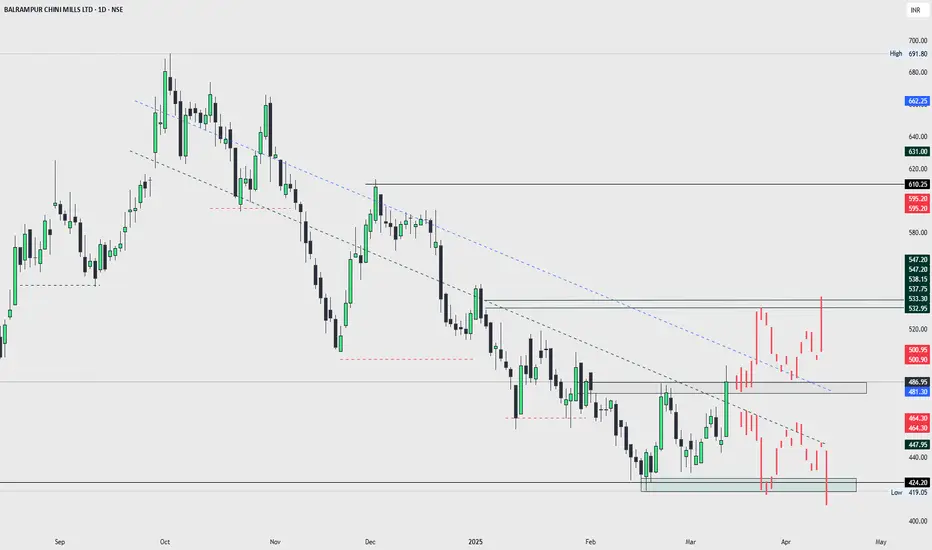

Balrampur Chini Mills Ltd | Breakout & Key Levels Analysis

The stock has been in a downtrend for the past few months, respecting a descending trendline. However, recent price action shows a strong breakout above key resistance levels, indicating potential bullish momentum.

Key Observations:

✅ Breakout Above Trendline: Price has broken past the descending resistance, signaling a possible trend reversal.

✅ Retesting Supply Zone (532-538): The price is currently testing a critical supply area. A strong close above this could confirm further upside.

✅ Supports to Watch: Immediate support around 486-481, followed by major demand at 424-419 if weakness persists.

✅ Resistance Levels: Next hurdle around 547-550 before a potential rally toward 595-610.

📉 If rejection occurs at resistance, expect a pullback to retest breakout levels.

📈 If sustained buying continues, price could move towards higher resistance zones.

Key Observations:

✅ Breakout Above Trendline: Price has broken past the descending resistance, signaling a possible trend reversal.

✅ Retesting Supply Zone (532-538): The price is currently testing a critical supply area. A strong close above this could confirm further upside.

✅ Supports to Watch: Immediate support around 486-481, followed by major demand at 424-419 if weakness persists.

✅ Resistance Levels: Next hurdle around 547-550 before a potential rally toward 595-610.

📉 If rejection occurs at resistance, expect a pullback to retest breakout levels.

📈 If sustained buying continues, price could move towards higher resistance zones.

Trade active

Stock has now given a breakout of 480 level, keep eye on that.Trade closed: target reached

Stock has reached 536, and First Target completed, let's see and wait for the second target.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.