Market analysis from Alice Blue

According to the SMC method, Oil India is currently approaching a potential supply zone near ₹494.05. A break of structure (BOS) will be confirmed if demand overcomes supply at this level, targeting ₹523. After reaching this target, a 50% retracement (between ₹495–₹500) could present a re-entry opportunity, marking a bullish continuation scenario. An alternative...

📊Technical Overview TCS has consistently traded above ₹3,000 since 2021, with this level serving repeatedly as a robust support zone. The stock reached an all-time high of ₹4,592 in August 2024. Given strong year-on-year financial performance and support at ₹3,000, TCS currently trades at ₹3,500. As long as the ₹2,900–₹3,050 support zone holds, the stock has...

📈Technical Analysis Crucial Resistance Zone: Since 2017 listing at ₹250–255, this level has repeatedly acted as major resistance throughout 2024–25. Recent Pullback: After reaching ₹248 recently, stock remains locked under this key zone. Breakout Prerequisite: For a genuine bullish move, the ₹250–255 resistance must be cleared with strong volume and...

📊Technical Analysis IPO & COVID Dip: Listed around ₹270 in 2017 → surged to ₹600 by 2020, then fell below ₹200 during the COVID crash. Post-COVID Recovery: Strong bounce from ₹180–₹200 with classic higher highs and higher lows → hit ₹813 all-time high in January 2024. Correction Phase: Decline followed into late 2024–2025, forming a descending channel. ...

Technical Analysis Silver has had a rollercoaster journey over the past decade. In 2015, silver futures were trading near ₹35,000, but by 2025, prices have tripled, reaching around ₹1,05,000. The journey, however, wasn't smooth. From 2016 to 2020, silver consistently faced strong resistance between ₹49,000 and ₹51,000. This range capped every bullish move...

Chart Annotations (Wyckoff-style Analysis) Timeframe: 1D Current Price: ₹2,581.20 Entry Zone: Breakout Zone / BOS / Entry 2654 Stoploss: ₹2,233 (13.50%) Primary Target: ₹3,211 (24.40%) Target 2: ₹3,742 (45.00%) Last Low (Selling Climax): ₹2,025 Dividend declared – ₹1.30/share → indicates confidence in earnings. Adani Airports raised $750M, reducing group-level...

📈Technical Analysis IPO & Rally: Since its listing on October - 2023 at ₹140–150, the stock surged to ₹360 by July 2024. Correction & Support: A pullback followed, finding solid demand at ₹220, which held firm. Recent Rally: Strong Q3 and Q4 2024 results triggered a rebound starting February 2025. Resistance Zone: The stock now faces resistance at the...

📊Technical Analysis Since its IPO in 2017, ICICI Lombard has steadily rallied from ₹600–₹700, reaching a peak of ₹1675 in September 2021. The ₹1,600–₹1,650 zone served as a strong resistance until it finally broke out in 2024, which then acted as a reliable support level in 2024 and again in March 2025. Following a decline, the stock rebounded from this...

📈Technical Analysis Since 2020, Hindustan Zinc rose from ₹130–₹150 to ₹380–₹400 by 2021, and this ₹380–₹400 zone acted as a major resistance level throughout 2022 and 2023. In April 2024, the stock broke out above the ₹380–₹400 resistance zone and surged to an all-time high of ₹807 in May 2024. From that peak, the stock experienced a sharp correction of nearly...

📈Technical Analysis Bajaj Finserv has exhibited a consistent uptrend over the past decade, ascending from ₹90–100 levels to an all-time high of ₹1,932 in October 2021. The ₹1,940–2,000 zone has served as a formidable resistance, with the stock attempting multiple breakouts since 2021. The recent Q4 FY24 results, announced on April 29, 2025, provided the impetus...

Despite the profit decline, the stock price has shown resilience. Analysts maintain a positive outlook, with targets ranging from ₹780 to ₹816, reflecting confidence in the company's long-term prospects. Short-Term Trading Setup (1–2 Weeks) Entry Price: ₹683.80 Stop Loss (SL): ₹677 Target 1: ₹692 Target 2: ₹696 Rationale: This setup is based on recent...

