Date 14.09.2025

Axis Bank

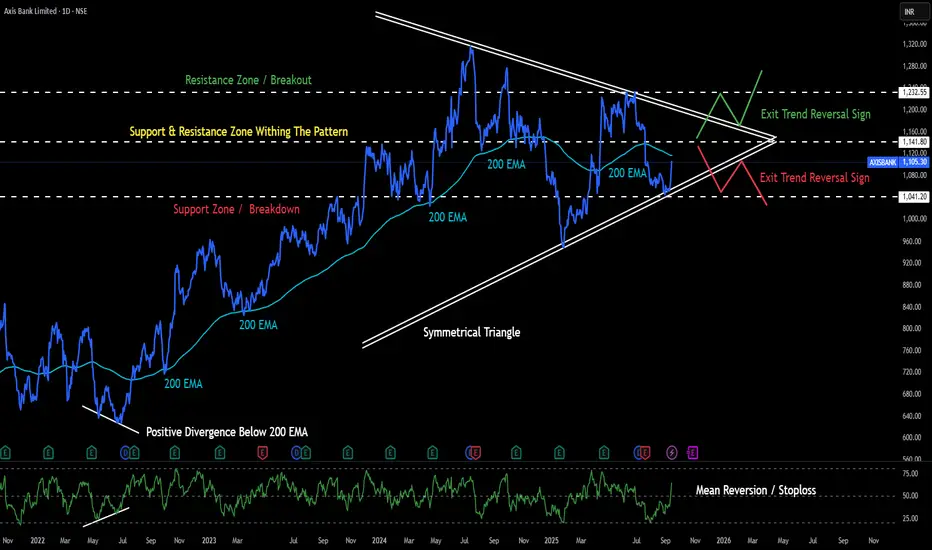

Timeframe : Day Chart

Technical Remarks :

(1) Conformation of Symmetrical Triangle Pattern after recent 2:2 channel confirmation

(2) Major support base at 1041 since forming just below symmetrical triangle

(3) Major resistance zone at 1232 since forming just above symmetrical triangle

(4) Major support/resistance at 1141 since forming at mid point of symmetrical triangle

(5) 200 EMA has shown strong character in the stock, next resistance/breakout is from 200 ema

(6) If breakdown occurs & RSI goes below mean reversion is short term weakness

(7) Upper exit from symmetrical triangle is good intraday/swing BTST opportunity , target 1232

(8) Lower exit from symmetrical triangle is good intraday/swing STBT opportunity , target 1041

Fundamental Remarks :

Market Leadership

(1) 3rd largest private sector bank in India

(2) 4th largest issuer of credit cards

(3) 19.8% market share in FY24

Ratios

(1) Capital Adequacy Ratio 16.63%

(2) Net Interest Margin 4.07%

(3) Gross NPA 1.43 %

(4) Net NPA 0.31%

(5) CASA Ratio 43%

Branch Network

(1) Metro 31%

(2) Semi-urban 29%

(3) Urban 23%

(4) Rural 17%

Revenue Mix

(1) Treasury 15%

(2) Corporate/Wholesale Banking 22%

(3) Retail Banking 61%

(3) Other Banking Business 2%

Loan Book

(1) Retail loans 60%

(2) Corporate 29%

(3) SME loans 11%

Retail Book

(1) Home loans 28%

(2) Rural loans 16%

(3) LAP 11%

(4) Auto loans 10%

(5) Personal loans 12%

(6) Small business banking 10%

(7) Credit cards 7%

(8) Comm Equipment 2%

(9) others 4%

Market Share

(1) 5.5% in Assets

(2) 5% in Deposits

(3) 5.9% in Advances

(4) 14% in Credit cards

(5) 5.2% in Personal loan

(6) 8.4% RTGS

(7) 30% NEFT

(8) 38.9% IMPS (by volume)

(9) 20% in BBPS

(10) 11.4% in Foreign LC

(11) 8.4% MSME credit

Regards,

Ankur

Axis Bank

Timeframe : Day Chart

Technical Remarks :

(1) Conformation of Symmetrical Triangle Pattern after recent 2:2 channel confirmation

(2) Major support base at 1041 since forming just below symmetrical triangle

(3) Major resistance zone at 1232 since forming just above symmetrical triangle

(4) Major support/resistance at 1141 since forming at mid point of symmetrical triangle

(5) 200 EMA has shown strong character in the stock, next resistance/breakout is from 200 ema

(6) If breakdown occurs & RSI goes below mean reversion is short term weakness

(7) Upper exit from symmetrical triangle is good intraday/swing BTST opportunity , target 1232

(8) Lower exit from symmetrical triangle is good intraday/swing STBT opportunity , target 1041

Fundamental Remarks :

Market Leadership

(1) 3rd largest private sector bank in India

(2) 4th largest issuer of credit cards

(3) 19.8% market share in FY24

Ratios

(1) Capital Adequacy Ratio 16.63%

(2) Net Interest Margin 4.07%

(3) Gross NPA 1.43 %

(4) Net NPA 0.31%

(5) CASA Ratio 43%

Branch Network

(1) Metro 31%

(2) Semi-urban 29%

(3) Urban 23%

(4) Rural 17%

Revenue Mix

(1) Treasury 15%

(2) Corporate/Wholesale Banking 22%

(3) Retail Banking 61%

(3) Other Banking Business 2%

Loan Book

(1) Retail loans 60%

(2) Corporate 29%

(3) SME loans 11%

Retail Book

(1) Home loans 28%

(2) Rural loans 16%

(3) LAP 11%

(4) Auto loans 10%

(5) Personal loans 12%

(6) Small business banking 10%

(7) Credit cards 7%

(8) Comm Equipment 2%

(9) others 4%

Market Share

(1) 5.5% in Assets

(2) 5% in Deposits

(3) 5.9% in Advances

(4) 14% in Credit cards

(5) 5.2% in Personal loan

(6) 8.4% RTGS

(7) 30% NEFT

(8) 38.9% IMPS (by volume)

(9) 20% in BBPS

(10) 11.4% in Foreign LC

(11) 8.4% MSME credit

Regards,

Ankur

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.