The Pair broke out of the range bound areas with strong downside momentum earlier It is expected to be bearish after correction and would complete this market cycle.

The 4 hour chart of Gold has formed a full elliot wave analysis pattern It is currently making corrective waves in the form of the bullish flag pattern we expect the price to be take support at the potential reversal zone and then up for the another bullish impulse move.

The 15 minute chart of GBP/AUD has forming a full elliot wave and Head & shoulders pattern we can expect to be bearish up to the support level which is the neck line. a break below the neck line would makes the potential selling pressure for the deeper downside moves.

The 4 Hour chart of EUR/AUD has formed the Full Elliot wave pattern It is currently making 'c' corrective downside moves with the running flag formation of further upside forecast bias after the corrective moves.

The 30 minute chart of EUR/JPY shows that the pair is uptrend As long as the supportive trend line holds,the pair would remain makes Higher highs.

The AUD/USD pair is currently in a downtrend in the daily chart. It is currently trading at the trend line and and is facing rejections at the trend line. Hence we expect the pair to be bearish from here.

The GBP/AUD pair has formed a bearish shark pattern. It is currently taking resistance at 1.84000 zone and evening star pattern has also formed. Hence we expect the pair to retrace to the support levels of 1.79565.

The EUR/NZD pair is currently in an uptrend and forming an elliot wave. It has completed its 4-th wave and currently resuming its 5-th wave. Hence we expect the pair to go the levels of 1.79500 from here.

The NZD/USD pair has broken its trend line. It can invigorate short covering by the bears. Hence we expect the pair to move to the resistance levels of 0.67176 from here.

The EUR/USD pair after a good move is now consolidating in an ascending triangle pattern. Hence we expect the pair to continue its bullish momentum. Fresh long positions can be initiated when the pair makes a bullish crossover above the resistance.

The 4 Hour chart of EUR/AUD has formed the full Elliot wave pattern After completed impulse moves, currently it is in the making of c correction wave so,It is expected to be bearish and would reach the expected target.

To validate our previous analysis, the pair moved down of 5th wave completed and now currently it is in the correction which also formed bullish butterfly pattern So, it is expected to be bullish for short term with the correction move.

The EUR/CHF pair is currently in a downtrend in 4-hour chart. It is currently forming an inverted head and shoulder pattern and is taking support at 1.12443 price levels. Hence we expect the pair to be bullish for short term.

The 30 minute chart of dollar index has formed a bullish bat pattern. So, It is expected to be bullish for short term.

The USD/CAD pair is currently in a downtrend. It has completed its 4-th wave of the Elliott wave by forming a bearish flag. Hence we expect the pair to head south from here to 1.29093 levels.

The AUD/NZD pair is currently in an ascending channel formation. It is currently taking support at its supportive trend line. Hence we expect the pair to bounce back strongly from this zone. Conservative traders can go long once it breaches the resistance line.

The EUR/USD pair has broken out of a triangle pattern. It is currently trading around a strong resistance. As per our analysis we expect the pair to form a full Elliot wave. Hence it is best to initiate long positions once the resistance is breached.

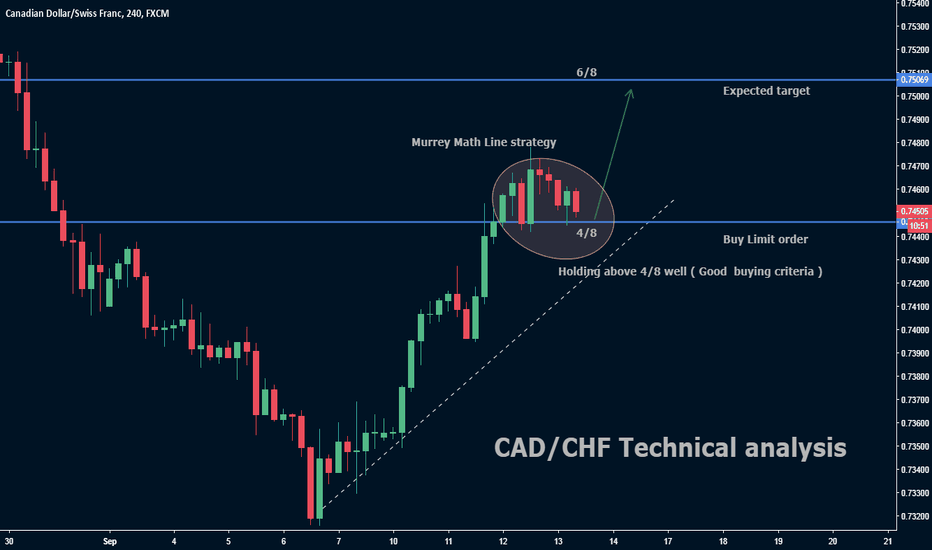

The CAD/CHF pair is currently trading above the 4/8 Murray math line. It is also in a strong uptrend and is currently consolidating. We expect the momentum to continue and move towards 0.75069.