-  NVDA export ban lifted for China will be beneficial for

NVDA export ban lifted for China will be beneficial for  NVDA for sure but main advantages would be for

NVDA for sure but main advantages would be for  BABA as they can get the shovels from the shop as well so that they can compete in Gold Rush and compete with

BABA as they can get the shovels from the shop as well so that they can compete in Gold Rush and compete with  GOOGL ,

GOOGL ,  META and other private companies like Open AI and Anthropic.

META and other private companies like Open AI and Anthropic.

- There are good universities in China and BABA is regional big tech in China which gets great talent. I'm confident that

BABA is regional big tech in China which gets great talent. I'm confident that  BABA would be able to compete with

BABA would be able to compete with  META &

META &  GOOGL in building LLMs even better with this export ban lift.

GOOGL in building LLMs even better with this export ban lift.

- Long BABA and short/avoid

BABA and short/avoid  META ( overvalued )

META ( overvalued )

- There are good universities in China and

- Long

Note

Price Target $160+ ; Ideally $180-200 rangeNote

Trade deal with China is bullish for Note

- -

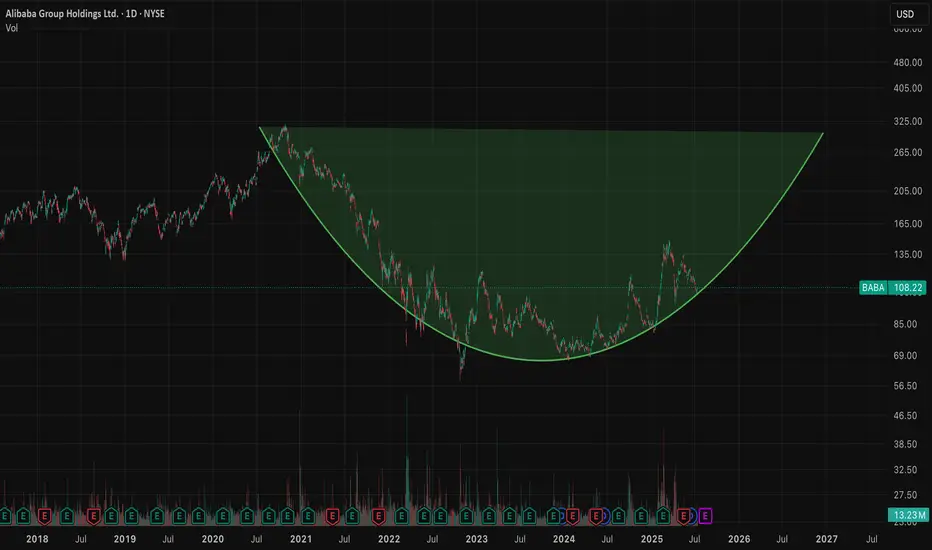

- Move 1: Started April 2024 when the trend reversal started. $68 -> $89 with around +30% then retraced $90 -> $72 ( -20% )

- Move 2: July 2024, $72 -> $116 (+61%) then retraced $116 -> $80 ( -31% )

- Move 3: Jan 2025, $80 -> $146 (+ 82.5%) then retraced $146 -> $108?? ( correction underway ) ~ -26% so far

- Move 4: Likely from $100-105 to $180-200

Note

Cross posting from my other post here:- If we cross $110 on BABA then that means the move #3 is over and the end of move #3 was around $103.83 and we have entered the Move #4 which will take

Note

- Reference:

cnbc.com/2025/07/27/us-china-trade-tariff-talks.html

Note

- - Move 4: Likely from $100-105 to $180-200 is in the play

Note

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.