🚨 **EARNINGS TRADE SETUP: APLD (Applied Digital)**

🗓️ Earnings: **July 31 (AMC)**

💥 Confidence: **65% Moderate Bullish**

🔥 Recent Run: **+94% past 3 months**

🧠 AI Infrastructure Hype + High IV = Opportunity

---

### 📊 FUNDAMENTALS SNAPSHOT

🟢 **Revenue Growth**: +22.1% YoY

🔴 **Profit Margin**: -110.4%

🔴 **Operating Margin**: -34.7%

⚠️ Historical EPS Beat Rate: **12% only**

📈 Analyst Target: **\$14.61** (+42.8% upside)

🔎 **Verdict**: High growth, deep losses — speculative with upside

---

### 🧠 OPTIONS FLOW

💣 **High IV Crush Risk**

🟥 **Put Wall**: \$10.00 (6,700 contracts)

🟩 **Speculative Calls**: \$10.50 & \$11.00 loaded

⚖️ Mixed Sentiment → Tilted Bullish

---

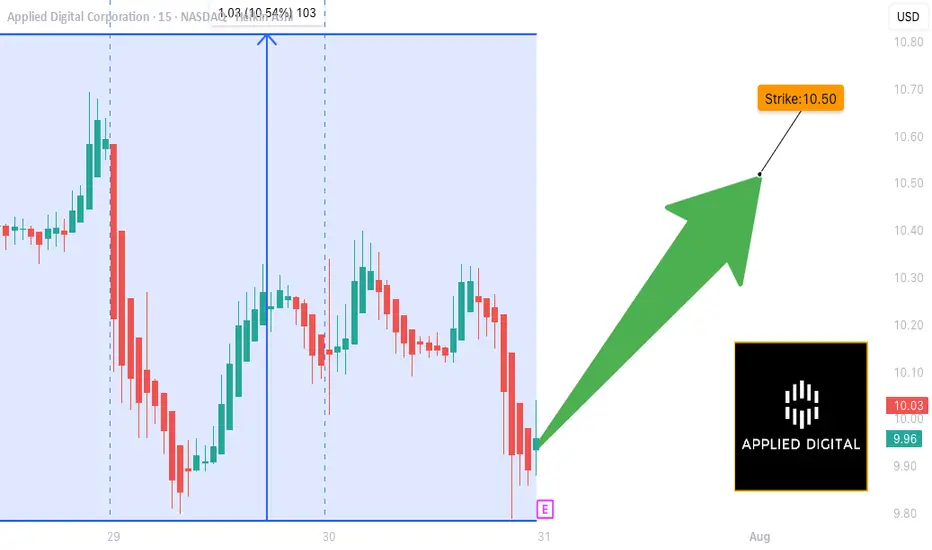

### 📉 TECHNICAL CHECK

💹 Price: **\$10.12**

📉 Below 20D MA (\$10.31)

📌 Support: **\$10.00**

📌 Resistance: **\$10.50**

⚠️ RSI Cooling → Watch for breakout or rejection

---

### 💥 TRADE IDEA

**🎯 Call Option — Strike \$10.50 — Exp 08/01**

💵 Entry: \$0.57

🚀 Profit Target: \$2.28 (200–400% ROI zone)

🛑 Stop Loss: \$0.285

📈 Size: 1 contract (2% of portfolio)

🕓 Exit: 1–2 hours post earnings to avoid IV crush

---

### 🧠 TRADE LOGIC

Risky setup — but technicals + AI narrative + speculative flow = **earnings lotto ticket with strategy.**

💬 *"Speculation with structure beats blind YOLO."*

---

📌 Tag a trader who likes calculated risk 📈

📉 Don’t forget to scale OUT, not just IN.

\#APLD #EarningsPlay #OptionsTrading #TradingView #AIStocks #YOLOWithStops #IVCrushProof #CallOptions #SwingTrade #BullishSetup

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.