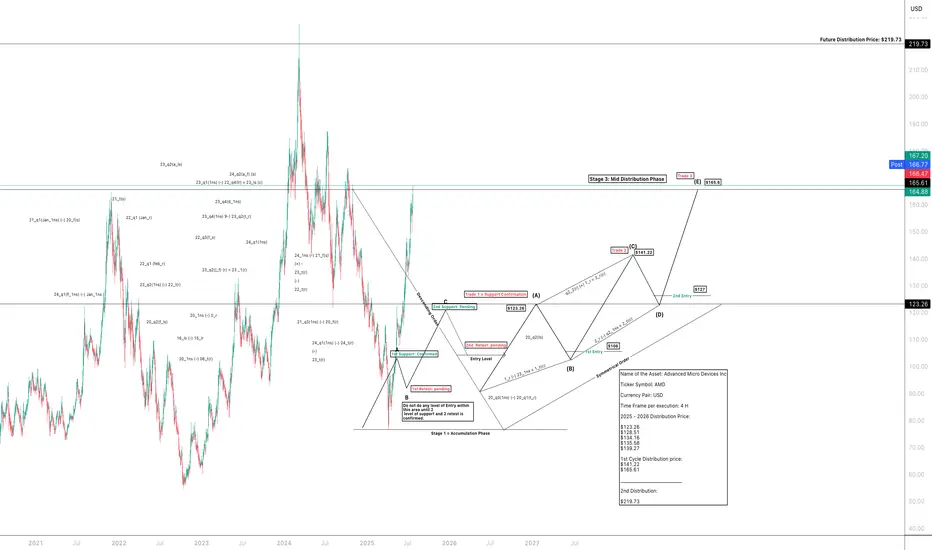

AMD Forecast Validation - Stage 3 Distribution Reached | Published May 2025

Asset: Advanced Micro Devices Inc. (AMD)

Forecast Published: Week 1, May 2025

In May 2025, I published a forward distribution cycle forecast for AMD based on a proprietary symmetrical distribution model. That forecast has now successfully reached Stage 3: Mid Distribution Phase, with price action hitting both:

✅ $123.26 - Trade 1 (Support Confirmation)

✅ $141.22 - Trade 2 (Cycle Distribution Level 1)

✅ $165.6 Trade 2 ( Mid Distribution) Phase

The model now anticipates the next target at:

This validates the integrity of the multi-phase cycle model, which clearly defined accumulation, confirmation, and distribution levels before price execution began.

📈 The model emphasises:

*Precision entries only after 2 support levels and 2 retests are confirmed

*Trade execution within a structured symmetrical order

*Strict price discipline and macro alignment

I’ll continue publishing live cycle forecasts across key assets - built with institutional discipline and retail accessibility.

Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

#AMD #MarketForecast #DistributionCycle #TradingModel #QuantitativeAnalysis #InstitutionalTrading #Stage3Distribution #AssetManagement #TradingStrategy #SymmetryInMarkets #ForecastAccuracy

Asset: Advanced Micro Devices Inc. (AMD)

Forecast Published: Week 1, May 2025

In May 2025, I published a forward distribution cycle forecast for AMD based on a proprietary symmetrical distribution model. That forecast has now successfully reached Stage 3: Mid Distribution Phase, with price action hitting both:

✅ $123.26 - Trade 1 (Support Confirmation)

✅ $141.22 - Trade 2 (Cycle Distribution Level 1)

✅ $165.6 Trade 2 ( Mid Distribution) Phase

The model now anticipates the next target at:

This validates the integrity of the multi-phase cycle model, which clearly defined accumulation, confirmation, and distribution levels before price execution began.

📈 The model emphasises:

*Precision entries only after 2 support levels and 2 retests are confirmed

*Trade execution within a structured symmetrical order

*Strict price discipline and macro alignment

I’ll continue publishing live cycle forecasts across key assets - built with institutional discipline and retail accessibility.

Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

#AMD #MarketForecast #DistributionCycle #TradingModel #QuantitativeAnalysis #InstitutionalTrading #Stage3Distribution #AssetManagement #TradingStrategy #SymmetryInMarkets #ForecastAccuracy

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.