🔍Technical Overview Tata Steel has been range-bound between ₹20–₹80 for over a decade. In 2021, it broke above the ₹80 resistance, which then acted as support in 2022. The stock rallied to ₹184 by June 2024, then it came to ₹120. A descending channel formed during this correction, characterized by lower highs and lower lows. This pattern was decisively broken...

JK Cement Ltd. has showcased a robust performance in Q4 FY24, marked by significant financial growth and positive technical indicators. 📊Technical Analysis: Over the past decade, JK Cement's stock has demonstrated a consistent upward trajectory, reaching an all-time high of ₹3,800 in 2021. Following a correction to ₹2,000, the stock resumed its ascent, forming...

Bank Nifty ended the week at 55,749.70 with a gain of 0.63% Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The critical range to monitor for potential trend reversals or continuation is 55,632 to 55,869 🔹 Support & Resistance Levels: Support Levels: S1: 55,280 S2: 54,810 S3: 54,303 Resistance Levels: R1: 56,224 R2: 56,698 R3:...

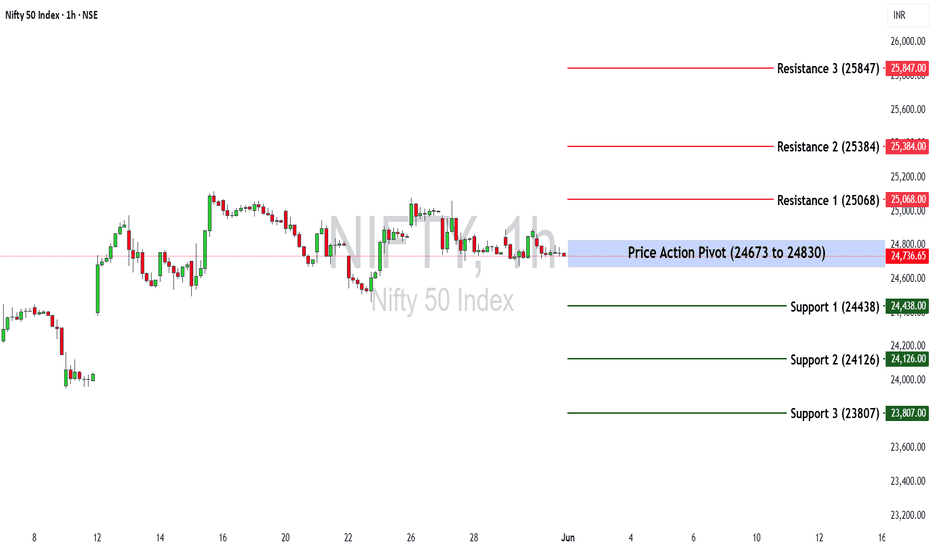

The Nifty 50 ended the week at 24,750.70 with a loss of (-0.41%) If Nifty sustains below 24,673, selling pressure may increase. However, a move above 24,830 could restore bullish momentum. Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The crucial range to watch for potential trend reversals or continuation is 24,673 -24,830. 🔹 Support &...

Pattern Summary Inverse H&S Pattern Left Shoulder: ₹535 Head: ₹525 Right Shoulder: ₹571 Neckline/Breakout: ₹631 (Confirmed breakout zone) Target (Projected): ₹712 (Measured move aligns with pattern height) Trendline Breakout Confirms bullish momentum post-H&S breakout. Price has cleared previous LH (Lower High) zones — trend bias shifting...

Phase A – Stopping the Downtrend Selling Climax (SC): Strong sell-off ends; panic selling. Price Level: Around 601–625 Automatic Rally (AR): First real bullish response. Level: Around 645 Preliminary Support (PS): Begins absorbing supply. Level: Around 722 Phase B – Building the Cause Accumulation Range: 🔹 Low: ~645 🔹 High: ~751 (acts as resistance...

Bank Nifty ended the week at 55,398.25 Key Levels for the Upcoming Week 🔹 Price Action Pivot Zone: The critical range to monitor for potential trend reversals or continuation is 55,516 to 55,281 🔹 Support & Resistance Levels: Support Levels: S1: 54,929 S2: 54,312 S3: 53,596 Resistance Levels: R1: 55,991 R2: 56,424 R3: 56,794 Market...