has climbed almost 400 points, ever since it has reversed last week. A small pull back or some consolidation can be expected, specially after the DOJI candle, that was formed today. Tomorrow is also Weekly Options Expiry day and Option Chain data suggests settlement between 11400 and 11500, There is...

Those friends who have been following me for some time, know I use EMA on RSI for estimating the trend / direction of Nifty n Bank Nifty . Many of you might have seen, (others may check my previous posts / ideas on this forum) where I have used this ( EMA on RSI ) as a effective system for determining trend. The attached chart uses an EMA (Nine periods) over RSI...

Those friends who have been following me for some time, know I use EMA on RSI for estimating the trend / direction of Nifty. Many of you might have seen, (others may check my previous posts / ideas on this forum) where I have used this (EMA on RSI) as a effective system for determining trend. The attached chart uses an EMA (Nine periods) over RSI (21 Periods)...

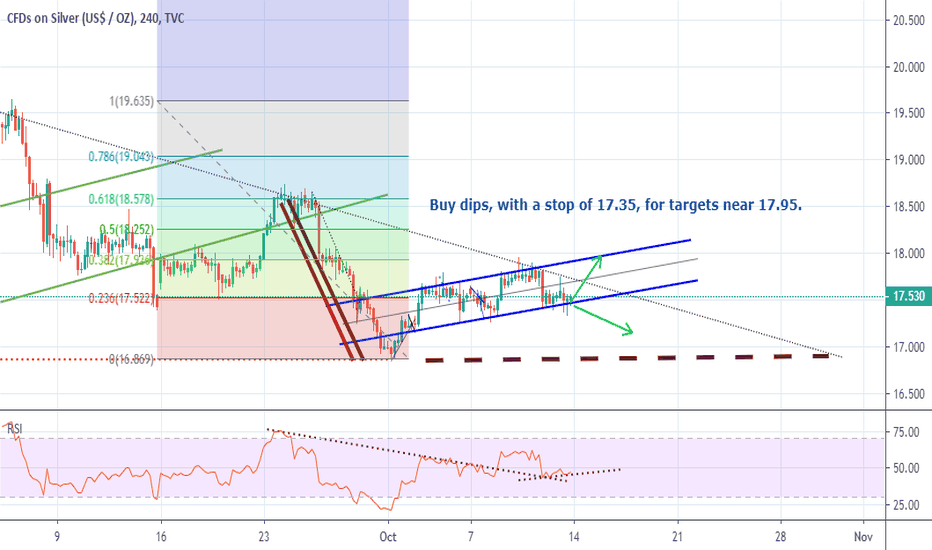

Silver moving in a flag pattern, in on the lower point of the channel. If the channel is broken on the downside, a slide upto 16.82 can be expected. It has been correcting for some time, there is a possibility that after all the news flow, the short positions will start to unwind and push the prices higher. Since my ideas can be seen in India only, by the time...

After a bag correction IndiaBulls Hosing Finance is trying to move back, long positions can be considered on dips. Probably all the bad news is priced in already, there is a huge buildup on short side. Show of little strength may result in a cascading effect and push the prices higher in no time. Trade on the long side, utilising dips for a target of 340 or so....

For Monday Nifty sailing above 11323 will provide comfort to the bulls, while a breach of 11229 may allow bears to take over. Daily indicators have turned from mild bearish to mild positive after yesterday's (11th Oct) session, but the same for Bank Nifty are still weak. Nifty and Bank Nifty may not move in different directions for long. False signals are...